From BlackRock's entry, to Robinhood's self-developed public chain, and to Nasdaq's layout of stock tokenization, the narrative of Real World Assets (RWA) has long been set. However, we must clearly recognize that moving stocks and bonds onto the blockchain is merely the first domino in this grand transformation.

The real disruption is not about what we can "buy" on-chain, but rather what new species and new gameplay we can "create" based on these assets that carry real-world value.

This article aims to further explore what the next step for RWA is after tokenization, and why it is expected to spark a narrative and innovation on the level of a DeFi Summer.

01. Tokenization is Just the Beginning

Essentially, moving RWA assets like US stocks and gold onto the blockchain is merely completing the "digital encapsulation" of assets, solving the issues of asset issuance and cross-regional circulation, but it has not yet unleashed their true potential.

Imagine a tokenized asset that can only sit in a wallet and cannot be used in combination; it loses the composability advantage of blockchain. After all, the introduction of RWA can greatly enhance asset liquidity and release new value through DeFi operations like lending and staking.

Thus, it should inject high-quality assets with real returns into DeFi, enhancing the value foundation of the entire crypto market. This is somewhat akin to ETH before the DeFi Summer, when it could not be lent, used as collateral, or participate in DeFi until protocols like Aave endowed it with functions like "collateralized lending," releasing hundreds of billions in liquidity.

For US stock tokens to break through the impasse, they must replicate this logic, turning stagnant tokens into "collateralizable, tradable, and composable living assets."

For example, users could short BTC with TSLA.M or bet on ETH trends with AMZNX, making these stagnant assets no longer just "token shells," but utilized margin assets, and liquidity would naturally grow from these real trading demands.

This is precisely the meaning of moving from RWA to RWAFi. However, true value release requires more than just a technical breakthrough; it necessitates a systematic solution that encompasses:

- Infrastructure layer: Secure asset custody, efficient cross-chain settlement, and on-chain clearing;

- Protocol layer: Standardized tools for developers and asset parties to quickly integrate;

- Ecosystem layer: Deep interlinking and cooperation of various DeFi protocols like liquidity, derivatives, lending, and stablecoins;

This reveals that the on-chain integration of RWA is not just a technical issue, but a systemic one. Only by safely and accessibly introducing RWA into diverse DeFi scenarios can we truly convert the stock dividends of traditional assets into incremental value on-chain.

02. Bringing Real Assets to Life: The Financialization Path of RWA

So where is the bottleneck now?

The biggest problem in the current RWA token market is no longer the "lack of underlying assets," but rather the "lack of liquidity structure."

First, there is a lack of financial composability.

In the traditional US stock market, the abundance of liquidity is not rooted in the spot assets themselves, but in the trading depth constructed by derivatives like options and futures. These tools support price discovery, risk management, and capital leverage, creating long-short games and diverse strategies that attract institutional funds, ultimately forming a positive cycle of "active trading → deeper market → more users."

However, the current US stock tokenization market precisely lacks this crucial layer of structure: the TSLA and AAPL tokens that users buy can mostly only be "held," but cannot be truly "used." They cannot serve as collateral to borrow stablecoins in Aave, nor can they be used as margin to trade other assets in dYdX, let alone build cross-market arbitrage strategies based on them.

Thus, while these RWA assets have come onto the blockchain, they are not yet "alive" in a financial sense; their capital efficiency has not been released, and the path to the vast DeFi world is blocked.

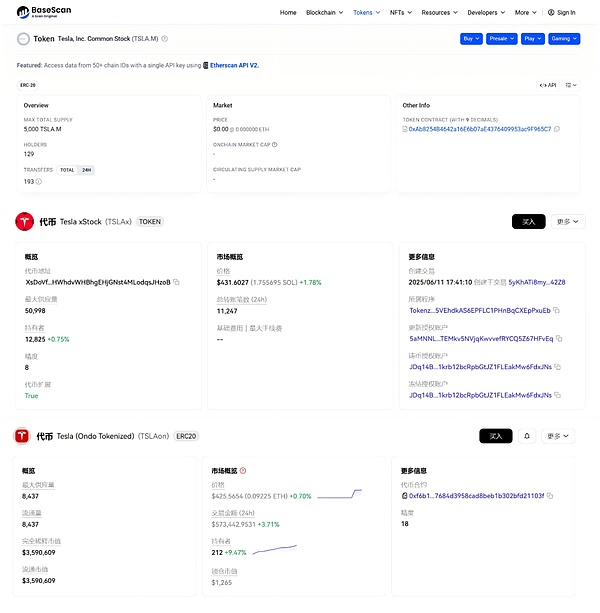

Note: From left to right are MyStonks' TSLA.M, xStocks' TSLAx, and Ondo Finance's TSLAon.

Second, there is a fragmentation and disconnection of liquidity.

This is an even trickier issue, as different issuers have launched their own independent, incompatible token versions based on the same underlying asset (e.g., Tesla stock), such as MyStonks' TSLA.M, xStocks' TSLAx, and Ondo Finance's TSLAon.

This "multi-issuer" situation inevitably recalls the early challenges of the Ethereum Layer 2 ecosystem—liquidity is fragmented across isolated islands, unable to converge into a sea. This not only greatly dilutes market depth but also creates significant obstacles for users and protocol integration, severely hindering the scalable development of the RWA ecosystem.

03. How to Complete the Missing Puzzle?

How can we solve the above dilemmas?

The answer lies in building a unified, open RWAFi ecosystem that transforms RWA from "static assets" into composable, derivable "dynamic Lego blocks."

Therefore, Nasdaq's latest moves are particularly noteworthy. Once top traditional institutions like Nasdaq enter the market to issue official stock tokens, it will fundamentally resolve the trust issue at the source of assets. Within the RWAFi framework, a unified RWA asset can be "financialized" in various ways—through collateralization, lending, staking, yield aggregation, etc., generating cash flow and introducing real-world value anchoring on-chain.

Importantly, this financialization is not limited to high-liquidity assets like US stocks and bonds; even those fixed assets with poor liquidity and composability in the real world can be "activated."

We can envision its potential through an example: real estate, an asset with extremely poor liquidity in the real world, once standardized and introduced into the RWAFi framework, would no longer be "immovable property," but rather a vibrant financial component:

- Participate in lending: Use it as high-quality collateral for low-interest financing on-chain, activating dormant capital;

- Achieve yield automation: Through smart contracts, automatically and transparently distribute monthly rental income in stablecoins to each token holder;

- Build structured products: Separate the "appreciation rights" and "rental income rights" of the property, packaging them into two different financial products to meet the risk preferences of different investors;

This "dynamic empowerment" actually breaks the inherent limitations of RWA, injecting DeFi-native, higher-dimensional composability into it. Thus, Nasdaq's stock tokenization is just the first domino; once they taste success with US stock tokens, a wave of on-chain transformation will sweep across various assets from real estate to commodities.

Therefore, the true explosion point will not be these assets themselves, but the derivative ecosystem built around them—collateralization, lending, structuring, options, ETFs, stablecoins, yield certificates… All these familiar DeFi modules will be recombined and nested on standardized RWA, forming a brand new "Real Yield Finance (RWAFi)" system.

If the DeFi Summer of 2020 was an experiment in "currency Lego" centered around crypto-native assets like ETH and WBTC, then the next wave of innovation sparked by RWAFi will be a grander, more imaginative "asset Lego" game based on the entire value of the real world.

When RWA is no longer just on-chain assets but becomes the underlying building blocks of on-chain finance, a new DeFi Summer may very well be set in motion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。