The price of BNB rose nearly 3% over the last 24 hours after Bloomberg reported that Binance is moving toward a potential deal that would end a a key compliance requirement from the exchange’s 2023 settlement with the U.S. Department of Justice.

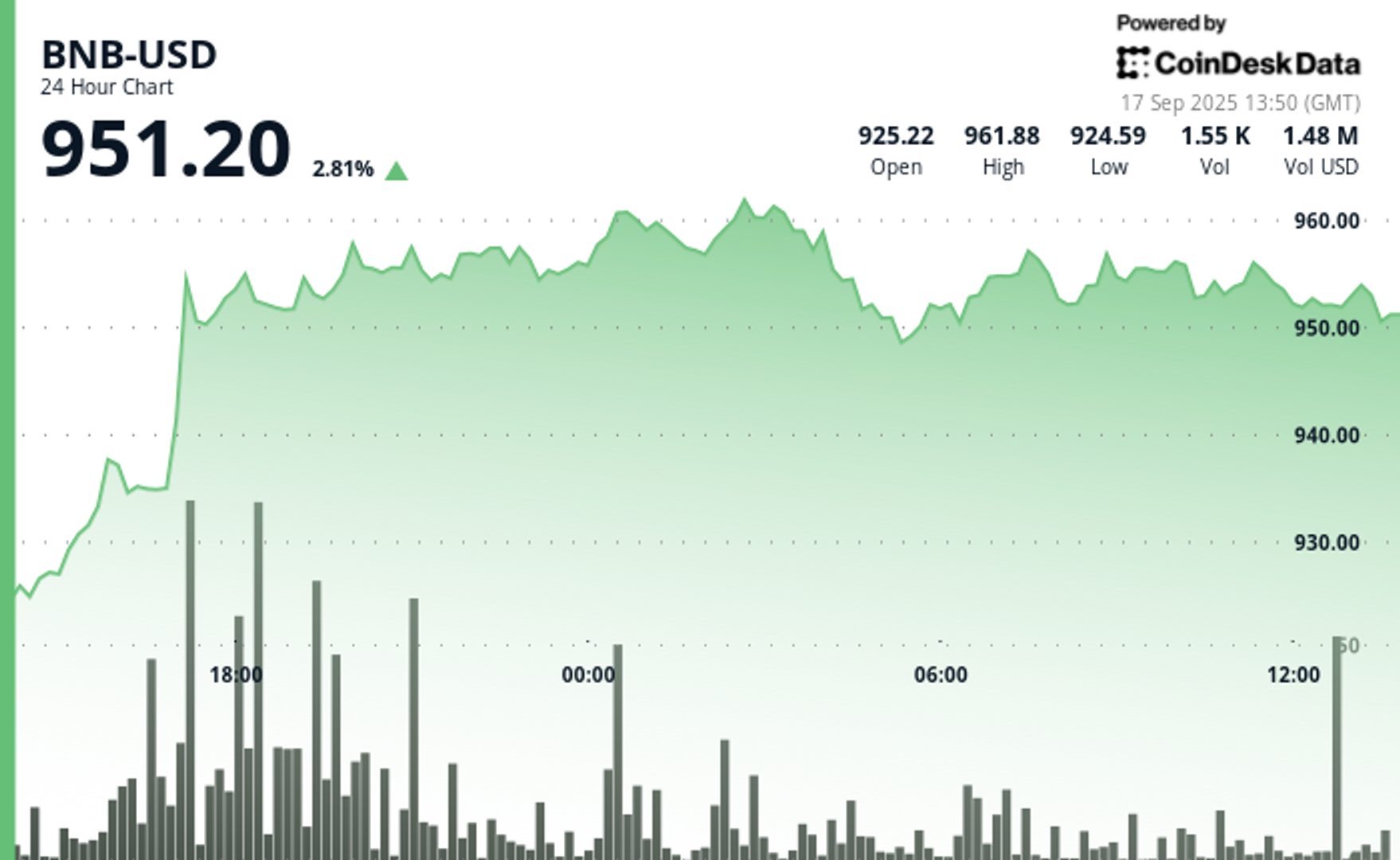

BNB, which offers discounted trading fees on the exchange, was recently trading near $950 after failing to decisively push through it on a rally that started after the report was published. The court-appointed monitor was appointed as part of Binance's $4.3 billion settlement over anti-money transmitting violations.

The move would follow a growing trend inside the DOJ, which has already released at least three other firms, including an arm of U.K. lender Natwest Group and shipbuilder Austin, from similar oversight after they agreed to enhanced reporting requirements.

If finalized, the deal would likely require Binance to adopt stricter internal reporting systems. The DOJ has not made a final decision, according to Bloomberg, and the Treasury Department's own monitor over Binance would remain in place for now, the report adds.

BNB’s price rose as high as $963 in today’s trading session, its highest level in months, before settling back. Trading volumes also spiked.

The rise allowed BNB to outperform the wider crypto market, which has been treading water ahead of the Federal Reserve's interest-rate decision due later Wednesday . The CoinDesk 20 (CD20) index is up 0.8% in the past 24 hours.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。