Author: Frank, MyStonks Research Institute

Over $6.8 billion in market capitalization, $12 billion in on-chain RWA issuance scale, but only $30 million in verifiable assets?

On September 13, 2025, a storm of skepticism regarding data authenticity hit Figure, the "first RWA stock," just two days after its NASDAQ debut.

0xngmi, the founder of the crypto data dashboard DeFiLlama, publicly pointed out that Figure's on-chain asset data and trading volume were severely inconsistent, suggesting that the IPO metrics were exaggerated: it claimed to have issued $12 billion in on-chain RWA, but the verifiable reserves of BTC, ETH, and stablecoins amounted to only about $30 million, with almost no real trading activity visible on-chain.

A series of doubts not only thrust Figure's constructed $10 billion RWA empire into the spotlight but also raised a core question that Wall Street must confront: How can effective due diligence and verification systems be established in the face of the increasing influx of Web3 companies into the capital markets, amidst a series of emerging on-chain narratives?

The Highlight Moment of the "First RWA Stock"

Before the storm of skepticism about data authenticity erupted, Figure's IPO was a highlight moment for the integration of crypto assets and traditional finance.

On September 11, Eastern Time, Figure, a leader in the RWA sector, rang the bell on NASDAQ with an IPO price of $25, soaring to $36 at the opening, a 44% increase, and ultimately closing at $31.11, marking a first-day increase of 24.4%. Based on the latest closing price, its market capitalization stood firmly above $6.8 billion, far exceeding its $3.2 billion valuation during private fundraising in 2021.

For a company established only seven years ago, this is undoubtedly a tremendous success.

The market's enthusiasm stemmed from Figure's unique positioning as the "first RWA stock."

RWA, short for Real World Assets, aims to bring real-world assets such as real estate, U.S. Treasury bonds, consumer credit, U.S. stocks, and artworks onto the blockchain through tokenization, to release liquidity and improve trading efficiency. This is a sector with immense potential.

Taking the U.S. consumer credit market, where Figure operates, as an example, the total scale exceeds $10 trillion, while the penetration of blockchain technology is nearly zero. Recognizing this blue ocean, Mike Cagney, the former CEO of "P2P star company" SoFi, founded Figure in 2018, with the core business of innovating loan services, particularly Home Equity Lines of Credit (HELOC), using blockchain technology.

Leveraging its self-developed Provenance blockchain, Figure has brought processes like loan approval and asset securitization on-chain, reducing the average loan approval cycle from 42 days at traditional banks to just 5 days, significantly lowering operational costs and providing investors with higher liquidity.

This model has proven to not only deliver an appealing narrative but also solid financial fundamentals, as evidenced by the financial documents submitted to regulators:

- Performance: Achieved a net profit of $29.1 million and revenue of $190.6 million in the first half of 2025, successfully reversing last year's losses during the same period;

- Business Growth: The U.S. has $35 trillion in home equity, and in the 12 months ending June 30, Figure facilitated approximately $6 billion in home equity loans, a year-on-year increase of 29%;

- Quality Clients: The weighted average FICO credit score of its loan clients exceeds 750, demonstrating robust risk control capabilities;

Its strong market position has also garnered industry endorsements. According to Mike Cagney, 10 of the top 20 mortgage companies in the U.S. are using Figure's technology, and over 20 major banks are utilizing its Provenance blockchain.

For this reason, Mike Cagney stated in the prospectus, "Figure is the largest player in the public blockchain space for real assets, and no other peers can surpass it." It is this immense market potential and the rarity of its business model that together confer a significant valuation premium on Figure.

The B Side of Figure: A Roshomon of RWA Data Authenticity

However, the impressive financial data and successful IPO narrative represent the A side that Figure presented to Wall Street, while its B side— the authenticity of on-chain data— sparked the storm regarding the authenticity of RWA data.

To understand the core of this controversy, one must first grasp the significance of TVL (Total Value Locked).

In the crypto world, TVL initially refers to the scale of assets locked in a DeFi protocol (decentralized finance project) and is a common metric used to measure the size of DeFi businesses, representing how much real money the market is willing to "put at risk" to trust the project.

The crux of the issue lies here: the TVL of RWA is fundamentally different from that of DeFi:

- DeFi assets are real assets like ETH and stablecoins stored in on-chain contracts, and anyone can verify balances and transactions through a blockchain explorer;

- In contrast, RWA involves complex off-chain modules such as custody, debt, and compliance, primarily recording the scale of loans and debts in internal systems (databases), and then generating corresponding token "certificates" on the blockchain;

Thus, whether the on-chain RWA issuance scale truly corresponds 1:1 to off-chain real-world assets is difficult to conclude based solely on on-chain information. This inherent "two-layer" property of on-chain and off-chain even allows project parties to simply "map" the numbers from their internal databases to a few controlled addresses with no transaction records, fabricating hundreds of millions in TVL out of thin air.

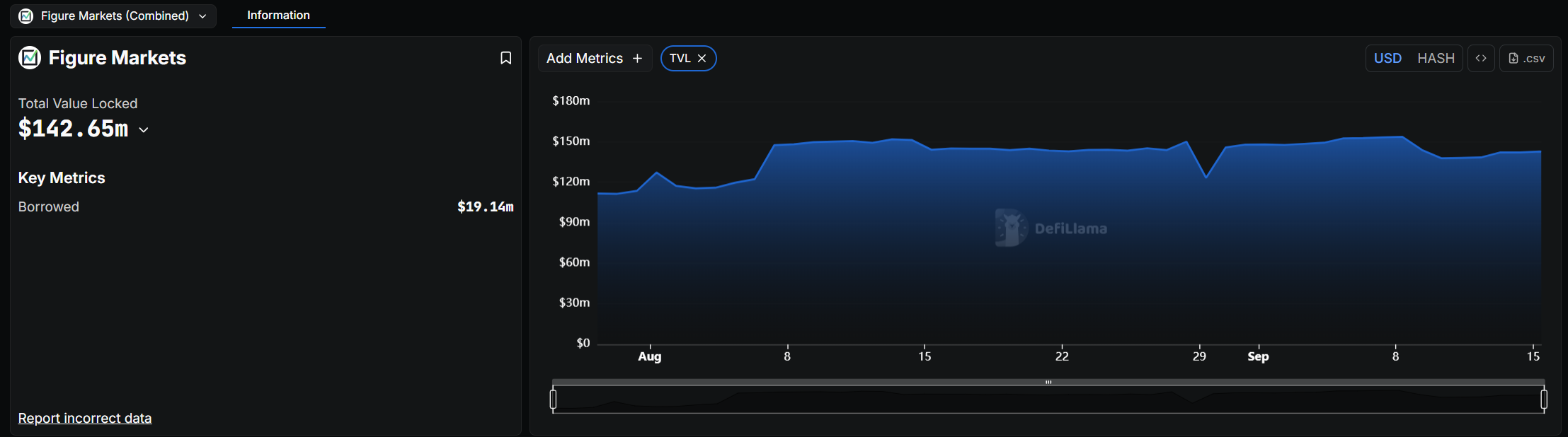

This makes the oversight and statistics from third-party data platforms particularly important. As one of the most commonly used dashboards in the crypto space, DeFiLlama's metrics have long been regarded as a reference by institutions, researchers, and project parties— and this was the spark that ignited the controversy. DeFiLlama's TVL statistic for Figure was only about $140 million (with other business lines' TVL also concentrated in the tens of millions to $100 million range), which is significantly different from Figure's publicly claimed issuance scale of over $10 billion in RWA.

Interestingly, the first spark that ignited this tug-of-war over the TVL metric actually came from Figure itself.

On September 10, the night before Figure's IPO, its co-founder Mike Cagney suddenly launched an attack on X, directly targeting DeFiLlama:

"We have migrated HELOC loans (one of the first native consumer loans on public chains) to CoinGecko (note: CoinGecko is a crypto market and data website), but DeFiLlama refuses to count them in TVL just because we don't have enough fans to support a $13 billion TVL… This is contrary to the authenticity and transparency that blockchain represents."

This "preemptive" statement quickly fermented on social media, placing DeFiLlama in the spotlight of "unprofessionalism and lack of transparency," with some even suggesting that DeFiLlama might have a hidden rule of charging for listings.

Two days later, DeFiLlama founder 0xngmi published a lengthy article titled "The Problem in RWA Metrics" in response, clarifying that the so-called "fan count" was not the reason for refusal, but rather that there was a serious discrepancy between Figure's on-chain data and its claimed scale:

- Figure claimed to have issued $12 billion in on-chain RWA, but the visible BTC and ETH assets on-chain were only $9 million, and the total supply of its own stablecoin YLDS was merely $20 million;

- Most loan businesses are still settled in fiat currency systems, with on-chain payments being almost invisible;

- The transactions driving asset liquidity are mostly operated by accounts unrelated to the asset holders;

In other words, since Figure does not use public chains like Ethereum or Solana but rather its proprietary blockchain platform, the so-called massive TVL may not represent real assets that can be freely circulated and independently verified, but rather a mapping of internal database numbers on-chain.

0xngmi also revealed that prior to Mike Cagney's public attack, the DeFiLlama team had privately communicated with the Figure team in Telegram groups regarding these doubts for several weeks, but Figure did not respond directly, instead choosing to amplify the "fan count" accusations on social media the night before the IPO, attempting to pressure DeFiLlama into relaxing its listing standards to endorse the data before its IPO.

Subsequently, well-known on-chain "white hat" detective ZachXBT also joined the fray, publicly supporting DeFiLlama and stating that Figure was using a set of RWA metrics that could not be fully verified on-chain to shape its scale and exert pressure on third-party platforms.

Thus, a "Roshomon" surrounding data authenticity and metric standards officially unfolded.

A Required Lesson for TradFi and Crypto

It is worth noting that the controversy surrounding Figure coincides with a grand backdrop—Web3 companies are collectively and rapidly embracing the capital markets.

Last week was dubbed the busiest IPO week in the U.S. since 2025. This was especially true for crypto-listed companies. Following the benchmark case of stablecoin issuer Circle, several crypto enterprises across different business lines have recently gone public, and the capital markets have responded with unprecedented enthusiasm.

This includes the IPO of the well-known cryptocurrency exchange Gemini Space Station Inc. (GEMI), led by billionaires Cameron and Tyler Winklevoss, which received over 20 times oversubscription. The price range was adjusted several times, ultimately pricing at an expected $28 per share, with the stock soaring over 60% on its first day of trading.

On the other hand, European "buy now, pay later" (BNPL) giant Klarna Group Plc (KLAR) also completed its pricing on September 10 at $40 per share, raising $1.37 billion. This pricing not only represented an 8% premium over the originally planned upper limit of $35-37 but also received over 20 times oversubscription, making it highly sought after.

It can be said that, under the dual backdrop of the Trump administration's friendly attitude towards the crypto industry and the passage of stablecoin legislation, investor enthusiasm is no longer limited to Bitcoin, Ethereum, and their related reserve companies, but is beginning to spill over into Web3 companies with concrete business scenarios.

This essentially marks the first large-scale collision between the parallel worlds of TradFi and Crypto, and for both sides, this is an expensive required lesson before the frenzy of paying high premiums for the sexy narrative of Web3 comes to an end.

For TradFi, which is accustomed to reading financial reports and analyzing price-to-earnings ratios, crypto companies bring a completely new valuation language and due diligence dimensions. Figure has vividly exposed the significant risks arising from this "language barrier." Traditional due diligence can verify Figure's impressive off-chain financial data—revenue growth, profitability, and quality clients.

However, the core support for its $10 billion valuation comes from an on-chain narrative that is somewhat unfamiliar to TradFi. Wall Street must catch up and learn on-chain metrics and verification methods to avoid being captured by a seductive "RWA narrative" and a string of attractive TVL numbers.

The same applies to Crypto, which is eager to embrace the mainstream. Going public means accepting more transparent standards and stricter disclosures. Attempting to exploit information asymmetry may yield short-term gains, but in the crypto world where on-chain data can be scrutinized at any time, it is akin to walking a tightrope. Once exposed, it will not only destroy the credibility of a single company but also deepen the mainstream world's negative stereotypes about the entire industry.

Regardless of how Figure's Roshomon ultimately concludes, it will serve as a significant case study for the alignment of valuation logic, transparency standards, and trust systems between TradFi and Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。