Recently, I studied the "RWA Report 2025" published by Dune (link) and the internal RWA report from Plume, gaining a clearer understanding of the development trends of on-chain real-world assets (RWAs) in 2025. The report indicates that the on-chain capital market is undergoing a structural upgrade: asset types are expanding from low-risk government bonds to private credit, commodities, institutional funds, stocks, and real estate, while liquidity, composability, and retail participation are significantly increasing. This trend not only validates the practical implementation of RWAs in DeFi but also provides important references for the future financialization of assets.

In my view, government bonds remain the core foundation of on-chain RWAs. Projects like BlackRock BUIDL, WisdomTree WTGXX, and Janus Henderson JTRSY not only provide compliant, low-risk government bond tokens but also support multi-chain issuance, real-time NAV, and near-instant redemption, making government bonds a composable base asset. Plume's nTBILL has performed exceptionally well on the retail side, attracting 86,000 users in just a few months, demonstrating that on-chain RWAs have already surpassed the limitations of traditional TVL metrics and are beginning to form a genuinely active user base. This dual-driven mechanism of institutions and retail is pushing RWAs from being mere "holdable assets" towards a programmable capital market.

The on-chaining of private credit and high-yield assets is a direction I am particularly focused on. Projects like Maple Finance, Tradable, and Pact are bringing high-yield, institutional-grade assets into DeFi through cross-chain composable networks, forming a complete yield chain. Notably, the on-chaining of these assets not only enhances liquidity but also brings actionable credit spread returns, while simultaneously raising higher demands for risk management, including credit assessment, collateral portfolio liquidation, and cross-chain operational risks. Therefore, I believe that in the next 12 months, the growth rate of high-yield RWAs may still exceed that of government bond assets, but sustainability will depend on the maturity of risk control and compliance mechanisms.

Composability is the greatest value innovation of on-chain RWAs. The combination of collateral, yield, and derivatives allows government bonds, private credit, commodities, and stocks to be freely combined like financial Lego blocks. For example, Ondo GM and Backed Finance's xStocks platform achieves retail-driven high liquidity through cross-chain trading and secondary market mechanisms, while also providing a foundation for DeFi strategies. This composability not only improves capital utilization efficiency but also means that RWAs will no longer be single assets but can form multi-layered, re-packagable on-chain financial instruments.

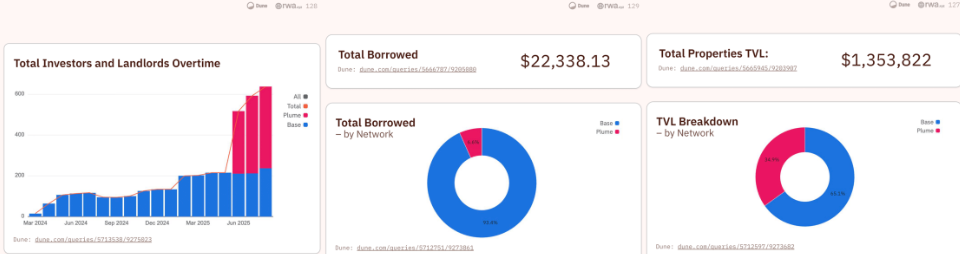

The on-chaining of commodities and real estate reflects the future potential of RWAs. Plume's XAUm, Mineral Vault (MNRL), and Spice Protocol's agricultural supply chain project demonstrate the initial activity of on-chain commodity and energy assets; RealtyX brings real estate rental income on-chain, achieving an average cash flow distribution of 6.9%. The DeFi transformation of such real cash flow assets provides investors with diversified income sources and brings on-chain assets closer to the real economy. My observation is that with the improvement of derivatives, lending, and secondary market mechanisms, in the next three to five years, real estate and commodity RWAs may become important growth engines in the on-chain capital market.

From an overall ecological perspective, the development of RWAs is forming a pattern of institutional foundation + retail activity + composable financial tools. Institutions provide stable, compliant funding and settlement channels, while retail participation brings liquidity and network effects. Whether on-chain RWAs can truly replace some functions of traditional capital markets in the future depends on the maturity of regulatory compliance, multi-chain settlement capabilities, and risk control mechanisms. I personally judge that on-chain RWAs are not only the underlying infrastructure of DeFi but also have the potential to become a new hub for global cross-border asset flows, especially when multi-currency and multi-regional sovereign assets and real cash flow assets can be further standardized and composable.

Plume: Benchmark Practice for On-Chain RWAs

In the entire on-chain RWA ecosystem, Plume can be seen as a benchmark in this field. Compared to traditional RWA projects, Plume's uniqueness lies in widespread retail participation + multi-asset category implementation + composability, forming a complete closed loop of on-chain asset financialization.

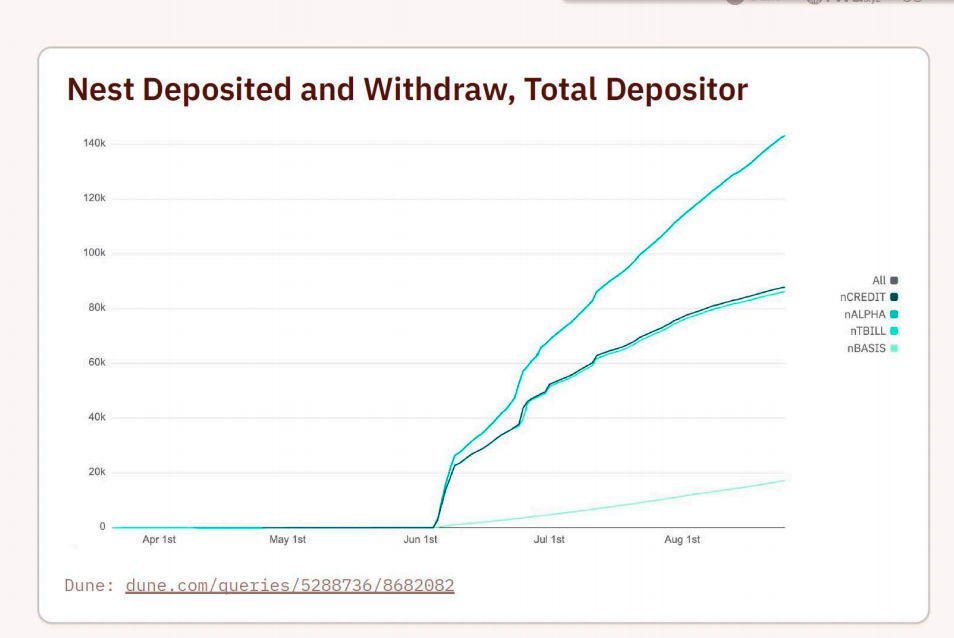

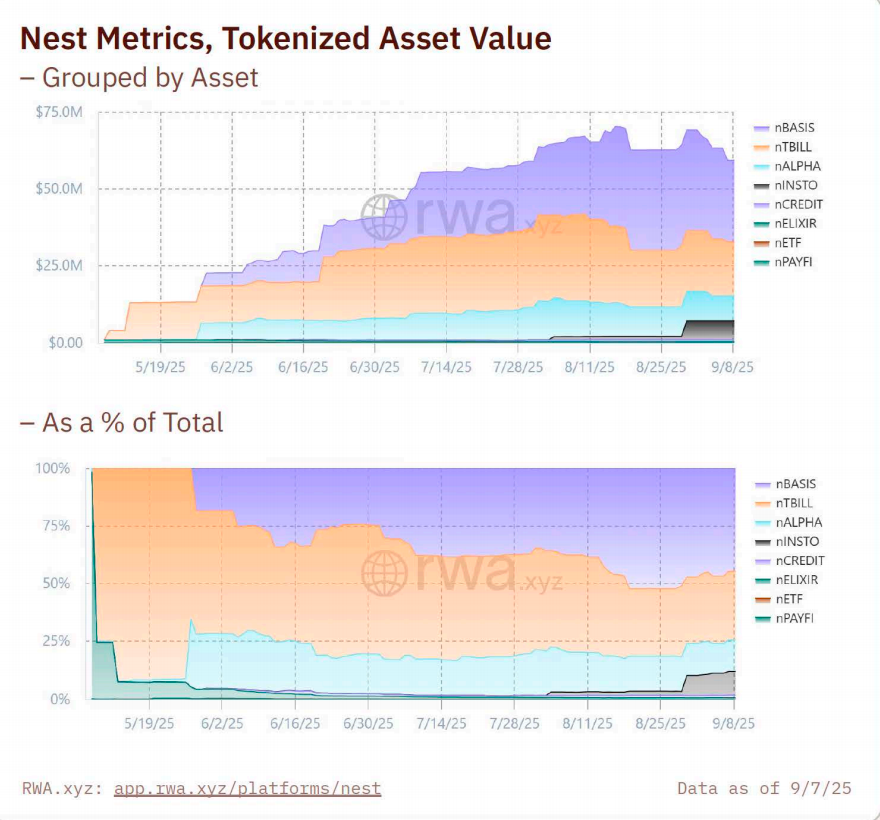

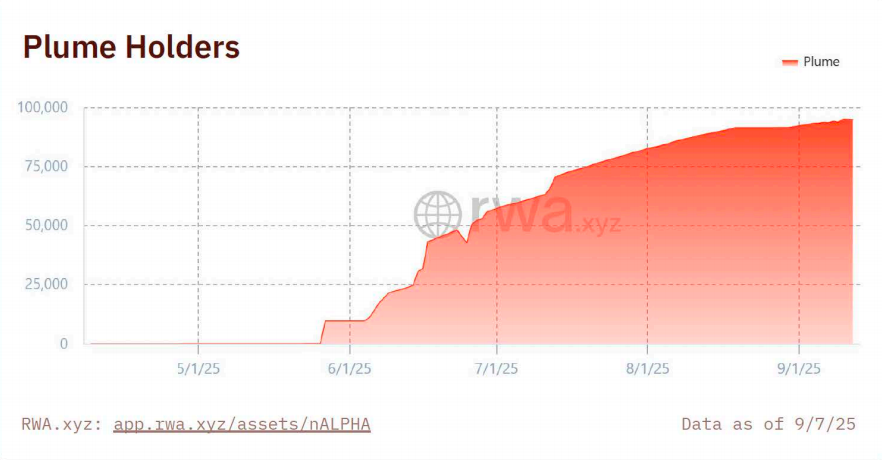

According to Plume's internal report, its Nest series products (nTBILL, nALPHA, nCREDIT, nBASIS, nINSTO, nELIXIR) have attracted hundreds of thousands of real active users in just a few months, rather than merely passive TVL accumulation. Among them:

- nTBILL: 86,000 users participated, serving as the on-chain government bond foundation, providing not only low-risk returns (annualized 4.75%) but also direct usability within the Plume DeFi ecosystem, supporting collateral, lending, and trading.

- nALPHA: Linked to commodity assets like MNRL, showcasing the potential for high liquidity and high composability on-chain, with an annualized yield of 10.20%.

- nCREDIT: Accessing multiple institutional credit products, achieving the on-chaining of high-yield assets while retaining programmability and cross-chain capabilities, with an annualized yield of 7.18%.

- nBASIS: Annualized yield of 11.54%, providing low-risk composable RWA investment tools.

- nINSTO: Annualized yield of 4.84%, focusing on high-quality institutional assets on-chain.

- nELIXIR: Annualized yield of 5.26%, serving as a composable low-volatility asset, providing stable underlying support for DeFi strategies.

Additionally, Plume continues to innovate in commodity and cash flow assets:

- XAUm: 61K users, with trading activity accounting for 87% of the total, showing that Plume has become the core network for XAUm on-chain trading.

- MNRL: Valuation increased from 0 to 2.3 million USD within two months, marking the rapid implementation of on-chain commodity assets.

- Spice Protocol: Over 140K deposit and withdrawal operations, with a TVL of 54,000 USD, utilizing the Proof of Trade system to bring international supply chain data on-chain, providing dual value of yield and market information for DeFi users.

- RealtyX: Real estate rental income on-chain, averaging a distribution of 6.9%, while supporting dual-chain operations between Plume and Base, demonstrating the feasibility of cross-chain cash flow assets.

Plume's successful practice not only reflects the usability and composability of on-chain assets but also sets an industry benchmark for RWAs. Its experience indicates:

- Retail participation is key to scaling: The number of active users and transaction frequency directly impact asset liquidity and secondary market depth.

- The implementation of multiple asset categories validates the potential of composable financial tools: From government bonds to credit, commodities, and real estate, RWAs are no longer limited to single assets but can form multi-layered, re-packagable on-chain capital markets.

- The maturity of risk management and compliance mechanisms determines sustainable development: Plume's institutional collaborations, custody arrangements, and transparent yield calculation mechanisms provide operational templates for the on-chaining of high-risk assets.

It can be said that Plume has completed the leap from "on-chain asset experiment" to "on-chain capital market infrastructure." For the entire RWA sector, it is not only a successful product case but also a barometer and reference template for the development of the on-chain asset ecosystem. In the future, if other projects wish to achieve balance on both retail and institutional sides and build composable assets, Plume's experience undoubtedly holds significant reference value.

Overall, the RWA market in 2025 has started from government bonds and is gradually expanding to diverse assets that are high-yield, composable, and cash-flow oriented. Plume's practical case shows that widespread retail participation and the convenience of on-chain operations are key factors driving the scaling and sustainable development of RWAs. In the long run, the true value of RWAs lies not only in the on-chaining of assets themselves but also in how they reconstruct the composability, liquidity, and global connectivity of on-chain capital markets. I believe that in the future, RWAs will upgrade from "on-chain asset display" to "on-chain capital markets," becoming an important bridge for the integration of DeFi and real finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。