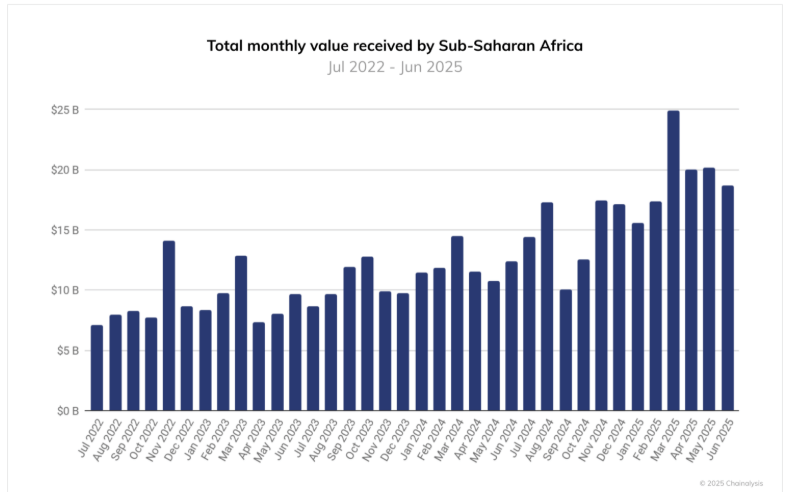

In March, Sub-Saharan Africa (SSA) saw a sharp surge in cryptocurrency usage, with monthly on-chain volume reaching nearly $25 billion, its highest since the beginning of the year. According to the blockchain security firm Chainalysis, this spike in activity defied a downward trend that was prevailing in other regions at the time.

In the two months that followed, however, the SSA region’s total monthly value received dropped to approximately $20 billion. The region’s volume has remained above $15 billion since the beginning of the year. As expected, centralized exchange activity in Nigeria accounted for a disproportionate share of the $25 billion.

“The surge was driven largely by centralized exchange activity in Nigeria, where a sudden currency devaluation prompted increased crypto adoption,” the Chainalysis report states. “Such devaluations typically drive volumes higher in two ways: more users move into crypto to hedge against inflation, and existing purchases appear larger in local currency terms as it takes more fiat to buy the same amount of crypto.”

Overall, the SSA region received over $205 billion in on-chain value between July 2024 and June 2025, a roughly 52% increase from the previous year. This growth makes SSA the third-fastest-growing region in the world, just behind Asia-Pacific (APAC) and Latin America.

During the same period, bitcoin ( BTC) dominated fiat-based crypto purchases in the region, accounting for 89% in Nigeria and 74% in South Africa—far above the 51% seen in USD-based markets. According to Chainalysis, this trend reflects BTC’s role as both a store of value and a primary gateway to crypto, especially in regions with currency volatility and limited investment options.

“Conversely, USDT adoption is also more pronounced in Nigeria than in USD markets, accounting for 7% of purchases versus just 5% in the USD cohort,” the report added.

Chike Okonkwo, marketing manager at the crypto exchange YDPay, attributed BTC’s dominance in Nigeria to two realities: trust and accessibility. Okonkwo also explained why Nigerians are particularly keen on bitcoin and stablecoins like USDT.

“Nigerians are very pragmatic in their adoption of crypto. Bitcoin is preferred because it’s globally recognized, liquid, and has proven its resilience over time,” Okonkwo explained. “Stablecoins, on the other hand, appeal to users who want dollar-denominated savings without the hurdles of restricted or limited FX access. This trend highlights what matters most to Nigerians: protection from inflation, fast access to value, and reliability.”

According to Okonkwo, ethereum (ETH) and other altcoins are largely seen as more suitable for trading as a means of generating extra income.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。