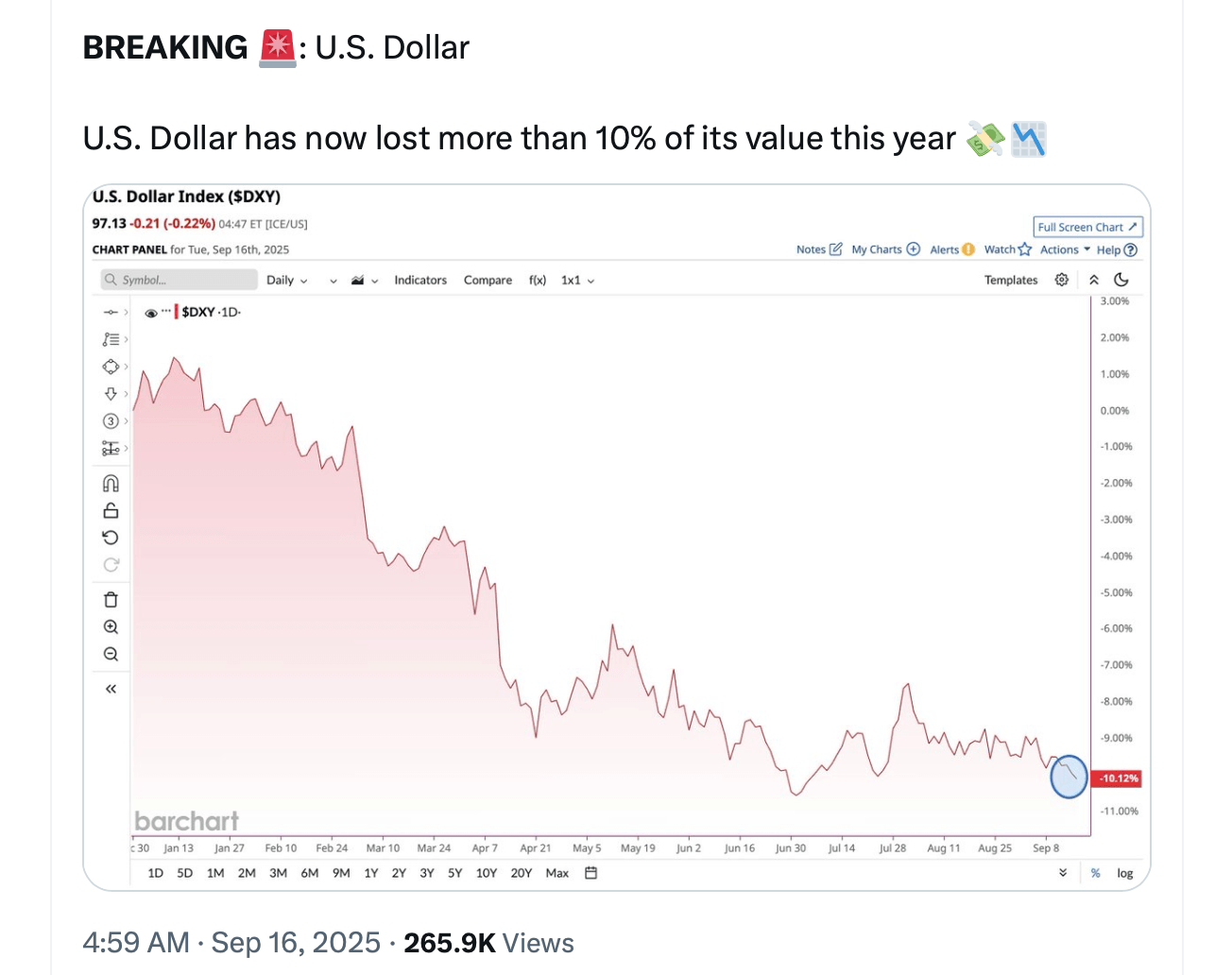

Wall Street calls it a rotation; Main Street calls it “why is my food pricier?” The greenback’s slide, captured by the DXY index, marks one of the sharpest retreats in years and signals a reset in how investors weigh U.S. risk, yields, and politics against opportunities abroad. Exporters are smiling. Importers are calculating.

Drivers are familiar but potent: softer data, fiscal jitters, tariff talk, and the drumbeat of expected rate cuts that narrows the U.S. yield edge. When the Federal Reserve hints at easier policy while Europe and others steady their hands, the dollar’s old advantage looks less like a moat and more like a puddle. Traders have noticed.

Consumers feel it first. A weaker dollar nudges up the price of imported goods and food, airline tickets, and foreign fuel, keeping pressure on inflation gauges policymakers hoped would drift lower by autumn. Overseas, U.S. tourists find the cappuccino costs more; at home, retailers juggle margins or pass costs along. None of this is catastrophic, but it isn’t free.

Corporate America is split. Multinationals love the translation lift when foreign sales convert into more dollars, and manufacturers welcome the extra tailwind in bids abroad. Import-heavy firms grumble as invoices swell, and hedging desks earn their keep. Equity strategists, meanwhile, dust off playbooks that favor cyclicals, commodities like gold, and international stocks when the dollar sags.

For markets, the shift scrambles the leaderboard. Non-U.S. assets outperform more easily when the dollar weakens, and emerging markets catch a breather on dollar-denominated debts. Gold and certain commodities tend to get a bid, and we are seeing this in real-time today. Bond investors watch whether a softer dollar and any tariff-linked frictions complicate the Fed’s disinflation story, or merely shade the path to modest cuts.

The big picture: This is not a currency coup, it’s a harsh come-down from a 15-year bull run. The U.S. dollar remains the world’s clearinghouse, but confidence is a rate, not a right, and greenback supporters insist it must be maintained. If policy steadies and growth firms, the slide can slow. If not, diversification—by central banks and portfolio managers—keeps creeping from slogan to standard.

What to watch next: incoming inflation prints, the Fed’s forward guidance during tomorrow’s meeting, and tariff salvos that could rattle supply chains. Until those cards are shown, investors are leaning into balance—trimming home bias, adding currency hedges, and letting the weaker dollar do some subtle portfolio engineering.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。