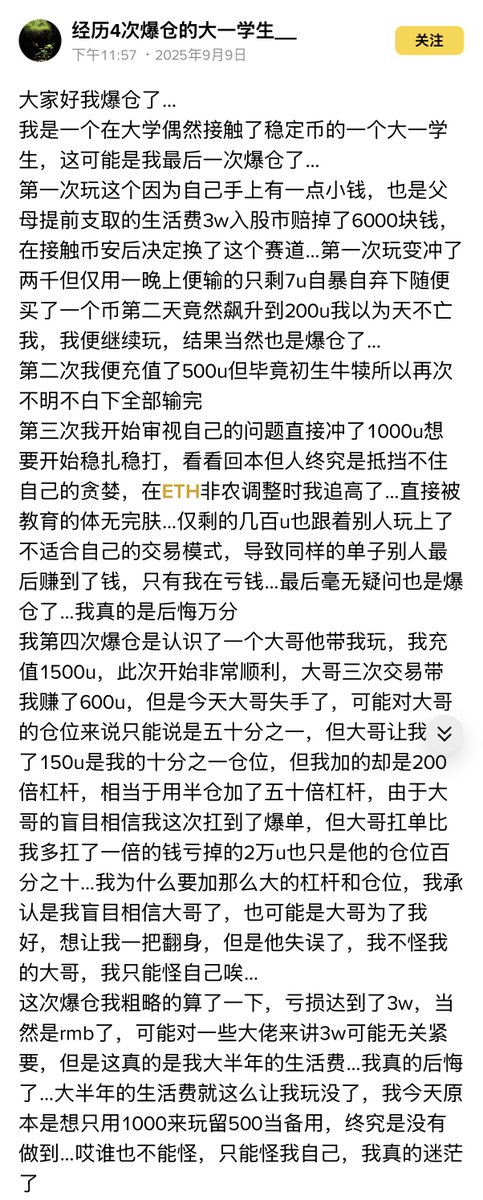

🩸I came across a university student's four liquidation experiences on Binance Square, and I felt quite emotional about it!

Some may laugh at him for being foolish, but from another perspective, he simply walked through pitfalls that would take most of us years to encounter, all in a few months.

If I were to extract something from these stories, I think it would be the four typical mistakes in investing—

1⃣ Treating luck as skill

At first, he only invested a few hundred dollars, just trying it out, and ended up making money.

This is precisely the most dangerous start—short-term good luck creates an illusion, making one mistakenly believe they have mastered the rules, thinking that if they replicate it once more, they can continue to win.

Napoleon said, “Victory has a hundred fathers, but defeat is an orphan.” Victory can obscure mistakes, while failure reveals the truth.

The market is best at dispelling illusions. Short-term profits are not hard skills; they are merely events of luck. True ability lies in maintaining one's trading logic amidst countless ups and downs.

2⃣ Blindly increasing stakes, ignoring risks

The second time, he borrowed 500 USDT, thinking he could make a quick comeback. As a result, when the market moved, it instantly went to zero.

This is a common mistake many people make: thinking that with less money, it doesn't matter.

But the reality is quite the opposite—when the principal is smaller, it needs more protection.

Because small capital cannot withstand a complete loss, especially in a phase without other cash flow, one must cherish every bit of their chips.

3⃣ Losing control of emotions, treating trading as gambling

The third time, he invested 1000 USDT, wanting to be more stable. However, due to an explosive mindset while watching the market, he was led by the market, chasing highs and cutting losses, ultimately accelerating his losses.

Warren Buffett said: The biggest enemy in investing is not others, but oneself.

There are actually many opportunities in the market; the real fatal issue is not the volatility, but losing your composure amidst it.

4⃣ Trusting others, losing independent thinking

Finally, he met a big brother who guided him in trading. Initially, it went smoothly, but the other party's operational mistake led to both of them being liquidated and losing everything.

This is the most fatal blow: handing over decision-making power to others.

There are no saviors in the market; whoever you listen to for tips or insider information, the final responsibility can only be borne by yourself.

Independent thinking is not only a required course in investing but also the starting point of all freedom.

True maturity means that even if you are wrong, you must be wrong within your own logic. Because only in this way can you have the opportunity to extract your own experiences from mistakes.

Four liquidations boil down to just four bottom lines—

Luck can deceive you,

Cherish your principal,

Control your emotions,

Persist in independence.

It sounds simple, but it is essentially the lifelong practice of most investors!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。