Abstract

RWA is undergoing a profound paradigm shift—from the experimental phase of Security Token Offerings (STO) to the mature stage of dollar stablecoins backed by U.S. Treasury bonds, and towards a future financial infrastructure composed of high-performance public chains and next-generation liquidity solutions.

This paradigm shift not only reflects the evolution of Crypto technology logic but also mirrors the impending reconstruction and innovation of the financial order.

01 The Paradigm Evolution of RWA

The evolution of RWA paradigms is essentially a history of the expansion of blockchain capability stacks.

2009-2015: Early RWA Attempts with Colored Coins

The birth of Bitcoin's genesis block in 2009 successfully established the first decentralized value ledger in human history. However, Satoshi Nakamoto's vision of creating "a P2P electronic currency" led him and subsequent Bitcoin developers, such as the BitcoinCore team, to adhere to the development philosophy of "verification over computation" and to use a non-Turing complete scripting language, making it difficult for the Bitcoin mainnet to serve as infrastructure for RWA assets to this day.

Moreover, during the early phase of the crypto industry from 2009 to 2015, the concept of RWA itself was not yet mature. At this time, the discourse in the crypto industry was dominated by crypto-punk geeks and Austrian economics believers, who were keen on forking the fully open-source Bitcoin mainnet code to innovate in consensus mechanisms, mining algorithms, and signature mechanisms to create digital currencies with faster confirmation speeds, fairer distribution, and better protection of personal privacy, joining a rare historical competition in the private currency free market.

However, amidst the collective fervor of "Long Bitcoin, Short The Real World," some industry pioneers, such as Amir Taaki, co-founder of Colored Coins, and J.R. Willett, founder of Mastercoin (later renamed Omni Layer), recognized the potential of RWA and began exploring technical routes that allowed users to create and trade coins representing physical assets like stocks, bonds, and real estate on the Bitcoin mainnet. Tether, based on Omni Layer, launched USDT, becoming one of the earliest centralized dollar stablecoins. However, due to insufficient programmability and lack of liquidity support, Colored Coins and Omni Layer gradually faded from the main stage of crypto history after the mainstream technological paradigm of the crypto market evolved.

2015-2020: Compliance Asset Issuance Attempts with STO

In 2015, Vitalik, an editor of Bitcoin Magazine advocating for a Turing-complete technical route, had a falling out with the Bitcoin community and created Ethereum, introducing the EVM and smart contracts, layering a new execution layer on top of the blockchain consensus layer, providing a programmable container for asset tokenization, which in turn gave rise to the ICO super wave characterized by free asset issuance, ultimately triggering backlash and constraints from financial regulatory authorities in major sovereign countries.

In this context, STO (Security Token Offering) became the mainstream paradigm for RWA under the guise of compliant ICOs. However, during this period, due to the lack of sound on-chain liquidity infrastructure, immature oracles acting as intermediaries between on-chain and off-chain, and a lack of decentralized financial application scenarios, RWA remained in a state of formal conceptual speculation, with exit channels primarily choosing traditional financial markets like U.S. and Hong Kong stocks.

The subsequent failure of STO revealed the fundamental flaw in the early RWA paradigm: attempting to replicate the business models of traditional financial assets (stocks, bonds) on-chain while neglecting the core advantage of blockchain, which is to create new types of liquidity rather than replicate the old financial system.

2020-2022: DeFi Summer Gives Rise to On-Chain Natives

As we entered the DeFi Summer of 2020, stimulated by the wealth effect of Yield Farming, traditional cryptocurrency trading users and professionals in the fintech sector transformed into DeFi Degens, becoming the first generation of true on-chain natives. DeFi protocols and developers, along with users, co-evolved, leading to a surge of new entities such as DEXs, decentralized pool lending protocols, CDP stablecoin protocols, and decentralized derivatives exchanges. The AMM DEX paradigm of Uniswap completely replaced on-chain CLOBs (Central Limit Order Books) as the on-chain liquidity infrastructure, and the launch of ChainLink's oracle mainnet became a foundational component for price feeding and risk management in DeFi protocols. At this point, RWA transitioned from a phase of formal conceptual speculation to a phase of practical exploration, with the classic architecture of off-chain asset endpoints, intermediary oracles, and on-chain liability endpoints taking shape.

During the innovation-active period from 2020 to 2022, while there was a Cambrian explosion of applications and intermediaries, the consensus and execution layers were also undergoing rapid evolution. Innovations in the consensus layer during this phase included Solana's PoH consensus algorithm, the HotStuff Byzantine consensus algorithm used by Sui and Aptos, and Avalanche's Avalanche protocol consensus algorithm, among others; innovations in the execution layer included L1 blockchain EVM-compatible frameworks and SVM supporting state parallel processing. The rapid evolution of the consensus and execution layers brought new features such as fast finality and rapid state execution, laying a solid technical foundation for the vigorous growth of RWA in the next cycle.

2023-2025: Establishment of Dollar Stablecoin Hegemony

The period from 2023 to 2025 marks a cycle of explosive growth for broad RWA (including stablecoins), during which the tokenization of U.S. Treasury bonds (primarily expressed as dollar stablecoins) replaces STO as the new paradigm for RWA.

In the early stages, the correlation between stablecoins and RWA was very weak; at that time, crypto practitioners never envisioned that stablecoins would one day become the mainstream expression of RWA. The asset side of centralized stablecoins was primarily composed of commercial paper, while decentralized stablecoins were mainly based on crypto-native assets. In 2022, following the catastrophic social impact of the collapses of algorithmic stablecoin Luna and crypto exchange FTX, the Biden administration demanded that the SEC impose stringent regulations on the cryptocurrency sector. Under regulatory pressure, stablecoin operators/protocols gradually evolved their asset sides to consist mainly of short-term U.S. Treasury bonds, which offer extremely high liquidity and very low risk. Starting in the first half of 2023, stablecoins began to be viewed by crypto industry practitioners as a subclass instance of U.S. Treasury bond tokenization under the broad RWA concept.

Taking USDT as an example, it initially claimed to be 100% backed by dollar reserves, but the actual reserves included a large amount of commercial paper (short-term unsecured debt). The first reserve disclosure on March 31, 2021, showed that approximately 65.39% of the reserves were in commercial paper, with cash accounting for only 3.87%, and the remainder including trust deposits (24.20%), repurchase agreements (3.6%), and Treasury bonds (2.94%)[1]. This disclosure sparked market controversy over its transparency and risk management. As regulatory pressure increased, Tether began to reduce its holdings of commercial paper. A report in May 2022 indicated that the proportion of commercial paper had decreased from $24.2 billion in the first quarter of 2021 to $20 billion, and by 2023, following the de-pegging of USDC due to the Silicon Valley Bank crisis in the U.S. stock market, it further dropped to zero, while increasing holdings of cash, short-term deposits, and U.S. Treasury bonds. As of September 2, 2025, Tether's short-term U.S. Treasury bond reserves amounted to approximately $105.3 billion[2].

On the technical side, the modular design concept aimed at breaking the blockchain "impossible triangle paradox" swept the entire industry, with on-chain settlement and off-chain execution architectures becoming popular. Rollup L2s, represented by Arbitrum and Base, rapidly and efficiently increased block space supply (Celestia, Bitcoin L2), providing technical support for the scale expansion of RWA, especially stablecoins; technological advancements in Baas/Raas such as Cosmos SDK and OP Stack (for example, the Vote Extensions in Cosmos SDK ABCI++ 2.0 allow blockchains to submit and verify external data during the consensus process) and cost compression laid the groundwork for the emergence of RWA/stablecoin Appchains like Pharos; the cross-chain intent standard ERC-7683 jointly formulated by Uniswap and Across, the intent paradigm represented by Cowswap, chain abstraction DEXs represented by Infinex and Particle, and liquidity solutions represented by GTE and Kuru further improved RWA's liquidity acquisition capabilities and capital efficiency.

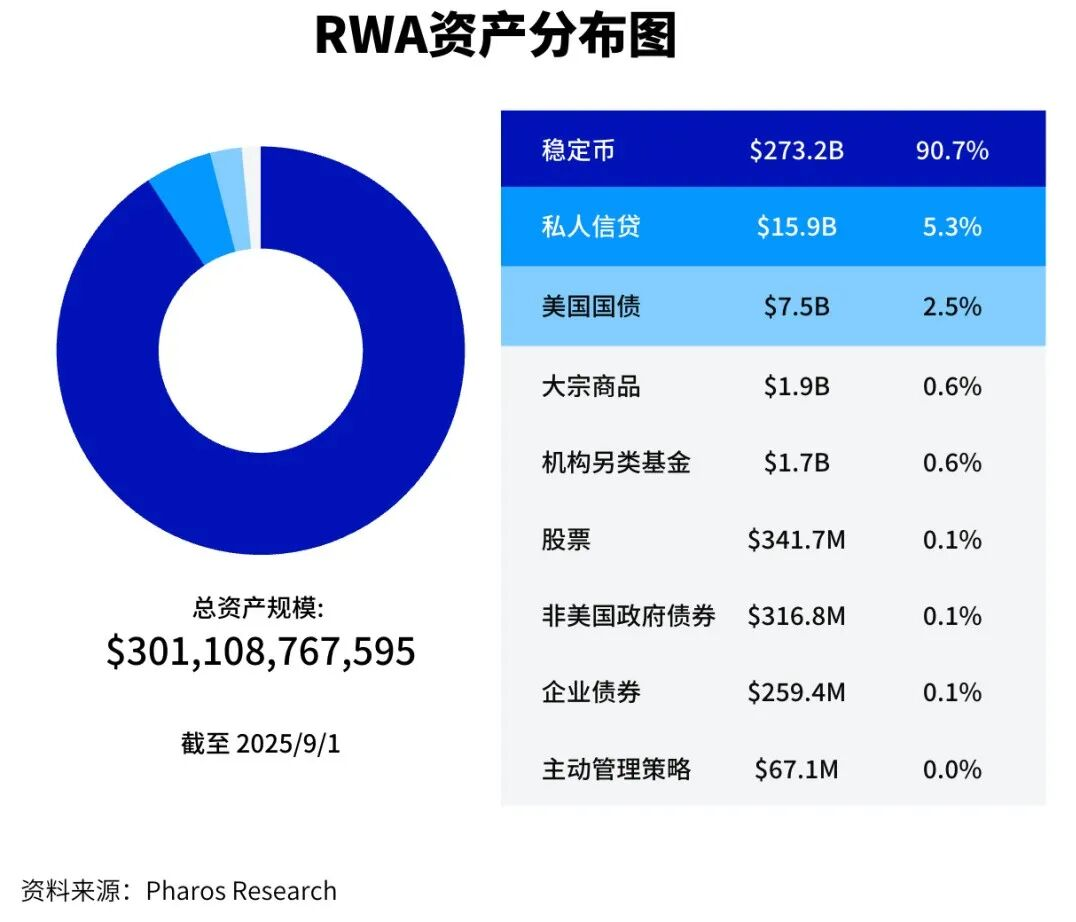

By 2025, the RWA market presents a pattern of "stablecoins devouring everything." According to RWA.xyz data, stablecoins account for as much as 90.7% of broad RWA assets, becoming the absolute mainstay of RWA.

The Trump administration, as the first "crypto government," prioritized the clarification of stablecoin regulation on par with establishing a national Bitcoin reserve, viewing stablecoins as a new solution to consolidate dollar hegemony, marginally increase demand for U.S. Treasury bonds, and even compete for discourse power in the global financial order. The U.S. GENIUS Act (Establishing National Innovation for Stablecoins Act) established a "cash + highly liquid Treasury bonds" gold standard for stablecoin reserves. U.S. Vice President Vance stated at the 2025 Bitcoin Conference: "Stablecoins are a multiplier of American economic strength." U.S. Treasury Secretary Basent has frequently expressed optimistic expectations in major public forums regarding the scale of stablecoins rising to $2 trillion or more within a few years.

The evolutionary path of RWA from a STO-dominated paradigm to a stablecoin-dominated paradigm indicates that the ultimate form of RWA is not merely the simple on-chain of assets, but rather the gradual replacement of the old industrial-era financial infrastructure composed of SWIFT, foreign exchange markets, bond markets, and stock exchanges by a new technological financial infrastructure driven by AI and Crypto in a new round of technological acceleration. This aligns with the vision and goals of Project Crypto recently announced by SEC Chairman Atkins, aimed at ensuring that the U.S. maintains its financial leadership in the future.

This will inevitably catalyze a new round of exponential growth in the demand for block space, forcing a new round of paradigm innovation on the supply side of block space: high-function L1/L2 solutions like Monad, MegaETH, and Pharos achieve millisecond finality and TPS levels of 100,000 through new blockchain architecture designs that decouple state execution from state finality, support state parallel processing, and optimize database throughput. Solana has introduced a new consensus algorithm, Alpenglow, further optimizing the block voting and verification process, aiming to help Solana realize its vision of becoming the next-generation Nasdaq. Ethereum is pursuing a "simplified L1" route, returning to Bitcoin's development philosophy, accelerating the ZK transformation, statelessness, and achieving L1/L2 state finality on the Ethereum mainnet, striving to become the foundational settlement layer of modern finance.

02 The Current Structure of RWA

Current Structure and Future Trends of RWA Off-Chain Assets

Traditional industry professionals have many "wild" imaginations about RWA, such as tokenizing non-standard real-world assets like certain industrial parks or hydropower stations that severely lack market fair pricing and mature risk management mechanisms through RWA in the crypto market. However, the current market structure of RWA off-chain assets is primarily composed of stablecoins, private credit, U.S. Treasury bond tokenization, commodity tokenization, institutional alternative investment funds, and U.S. stock tokenization, with other non-standard real-world assets having almost zero market share. This market structure has emerged as a balanced state reached through multiple rounds of market cycles and the interplay of market forces and technological realities.

The following are the main categories of the current structure of RWA off-chain assets as of September 2, 2025[3]:

• Stablecoins: The total scale of stablecoins is $273.18 billion, with a monthly trading volume of $2.82 trillion and 33.02 million monthly active addresses, and 191 million addresses holding stablecoins. Among them, 99% of stablecoins are pegged 1:1 to the U.S. dollar. The top 5 stablecoins are USDT, USDC, USDS, USDE, and BSC-USD, with market shares of 60.79%, 25.33%, 4.58%, 3.43%, and 1.68%, respectively. Because approximately 75% of the off-chain assets of the leading stablecoins USDT and USDC are U.S. Treasury bonds, stablecoins are viewed as a special form of U.S. Treasury bond tokenization RWA. The issued stablecoins are primarily concentrated on the Ethereum and Tron blockchains, with stablecoin scales of $155.5 billion and $78.4 billion, respectively. The scale of stablecoins on Solana has dramatically dropped to $11.1 billion.

• Private Credit: The total loan scale of private credit is $29.58 billion, with an average yield of 9.75% and a total of 2,583 loans. The top 3 entities in the private credit sector are Figure, Tradable, and Maple, with loan scales of $15.3 billion, $5.02 billion, and $4.08 billion, respectively. Figure is the largest non-bank home equity line of credit (HELOC) provider in the U.S., utilizing blockchain and AI technology to provide consumers with fast online loan services. Tradable is a fintech company that tokenizes private credit, allowing trading in the market and providing an on-chain assetization platform for asset management institutions. Maple is a CeDeFi platform that offers digital asset loans and yield products to institutional and individual accredited investors.

• U.S. Treasury Bond Tokenization: Strictly speaking, the off-chain assets of U.S. Treasury bond tokenization are composed 100% of U.S. Treasury bonds, distributing most of the income from holding U.S. Treasury bonds to token holders. The total scale of U.S. Treasury bond tokenization is $7.46 billion, with an average yield of 4.08% and a total of 52,793 holders. The top 5 U.S. Treasury bond tokenization projects are BUIDL issued by Securitize, WTGXX issued by WisdomTree, BENJI issued by Franklin Templeton, OUSG issued by Ondo Finance, and USDY, with scales of $2.39 billion, $880 million, $740 million, $730 million, and $690 million, respectively.

• Commodity Tokenization: Currently, commodity tokenization is essentially equivalent to gold tokenization. Gold tokenization introduces a high-quality commodity asset that is uncorrelated with core crypto assets like BTC and ETH into the crypto market, facilitating institutional and professional investors in diversifying their crypto investment portfolio risks. The total scale of commodity tokenization is $2.39 billion, with a monthly trading scale of $958 million, 7,866 monthly active addresses, and 83,700 holding addresses. Among them, the gold tokenization project PAXG issued by Paxos has a market value of $975 million, accounting for 40.80% market share; the gold tokenization project XAUT issued by Tether has a market value of $854 million, accounting for 35.75% market share.

• Institutional Alternative Investment Funds: The RWA transformation of private equity and hedge funds can provide higher transparency, lower fees, and better liquidity. Currently, the total scale of institutional alternative investment funds is $1.75 billion, with a total of 27 products. Centrifuge, Securitize, and Superstate rank as the top three in this segment with market shares of 40.31%, 37.34%, and 11.95%, respectively.

• U.S. Stock Tokenization: The total scale of U.S. stock tokenization is currently $342 million, with a monthly trading volume of $164 million and 62,600 holding addresses. The U.S. stock tokenization product Exodus Movement Inc. Class A issued by Securitize has a market value of $226 million, accounting for 79.34% market share. Backed, which collaborates with Kraken, Coinbase, and Bybit to issue U.S. stock tokenization products, has a total of 71 products (S&P 500, T-bills, TSLA, AAPL, etc.), with a total issuance scale of $88 million and a monthly trading volume of $163 million.

From the above data, it can be observed that the off-chain asset side of RWA is primarily composed of standard assets with high liquidity and high credibility (with U.S. Treasury bonds holding a monopoly position), supplemented by private credit, while the main forms of on-chain expression are transaction medium-type stablecoins and yield-bearing stablecoins (YBS). The core business logic of RWA at present is to bring the above real-world assets from off-chain to on-chain for yield generation and to diversify investment portfolio risks.

However, as new-generation high-performance public chains (represented by Monad, MegaETH, Pharos), new liquidity creation paradigms (intent-centric, integration of CLOB and AMM, etc.), and new oracle technologies (Chainlink, Redstone's high-frequency price feeding capabilities) enter the mature stage of their lifecycle, the core business logic of RWA will evolve to focus on selling volatility. Specifically, on-chain high-frequency trading of tokenized U.S. Treasury bonds, tokenized U.S. stocks, and tokenized financial derivatives, along with participating in their global pricing, will become the new dominant paradigm for the next cycle of RWA.

In April 2025, Robinhood submitted a proposal to the SEC to establish a federal framework for tokenizing real-world assets (RWA), aiming to modernize the U.S. securities market. Specifically, it seeks to treat tokenized assets like stocks and bonds as legally equivalent to their traditional forms, rather than as derivatives. This federal framework includes a hybrid liquidity system that matches off-chain to improve speed and on-chain settlement to enhance transparency, along with KYC/AML compliance tools. However, until the CLARITY Act is passed by the U.S. Congress later this year, Robinhood's proposal lacks practical market feasibility.

Therefore, Robinhood chose to launch tokenized U.S. stock trading services in the EU on June 30, allowing EU users to trade over 200 tokenized U.S. stocks and ETFs through blockchain technology. These tokenized assets are issued based on the Ethereum L2 Arbitrum and will eventually migrate to the Robinhood Chain, which is isomorphic to Arbitrum.

Components and Functions of the RWA Middleware

From the perspective of blockchain technology, the RWA middleware primarily addresses the issues of consistency and finality of state between the off-chain asset side and the on-chain liability side, as well as the messaging between on-chain and off-chain, and between chains. From the perspective of business models, the RWA middleware mainly resolves issues of off-chain security, credibility, compliance, and on-chain liquidity, availability, and application scenarios.

The RWA middleware stack consists of off-chain custodial entities, state settlement layers, oracles, application layers, interoperability protocols, and on-chain liquidity layers.

• Off-Chain Asset Custodial Entities: Off-chain asset custodial entities are responsible for managing the underlying assets (such as the custody of physical assets) and compliantly, transparently, and credibly minting RWA asset-mapped tokens. Currently, the top 5 narrow RWA off-chain asset custodial entities are Securitize, Tradable, Ondo Finance, Paxos, and Superstate, with market shares of 28.0%, 16.0%, 10.6%, 6.9%, and 6.7%, respectively.

• State Settlement Layer: The state settlement layer is generally served by L1/L2 blockchains, responsible for the consistency and finality of RWA asset states. Currently, the top 5 networks used as state settlement layers for narrow RWA are Ethereum, Zksync Era, Stellar, Aptos, and Solana, with market shares of 59.4%, 17.7%, 3.5%, 3.4%, and 2.8%, respectively. The market share distribution of the RWA state settlement layer is vastly different from the market share distribution of familiar DEX trading volumes, TVL, and transaction counts. This is related to the fact that the current RWA business types are primarily B-end businesses. The large and active retail investor group prefers to participate in volatility gaming. Therefore, for Solana, Sui, and the new generation of high-performance public chains, how to accelerate the transformation of the RWA paradigm from yield generation to selling volatility is a new challenge they urgently need to address. Only by solving this new challenge can they better adapt to this new version of the system environment characterized by clear regulatory policies and the integration of cryptocurrencies and stocks.

• Oracles: Oracles are responsible for providing secure and reliable off-chain data, ensuring that the on-chain representation of RWA is synchronized with the real world. For example, RedStone's RWA Oracle provides price feed services for $20 billion worth of RWA on the Solana chain (including Apollo's ACRED and BlackRock's BUIDL); Chainlink provides Proof of Reserve (PoR) services for RWA assets to platforms/protocols like Backed, Superstate, 21BTC, ARK 21Shares (ARKB), and Solv. Currently, the scenarios for oracles in the RWA field mainly serve the yield generation of off-chain assets and on-chain asset lending, clearing, and spot trading. In the future, as it expands into high-frequency trading scenarios, there is room for optimization in the speed of price feeds, time granularity, and costs.

• Application Layer: The application layer provides use cases such as lending, LST, Loop, interest tokenization, and vaults for the on-chain liability side, enhancing the yield and liquidity of RWA assets. Currently, mainstream DeFi protocols' support and integration of RWA assets are still in the early stages, with a relatively conservative attitude. However, RWA public chains like Plume and Pharos are actively building a complete set of application layer components for RWA.

• Interoperability Protocols: Currently, the most vigorous demand for cross-chain interoperability in the RWA field is for stablecoin cross-chain transfers, which has led to Chainlink's CCIP protocol achieving a high market share in this niche. However, with the improvement of chain-abstract DEXs, intent-centric infrastructure, and the evolution of the RWA off-chain asset structure, intent-based cross-chain bridges like Wormhole and Across may become strong competitors.

• On-Chain Liquidity Layer: The creation of on-chain liquidity for RWA has always been a systemic financial engineering challenge, requiring both spot liquidity for easy swaps and futures liquidity to hedge risks. It needs AMM-style liquidity for cold starts and long-tail assets, as well as CLOB-style liquidity to enhance capital efficiency and reduce transaction costs. The most fashionable and complete on-chain liquidity layer currently consists of DEX LP Pools, aggregator trading routes, intent DEX Solvers, and intent aggregation from chain-abstract DEXs. It is important to note that the optimization of on-chain liquidity is not limited to the execution layer of the blockchain stack but also delves into the consensus layer's transaction ordering and block finality performance and mechanisms, such as Celestia's new narrative CLOB on Blobs and Solana's new consensus algorithm Alpenglow.

RWA On-Chain Liability Side: Transaction Medium Stablecoins, YBS, RWA Equity Assets

The liability side is the financial abstraction layer that users directly interact with, and its main forms of RWA are expressed as transaction medium stablecoins, yield-bearing stablecoins (YBS), and RWA equity asset tokens.

Transaction medium stablecoins mainly include USDT and USDC, which are issued and maintained by centralized entities that manage their vast on-chain and off-chain liquidity networks. They feature accessibility, low transfer costs, fast confirmation, and programmability. Transaction medium stablecoins are fundamentally different from Central Bank Digital Currencies (CBDCs); the essence of transaction medium stablecoins is that they are token representations of fiat cash on-chain, while CBDCs represent a new form of fiat cash. The Trump administration in the U.S. explicitly opposed CBDCs while supporting stablecoins, whereas the EU and China chose to promote CBDCs while restricting stablecoins. In this cycle, the application scenarios for stablecoins, in addition to serving as trading mediums and stores of value in the crypto market, cross-border payments, and assisting in U.S. debt monetization, have expanded to new scenarios like PayFi and supply chain finance, such as Huma's cross-border settlement financing and JD.com's stablecoin supply chain finance. The next battleground for traditional stablecoin competition will be in A2A micro-payment scenarios. Tether and Circle have each invested in incubating Stable and Arc to ensure they maintain their leading position in the stablecoin space in the AI era.

To protect traditional banking from disruption, the GENIUS stablecoin bill prohibits compliant stablecoins from issuing interest to stablecoin holders, which provides a survival space for YBS that primarily adopts DeFi product paradigms and operates within regulatory sandboxes. YBS yields typically come from DeFi lending, market-neutral strategies, staking rewards, or interest income from RWA. RWA YBS includes traditional financial assets like U.S. Treasury bonds and structured credit, which, after on-chain tokenization, can serve as collateral or investment objects for stablecoins. This combination not only enhances the stability of stablecoins but also provides DeFi users with yield opportunities similar to those in traditional finance.

RWA equity asset tokens are the equity tokens of real-world assets (such as private credit, commodities, U.S. Treasury bonds, and U.S. stocks) that have been brought on-chain. Previously, RWA equity asset tokens had low demand for DeFi composability and on-chain liquidity. However, after the clarification of crypto regulations, embedding RWA equity asset tokens into DeFi composability and pursuing stronger on-chain liquidity has become a new trend. For example, AAVE recently launched an RWA lending platform that supports the lending of collateralized licensed RWA assets for stablecoins. In the future, equity asset tokens for U.S. Treasury bonds, U.S. stocks, and commodities will be legally equivalent to their off-chain asset counterparts, further enhancing the demand for DeFi composability and on-chain liquidity.

Observing the current market structure of RWA, we find that the RWA that has successfully "gone on-chain" at this stage is primarily composed of standardized assets with high liquidity and fair market prices, such as U.S. Treasury bonds, private credit, gold, and U.S. stocks. Currently, what RWA can do more is to package standardized assets into on-chain tokens.

This is due to the technical bottlenecks of oracles in handling the pricing and ownership of non-standard assets, which limits the RWA transformation of a vast amount of non-standard real-world assets (such as real estate, industrial parks, land, forests, mines, etc.). For non-standard assets like real estate and minerals, how is the price determined? How is ownership verified? Existing oracle technologies still struggle to provide credible price assessments and ownership verification for non-standard assets. Moreover, bringing non-standard assets on-chain typically requires the establishment of a legal entity (SPV) to hold the actual assets, and the tokens on-chain often only represent rights to income rather than true property rights.

The future of RWA is not simply about "putting everything on-chain." A more realistic path is to find a balance between regulatory compliance and technological innovation through the abstraction of compliance layers (using legal entities to encapsulate real assets) and enhancing on-chain liquidity (high-performance public chains + mixed market-making models of CLOB and AMM), thereby unlocking the trillion-dollar value of non-standard assets. The large-scale explosion of non-standard asset RWA may still depend on the maturation of oracle technology and the successful operation of regulatory sandbox models, with expectations for a rapid growth period after 2026.

03 Conclusion

RWA 1.0 simply tokenized traditional assets like real estate, industrial parks, and artworks. This approach is inherently flawed because it assumes that blockchain is a magical machine for creating liquidity.

The current RWA 2.0 paradigm is centered around stablecoins backed by U.S. Treasury bonds as core reserves, achieving significant scale success in transaction mediums, cross-border transfers, and value preservation, but lacking compatibility with traditional financial infrastructure, resulting in serious friction during on/off ramps.

The future RWA 3.0 will leverage high-performance blockchains, RWA-friendly oracles, AMM+CLOB mixed models, and intent-centric technologies to create a new financial primitive aimed at the era of sovereign personal capitalism driven by AI and crypto.

What we are about to witness is not only a technological financial innovation but also a significant historical process of global capital order reconstruction.

References

[1] Coindesk, https://www.coindesk.com/markets/2021/05/13/tethers-first-reserve-breakdown-shows-token-49-backed-by-unspecified-commercial-paper

[2] Tether, https://tether.to/en/transparency/?tab=reports

[3] RWA.xyz, https://app.rwa.xyz/

Source:

https://mp.weixin.qq.com/s/iVmfFaIpw6Nob6igCOsG-w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。