Institutional Flows Favor Bitcoin as Ether ETFs End Five-Day Winning Run

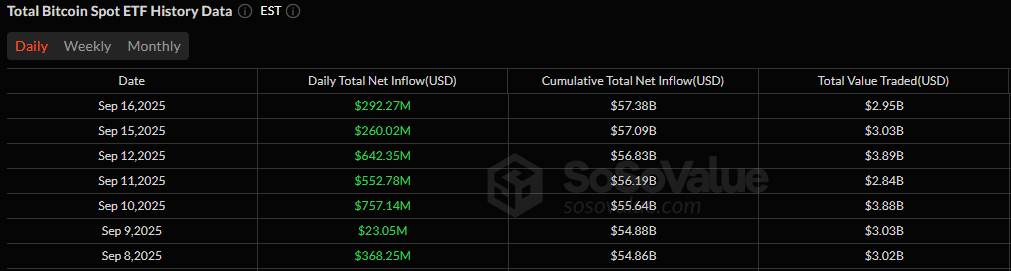

Momentum stayed firmly behind bitcoin exchange-traded funds (ETFs) on Tuesday, Sept. 16, as the funds notched their seventh straight day of inflows while ether ETFs took a break. The split underscored how investors are currently leaning more heavily toward bitcoin, even as ether funds cooled after an impressive streak.

Bitcoin ETFs added $292.27 million, with Blackrock’s IBIT again commanding the spotlight. Its $209.18 million haul dwarfed the rest of the field. Fidelity’s FBTC contributed $45.76 million, while Ark 21Shares’ ARKB pulled in $40.68 million. Vaneck’s HODL rounded out the green with $7.42 million. The only blemish came from Bitwise’s BITB, which saw a $10.78 million outflow. Even so, trading remained robust at $2.95 billion, with net assets rising to $153.78 billion.

Seven days of inflows for BTC ETFs. Source: Sosovalue

Ether ETFs, on the other hand, ended their five-day inflow streak with $61.74 million in outflows. Fidelity’s FETH led the retreat with $48.15 million exiting the fund, followed by Blackrock’s ETHA with a $20.34 million outflow. Bitwise’s ETHW did provide a $6.75 million boost, but it wasn’t nearly enough to offset the exits. Total value traded for ether ETFs was $1.70 billion, with net assets steady at $29.60 billion.

With bitcoin continuing to attract steady institutional inflows and ether cooling off, the market is showing a clear preference, at least for now. The coming days will test whether ether’s pause is a blip or the start of a deeper shift in sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。