Tom Lee Fed Rate Cut Prediction: How Crypto & Stocks Could Gain prices

Tom Lee Fed rate cut predictions are gaining attention after in a recent interview he spoke with CNBC. The chairman of Bitmine Immersion Technologies shared why he believes Bitcoin, Ethereum and even stocks could see gains if the Fed eases monetary policy which is currently at 4 -4.25%.

Ethereum’s Growing Role in Finance

He highlighted that Ethereum acts as the backbone of stablecoins, now widely used by banks, businesses and for payment networks also. Bitmine Immersion has recently updated that it had $10.77 billion in cash and 2.15 million ETH.

Source: X

On September 8, it purchased 202,469 coins and filled Bitmine treasury with 919,180 ETH, a move he says strengthens the network and positions investors ahead of the expanding stablecoin market.

“ More Ethereum means stronger transaction validation and a more secure network. It’s the infrastructure for the future of finance, ” – Tom Lee said.

Stablecoins could grow from $250 billion to $2 trillion, increasing network activity and fees and making Ethereum a core asset for investors. Currently Ethereum is trading around $4,512, showing a down of around 2.54% recorded in 24 hours, as per the data of CoinMarketCap.

Bitcoin: Digital Gold in a Rate Cut Environment

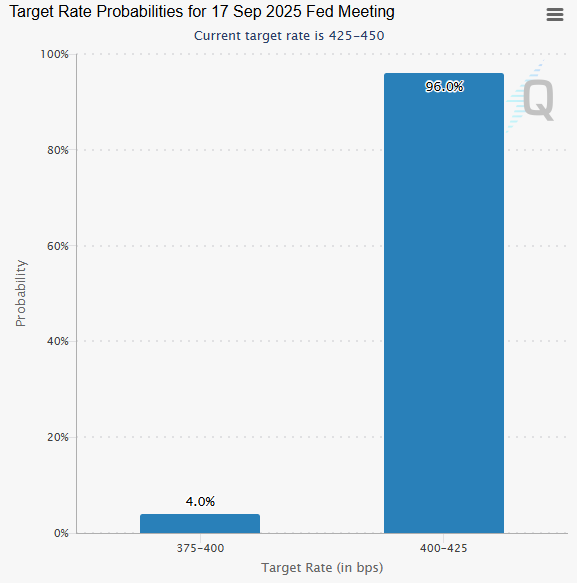

Tom Lee continues to back Bitcoin as a store of value. With the Fed expected to lower rates by 25 basis points and bringing the federal funds interest to 4.00%-4.25% for the first cut after months on hold.

Tom Lee Federal rate cut predictions says that Bitcoin could benefit from this increased liquidity and boost risk assets, making crypto a natural beneficiary.

Source: Fedwatch

Markets are already pricing in easing whereas Bitcoin recently traded near $115,800, rising 3.4% in the past week. Ethereum is also up, trading near $4,528 with a 5% gain. At the present time the Bitcoin is trading around $116k with a rise shown 0.32% in a day.

Stocks and Other Assets Could Benefit Too

Tom Lee Fed rate cut predictions stands beyond crypto also as he noted that tech shares, small caps and financial stocks often react positively to lower rates. He suggested that Bitcoin and Ether might stand out even more due to their sensitivity to monetary policy and seasonal strength.

Investor optimism is growing as markets await the Federal Reserve two-day meeting and Wednesday’s announcement. Signs of a cooling labor market, slower job growth and an unemployment interest of 4.2% in July have fueled expectations of easier liquidity.

Strategic Implications for Investors

According to Tom Lee Fed rate cut predictions, the convergence of crypto and finance makes now a right time for strategic investments.

By holding Ether and digital gold, the crypto investors can benefit from network security, staking rewards and potential market rallies fueled by a Fed rate reduction. He emphasized that this approach positions investors to capitalize on the long-term evolution of digital finance.

Conclusion

Overall, Lee sees a Fed rate cut as a big opportunity for BTC, ETH, and stocks. Investors keeping an eye on this move could benefit as markets respond to easier liquidity and growing crypto adoption.

Also read: Bitcoin ETFs See $260M Inflows as Fed Rate Cut Looms免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。