The general listing standards may be passed as early as October, and their adoption could bring a large number of new cryptocurrency ETPs.

Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Luffy, Foresight News

In my usual CIO memo, I try to provide insights on market dynamics. For example, last week I wrote about why it is "Solana season" now and predicted that Ethereum's main competitor would make a strong push by the end of the year. Since then, SOL has risen by 7.72%, which is quite good.

However, observing the cryptocurrency market today is like watching the pre-game show of the Super Bowl. With interest rate cuts, a surge in ETP (Exchange-Traded Product) inflows, increasing concerns about the dollar, and strong momentum in tokenization and stablecoins, the market is poised for a significant rebound by the end of the year. Yet, as investors, we are mostly in a wait-and-see mode. Why is that?

First, historically, August and September are the two worst-performing months for cryptocurrencies in the year. But more importantly, significant developments—such as the recent approval of Bitcoin ETPs by major brokerage firms or progress on new legislation in Congress—often take time to yield results.

So, while we wait, I want to share some insights on the U.S. Securities and Exchange Commission (SEC) regarding the approval of cryptocurrency ETPs. In my view, the SEC is preparing to fully open up this market.

General Listing Standards

Currently, spot cryptocurrency ETPs are approved by the SEC on a case-by-case basis. If you want to launch a spot cryptocurrency ETP based on a new asset in the U.S. (such as a Solana ETP or Chainlink ETP), you must submit a special application to the SEC requesting the right to do so.

In your application, you must demonstrate certain market conditions: the market has sufficient liquidity to support the ETP, the market is not subject to manipulation, and so on.

It is no exaggeration to say that this takes time. The SEC's review process for each application can take up to 240 days, and even then, approval is not guaranteed. The first application for a spot Bitcoin ETP was submitted in 2013, but it wasn't until 2024 that the SEC approved related products. The application process has always been costly and fraught with risk.

But as we speak, the SEC is working to establish "general listing standards" for cryptocurrency ETPs. The idea is that under these general listing standards, as long as an application meets certain clearly articulated requirements, the SEC will almost certainly approve it. Moreover, the approval process will be quick: applications will be approved within 75 days or less.

What are the requirements?

The SEC is still studying this issue and gathering input from the cryptocurrency industry. Currently, most proposals suggest that as long as the underlying asset has futures contracts traded on a U.S. regulated futures exchange, the issuer should be able to launch a spot cryptocurrency ETP. Eligible futures exchanges include giants like the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (Cboe), but may also include lesser-known derivatives platforms like Coinbase Derivatives Exchange and Bitnomial. Assuming a broader list is approved, potential ETPs for cryptocurrencies could soon include Solana, XRP, Chainlink, Cardano, Avalanche, Polkadot, Hedera, Dogecoin, Shiba Inu, Litecoin, and Bitcoin Cash. As more futures contracts are introduced, this list is likely to grow.

What history tells us

The general listing standards may be passed as early as October, and their adoption could lead to a large number of new cryptocurrency ETPs. This is intuitively understandable, and the history of ETFs supports this.

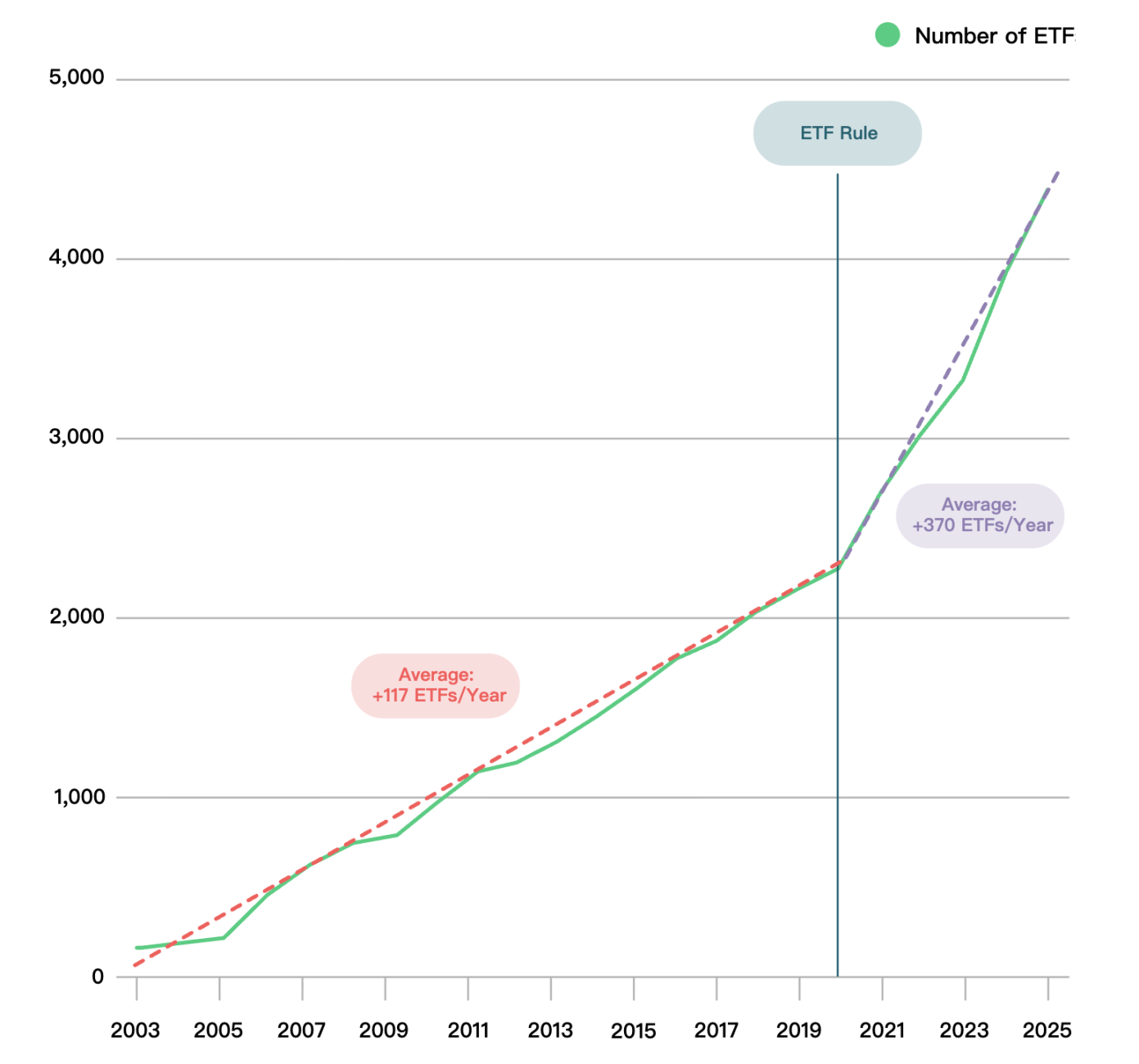

Until the end of 2019, all ETFs followed the same case-by-case regulatory approach that cryptocurrency ETPs currently follow. However, in 2019, the SEC passed the "ETF Rule," establishing general listing standards for stock and bond ETPs. Subsequently, the number of ETF issuances surged dramatically.

The chart below from ETFGI shows the number of ETFs listed in the U.S. each year. Before the ETF Rule was passed, an average of 117 new ETFs entered the market each year. Since the ETF Rule took effect, that number has more than doubled to 370 per year.

Source: Bitwise, ETFGI

As the number of ETFs increases, the number of ETF issuers has also risen significantly, as it has become very easy for companies to launch ETFs.

I expect to see the same thing happen in the cryptocurrency space. We should see the rise of dozens of single-asset cryptocurrency ETPs as well as index-based cryptocurrency ETPs, and we will see many traditional asset managers also launching spot cryptocurrency ETPs.

What does this mean for cryptocurrency prices?

Investors may easily misunderstand the impact this will have on the market. The mere existence of cryptocurrency ETPs does not guarantee a massive influx of funds. There needs to be a fundamental interest in the underlying assets.

For example, a spot Ethereum ETP is set to launch in June 2024, but it won't really start attracting funds until April 2025, when interest in stablecoins begins to rise. Similarly, I suspect that ETPs based on assets like Bitcoin Cash will struggle to attract inflows unless the asset itself shows new promise.

However, the significance of ETPs is that if the fundamentals start to improve, the assets are more likely to see substantial increases. Most of the world's capital is controlled by traditional investors, and when ETPs exist, it becomes much easier for these investors to allocate funds to the cryptocurrency space.

There is also a larger, perhaps harder-to-quantify point: ETPs reduce the mystique surrounding cryptocurrencies. They make cryptocurrencies less intimidating for the average investor, easier to see, and more accessible. For crypto natives with a dozen wallet addresses, Chainlink, Avalanche, and Polkadot no longer sound like strange tokens; they are stock symbols that anyone can access in a brokerage account. This leads to greater real-world attention on cryptocurrencies and their many use cases. People are more likely to notice articles about Chainlink partnering with Mastercard for payments, Wyoming using Avalanche to issue stablecoins, or Standard Chartered exploring the use of Ripple technology for cross-border payments.

The SEC adopting general listing standards is a "maturing" moment for cryptocurrencies, a signal that we have entered the mainstream, but it is just the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。