This report is authored by Tiger Research and outlines practical approaches for institutional blockchain applications. Using Avalanche as an example, it details how to apply a five-step framework and provides specific methods for successful implementation.

Global enterprises are re-entering the blockchain space with a fresh focus.

Unlike the speculative frenzy during the 2021 NFT boom, today’s activities are based on clearer regulations and practical business models. The approval of ETFs, the implementation of the EU MiCA framework, and the passage of the US FIT21 bill provide a stronger regulatory foundation. Meanwhile, the stablecoin market has expanded to a scale exceeding the combined transaction volume of Visa and Mastercard, highlighting the real-world relevance of blockchain. Institutions are now pursuing structured strategies rather than opportunistic entries, making progress in areas such as real-world asset (RWA) tokenization and payments.

As blockchain applications move to the core of business operations, institutions face a key challenge: success cannot be achieved merely by following trends. A structured five-step framework is required. This begins with validating the business case, followed by assessing internal development capabilities, selecting the appropriate blockchain, pursuing phased integration, and finally integrating and scaling into a broader ecosystem.

Among these steps, blockchain selection is the most decisive phase. This is because the platform serves as the foundational infrastructure, influencing both execution quality and risk exposure. Key evaluation criteria include finality, available resources, verified reference cases, security, and cost-effectiveness. Institutions must comprehensively weigh these factors and choose a platform that effectively meets all conditions, thereby achieving long-term resilience.

Avalanche stands out in this framework due to its structural differentiation. While most blockchains handle all activities on a single chain, Avalanche offers a "network of networks," allowing institutions to deploy their own customized chains.

Avalanche provides near-instant transaction finality in two seconds, achieves broad regional coverage through structured support, and has verified reference cases such as the Wyoming stablecoin initiative. Dedicated L1 chains ensure operational independence, eliminating risks of network congestion or 51% attacks. Its relative cost-effectiveness and complete EVM compatibility minimize conversion costs.

These advantages have become evident in use cases across multiple industries: BlackRock and KKR in RWA tokenization, StraitsX in cross-border payments, Nexon in blockchain gaming, and Suntory in product certification. Each case demonstrates tangible business outcomes.

Another advantage is AvaCloud, which supports no-code blockchain deployment. Institutions can create dedicated L1 chains with just a few clicks in a web browser. With professional support, projects can advance from consultation to mainnet launch in a matter of weeks.

As more institutions reassess their blockchain plans, choosing the right platform will be a key determinant of their success. Avalanche stands out as one of the most trusted partners. Now is the time to decisively enter the blockchain space before opportunities fade.

1. Institutions Accelerate Entry into the Blockchain Space

Figure 1.1. Timeline of Major Institutional Blockchain Initiatives

Year

Timeline of Major Institutional Blockchain Initiatives

2021

- Adidas: Collaborated with BAYC and other blue-chip NFT projects to launch clothing-related NFTs

- Nike: Acquired RTFKT, expanding into the metaverse and NFT business

2022

- Monetary Authority of Singapore (MAS): Launched Project Guardian with J.P. Morgan to tokenize Japanese government bonds

- KKR: Tokenized its healthcare growth fund as a security token on Avalanche

2023

- PayPal: Partnered with Paxos to issue the USD stablecoin PYUSD

- J.P. Morgan: Collaborated with BlackRock and Barclays to tokenize collateral settlements

2024

- PayPal: Partnered with Paxos to issue the USD stablecoin PYUSD

- J.P. Morgan: Collaborated with BlackRock and Barclays to tokenize collateral settlements

- Hong Kong Government: Issued HKD 6 billion in digital green bonds covering HKD, RMB, USD, and EUR

2025

- Goldman Sachs × BNY Mellon: Jointly launched a tokenized money market fund

- State of Wyoming: Issued FRNT, the first state-level stablecoin in the US

Visa, J.P. Morgan, PayPal, Nexon, and other global companies have entered blockchain-related businesses, with other institutions also considering entry. However, institutional participation in blockchain is not a new phenomenon. Similar activities were observed during the 2020-2021 NFT boom, although the focus was more on speculation at that time.

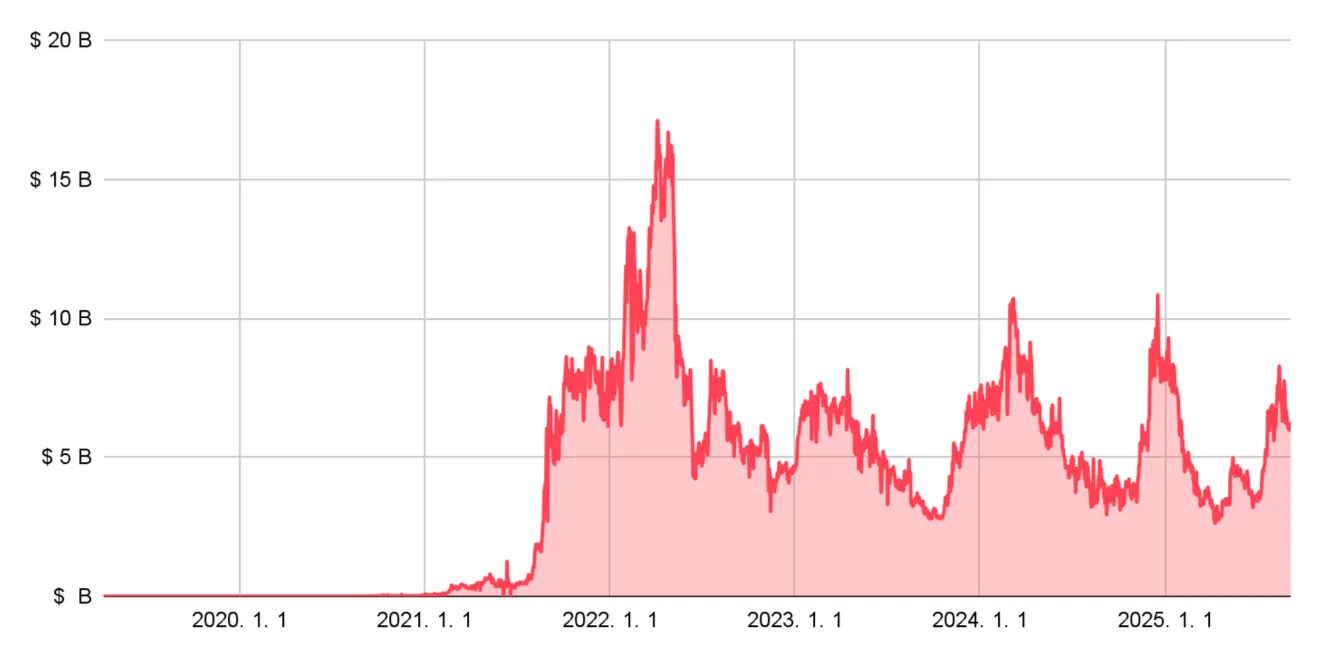

Figure 1.2. Growth and Decline of the NFT Market

Source: Coingecko

During the NFT boom, major companies like Nike, Adidas, LG, and Samsung entered the space. The NFT market rapidly expanded from $17.6 billion to over $40 billion. Nike alone generated $185 million in revenue. However, most of these initiatives stagnated, achieving only short-term success.

After initial gains, the situation quickly changed. By the end of 2022, the sustainability of indiscriminate NFT ventures was questioned. The collapse of FTX dealt a decisive blow. While the immediate triggers were high-profile failures like FTX and Terra-Luna, the deeper issues were regulatory uncertainty and the lack of viable business models. This led to what is known as the "crypto winter."

The impact rippled across the entire blockchain space. Over 13,000 employees were laid off, and investment in startups plummeted by 80%, from $21.2 billion to $4.1 billion. Institutional participants like Nike also began to withdraw, indicating that the market had reached the peak of speculative FOMO (fear of missing out) cycles.

2025 presents a fundamentally different picture. Institutions are once again decisively entering the blockchain space. This time, the movement is supported by regulatory clarity. The approval of cryptocurrency ETFs, the introduction of the EU MiCA framework, and the passage of the FIT21 bill in the US House of Representatives provide a more solid foundation. These measures, along with the Trump administration's strategic Bitcoin reserve policy and new stablecoin legislation, offer institutions greater regulatory certainty.

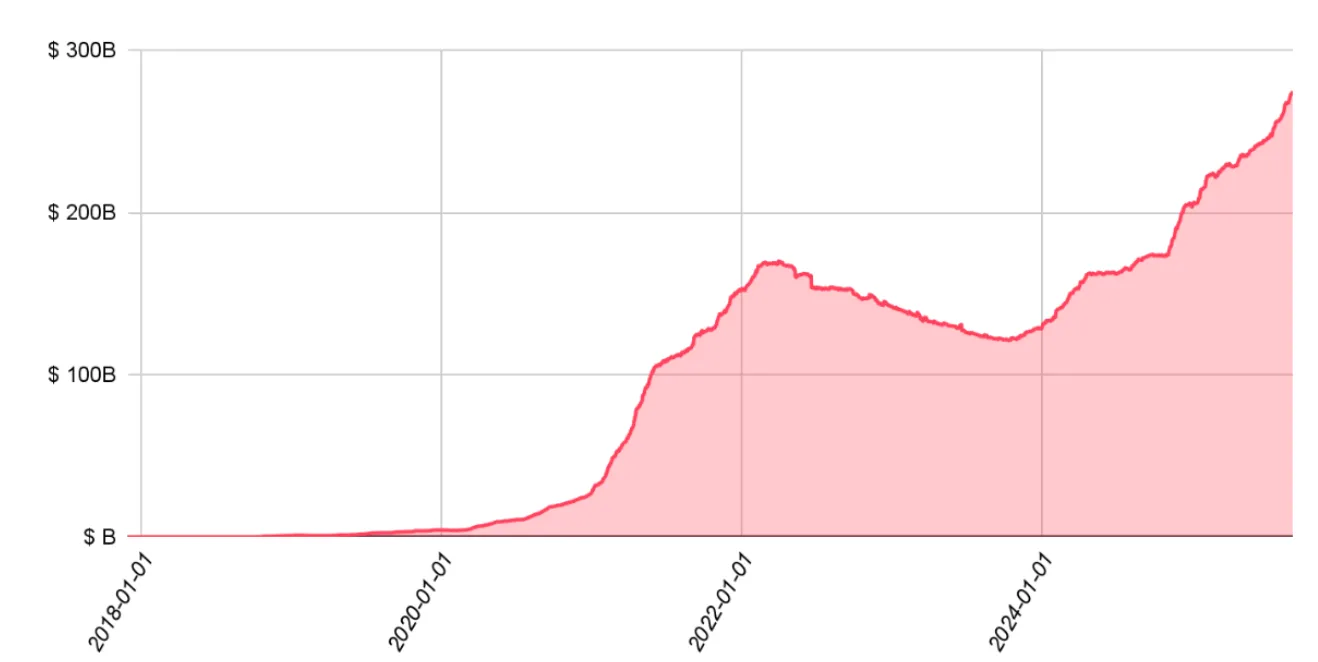

Figure 1.3. Growth of the Stablecoin Market

Source: rwa.xyz

On this regulatory foundation, tangible results are emerging—most notably in the RWA space, where the stablecoin market is rapidly expanding. In 2024, stablecoin transaction volume reached $27.6 trillion, surpassing the combined transaction volume of Visa ($25.8 trillion) and Mastercard. This scale indicates that blockchain applications are moving beyond speculation and serving as practical financial infrastructure.

The participation of leading financial institutions in the US has also accelerated. A notable example is BlackRock's BUIDL fund, which grew to $2.9 billion in assets within six months. This growth reflects the direct impact of reduced regulatory uncertainty.

Today's environment is starkly different from earlier cycles. Institutions have learned from past experiences, guiding them to assess sustainable and necessary business models with greater prudence. They are no longer pursuing opportunistic entries but are taking a more thoughtful and strategic approach.

A hallmark of this shift is the focus on creating real value. Use cases now include improving payment efficiency, enhancing liquidity through asset tokenization, and reducing cross-border transaction costs. These concrete business benefits bolster institutional confidence in blockchain applications. With the convergence of regulatory clarity, market maturity, and practical applications, institutions increasingly view the present as the right time to enter.

2. Institutional Blockchain Adoption Framework

When evaluating blockchain initiatives, institutions should avoid proceeding merely because it is seen as a "must-do." The first step is to validate whether blockchain is a necessary next step for their business development by analyzing existing use cases. Institutions must then assess internal capabilities, select the appropriate blockchain technology, implement it in phases, and expand integration across the organization.

Figure 2.1. Institutional Blockchain Adoption Framework

Phase

Core Activities

Key Validation Questions

Phase 1: Business Case Validation

- Assess the necessity of blockchain

- Define clear business objectives

- Review precedents

- Are there precedents for blockchain integration in the planned initiative?

- Why is blockchain needed instead of existing solutions, and what unique value does it add?

- What is the expected ROI over 3-5 years, and what quantifiable benefits are anticipated?

- How does it differentiate from competitors?

- Are the business objectives clear and supported by management?

Phase 2: Development Capability Assessment

- Assess internal readiness

- Evaluate the ability to form a dedicated blockchain team

- Review legacy system compatibility

- How many Solidity developers or smart contract experts are available?

- Does the team have a sufficient understanding of blockchain concepts?

- Is integration with legacy systems technically feasible?

- Is there a budget and hiring plan to form a dedicated team?

- What is the acceptable level of external dependency, and how will risks be managed?

Phase 3: Blockchain Selection

- Map business requirements

- Evaluate and select platforms

- What are the requirements for transaction finality, and how do the platforms compare?

- Is there a reliable technical support team available when issues arise?

- Are there real-time use cases from Fortune 500 companies?

- How is the platform's track record regarding downtime, security incidents, and compliance with international standards?

- In cases of network congestion, are total operational costs predictable?

Phase 4: Phased Implementation

- Develop and release MVP (Minimum Viable Product)

- Gradually expand functionality

- Continuous testing and validation

- What core MVP functionalities are needed for independent operations?

- How will user feedback be collected, and what are the success metrics for each phase?

- How will data be synchronized with existing systems?

- What technical risks exist at each phase, and how will they be monitored?

- What kind of communication strategy will build organizational trust?

Phase 5: Ecosystem Integration and Expansion

- Integrate with enterprise systems

- Optimize operations

- What training and change management plans have been developed for organization-wide adoption?

- Which business processes need to be adjusted for blockchain integration?

- What incentives will attract external partners?

- What additional ecosystem value has been created with the growth of participants?

- What is the structure and budget for long-term operation and maintenance?

The table outlines a structured framework for institutional blockchain adoption. It is developed based on consulting experience accumulated with enterprises. The goal of the five-step framework is to minimize risks by systematically validating each phase.

Phase 1: Business Case Validation

Figure 2.2. Key Blockchain Business Areas

Core Areas

RWA

Payments/Remittances

Gaming

Consumer

Market Potential

High

High

Medium-High

Medium-Low

Business Cases

Tokenization of government bonds

Tokenization of equity investments

Tokenization of commodity trading

Tokenization of equity

Virtual asset payment systems

Virtual asset credit cards

Trading of in-game items

Cross-game asset utilization

Integrated points systems

Digital memberships

Product certification

Technical Applications

Smart contracts

Use of oracles

Smart contracts

Stablecoins

NFTs

Distributed ledger technology

Smart contracts

Key Success Factors

Regulatory clarity in target markets

Technical scalability

Transaction speed and costs

User convenience

Interoperability

System compatibility

Interoperability

Low entry barriers

The most important part of the first phase is to determine whether blockchain technology is truly necessary for the problem at hand. Applying blockchain in situations that can be addressed with existing solutions only adds unnecessary complexity. Institutions must define clear business objectives and identify specific use cases where blockchain can provide unique value.

In the current phase, the most attractive business areas are RWA and payments. Gaming, customer loyalty programs, and IP or brand-driven applications are also regaining attention. Using these representative cases, organizations should assess how their proposed initiatives align with areas that have proven relevance for blockchain applications.

Phase 2: Organizational Capability Assessment

The second phase involves assessing the organization’s readiness. Institutions must evaluate whether they can establish a dedicated blockchain team and whether existing IT systems are compatible with blockchain integration. Conflicts with legacy systems are one of the main reasons for blockchain project failures.

Blockchain development is significantly different from traditional tech stacks. For example, smart contract development requires Solidity, a programming language fundamentally different from widely used languages like Java or Python. Additionally, traditional databases allow administrators to change or delete data, while blockchain is based on immutability. Once a transaction is recorded, it cannot be undone; errors must be corrected through new transactions.

These characteristics make it crucial to assess internal understanding of blockchain. Depending on the team's expertise and training needs, institutions may need to consider new hires or external development support.

Phase 3: Blockchain Selection

In the third phase, institutions must choose the blockchain that best meets their business needs. With the increasing number of available platforms and new chains launching almost daily, determining the most suitable option can be challenging. Choosing a blockchain to build on is akin to selecting AWS or another foundational infrastructure provider. Making the wrong decision at this stage can lead to significant migration costs later.

Figure 2.3. Key Considerations for Blockchain Selection

Evaluation Criteria

Key Questions

Finality

- How long does it take for a transaction to become irreversible?

- Does finality remain consistent during network congestion?

- What is the risk of chain reorganization invalidating transactions?

Resources

- Is there a dedicated team available to provide technical and business development support?

- Is there an active developer community and sufficient development resources?

- Is there a clear accountability structure for handling disruptions?

Reference Cases

- Are there enterprise use cases, preferably from Fortune 500 companies?

- How long has the platform been stably deployed in real-world environments?

- Has it demonstrated the ability to handle high-volume transactions?

Security

- Does the platform comply with international standards such as SOC 2 or ISO 27001?

- Has it experienced downtime or security breaches?

- Does it include safeguards against risks such as 51% attacks?

Cost Structure

- What is the total cost of ownership from initial deployment to ongoing operations?

- Are costs predictable during network congestion?

- Are there hidden costs in areas such as development, maintenance, or compliance?

Institutions should weigh multiple factors when deciding which blockchain to use. The five most important factors are finality, resources, reference cases, security, and cost structure.

Finality refers to the point in time when a transaction becomes irreversible. While transactions per second (TPS) measure throughput, finality concerns settlement time, which is a separate and equally important issue. A weak support structure is another risk. Some foundations prioritize decentralization but lack a clear accountability structure when issues arise. Therefore, a platform with a strong developer community and dedicated technical support is crucial.

Reference cases build trust. When Fortune 500 companies or major financial institutions run production workloads on a platform, its credibility significantly increases.

Security should be assessed by examining the consensus mechanism, fault isolation features, and compliance with international standards. Past downtimes or security incidents are red flags, as such events can pose serious reputational risks to institutions.

Finally, cost structure must be evaluated beyond transaction fees. Platforms with skyrocketing costs during congestion can lead to unpredictable operational expenses. Institutions should consider total cost of ownership, including development, operations, and compliance.

The most prudent long-term choice is a platform that can balance all five criteria, ensuring operational reliability and reducing strategic risks.

Phase 4: Phased Implementation

In the fourth phase, the blockchain system is put into practice. The most important principle is to avoid a "big bang" approach that attempts to deploy all functionalities at once.

The process should start with a minimum viable product (MVP) that includes only core functionalities. For example, when building a supply chain management system, the initial version may focus solely on product tracking. Once this foundation is tested, additional functionalities such as payment and inventory management can be introduced in phases.

Each phase requires rigorous testing. New functionalities must be checked for compatibility with existing systems, and potential security vulnerabilities should be addressed before deployment. This iterative process enhances the overall stability of the system.

One of the main reasons blockchain projects fail is the pursuit of a complete solution from the outset. In reality, user needs often differ from expectations set during the planning phase. By delivering small, specific successes, organizations can build internal trust and credibility. This trust then becomes the foundation for expanding blockchain applications throughout the enterprise.

Phase 5: Ecosystem Integration and Expansion

The final phase involves expanding the blockchain system across the organization and optimizing its operations. The key is not simply to add a new system but to seamlessly integrate it into existing workflows.

A critical step is to synchronize the blockchain with legacy databases. For example, a connector can be built to automatically write transactions recorded in the accounting system to the blockchain. At the same time, business processes should be redesigned to help employees adapt to the new environment.

Once internal coordination is achieved, external partners and customers can be brought into the network. The full value of blockchain is only realized when multiple organizations participate. In and of itself, blockchain may not differ significantly from traditional databases. However, as participation increases, transparency and trust grow exponentially.

Therefore, the ultimate goal of blockchain adoption is not limited to improving the efficiency of individual enterprises. Its broader impact lies in reshaping collaboration across entire industries and generating new value. A blockchain project can only be considered fully successful when these ecosystem-level transformations occur.

3. Enterprise Adoption of Blockchain: Avalanche

As mentioned, most phases of the blockchain adoption framework depend on internal organizational capabilities, except for the selection of the blockchain. Unless an institution chooses to build a blockchain from scratch, it will rely on existing platforms. Developing a proprietary blockchain requires years of work and hundreds of millions of dollars in investment, comparable to establishing a completely independent business.

Therefore, most institutions adopt blockchains that are already available in the market. The challenge lies in the fact that blockchain serves as foundational infrastructure, and thus the choice of platform directly impacts the integrity and scalability of the project. Choosing a platform with weak support structures can slow down development, while using unproven platforms can undermine service reliability.

From the institution's perspective, identifying the right blockchain is very complex. The number of available platforms continues to grow, with new chains launching almost daily. The abundance of choices makes decision-making more difficult rather than easier.

Figure 3.1. Institutional Use Cases of Avalanche

Institution

Description

State of Wyoming

Issued FRNT, the first state-supported stablecoin in the US, on seven blockchains including Avalanche.

Toyota Blockchain Lab

Tokenized vehicle lifecycle data and ownership as NFTs, planning to issue them as security tokens (ST) for mobility finance.

Nexon

Launched the Web3 game MapleStory Universe (N) on Avalanche based on its flagship IP, with daily transaction volumes exceeding one million.

In this context, an increasing number of institutions are adopting Avalanche. Notable examples include the public stablecoin issuance by the State of Wyoming, Toyota Blockchain Lab's initiative to record vehicle lifecycle data and tokenize ownership, and Nexon's development of MapleStory Universe on Avalanche.

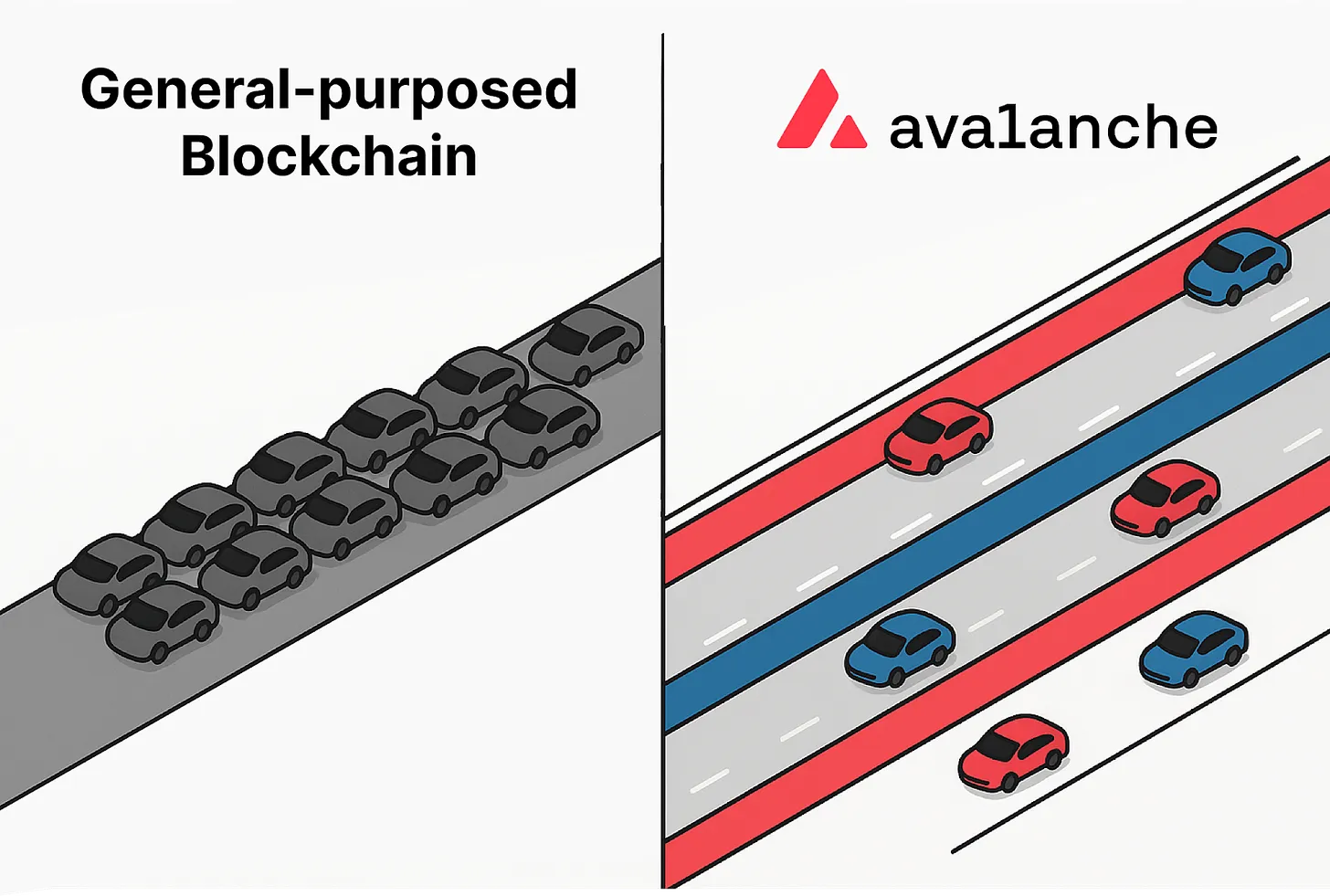

The reasons institutions from different industries are turning to Avalanche lie in its structural differentiation. Most blockchains handle all activities on a single chain, leading to performance bottlenecks and scalability limitations. Avalanche addresses these limitations through a novel architectural approach.

Figure 3.2. Explaining Avalanche's Differentiation through Highway Analogy

A simple analogy illustrates this differentiation. Traditional blockchains are like a single highway that all vehicles must travel. As traffic volume increases, congestion inevitably occurs. In contrast, Avalanche operates multiple independent highways in parallel. Each highway has its own rules and toll systems and does not share lanes or rest stops with other highways. Therefore, congestion on one highway does not affect traffic on others.

This parallel structure is why Avalanche is often described as a "network of networks." It goes beyond simply running multiple independent chains. Each chain can be designed with different purposes and rules, yet they can still interconnect when needed. This architecture simplifies complex blockchain infrastructure while allowing institutions to flexibly adapt to their specific needs.

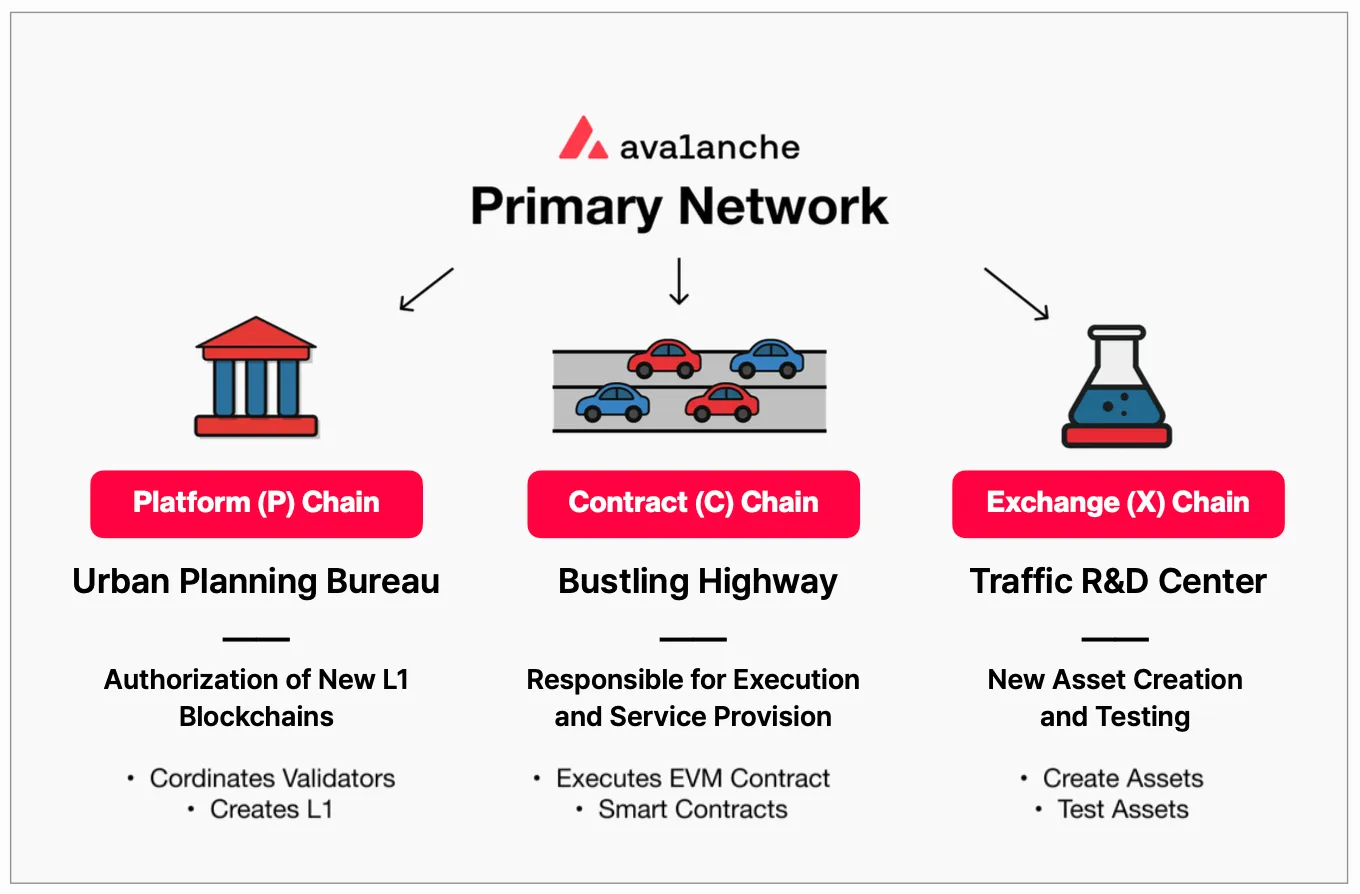

Figure 3.3. Structure of the Avalanche Mainnet

Avalanche can be compared to a large urban transportation system. Multiple highways (individual chains) operate independently while remaining interconnected. Each institution can run its own chain while still being able to communicate with other chains when needed.

At the center of this system is the Primary Network, which acts as a central hub. It consists of three core components:

- The P-Chain (Platform Chain) functions like a city planning department, responsible for creating and managing new blockchains.

- The C-Chain (Contract Chain) is the busiest highway where most blockchain applications are executed.

- The X-Chain (Exchange Chain) acts like a traffic R&D center, testing new asset forms.

Each component specializes in its own area while being organically connected to the others. This allows institutions to utilize only the functionalities they need without having to master the underlying technical complexities. The intuitive and flexible design of this architecture is a key reason many institutions choose Avalanche.

3.1. P-Chain (Platform Chain): City Planning Department

The P-Chain is the central management office of the Avalanche network. In the urban transportation analogy, it is the planning department that grants permits and oversees the construction of new highways. One of the reasons institutions adopt Avalanche is this structured governance layer.

The most critical role of the P-Chain is to authorize and create new L1 blockchains. When an institution needs a dedicated chain, it can deploy a customized L1 through the P-Chain. Here, L1 refers to independently operating blockchains. This means institutions can build chains tailored to their characteristics and needs, similar to authorizing the construction of roads for logistics, passenger vehicles, or public transportation.

3.2. C-Chain (Contract Chain): The Busiest Highway

The C-Chain is where blockchain applications are executed. In the analogy, it is the busiest highway in the city, where traffic flow and commercial activities take place. While the P-Chain handles management and authorization, the C-Chain provides execution and services.

Its main advantage is Ethereum compatibility. The C-Chain fully supports the Ethereum Virtual Machine (EVM), allowing smart contracts developed for Ethereum to run without modification. For institutions, this compatibility reduces development time and costs, as existing Ethereum-based solutions can be deployed directly.

In practice, any smart contract written in Solidity (the most widely used programming language in blockchain) can run on the C-Chain. This is like providing a new, wider, and faster highway that follows the same traffic rules and lane structure as Ethereum.

3.3. X-Chain (Exchange Chain): R&D Center

The X-Chain is an environment within Avalanche for experimentation and innovation. It can be likened to an R&D center for testing new transportation systems and vehicle technologies. While the P-Chain provides management and the C-Chain handles execution, the X-Chain focuses on future developments.

Its unique capability lies in creating and testing "smart assets." Unlike traditional cryptocurrencies, assets on the X-Chain can be programmed with complex rules. Examples include tokens that cannot be transferred before a specific date or assets that can only be used under certain conditions. These features are particularly valuable when digitizing traditional financial instruments such as stocks or bonds. Institutions exploring the tokenization of complex financial products can use the X-Chain to design and test them.

3.4. ICM (Inter-Chain Messaging): Highway Interchange Network

When Avalanche's chains interact, their full potential is realized. This is achieved through Inter-Chain Messaging (ICM), which acts like interchange roads connecting independent highways.

Through ICM, a dedicated blockchain of an institution can operate as part of a larger integrated system. For example, digital currency issued on a banking chain can be used directly on the chain of a corporate partner. Each chain operates independently but can connect seamlessly when needed.

This interoperability is crucial as it generates network effects. As new institutions join Avalanche, they can immediately leverage the infrastructure and services already built by others. Just like a newly constructed highway becomes useful as soon as it connects to the existing road network, each additional participant strengthens the entire ecosystem.

Due to space limitations, more content from Chapters 4 and 5 can be read in the original text.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。