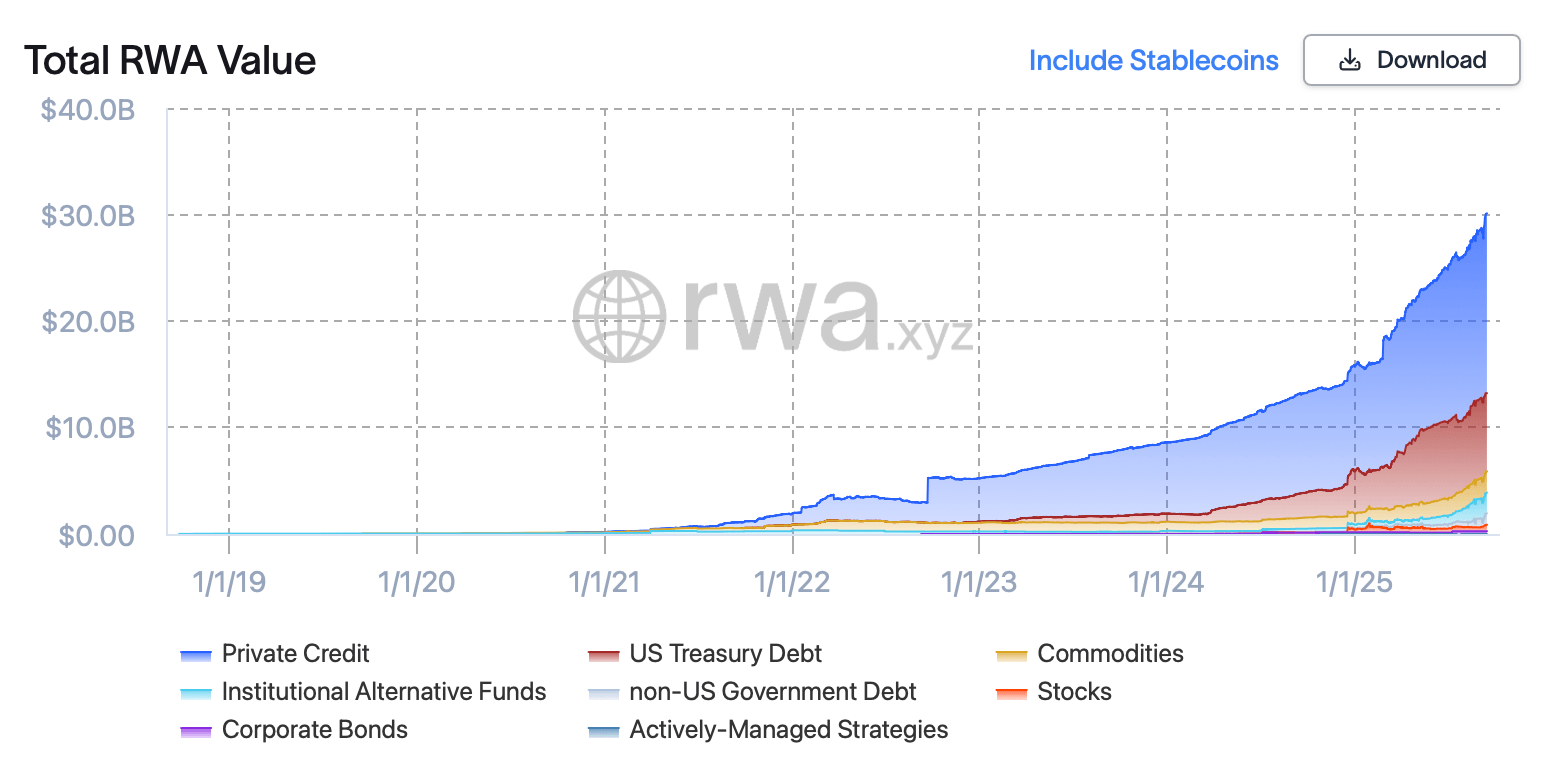

If 2025 had a theme playlist, real-world assets (RWAs) would be on repeat. Tokenized treasuries, onchain private credit, and even wrapped commodities and equities have all bulked up in style. According to rwa.xyz metrics, the market tacked on a 9.51% lift over the past 30 days.

Source: rwa.xyz

Across the RWA arena, the numbers tell their own story: roughly 392,697 holders are in the game, backed by more than 200 asset issuers keeping the pipeline flowing. Ethereum wears the crown with $9.16 billion in RWA value locked in, while Zksync Era trails behind in second place, holding a still hefty $2.4 billion.

Private credit sits at the throne with $16.89 billion, while tokenized U.S. treasury funds follow as runner-up, stacking a solid $7.42 billion. The mix gets even richer with $1.33 billion in global bonds, $2.52 billion tied to commodities, $1.95 billion in institutional funds, and about $529.11 million tucked into onchain stocks.

The tokenized RWA sector isn’t just growing—it’s gearing up for liftoff. Forecasts suggest today’s billions will balloon into trillions by 2030 and beyond. Heavyweights like McKinsey and BCG peg the market cap anywhere from $2 trillion to $10 trillion by the end of the decade.

As capital continues its digital makeover, RWAs appear set to become the backbone of blockchain finance, bridging traditional finance (TradFi) markets with onchain innovation. The accelerating momentum hints at a future where tokenized assets dominate portfolios, reshaping how value is stored, transferred, and unlocked globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。