Original Title: "US SEC Approval Paves the Way for a Surge in Crypto ETP Listings!"

Original Source: BitPush

On September 17 local time, the U.S. Securities and Exchange Commission (SEC) "accelerated the approval" of the Generic Listing Standards for exchange-traded funds (ETFs) on cryptocurrency trading platforms, paving a fast track for related products to enter public issuance and trading.

1. Generic Listing Standards: From "Case-by-Case Approval" to "One-Click Listing"

Previously, the listing of crypto ETPs was a long, costly, and high-risk process. Issuers needed to submit special applications for each new asset, proving that its market had sufficient liquidity and would not be manipulated, with SEC review periods lasting up to 240 or even 270 days.

The impact of the Generic Listing Standards is revolutionary:

Streamlined and Accelerated Process: ETPs that meet certain requirements clearly defined by the SEC will almost certainly receive approval, with the process time significantly shortened to 75 days or less. It also allows compliant crypto ETPs (trading platform trading products) to list and trade without the need for a 19b-4 form.

Trading Platform Options: Most proposals in the industry suggest that the Generic Listing Standards should require the underlying assets to have futures contracts traded on regulated U.S. futures trading platforms. Eligible trading platforms include CME, Cboe, and possibly Coinbase Derivatives Exchange and Bitnomial.

First Beneficiaries: The SEC has approved the trading platform listing standards and quickly approved the Grayscale Digital Large Cap Fund (primarily holding BTC, ETH, etc.) for trading.

2. Explosive Growth of Products: A Repetition of History

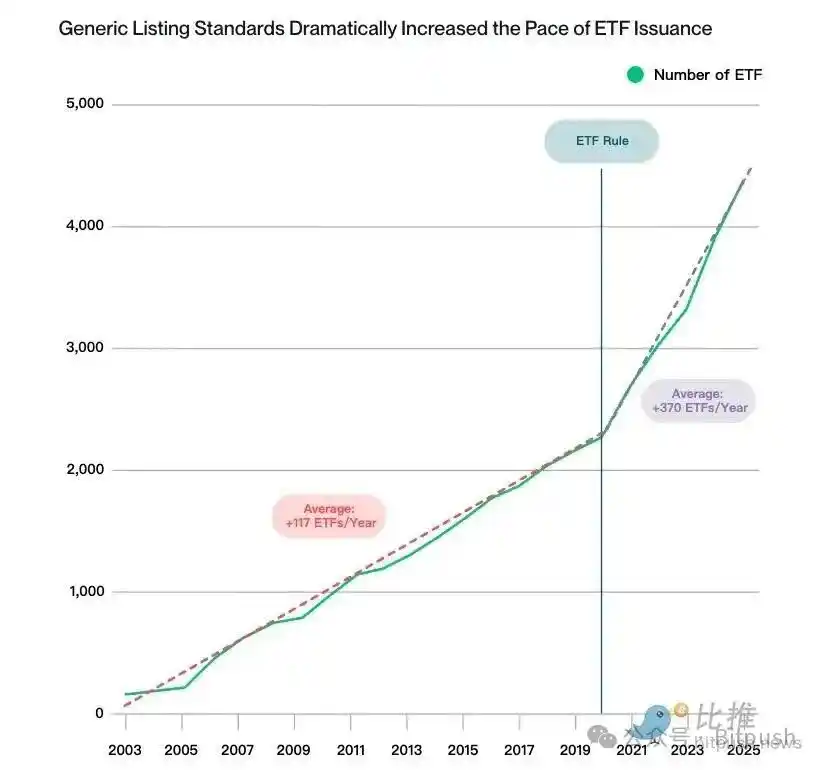

Bitwise Chief Investment Officer Matt Hougan predicts that the Generic Listing Standards will trigger explosive growth in the number of crypto ETPs, supported by historical experience:

Precedent of Traditional ETFs: After the SEC established Generic Standards for stock and bond ETPs with the "ETF Rule" at the end of 2019, the pace of new ETF launches immediately tripled, rising from an average of 117 per year to 370 per year.

Expectations in the Crypto Market: The crypto ETP sector is also expected to experience similar expansion. Altcoins that meet futures contract conditions, such as Solana, XRP, Chainlink, Cardano, Avalanche, and Polkadot, will welcome ETPs and attract a large number of traditional asset management companies into the field.

3. Macroeconomic Dual Benefits: The Overlap of Rate Cuts and ETP Waves

The regulatory breakthrough for ETPs coincides with a shift in U.S. macro policy:

Fed Shift: On the same day, the Federal Reserve announced a rate cut, which Powell referred to as a "risk management-style rate cut," clearly stating that the labor market "does not need to soften further." This marks a shift in the Fed's policy focus from controlling inflation to preserving employment, expected to initiate a liquidity-rich rate cut cycle.

Liquidity and Channels: The rate cut cycle will release more capital into risk assets, while the Generic Listing Standards provide the most convenient channel to access this capital.

4. Impact on Crypto Asset Prices

Bitwise Chief Investment Officer Matt Hougan stated in his report that the existence of ETPs alone cannot guarantee capital inflow, but it prepares assets for "explosion."

Unlocking Traditional Capital: The vast majority of funds worldwide are controlled by traditional investors. With ETPs, these investors can easily allocate crypto assets through brokerage accounts without dealing with complex wallets and private keys.

Reducing "Mystique": ETPs transform cryptocurrencies from "geek-exclusive unfamiliar tokens" into trusted stock codes. This lowers the threshold and fear for ordinary investors, making it easier to associate Chainlink with Mastercard partnerships and stablecoin applications.

Capital Reservoir: ETPs effectively create a massive capital reservoir for assets. Once the fundamentals of an asset (such as Solana's activity or Ethereum's ecosystem development) begin to improve, capital can flow in at an extremely fast pace and large scale, triggering rapid price increases.

In summary, with the elimination of SEC regulatory barriers and the initiation of the Federal Reserve's rate cut cycle, this "ETP Explosion" will thoroughly release suppressed crypto capital and innovation, accelerating the mainstreaming of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。