In-depth exploration of CoinW's underlying breakthrough logic as a "contract exchange."

Written by: Deep Tide TechFlow

Introduction

Coinglass' "2024 Exchange Derivatives Market Report" points out:

In 2024, the global crypto derivatives market set a new record, with an average daily trading volume exceeding $100 billion, far surpassing the trading volume of the spot market.

Contract trading has become the core battleground for competition among major exchanges. Those who can establish barriers in the contract arena are more likely to take the initiative in the next phase.

However, building a moat in the contract market is not easy. A phenomenon that cannot be ignored is that the contract products of current mainstream exchanges are gradually becoming functionally homogeneous, with product pages and features being highly similar, differences in matching performance continuously narrowing, and mainstream coin contract categories being highly overlapping… As the entire contract market enters a phase of "micro-innovation + refined operations," we still observe some potential platforms accelerating their breakthroughs among hundreds of exchanges worldwide:

In the global crypto exchange rankings by CoinGecko, CoinW ranks 24th, while in the global derivatives exchange rankings, CoinW is in the TOP 5. In the misalignment between "comprehensive volume ranking" and "contract specialty ranking," we see CoinW's breakthrough in the contract sub-market and are more interested in exploring CoinW's unique advantages in contract business.

As a well-established exchange operating for 8 years, CoinW has always adhered to the core strategy of "long-termism, safety assurance, and user experience first," dedicated to providing a safer, more stable, and more experiential contract trading environment for global traders. With over 15 million registered users in more than 200 countries and regions, and maintaining a record of zero major security incidents over eight years, CoinW has laid a solid trust foundation for user retention and capital accumulation.

In terms of contract business, the number of contract users has grown by over 20% year-on-year, with a monthly retention rate exceeding 80%, combining both "growth speed" and "growth quality."

On the occasion of CoinW's eighth anniversary, we will delve into CoinW's market data performance, product design philosophy, risk control system, and user experience optimization paths to explore the underlying breakthrough logic of CoinW as a "contract exchange."

Product innovation drives growth, functional details shape experience

User experience is key to attracting users to come in and stay.

However, the quality of user experience is not just about whether the product interface is visually appealing and user-friendly; it is a comprehensive reflection of the platform's understanding of users' real demands, testing the R&D team's insights into the habits and preferences of different levels of traders, and requiring comprehensive control of product details from a global perspective.

As a core business segment, CoinW's contract trading adopts "continuous innovation, user experience first" as its product design philosophy, aiming to create a high-efficiency, low-friction, smooth, and coherent one-stop contract trading experience from multiple angles, including rates, functions, and support responsiveness.

In terms of optimizing the fee structure, CoinW has extremely low** trading fees: **While most platforms charge a 0.02% maker fee for contracts, CoinW's contract maker fee is as low as 0.01%, further reducing user trading costs and achieving higher capital efficiency.

In terms of contract functionality, on the basis of ensuring safe and efficient trade matching, CoinW establishes a differentiated competitive advantage through continuous "micro-innovation" on the user experience side.

On one hand, CoinW provides a one-stop functional service covering all scenarios of contract trading, aiming to make users feel convenience and intelligence in every operational step: Whether it's freely splitting and merging positions to help users manage their positions finely, or one-click reverse opening when the market turns, CoinW's contract platform aims to assist traders in capturing market opportunities more timely and controlling risks more flexibly through comprehensive and detailed functional design, thereby enhancing the possibility of profit in a volatile market.

On the other hand, the copy trading function has always been one of the highlights of contract trading. Based on the transparency of blockchain, contract copy trading supports one-click copying of professional traders' strategies, effectively connecting novices with experienced players and promoting a two-way value cycle:

For novice copy traders: Lowering the participation threshold and increasing profit opportunities by leveraging the knowledge and capabilities of professional traders.

For experienced traders: Earning additional income from copy trading commissions and continuously building community influence.

CoinW's contract copy trading function attracts active participation from both new and old players by lowering the threshold: Copy traders need only 1 USDT to follow star traders and professional KOL trading strategies with one click; while there is no threshold for experienced traders to join, copy trading commissions are settled daily.

At the same time, the principle of "micro-innovation" continues in contract copy trading, with multiple differentiated designs constructing CoinW's comprehensive and flexible copy trading ecosystem: As the industry's first mini-program supporting copy trading, the lightweight Telegram copy trading makes contract trading more convenient, and the deep integration with Telegram further socializes contract trading; while signal copy trading allows experienced traders to efficiently publish strategies, enabling copy traders to synchronize with one click on mobile, further enhancing efficiency.

In terms of responding to user demands and solving problems, CoinW provides 7 x 24 hours of customer support and has established multi-language support covering Chinese, English, Japanese, French, Spanish, and more, ensuring that any issues can be responded to and resolved promptly through an efficient user feedback mechanism in the global user community.

The trading opportunities in the contract market change rapidly. If we view contract trading as a running race, then:

Low fees allow users to gear up for the start, a comprehensive contract function matrix serves as a universal toolkit for users, one-click copy trading acts as a strategy replication accelerator, and 7 x 24 hours of multi-language response serves as a thoughtful supply station… All product designs "centered on the user" aim to help traders take fewer detours and run faster and more steadily.

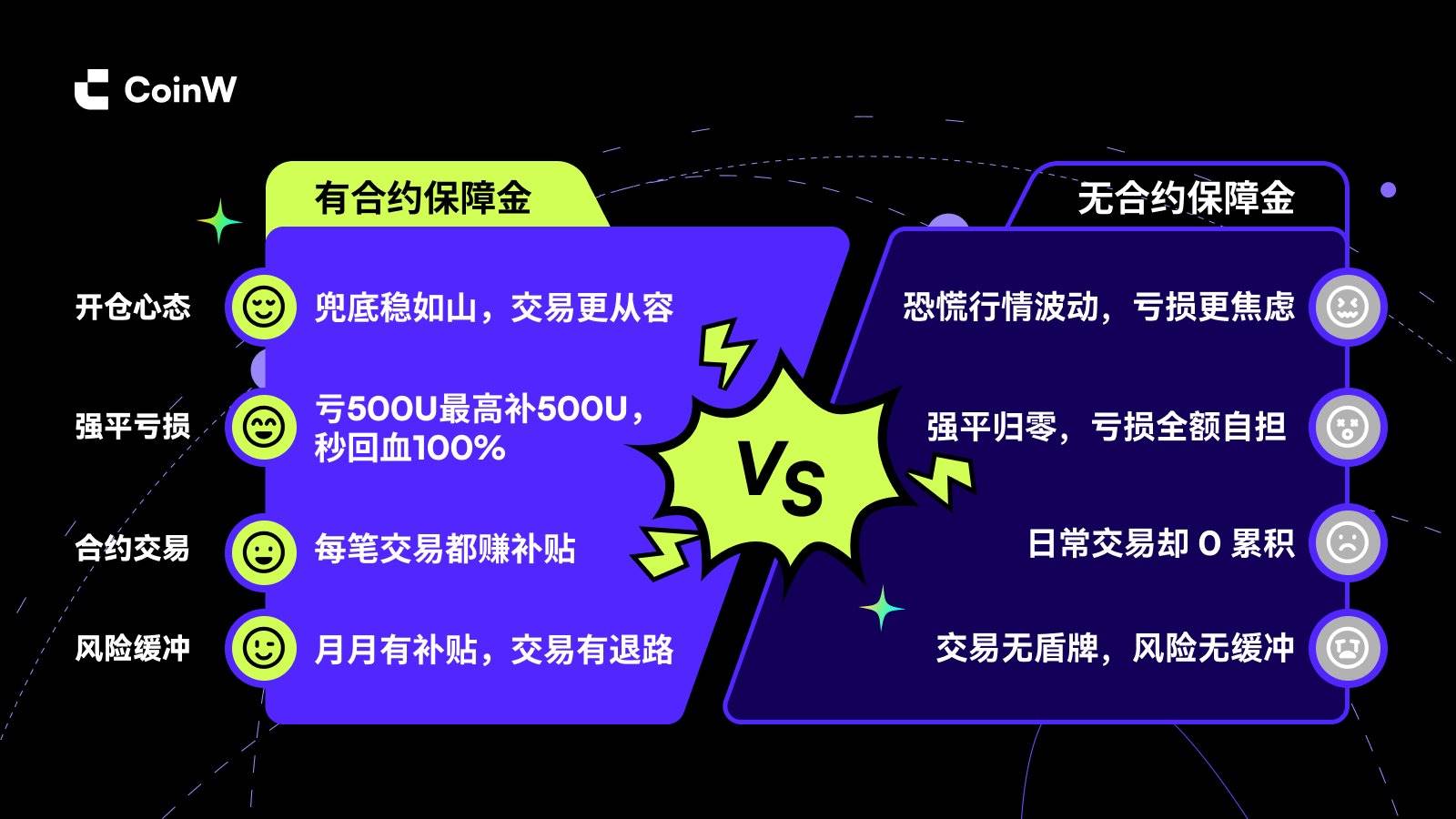

Moreover, the "Contract Margin Plan," the industry's first systematic instant compensation mechanism for traders launched by CoinW in May 2025, aims to provide additional risk mitigation and subsidy guarantees, laying a protective "soft cushion" for the contract market, allowing traders to be less afraid of falling (liquidation) and thus run bolder and more confidently.

Contract Margin: An effective safety net under loss anxiety

The contract market has always followed the "users bear their own risks" operational model. For many users, they either fear losses and dare not try recklessly, or they suffer liquidation and leave quietly, developing PTSD towards contracts.

Under loss anxiety, a key point of differentiation in the contract market emerges: the risk hedging or buffering mechanism for contract trading.

The launch of CoinW's "Contract Margin Plan" not only meets this user demand well but also fills a market gap.

So, how does the contract margin protect users?

As a special subsidy plan for contract users, CoinW invests 500,000 USDT each month to establish a total margin fund pool. When users face liquidation, they can receive a subsidy of up to 500 USDT based on their accumulated amount, which can be used to offset losses, fees, or margin, reducing trading losses.

The logic is simple, and participation is even simpler; it can be said that every user who has experienced it can easily feel CoinW's "user-centric" product philosophy reflected everywhere.

In terms of participation, CoinW sets no thresholds. When contract users click the [Click to Enter] button to access the contract margin page, they are automatically considered participants in the activity.

In terms of subsidy amounts, CoinW has established clear calculation rules: the subsidy amount is determined by three key factors: trading volume, daily check-ins, and new user invitations. The higher the contract trading volume, the higher the subsidy amount that can be obtained. Users can complete check-ins by trading 100 USDT daily to receive a fixed daily subsidy. Inviting new users to participate in the contract margin plan can increase the subsidy amount.

Starting from the third phase of the contract margin plan, CoinW adopts a more advanced system algorithm to construct a dynamic shield throughout the entire trading cycle, ensuring that subsidies are truly distributed to users contributing to contract trading: the system will automatically adjust the accumulation speed based on the user's current subsidy amount; the lower the amount, the faster the growth. At the same time, the efficiency of converting fees into subsidies is fully upgraded, achieving "double acceleration" in conjunction with trading volume, allowing users to obtain more subsidies under the same trading expenditure.

In terms of subsidy collection, CoinW adheres to the principles of efficiency, transparency, and fairness: each phase has a fixed quota of 500,000 USDT, available on a first-come, first-served basis. After participating in the margin plan, if liquidation occurs, users can immediately receive the corresponding subsidy amount, which is credited instantly, with the entire process requiring no customer service intervention. Within each contract margin cycle, users can increase their subsidy amount by boosting trading volume or inviting friends, and can view their personal quota and total prize pool balance in real-time on the official page.

It can be said that the contract margin mechanism creates a safer, more stable, and more experiential contract trading environment, like a soft cushion laid by CoinW in the uncertain contract market: Before trading, it greatly alleviates users' fears of liquidation; with the safety net mechanism, users can explore market profit opportunities more boldly; if unfortunate liquidation occurs, it provides users with real monetary subsidies to help them achieve a safe landing, while also bringing CoinW stronger new user attraction and capital accumulation capabilities.

This also symbolizes a conceptual shift emerging in crypto trading: placing the safety and psychological assurance of users' trading at the core of the business model, transitioning from "platform liability thinking" to "user assurance thinking," from users "bearing their own risks" to the platform actively "sharing risks," with CoinW being the pioneer and leader of this transformation.

Since its launch, CoinW has invested a total of 2 million USDT in the contract margin, and multiple impressive data sets have already demonstrated that the product value of the contract margin has withstood the test of the market and users: According to data released by CoinW, as of now, the contract margin has provided protection for over 40,000 users, with a cumulative amount exceeding 970,000 USDT, and a 100% success rate in protecting against extreme market conditions, with a 100% asset safety protection rate for users.

At the same time, since the launch of this feature, the number of new contract users and the activity level of contract trading have significantly increased.

New features brewing, ecological synergy assisting: Continuously building the "most user-friendly" contract trading platform

With the eighth anniversary celebration concluded, a new round of evolution begins. Through clear business planning, CoinW has also demonstrated its strong growth momentum in the contract business to the community.

According to the official roadmap revealed, the next iteration and improvement path for CoinW's contract products includes:

Continuously upgrading the contract margin plan: Providing a safety cushion for more users during extreme market conditions, encouraging bolder attempts at diverse trading strategies.

Launching the Smart Money feature: Smart algorithms will track on-chain profitable addresses and KOL operations in real-time, supporting one-click trade following, along with algorithm recommendations, leaderboards, real-time alerts, etc., to create a "zero cognitive difference profit" experience.

Launching the Strategy Square: Collaborating with globally renowned financial institutions, professional quantitative teams, and top strategy developers to introduce high-yield, low-risk stable quantitative strategies, allowing users to follow high-win-rate strategies with one click, while individual developers can also share profits, building an open quantitative ecosystem and providing rich asset appreciation options.

Shifting the focus from the contract ecosystem to the overall picture, on the occasion of its eighth anniversary, CoinW announced the completion of a full-stack ecological integration upgrade, transforming from a single trading entry point into a trusted one-stop crypto financial ecosystem, with the powerful ecological synergy generated further empowering the development of the contract business.

After the full-stack integration upgrade, the four key products under CoinW's four core directions are clearly presented:

Trading Platform CoinW: As a comprehensive trading platform, CoinW supports both spot and contract trading, combining AI strategies and multi-layer risk control to achieve intelligent order routing and matching optimization, providing users with an efficient and secure trading experience in a centralized environment.

On-chain Asset GemW: An on-chain asset aggregation platform that allows one-click access to on-chain assets without the need for a separate wallet or Gas tokens. Transactions can be completed through contract addresses, and on-chain data, social heat, and project analysis are integrated based on the LENS model to help users discover potential assets.

Public Chain Infrastructure DeriW: A public chain infrastructure based on Rollup architecture, supporting 80,000 TPS, providing zero Gas perpetual contracts and transparent on-chain matching, while building high-yield LP liquidity pools to deliver an efficient and low-cost on-chain trading experience for users.

Self-operated Trading PropW: The first self-operated trading platform designed specifically for crypto traders, allowing traders to use the funds provided by the platform for trading and showcasing their trading capabilities through systematic trading assessments to obtain substantial funding support. PropW offers up to 90% profit sharing for outstanding traders.

Through the full-stack ecological integration upgrade, CoinW merges centralized efficiency with on-chain transparency, providing users with a collaborative system for the entire trading lifecycle, from reducing cognitive differences and lowering trial-and-error costs to managing risk boundaries and enhancing sustainable profitability.

As CoinW deepens the construction of its "one-stop crypto financial ecosystem," the four major products will provide solid support for CoinW's contract market and broader derivatives business by lowering user thresholds, optimizing underlying performance, and strengthening strategy capabilities, reinforcing CoinW's position as a "contract exchange" and continuously evolving towards a more innovative and prosperous contract trading ecosystem.

Conclusion

The competition among crypto market trading platforms has no endpoint. In the eternal pursuit of safer, lower-threshold, more efficient, and superior user experiences, the best milestone is always the next one.

Over the eight-year journey, from 0 to 1 and then to +∞, from single-point breakthroughs to ecological integration. CoinW has demonstrated to the market with an impressive performance record that competition in the contract arena is not only about technology, speed, and scale but also a continuous marathon focused on user experience, product innovation, and trust building. The choice of over 15 million users, a record of zero incidents over eight years, and a daily contract trading volume exceeding $5 billion are not only victories of data but also positive feedback on CoinW's commitment to long-termism.

After being the first to launch the contract margin mechanism and becoming a leader in shared contract risk, what more innovative paradigm shifts will CoinW lead in the contract arena and the broader crypto financial market?

With the launch of new engines such as contract margin, smart money copy trading, and strategy square, the contract trading experience of CoinW is elevated to a new level. Coupled with the strategies of CoinW, GemW, DeriW, and PropW, a high-speed formation of a one-stop crypto financial ecosystem that covers both centralized and decentralized aspects, connecting on-chain and off-chain, CoinW is also stepping into the pursuit of the next milestone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。