Source: Coinbase Research

Translation: Golden Finance

Key Points:

We believe the Federal Reserve will cut interest rates by 25 basis points on September 17: Weak labor and real estate markets increase the likelihood of a rate cut, but inflation trends make a conservative path more probable.

DAT in the PvP phase: Many DATs have compressed their mNAV to around 1, and trading volume has decreased; however, NAV and supply shares continue to rise.

Federal Reserve: Current Urgency

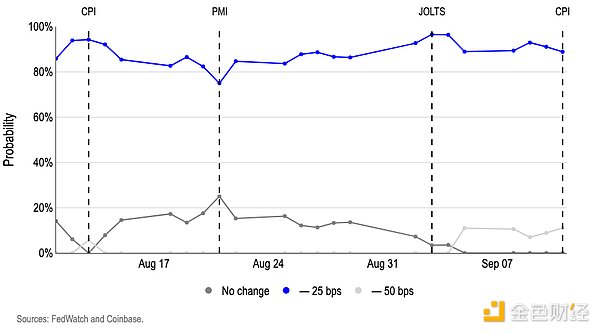

We believe the Federal Reserve will cut interest rates by 25 basis points (rather than 50 basis points) at the Federal Open Market Committee meeting next week (September 17) for the following reasons:

Inflation trends remain unchanged—driven by the continued rise in core services/housing and energy, the overall CPI in August was slightly above expectations (month-on-month increase of 0.4%, with a median expectation of 0.3% month-on-month). This data is insufficient to reverse the annualized inflation trend; more importantly, core CPI remains manageable (super core services only increased by 0.33%, down from 0.48% in July). However, we believe this data is enough to prevent conservative board members from taking more aggressive cuts this month.

Employment is crucial—nevertheless, expectations for job cuts continue, as the U.S. Bureau of Labor Statistics revised its preliminary estimate of non-farm payrolls down by 910,000 this week, indicating that labor market weakness may have begun as early as spring 2024. If so, this means the business cycle actually peaked in early Q2 2024, and recent data suggests we may have extended this downturn.

Housing—we believe housing is currently the biggest risk factor for the U.S. economy, as despite a 2.9% year-on-year increase in the median U.S. home price, the number of housing starts and permits has fallen to its lowest level in years. Coupled with weak labor market data, the outlook for the real economy appears bleak from the perspective of long-term high interest rates.

Credibility—nevertheless, a 50 basis point cut would be interpreted as suggesting that policy has been too tight for too long, which contradicts the "data-dependent" guidance of recent months. A gradual policy allows the committee to update more labor and inflation data without locking in an aggressive path. From the perspective of the policy loss function, the Fed's risks are asymmetric: the cost of being overly accommodative and reigniting price pressures is greater than the cost of being overly accommodative and reassessing at the next meeting.

Figure 1: Futures prices currently reflect a 100% certainty of a rate cut in September, with a very low probability of a 50 basis point cut.

In-Depth Exploration of DAT

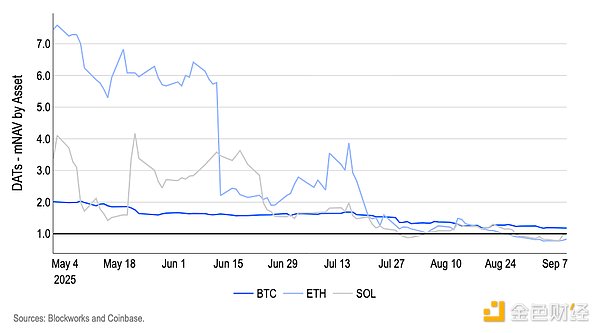

The mNAV of most Digital Asset Trusts (DATs) has essentially converged to par, with the compression of ETH DAT being the most significant since May. We believe this indicates that the "DAT premium" is disappearing and has entered a valuation-constrained PvP phase. The weighted average mNAV of ETH DAT has dropped from over 5 times in early summer to below 1 time in early September (Figure 2). We believe this pattern indicates: 1) Investors are now pricing ETH DAT shares primarily as a transfer of underlying reserve assets rather than speculative "operations" driven by cryptocurrency enthusiasm; 2) Competition among issuers has offset most of the "DAT premium."

Figure 2. Weighted average mNAV of digital asset trusts categorized by asset class.

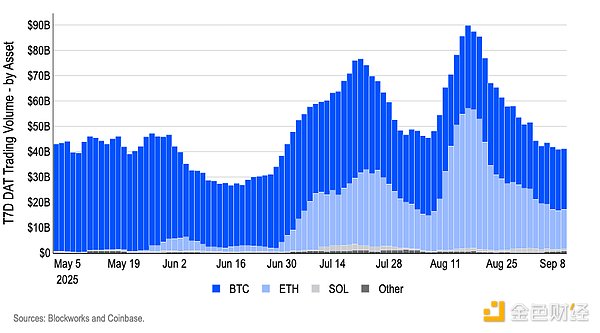

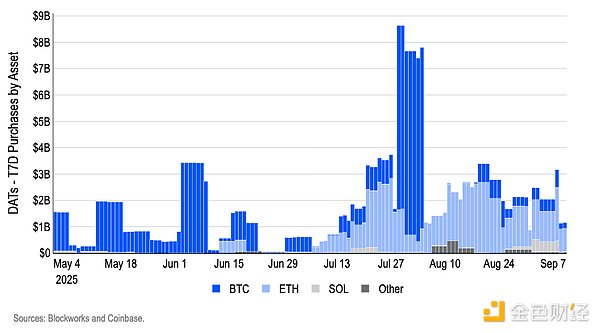

DAT trading volume peaked in mid-August and has declined in September, indicating that the narrative around DAT is gradually fading, while valuations are re-anchoring around net asset value (NAV). During this period, the trading volume of DAT has decreased by about 55% over the past 7 days, with the shares of ETH DAT shrinking alongside those of BTC DAT (Figure 3). Using trading volume as an indicator of attention, we believe the narrative around DAT is marginally weakening, which may reduce market participants' willingness to pay speculative premiums. The surge in Treasury purchases in late July/August and the subsequent consolidation of cryptocurrency prices highlight the liquidity-driven nature of trading: enthusiasm wanes when major buying momentum slows and macro uncertainty dampens market sentiment, causing mNAV to retreat to around 1 (Figure 4).

Figure 3. T7D DAT trading volume – categorized by asset.

Figure 4. T7D DAT purchase volume – categorized by asset.

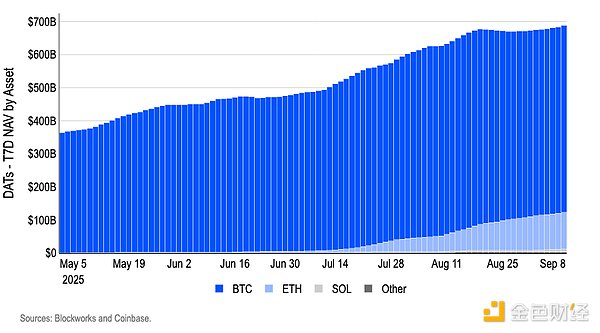

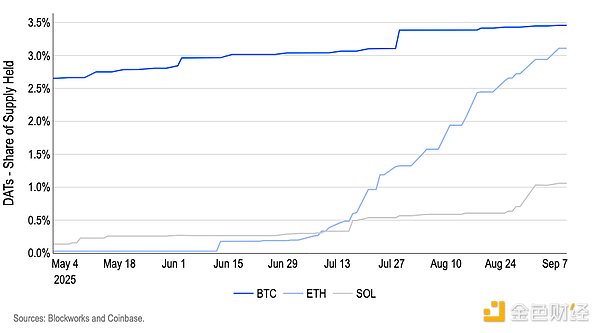

However, despite the decline in trading volume and compression of premiums, the absorption of balance sheets continues—most notably in ETH—shifting the focus from mispricing to capital flows and structural factors. The NAV of DAT and the total supply share held by DAT have continued to rise in September (Figures 5 and 6), indicating that even as the equity pricing of DAT approaches NAV, they remain structural demand absorbers for circulating supply. We believe the combination of rising ownership shares and mNAV ≈ 1 defines the PvP phase. Cross-sectional results depend on execution and policy choices (financing mix, pace of capital purchases, treatment of staked ETH), while at the overall level, the constraining variables are merely the pace and breadth of net capital purchases, rather than any persistent equity premium.

However, we note that if the cryptocurrency market regains momentum, the PvP phase may reverse, as we believe that under a risk preference mechanism, when attention exceeds major issuances, speculative premiums may re-emerge, forming a temporary wedge. We believe that the key factor determining whether such mechanisms can return may lie in macro liquidity—especially the trajectory of policy interest rates—we believe that the role of macro liquidity in shaping risk preferences is greater than the fundamentals of specific protocols.

Figure 5. T7D DAT net asset value – categorized by asset.

Figure 6. Proportion of assets held by DAT to total supply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。