The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast community of cryptocurrency enthusiasts. I welcome all crypto friends to follow and like, and I reject any market smoke screens!

The interest rate cut cycle initiated by the Federal Reserve in 2023 is triggering a chain reaction in the capital markets. While the traditional financial sector cheers for the "reopening of the era of easing," Bitcoin's price has been experiencing severe fluctuations after breaking historical highs. This cognitive dissonance reveals that the crypto market is facing unprecedented strategic opportunities and systemic risks.

- The false prosperity of liquidity flood: Data reveals a new paradigm of whale manipulation (Analysis of interest rate cut impact) According to CoinGecko, the total market capitalization of global digital currencies reached a new high of $3.2 trillion in March this year, superficially validating the traditional logic of "interest rate cuts = bull market." However, in-depth analysis by on-chain analytics firm Glassnode shows that the most concentrated chip accumulation phenomenon in five years is occurring in exchange wallets, with the top 1% of addresses increasing their holdings by 17% compared to the 2021 bull market. The over-the-counter USDT premium index has been negative for three consecutive weeks, sharply contradicting the massive influx of funds during the 2019 interest rate cut cycle. A head of a Wall Street quantitative fund candidly stated in an interview: "When traditional institutions obtain low-cost credit, they are more inclined to use complex financial instruments (such as perpetual contract funding rate arbitrage) to harvest retail investors, rather than simply driving up coin prices." This confirms our earlier viewpoint that when chips are highly concentrated, it will be the node for the bull market to start. Will the $18 trillion liquidity released by global central banks become fuel for the crypto circle or a meat grinder for the derivatives market?

- The twilight of regulatory arbitrage: The life-and-death speed behind Hong Kong ETF approval (Industry trend prediction) The approval of the first batch of Bitcoin spot ETFs in Hong Kong in 2024 marks the first time that crypto assets have obtained a compliance entry ticket in the mainstream markets of the Asia-Pacific region. However, the regulatory agency simultaneously announced the "Virtual Asset Custody Guidelines," requiring exchanges to retain 30% risk reserve funds, which directly led to a 42% drop in weekly trading volume for small and medium-sized platforms. Paradoxically, the U.S. SEC cited Section 5 of the Securities Act of 1934 for the first time when suing a certain DeFi protocol, indicating that global regulation is forming a new battleground of "compliance predators and violators' destruction." A Matrixport research report warns: compliance costs will eliminate 70% of existing exchanges, but survivors may monopolize 85% of market share. △ Data impact: Currently, the average profit margin of the top ten exchanges has plummeted from 38% in 2021 to 7%. The "legitimate survival" in the era of interest rate cuts is more important than the bull market. When exchange profits decrease, how do you think the reduced portion will be compensated?

- The geopolitical reconstruction of computing power: The energy war indicated by the collapse of Kazakhstan's mining farms (In-depth analysis) The sudden closure of 23 mining farms in Kazakhstan in April last year exposed the deep connection between Bitcoin network hash rate distribution and interest rate policies. Data from the Cambridge Centre for Alternative Finance shows that the hash rate share in Texas, USA, has surged from 14% in 2022 to 38%, while the proportion of coal-powered mining farms has increased by 15%. Behind this is energy giants like Exelon utilizing interest rate policies to issue green bonds, building an arbitrage model of "high-carbon mining - environmental hedging." Bitmain's latest 7nm mining machine has improved energy efficiency by 35%, but the contradiction of the overall network's carbon footprint not decreasing but increasing is triggering a new round of regulatory storms in the EU. When traditional capital obtains low-cost funds through interest rate cuts, they are using environmentalism as a weapon to harvest the pricing power of cryptocurrencies. The increase and decrease in computing power will determine whether costs rise, which is very important for Bitcoin, though this does not apply to Ethereum and SOL.

In the year 2025, when the Federal Reserve's interest rate cut path overlaps with the turning point of crypto market regulation, investors need to establish a threefold defense:

- Replace 20% of positions with assets held on compliant platforms (such as CME Bitcoin futures) to hedge policy risks.

- Pay attention to the correlation arbitrage opportunities between Nvidia GPU futures prices and AI tokens.

- Monitor Tether Treasury liquidity weekly, as its fluctuations lead Bitcoin price changes with an 87% confidence interval.

Let me remind everyone that interest rate cuts are catalysts for the financial market, and the outflow of funds from interest rate cuts requires a timeline of waiting. You can refer to last year's interest rate cut cycle, where Bitcoin's high price appeared after the last interest rate cut. The accompanying trauma is the sense of powerlessness in the first half of this year, which is also due to the funding shortage caused by the crazy pull at the end of the year. At this stage, the crypto circle is almost devoid of any shortcomings except for the tight funds, so the first interest rate cut has become a critical period for everyone's decision-making.

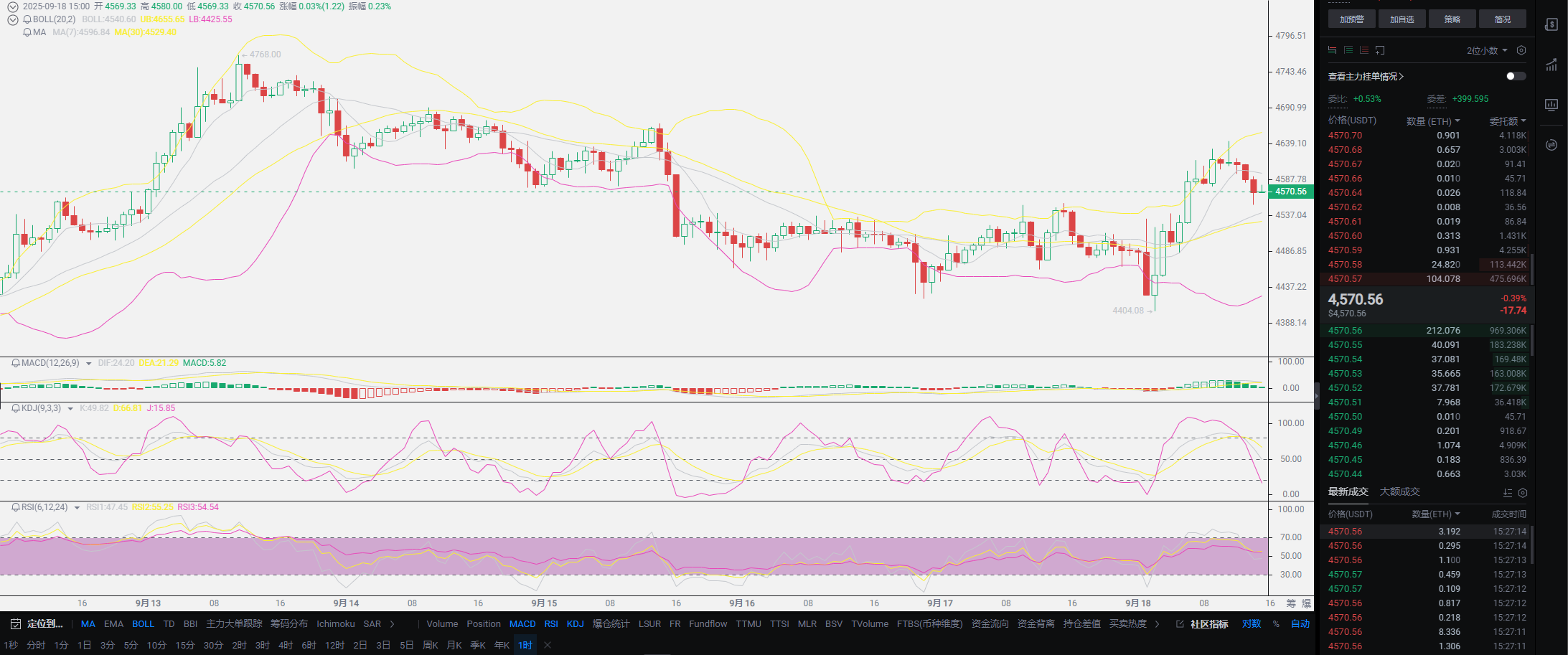

Lao Cui's summary: Yesterday, I reminded everyone that I have fulfilled my duty. I have always been a firm bullish candidate and have indeed never seen a stage where a bear market starts after an interest rate cut. You cannot determine the extent of the bubble based on the current price. The current prices in the crypto circle are considered normal in my eyes. Especially with the catalyst of interest rate cuts, the only competing market with the crypto circle is the U.S. stock market, which has become the same market as the crypto circle, both backed by American asset endorsements. Therefore, there is no reason for a decline, and of course, blind bullishness is also inadvisable. For us ordinary people, going long is the only choice. The trend has already emerged today, and my suggestion is that whether in contracts or spot, you should start preparing to enter the market from today. The wave of interest rate cuts at the end of September will completely explode in October. The traditional structure of "golden September and silver October" is itself a tradition in the crypto circle, and my contracts can finally enter the market!

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。