Original|Odaily Planet Daily (@OdailyChina)

The issuance bidding of Hyperliquid's native stablecoin USDH is in full swing, but discussions in the crypto market and the Hyperliquid community about this "bidding war" have already reached the "Next Level." A partner at Dragonfly referred to it as "a predetermined farce"; members of the Hypurrscan team explicitly stated that Jan Van Eck himself holds 15% of the voting rights and wants to hear the other party "meow" an explanation for the corresponding information; Ethena suddenly announced its withdrawal from the bidding after offering various preferential conditions. As things have developed, the intensity and level of discussion surrounding the "USDH bidding case" may far exceed the expectations of Hyperliquid officials and community members.

Although the voting deadline on September 14 has not yet arrived, the current drama already includes "predetermined scripts," "tycoon pursuing love," and "heroic withdrawal," among other dramatic plots. Odaily Planet Daily will organize the recent USDH-related events in this article for readers' reference.

For background, see “Hyperliquid Stablecoin USDH Becomes ‘Industry Darling,’ Giants Start Distribution Rights Chaos”.

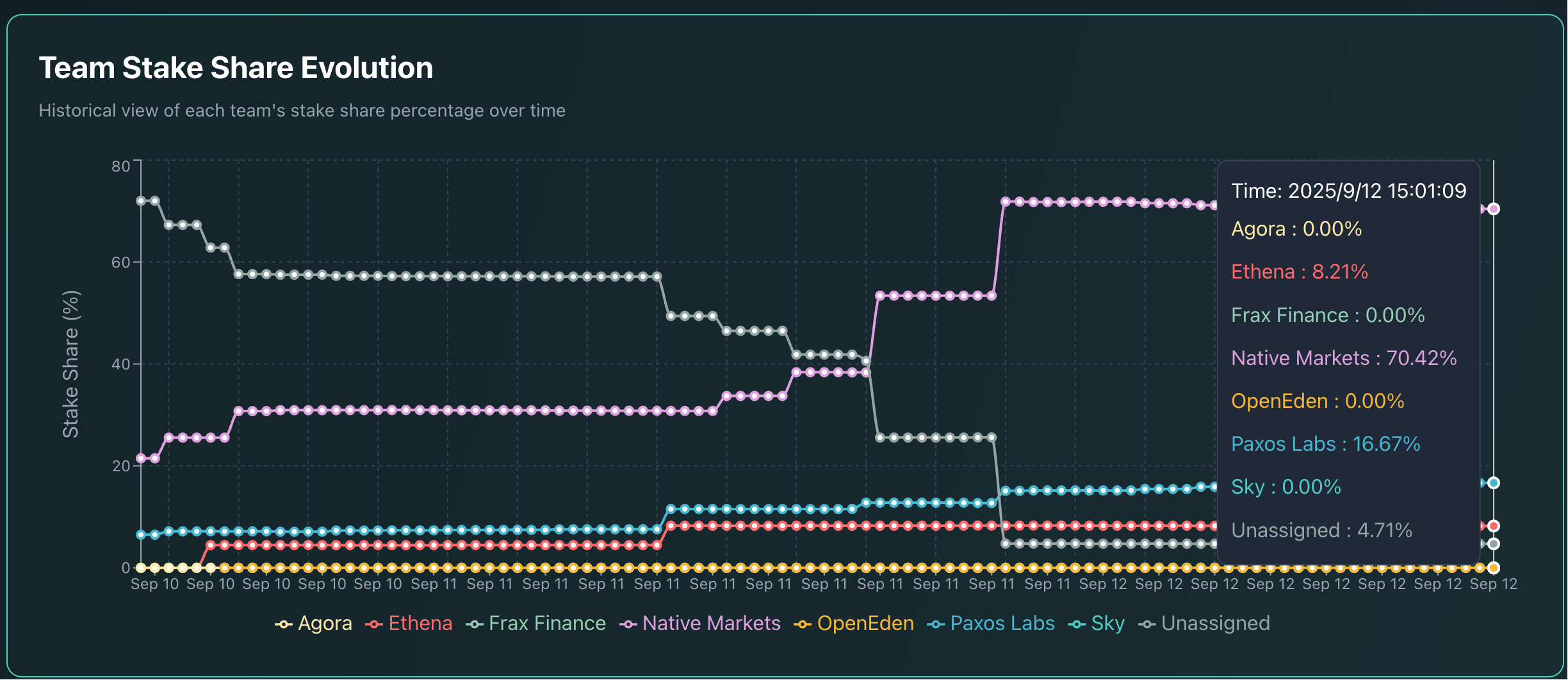

USDH Voting in Progress: Native Markets Receives Over 70% of Validator Votes, Paxos Labs Comes in Second

According to information from the USDHTracker website, as of September 12 at 3 PM, the voting percentages for major issuers in the USDH bidding are as follows:

- Native Markets: 70.42%;

- Paxos Labs: 16.67%;

- Ethena: 8.21%;

- Unallocated votes: 4.71%.

Issuers such as Agora, Frax Finance, OpenEden, and Sky received 0 votes.

USDH Validator Voting Interface Information

Considering the previous community discussions mentioning that Native Markets submitted its bidding proposal just one hour after Hyperliquid's official announcement, it is no wonder that Dragonfly managing partner Haseeb previously stated, “It’s starting to feel like the USDH RFP is a bit of a farce. I’ve heard from multiple bidders that, aside from Native Markets, no validators are interested in considering other issuers. This isn’t even a serious discussion; it’s as if a backroom deal has already been made. The proposal from Native Markets appeared almost immediately after the USDH RFP was announced, suggesting they were notified in advance. Others were scrambling to put things together all weekend. So the entire USDH RFP is basically tailored for Native Markets.”

Meanwhile, the community seems to have reached a consensus that the best proposals come from established players like Ethena, Paxos, and Agora, rather than a brand new startup like Native Markets. Polymarket tells a similar story—once Ethena's proposal was announced, the odds skyrocketed, becoming the most likely winning option until people realized that validators were not interested. Within 2 hours, the odds plummeted.” Subsequently, he added in the comments, “Now I’ve heard from over half of the USDH bidders that they agree with this and say they won’t publicly say it because they think it’s pointless and will only be criticized.” Additionally, another bidder remarked, “For obvious reasons, I don’t want to say this publicly, but count me among those who are ‘sure this is prepared for Native Markets and they underestimated how fierce the competition would be.’”

Of course, in response to Haseeb's comments, Alex Svanevik, CEO of Nansen, which operates the largest HL validator alongside Hypurr Collective, stepped up to refute, stating: “This is absolutely a factual error. Our team has put in a lot of effort to review proposals and communicate with bidders to find the best alternatives for HL. I’ve been receiving private messages and calls from USDH bidders all week, and it’s always us reaching out to them. We even encouraged hesitant players to push their proposals forward to make the whole process more competitive.”

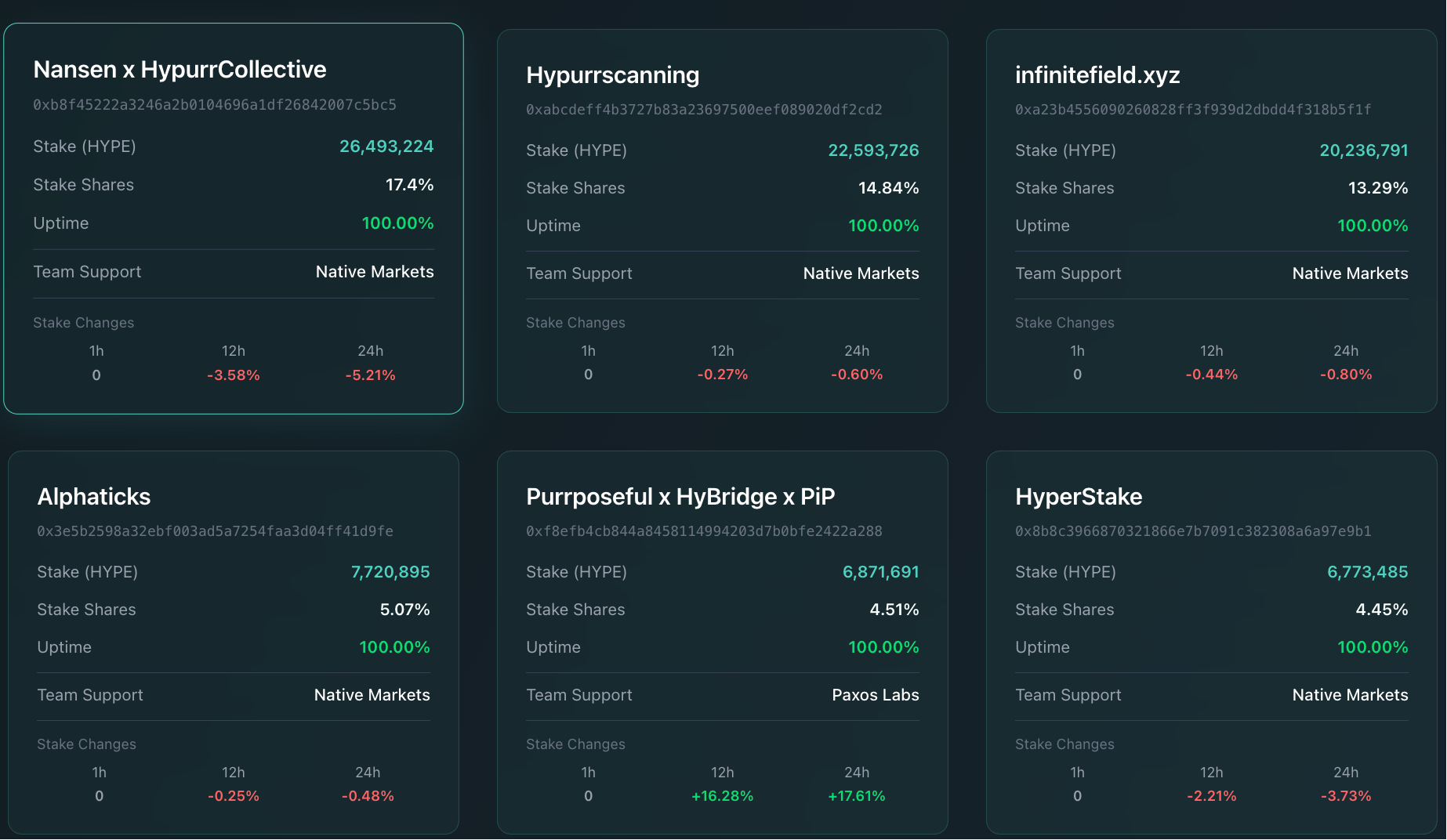

However, the facts show that Nansen chose to "vote with their feet"—according to USDH voting information, Nansen and Hypurr Collective's HYPE staking amount is approximately 26.5 million, accounting for a staggering 17.4% of the staking share, making them the validator with the highest voting share, and the USDH issuer they support is the "native project of the Hyperliquid community"—Native Markets. And despite the Nansen CEO's previous assertions, their voting share has dropped by 5.21% in 24 hours and 3.58% in 12 hours.

Some Hyperliquid Validators USDH Proposal Voting Information

USDH Proposal Interlude: Millionaires' “!Rank” and “Meow” Moments

It is worth mentioning that during the USDH proposal bidding process, two rather interesting events occurred, even somewhat amusing.

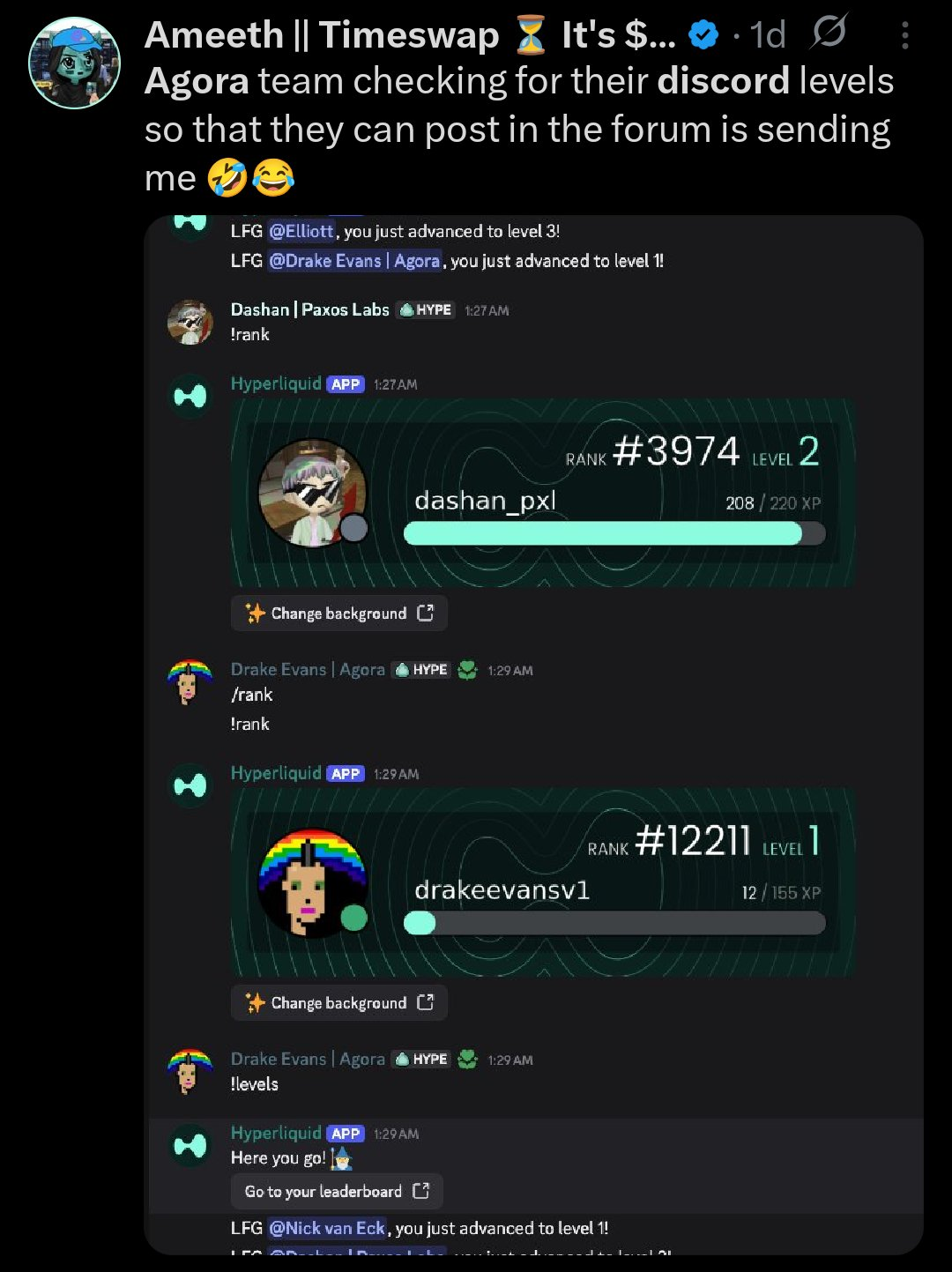

To show sincerity, members of the Agora and Paxos teams were busy checking their community speaking levels.

After Hyperliquid officially opened a sub-channel for various issuers to submit proposals for USDH, the teams from established issuers Paxos Labs and Agora frequently checked their speaking levels and community rankings on Discord to ensure they would smoothly secure their speaking rights and demonstrate their active participation in the community.

It must be said that the USDH bidding once again showcases the charm of the "auction mechanism," after all, behind it is a cash flow business worth over $5.6 billion, with annual profits exceeding $200 million.

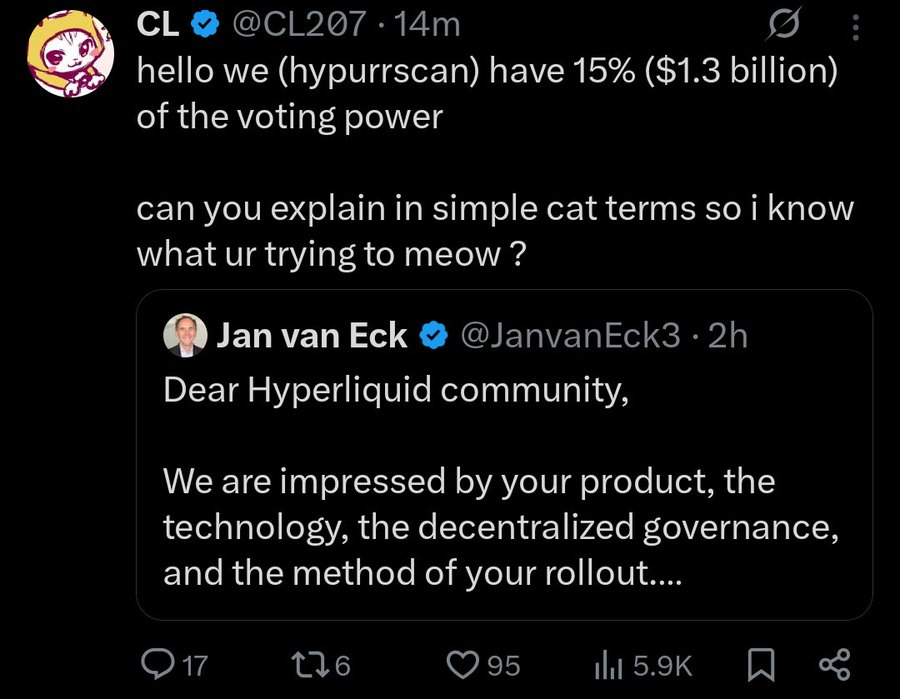

Billion-dollar asset management giant Van Eck's leader makes efforts to win over validators, asking them to “meow” for explanations.

Aside from the issuer team members doing their utmost to show sincerity, Jan van Eck, the CEO of VanEck, a resource provider behind the issuer Agora, also rarely made a statement on the X platform, directly addressing Hyperliquid community members and praising the platform, ecosystem, and community achievements.

Subsequently, CL, a builder behind Hypurrscan, stated directly: “We have 15% of the voting rights (worth $1.3 billion), can you explain what you mean in simple terms?”

Of course, in the end, Hypurrscan team member Syavel stated: “After careful consideration, Hypurrscan has voted for Native Markets. Among many competitors, we believe Native Markets is the only proposal that truly prioritizes Hyperliquid and aligns most closely with Hyperliquid.”

But in any case, as someone commented: “This is actually too crazy! A bunch of Wall Street billionaires have to fight like mice with a bunch of cartoon characters just to get their stablecoin approved.”

“Crypto Tycoons Show Affection”: Paxos Labs and Ethena Show Maximum Sincerity, but the Latter Ultimately Withdraws

Now it seems that if we view the USDH bidding as a "courtship ceremony" initiated by major stablecoin issuers towards the Hyperliquid platform, Native Markets, led by Max Fiege, is like a childhood friend who has weathered storms with the Hyperliquid platform, while established stablecoin issuers like Paxos Labs and Ethena are more like domineering CEOs coming to court.

Paxos: Inviting PayPal and Venmo to Join the Cooperation Network, Holding Global Legal Issuance Rights

In the USDH v 2 version proposal submitted by Paxos, as an established stablecoin issuer, it chose to leverage its strong "cooperation resource advantages" and "global layout advantages"—

Collaboration with global payment giant PayPal - HYPE will be listed on PayPal/Venmo, with free deposits and withdrawals for USDH, offering $20 million in ecosystem incentives, as well as full-channel payment integration with Checkout, Braintree, Venmo, Hyperwallet, and Xoom. It is worth mentioning that PayPal and Venmo cover a user base of up to 400 million people.

Redesigned reward mechanism - A clear AF-first (donation foundation priority) incentive structure, where Paxos Labs only earns when the TVL milestone is reached, capped at 5%, with all fees charged in HYPE tokens, directly aligning with community interests.

Global expansion plan - Paxos Labs will collaborate with Paxos, the only issuer legally authorized to issue global stablecoins, while other bidders only claim to meet GENIUS standards and cannot legally issue in Europe. Their issuing entities only hold MTL. Paxos is currently the only issuer in the world that can ensure USDH expands globally in a fully compliant manner.

Ethena: I would have directed my heart to the bright moon, but the bright moon shines on the ditch

Compared to Paxos, Ethena is seen as the "new star of stablecoins" after Tether and Circle. The latest data shows that its two major stablecoins, USDe and USDtb, have issued over $15 billion (with USDe issuing over 13.2 billion and USDtb over 1.8 billion).

Previously, Ethena put considerable effort into competing for the USDH issuance rights, with its core proposal terms including:

- USDH will initially be 100% backed by USDtb;

- Ethena promises to use at least 95% of the net income generated from USDH reserves for the Hyperliquid community;

- If the Hyperliquid community wishes to reprice the current USDC-denominated trading pairs to USDH, Ethena will bear all the trading costs of migrating USDC to USDH;

- The Ethena Labs research team will submit a proposal to the Ethena risk committee to list USDH as a compliant backing asset for USDe, among other things.

In other words, Ethena will not only bear the migration costs of USDC on the Hyperliquid network but will also share 95% of the revenue back to the community. To put it in perspective, it’s like a domineering CEO in a relationship not only giving you money but also covering the "breakup fee" with your ex.

However, with the fresh results of the validator voting, even this wealthy CEO, Ethena, could no longer continue its self-pitying "courtship"—on the evening of September 11, Ethena founder Guy Young posted that after communicating with validators and delegators, due to community concerns about its non-local team identity and compatibility with the Hyperliquid ecosystem, Ethena decided to withdraw from the USDH stablecoin issuance competition.

Of course, this does not mean Ethena is completely exiting the Hyperliquid ecosystem's stablecoin track; it emphasized that there will be a series of plans to follow, such as developing new products with the local Hyperliquid ecosystem team, including:

- hUSDe native synthetic dollar,

- USDe enabling savings and card consumption products,

- achieving hedging liquidity on Hyperliquid,

- and the unique HIP-3 market design space enabled by Ethena:

a) Trading collateral with rewards,

b) Modular primary brokerage business,

c) Stock perpetual contracts.

Additionally, it mentioned that "other corresponding stablecoin codes have long been prepared", with plans to launch new stablecoins in the future.

It is worth noting that in this lengthy statement about withdrawing from the USDH bidding, Guy Young's words contained many playful remarks, implicitly expressing sarcasm towards the Native Markets team and Hyperliquid ecosystem validators.

As for who is right or wrong, and who will ultimately laugh in the Hyperliquid ecosystem stablecoin war, all will be verified by time.

Finally, according to previous official announcements from Hyperliquid, each node validator indicated their voting intentions and reasons in the "Validator USDH Voting Statement." Formal voting will begin on September 14 at 18:00 UTC+8, and stakers must delegate their stakes to validators aligned with their voting intentions before this time. Formal voting will close at 19:00 UTC+8, and when a two-thirds support ratio is reached, the designated bidder will be able to bid for the USDH token symbol in the spot deployment gas auction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。