Author: Yokiiiya

The "impossible triangle" of stablecoins originates from the classic "Mundell's impossible trinity" in economics, but its connotation is entirely different. It describes the fundamental contradictions in the inherent design goals of stablecoin systems.

Underlying Logic: Why These Three Corners?

The theoretical framework of the "impossible triangle" of stablecoins indicates that any stablecoin design struggles to perfectly achieve the following three goals simultaneously:

Price Stability: This is the core value of stablecoins, meaning its value should remain stable in relation to the pegged asset (usually the US dollar).

Capital Efficiency: Refers to the value of collateral assets required to create a unit of value stablecoin. 100% capital efficiency means that $1 of collateral generates 1 stablecoin without the need for over-collateralization.

Monetary Independence (or Wide Adoption): For non-sovereign stablecoins, this often points to decentralization characteristics, meaning it does not rely on a specific centralized issuing entity or traditional financial system, is resistant to censorship, and is globally accessible.

No stablecoin protocol can perfectly achieve all three simultaneously; at least one must be sacrificed. The underlying logic is that these three goals are in conflict with two fundamentally different "sources of trust":

Asset-based Trust: Requires sufficient, real, low-risk real-world assets (such as US dollars, government bonds) as collateral. This can provide excellent price stability but inevitably leads to centralization (assets are held and audited by centralized entities) and low capital efficiency (funds are locked and cannot be used for earning interest or other purposes).

Algorithm-based Trust: Requires maintaining price stability through sophisticated algorithms, smart contracts, and market incentives. This pursues decentralization and capital efficiency (requiring little or no collateral), but its price stability relies on continuous market confidence and gamesmanship, making it extremely fragile.

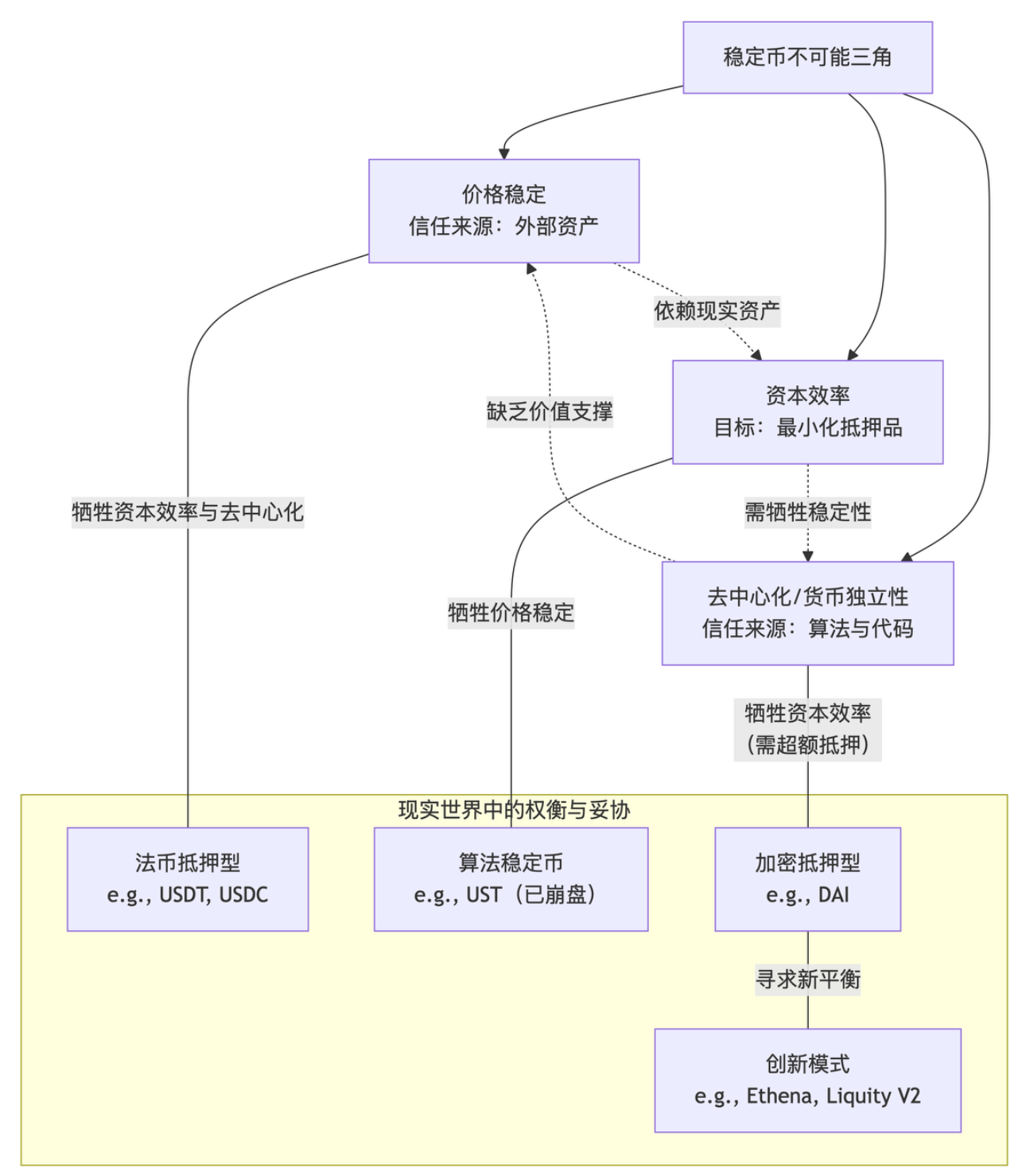

The essence of this "triangle" is the irreconcilable contradiction between the credit of "hard assets" and the credit of "soft algorithms." To better understand the balance between these three aspects and how various stablecoins make trade-offs, we can refer to the following diagram:

Inherent Fundamental Contradictions

There are inherent fundamental contradictions between these three goals, forcing stablecoin designers to make trade-offs.

Price Stability vs Capital Efficiency: Achieving price stability typically requires sufficient asset reserves (such as 100% fiat collateral) to support redemption promises and respond to runs. However, this locks up a large amount of capital, sacrificing capital efficiency. Conversely, if high capital efficiency is pursued (such as algorithmic stablecoins attempting to generate stablecoins with little or no collateral), the price stability mechanism becomes very fragile and can easily become unpegged due to market panic or design flaws.

Price Stability vs Decentralization: True price stability often requires trust in centralized entities (such as recognizing the authenticity and sufficiency of their reserves) or introducing real-world assets (such as fiat currency, bonds) as collateral. These centralized elements contradict the ideal of decentralization. Purely relying on over-collateralization of decentralized crypto assets (like ETH) can somewhat balance the two, but the price volatility of the collateral itself introduces risks and is not capital efficient.

Capital Efficiency vs Decentralization: High capital efficiency (such as under-collateralization) often requires complex mechanisms or centralized authorities to manage and hedge risks, which conflicts with the idea of decentralization. Decentralized systems, to enhance security, often tend to require over-collateralization, which again reduces capital efficiency.

Based on the above contradictions, the major stablecoins in the market have made different trade-off choices within the impossible triangle:

Fiat-Collateralized Stablecoins

In a nutshell:

Fiat-collateralized stablecoins (such as USDT, USDC) sacrifice "decentralization" -> pursuing (price stability + capital efficiency), meaning you must trust Tether/Circle, with the cost of high centralization.

These stablecoins rely on centralized issuing entities holding reserves in fiat currency and other assets. Their capital efficiency is low because a large amount of capital is locked in cash or low-yield short-term government bonds. More importantly, their credibility and value are entirely dependent on the hegemonic status of the US dollar, rather than being an independent monetary system.

Correct Understanding of the "Impossible Triangle"

The "impossible triangle," as a theoretical model, has its important value and inherent limitations.

Advantages and Value

Strong explanatory power: This framework clearly reveals the fundamental trade-offs and inherent contradictions behind various stablecoin designs, which can be used to deconstruct the essence of any stablecoin project, effectively explaining why different forms of stablecoins have their own advantages, disadvantages, and risk points. When observing a project, this can be used to analyze its inherent contradictions and the necessary trade-offs it must make, as well as predict its potential risk points (such as algorithmic stablecoins being inherently vulnerable to runs).

Indicates regulatory focus: This theory suggests that fully decentralized and highly capital-efficient stablecoins (i.e., those attempting to achieve all three goals simultaneously) may be extremely unstable and carry significant risks. This helps regulatory agencies focus on the potential risks posed by such projects.

Limitations and Challenges

Differences in "degree": This theory is more qualitative than quantitative. Decentralization, capital efficiency, and stability are not binary options of "having" or "not having," but exist on a spectrum. For example, the degree of centralization and transparency of USDC and USDT also varies; different over-collateralized stablecoins have different collateralization rate requirements.

Dynamic development and innovative attempts: The market is continuously trying to use new technologies and financial engineering to break through or alleviate the constraints of the impossible triangle. For instance, Liquity V2 plans to attempt to enhance capital efficiency while maintaining decentralization and stability through risk-neutral "Delta Neutral" stablecoins; Ethena Finance seeks to explore new paths through derivatives hedging and other methods. Although these innovations have not completely broken the triangle, they may find new balance points in practice.

Neglect of externalities: This model primarily focuses on internal system design, but external regulation, as a powerful force, is reshaping this triangle. For example, regulations may require all stablecoins to be centralized (to meet KYC/AML), which could externally compress the survival space of the "decentralization" option.

In Conclusion:

The "impossible triangle" of stablecoins is not a curse that needs to be broken, but a framework that helps us understand its essential laws.

Future innovations (such as Liquity V2, Ethena) are attempting to expand outward along the boundaries of this triangle using more complex financial engineering and risk management, but they still cannot escape the constraints of this basic law; they merely transform the form of risk (such as smart contract risk, counterparty risk).

Understanding this triangle allows us to grasp all the contradictions and future development directions in the world of stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。