Risks are more about timing than direction.

Written by: Prathik Desai

Translated by: Block unicorn

Article published on September 16

Gold has reached an all-time high, the stock market has also surpassed profit warnings, and the dollar has begun to weaken. Risk assets seem ready to continue climbing. However, Bitcoin, which is usually most active during periods of liquidity easing, has now dropped to just below $117,000.

Despite ample market momentum—ETFs have absorbed billions of dollars, stablecoins are piling up on exchanges, and long-term holders are gradually reducing supply.

What exactly is missing?

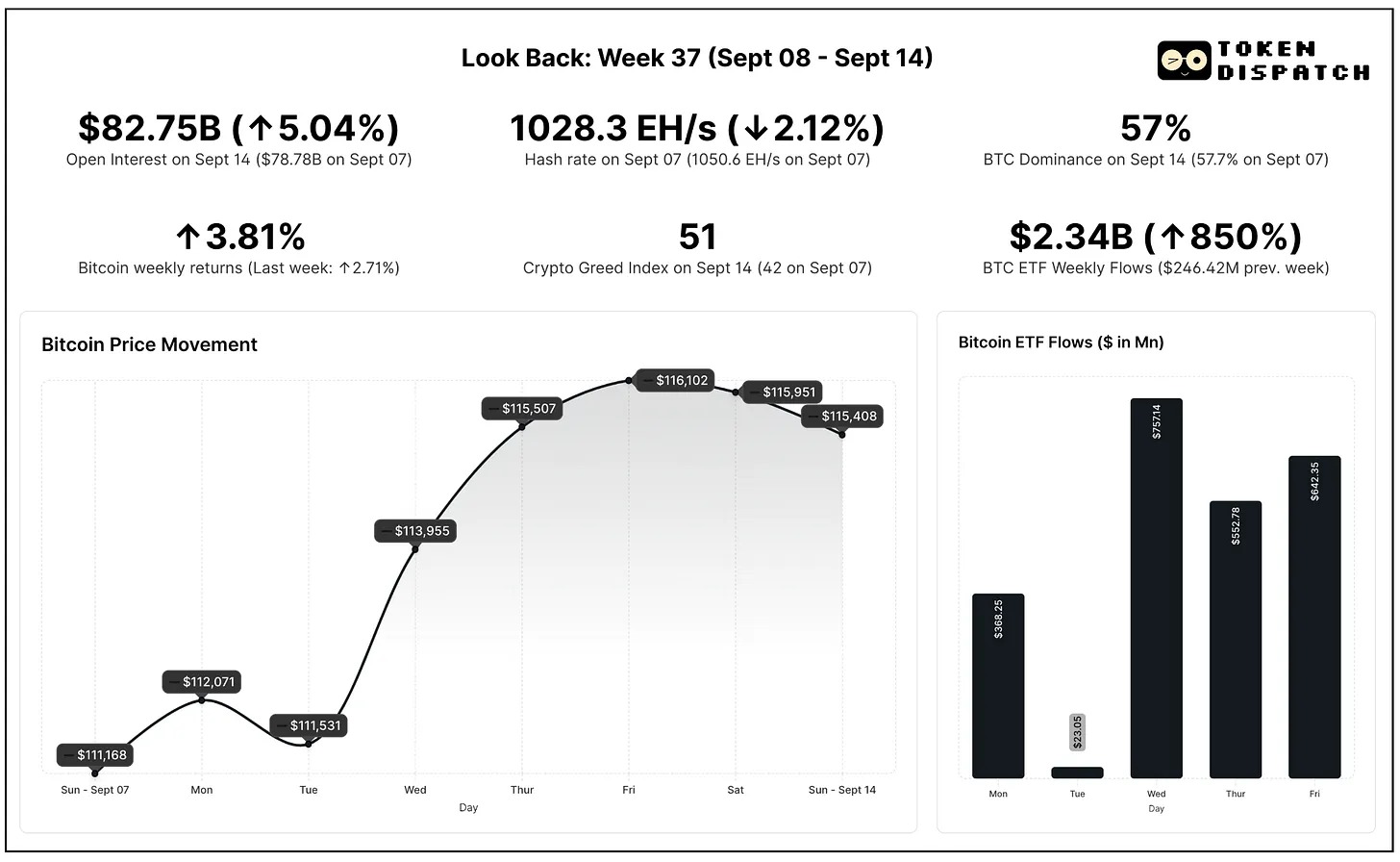

When we delve into Week 37 of 2025 (September 8 to 14), we will find the answer.

Last week, Bitcoin filled the gap of August futures on the Chicago Mercantile Exchange (CME) at a price of $117,000, then after two weeks of significant macroeconomic developments, it stopped rising between accumulation and price discovery.

The market rose, recording its first consecutive two-week increase in over two months. However, the market struggled to break through the resistance level of $117,000, as it awaited a key event: the Federal Reserve's decision on September 17.

This situation has emerged against a backdrop of economic uncertainty. First, the U.S. employment data released two weeks ago was weaker than expected.

Now, inflation data is showing mixed signals. The Producer Price Index (PPI) has cooled, with monthly data turning negative, indicating that cost pressures in the supply chain are easing. However, the Consumer Price Index (CPI) has shown divergence. The August CPI rose 0.4% month-on-month, with an annualized rate reaching 2.9%, the highest since February. This is still well above the Federal Reserve's 2% target, indicating that inflation is far from being defeated.

PPI data suggests that future inflation pressures may be easing, but CPI data indicates that households are still under pressure. Combined with a weak labor market, the case for interest rate cuts remains strong. The CME's FedWatch shows that the market has priced in over 95% probability of a rate cut.

Meanwhile, other assets are also coming into focus.

Gold prices have soared to an all-time high of over $3,640 per ounce. In the stock market, the S&P 500 and Nasdaq indices have both reached historical highs ahead of the upcoming Federal Reserve meeting.

Bitcoin is attempting to follow the same trajectory.

Bitcoin has rebounded from a low of nearly $108,000 at the end of August to over $116,000 last week. However, unlike gold or stocks, Bitcoin has failed to break through this threshold. The gap has been filled, upward momentum is strengthening, but the resistance level at $117,000 remains stubborn.

Bitcoin maintained above $110,000 throughout the week, closing Sunday night with a weekly increase of 3.81%.

The spot Bitcoin ETF has absorbed over $2.3 billion in just five days, marking the strongest week since July and the fifth best week of 2025. Institutional investors are supporting buying, establishing positions with new capital.

However, the derivatives market has not shown the same confidence.

Open interest in Bitcoin futures has slightly increased, but speculative energy has shifted towards Ethereum and other altcoins. Bitcoin's dominance has decreased by 0.7 percentage points, reflecting this shift.

The Crypto Fear and Greed Index has risen by 9 points, entering neutral territory, moving away from the fear zone, indicating that investor sentiment is strengthening.

On-chain data aligns with this, showing that liquidity is waiting for market conviction.

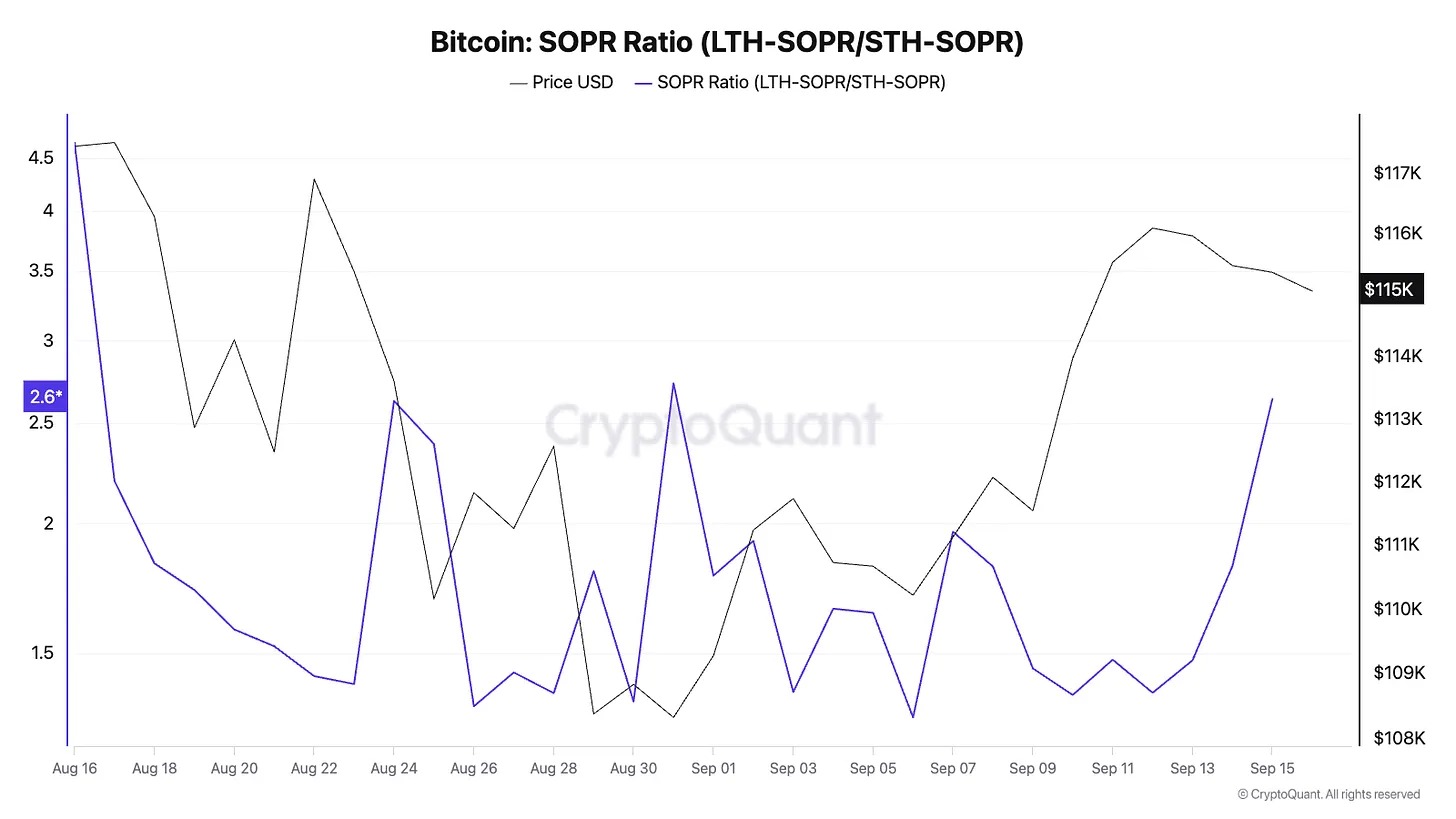

The Spent Output Profit Ratio (SOPR) indicates that long-term holders continue to sell into strength, while short-term holders are returning to profit-taking rather than loss-selling. This suggests that market liquidity is healthy, keeping supply flowing without releasing pressure signals.

The SOPR ratio of long-term holders to short-term holders remains high, indicating that selling pressure mainly comes from experienced wallets rather than anxious newcomers.

This week, the Market Value to Realized Value (MVRV) ratio rose from 2.09 to 2.17, indicating that Bitcoin is in a mid-cycle area. Historically, MVRV levels between 3.5 and 4 typically signal an overheated market. A MVRV level of 2.2 indicates that the market is neither cheap nor overly expanded. Valuations are stable rather than bubbly.

The stablecoin supply ratio (the ratio of total cryptocurrency market cap to total stablecoin market cap) has dropped to a four-month low. This indicates that idle stablecoin liquidity on exchanges has increased relative to Bitcoin balances.

The short-term Relative Strength Index (RSI) has also dropped to around 50, indicating neutral momentum with upside potential. All this data supports the general view of ample liquidity, but the market still lacks confidence.

What comes next?

Rate cuts are not always a good thing for Bitcoin.

In March 2020, the Federal Reserve significantly cut rates in response to the pandemic, and Bitcoin initially crashed along with risk assets, then rebounded sharply after liquidity flooded in. A similar pattern occurred at the end of 2024: the first rate cut triggered market volatility and profit-taking, followed by a loosening cycle that laid the groundwork for another rebound.

At that time, on-chain indicators like MVRV and whale ratios showed short-term volatility, followed by long-term increases. If history repeats itself, this week's initial cut may bring volatility rather than a straight-up rally, even if the overall situation remains favorable.

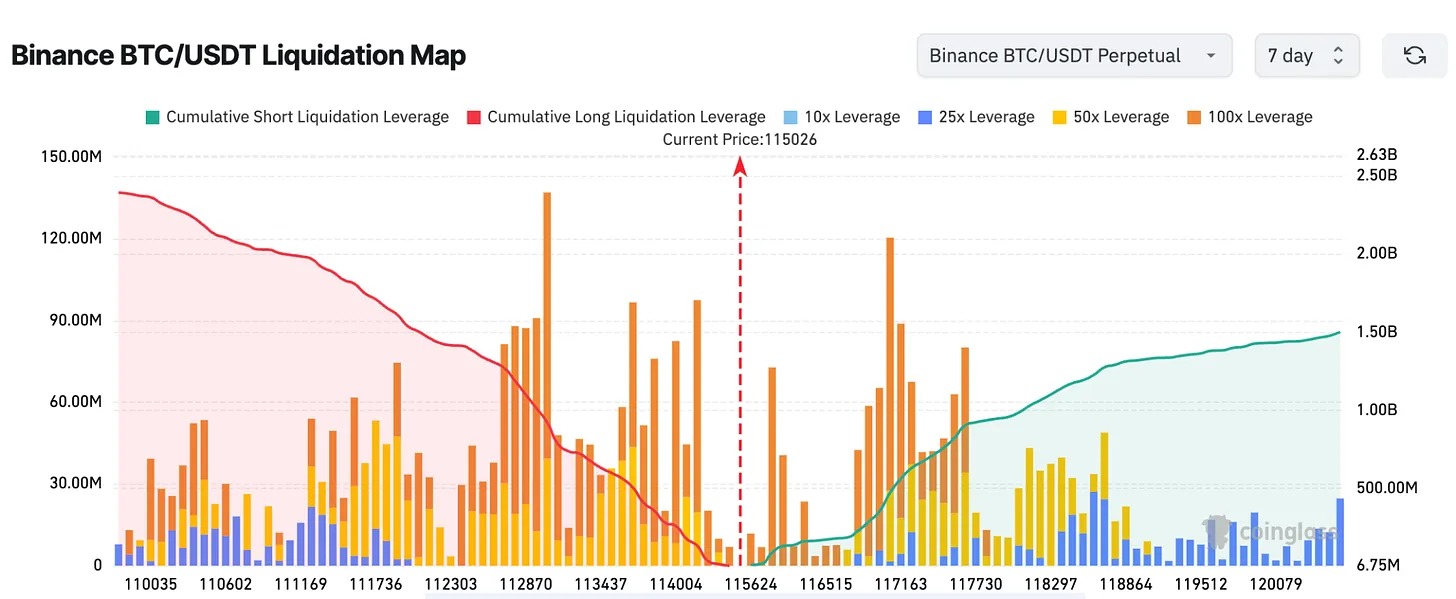

If Bitcoin reclaims and holds above $117,000, it could quickly open the door to new highs. However, if the Federal Reserve delays rate cuts due to recent inflation data, the market may drop back to $113,000 or lower. The order book shows substantial liquidity at these levels, and traders are prepared to sweep orders.

Institutions clearly prefer Bitcoin ETFs as investment tools, while speculative traders are shifting funds towards Ethereum and Solana.

If Bitcoin breaks out after the Federal Reserve's decision, this momentum is expected to continue spreading. Ethereum has already attracted significant leverage, and its performance may outperform Bitcoin. However, if Bitcoin stagnates, altcoins may become the first domino to fall as speculative capital reverses.

As ETFs absorb supply, stablecoin balances swell, and long-term holders gradually sell, liquidity is accumulating. However, the market lacks confidence and is still waiting for a catalyst.

If Powell hints at initiating a loosening cycle without any warnings, Bitcoin is likely to rebound to $117,000 and enter a price discovery phase above that level. If he takes a cautious stance, warning of persistent inflation or external risks, the market may continue to oscillate within the current range, perhaps until the next data release in October.

For investors, on-chain indicators suggest that the current phase is healthy, but caution is warranted. Institutional and corporate funds are flowing into ETFs. Risks are more about timing than direction.

The coming week will reveal whether the phase of waiting for confidence will come to an end. All eyes are on Powell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。