Is “Banks to Adopt BNB” Is Possible Amid Rising Price & Market Demands

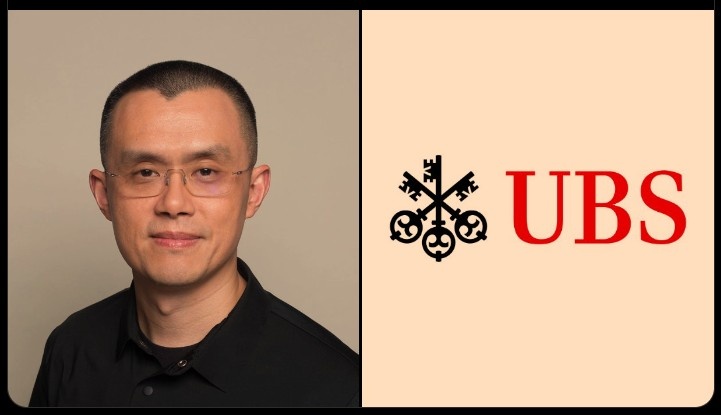

Changpeng Zhao (CZ), founder of Binance, has once again made a spark in the crypto world through his urging of traditional banks to adopt BNB, the native token of the Binance ecosystem. His message came shortly after reports showed BNB’s market capitalization had grown larger than that of Union Bank of Switzerland (UBS), the world’s biggest private bank.

Source: X

What Make The Coin A Wise Choice For Banks

BNB-coin has been widely adopted in decentralized finance (DeFi) platforms and exchanges, because it is faster and cheaper compared to many other blockchains.

For banks, this technology could be useful in areas like global payments and digital assets, where low charges and high speed are important. Unlike traditional systems that generally cost high fees and days period for transactions, BNB-based transfers are designed to be rapid and low-cost.

Institutional BNB-Treasuries Signal Bullish Demand

Binance coin is getting attention from big companies, similar to how bitcoin became popular with businesses in 2020-2021. Nano Labs, a Nasdaq-listed firm, announced plans to buy up to $1 billion in BNB-asset, after CEA Industries ($160M) and Windtree Therapeutics ($60M) recent purchases.

Source: CoinMarketCap

Binance coin has about 139 million tokens in circulation. If a company spends $100 million to buy the asset, it takes away about 0.7% of the tradable supply, which makes the token more scarce. Analysts say this looks like MicroStrategy’s Bitcoin strategy, but applied to an altcoin.

BNB’s Price Performance

BNB , the main token of the Binance ecosystem, went up 3.64% in the last 24 hours, doing better than the overall crypto market, which rose 1.99%. Over the past week, BNB has gained 9.4%, helped by signs that big investors are buying, strong trading signals, and growth in the Binance ecosystem.

Options trading shows that investors are optimistic. Many traders are betting on it forgoing higher. The next big price level they’re watching is around $959.83, a point it last reached in July 2025, which could act as resistance.

Conclusion: Rally With Caution

BNB’s recent rise is being driven by companies rushing to buy in (FOMO), strong trading signals, and real use within the Binance ecosystem. Together, these factors have made the token one of the best-performing major altcoins in 2025.

Still, whether BNB’s rally can last will depend on clear rules from regulators and key upcoming events, like VanEck’s proposed BNB-ETF and a September 17 Fed meeting about rate cut.

Also read: Hamster Kombat Daily Cipher September 15 2025: Play And Win免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。