RWA underlying infrastructure is stablecoins. Boston Consulting Group predicts that by 2030, RWA will reach a scale of $10 trillion, and stablecoins are the foundation for the tokenization of all real assets, complementing each other! Therefore, in the past two years, the stablecoin sector has become increasingly "competitive."

At the same time, stablecoins not only have a bright growth outlook but also serve as "intermediaries for crypto trading" and "gateways to yield." The three giants of stablecoins are #DAI from MakerDAO, #USDC from Circle, and #USDT from Tether. However, their positioning is different:

- USDT and USDC are more focused on payment and settlement, without emphasizing yield;

- DAI emphasizes collateral + yield, but in recent years has gradually moved towards "U.S. Treasury-like" characteristics.

As time progresses, the pain points of stablecoins are becoming more pronounced. Users' demand for stablecoins is no longer just "stability," but "stability + yield." This is why various yield-bearing stablecoin protocols (such as #Ethena, #Resolv, #sDAI, #USDY) have begun to emerge over the past year. However, the logic of most protocols is either single arbitrage (like #Ethena based on funding rates) or a "buying treasury bonds" model. Single strategies are prone to failure, and yields are not robust enough.

Recently, we have focused our research on @FalconStable, which is quite different from these projects. Its positioning is very clear: to create the first universal collateral infrastructure.

In simple terms, if you have #BTC, #ETH, #SOL, stablecoins, or even tokenized U.S. Treasury RWA, you don't need to sell or liquidate; you can directly deposit them to mint #USDf — Falcon's over-collateralized stablecoin.

This is similar to DAI but more aggressive. DAI's collateral assets are relatively limited, while Falcon supports a broader range: mainstream cryptocurrencies, stablecoins, selected altcoins, and even U.S. Treasury-like RWAs. Its goal is to turn any custodial asset into liquid dollars.

So what is #Falcon's secret weapon? It is #sUSDf — by staking #USDf, you receive an ERC-4626 yield token. Its yield comes from a set of institutional-grade, diversified strategies:

- Forward/reverse funding rate arbitrage

- Cross-exchange arbitrage (CEX/DEX)

- Native altcoin staking

- Leading DEX market making

This is not a single-point strategy but a combination approach. In contrast, #Ethena relies too much on funding rates, while #DAI's yield is overly dependent on U.S. Treasuries. #Falcon's logic resembles a "hedge fund + stablecoin," pursuing stable yields rather than the fragility of single arbitrage.

Currently, the yield return data also demonstrates strong industry competitiveness: as of the end of August 2025, the 30-day annualized yield of sUSDf is around 10%; while the average APY of the top five stablecoin yield protocols is only about 6.3%. The gap during this period is very significant.

What makes me more optimistic is that #Falcon has already established a solid ecological foundation:

- sUSDf/USDf on #Pendle has a TVL of $273 million, indicating a vibrant yield token trading market;

- On #Morpho, users can use sUSDf/PT-sUSDf for lending, further amplifying yields;

- Liquidity pools for USDf are already available on #Curve, #Uniswap, #PancakeSwap, #Bitfinex, and #MEXC;

- #Chainlink provides oracles to ensure price safety;

- It has also secured a $10 million strategic investment from #WLFI.

Currently, USDf has a circulating supply of $1.5 billion, over $1.6 billion in reserves, and more than 58,000 monthly active users. For a protocol that has only been established for 8 months, this growth curve is quite impressive. Just looking at these collaborations and data, it is no longer a "paper project" but a system that has put in significant effort to get up and running.

Finally, let me talk about #Falcon's ecological token $FF. In #Falcon's ecological logic, USDf and sUSDf are product layers, while $FF is the core token for capturing value. On one hand, as asset collateral and USDf issuance increase, the larger the protocol scale, the more directly $FF captures value; on the other hand, $FF also has governance, staking, community incentives, and other functions, serving as a proof of rights for ecological expansion.

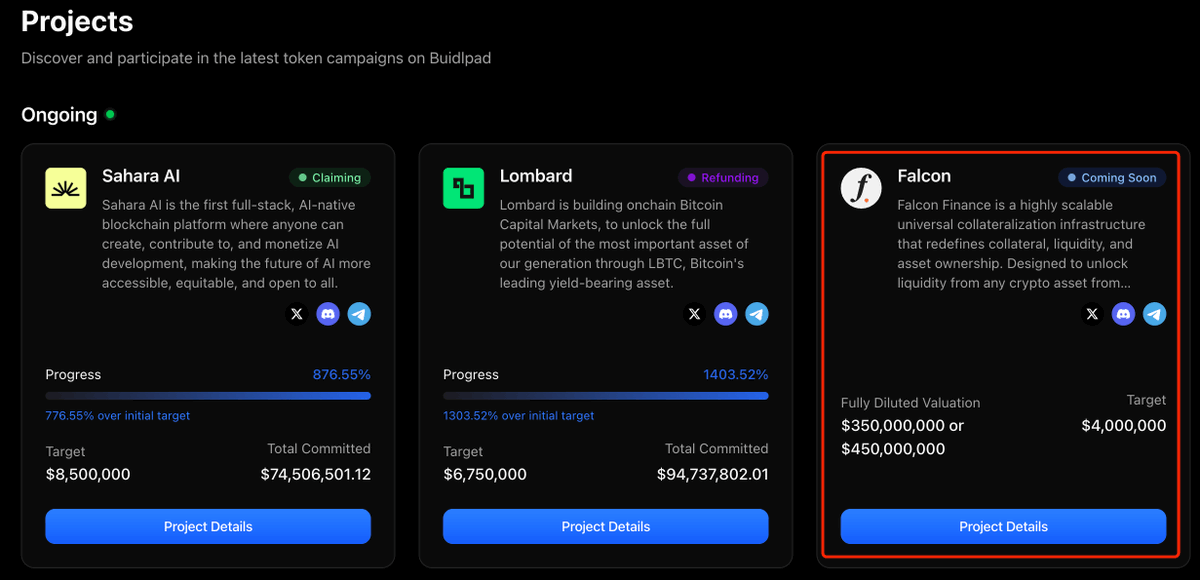

Overall, #Falcon is not competing in the "stablecoin payment market," but aims to define a new "collateral-liquidity-yield" infrastructure layer. It can absorb both existing assets like BTC/ETH and real assets like U.S. Treasuries, releasing dollar liquidity while providing users with competitive yields. If we consider #DAI as the first generation (crypto-collateralized stablecoin), USDC/USDT as the second generation (payment and settlement stablecoins), and #Ethena as the third generation (arbitrage stablecoin), then #Falcon resembles the fourth generation: universal collateral + multi-strategy yield stablecoin. This time, the #Buidlpad new project launch is a rare opportunity to participate in the project, so remember to complete KYC verification and subscribe between September 16 and September 19! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。