Binance will update the funding rate algorithm on September 18, aiming to keep the funding rate within a relatively moderate range and striving to change the image of "position = liquidation" to true holding costs. The purpose of this algorithm change is likely to suppress the blood transfusion and pressure on opposing positions created by tokens like $Alpaca, $TRB, and $MYX that exploit the funding rate mechanism.

The original text is as follows: https://www.binance.com/en/support/announcement/detail/c00588a7e8504b3eb28d02a2da00530b

Section 1: The Role of Funding Rates in Perpetual Contracts: The Weaponization of Regulators

Perpetual contracts differ from traditional futures primarily in that they have no expiration date. This characteristic greatly enhances the liquidity and speculative nature of the contracts but also introduces an inherent risk: the contract price may persistently deviate from the spot price of the underlying asset, creating what is known as the "futures and spot spread." (One underlying asset, two prices)

To address this core issue, the funding rate mechanism was born. It is essentially a price anchoring mechanism that incentivizes market participants to engage in trading behaviors that can push the perpetual contract price back to the spot price level through periodic funding exchanges between long and short position holders, thereby maintaining price consistency over the long term.

The operational logic of this mechanism is very clear: when the funding rate is positive (i.e., the perpetual contract price is higher than the spot price), long position holders must pay funding fees to short position holders; conversely, when the funding rate is negative (i.e., the perpetual contract price is lower than the spot price), short position holders pay long position holders. This design creates a direct financial incentive, encouraging traders to hold positions contrary to the prevailing market sentiment, thus balancing the market and correcting price discrepancies.

These periodic funding exchanges continuously create arbitrage incentives: when the perpetual contract price is too high, arbitrageurs can sell the perpetual contract while buying an equivalent amount of the spot asset to earn a positive funding rate, and their actions will exert downward pressure on the perpetual contract price, prompting it to revert.

1.2 Composition of the Funding Rate: Deconstructing Core Elements

The calculation of the funding rate mainly consists of two core components: Interest Rate and Premium Index.

Interest Rate Component: This is a relatively stable component preset by the exchange, theoretically representing the difference in borrowing costs between the base currency and the quoted currency in the contract. On Binance, the BTC/ETH interest rate is typically fixed at 0.01% every 8 hours (i.e., 0.03% daily), while the interest rates for other currencies are set at 0%.

Premium Index Component: This is the most dynamic and influential component of the funding rate. It directly quantifies the degree of deviation between the perpetual contract price and the spot index price of the underlying asset. When the perpetual contract price is higher than the spot index price, the premium index is positive; conversely, it is negative. To smooth out short-term price fluctuations, the premium index is usually determined based on the moving weighted average of the price spread during the funding rate calculation period.

Section 2: Comparative Analysis of Algorithm Evolution

2.1 Traditional Formula: The 8-Hour Industry Standard

Before this update, Binance's funding rate calculation followed a model based on a standardized 8-hour settlement cycle. Its formula can be effectively expressed as:

Funding Rate = Average Premium Index (P) + clamp(Interest Rate - Premium Index (P), 0.05%, -0.05%)

Within this framework, except for the BTC/ETH "interest rate" which is assumed to be 0.01% every 8 hours, all other currencies are set to 0%. The entire calculation produces a rate directly applicable for settlement every 8 hours, resulting in three settlements per day (24 hours / 8 hours = 3 times). This fixed 8-hour structure is inherited from Bitmex's standard.

2.2 Updated Formula: Introduction of the "Frequency Normalization Factor"

Effective from September 18, 2025, the new formula is as follows:

Funding Rate (F) =

[Average Premium Index (P) + clamp(Interest Rate - Premium Index (P), 0.05%, -0.05%)] / (8/N)

The key innovation of this formula lies in the introduction of two core variables:

N: The funding settlement interval in hours (i.e., "settlement frequency"). This is the core of the algorithm's dynamic adjustment.

(8/N): The divisor in the formula, referred to as the frequency normalization factor.

The numerator of the new formula is identical to the old formula, which can be understood as calculating a "benchmark 8-hour rate." The newly added frequency normalization factor is responsible for scaling this benchmark rate. Its core purpose is to adjust the size of each funding exchange rate based on shorter settlement periods, keeping the funding rate within an 8-hour-based window.

This formula design reveals a core design principle: Binance aims to limit the "holding costs" imposed on counterparties by the funding rate or, from a market manipulation perspective, to reduce the "destructive power" of the funding rate on opposite-direction trades.

For example, with a maximum funding rate of 2% every 4 hours:

Under the old algorithm, the 24-hour funding rate is 12%;

Under the new algorithm, the 24-hour funding rate is 6%.

Section 3: Quantitative Impact of the Settlement Frequency Variable (N)

This section will provide a detailed numerical breakdown of the funding rate under different settlement frequencies through a hypothetical scenario to intuitively demonstrate its operational mechanism.

Model Assumption:

Assume the "benchmark 8-hour rate" (i.e., the numerator of the new formula) is a constant value of 0.02%. This represents a market environment where the perpetual contract price has a moderate premium over the spot price.

The nominal value of the trader's position is $100,000.

3.1 Scenario A (N=8): Benchmark Scenario (Standard Settlement)

Collection Frequency: 8/8=1 (1 collection every 8 hours)

Single Settlement Funding Rate: 0.02%/1=0.02%

Number of Settlements in 24 Hours: 24/8=3

Single Settlement Payment Amount: $100,000×0.0002=$20

24-Hour Effective Cumulative Cost: $20×3=$60

3.2 Scenario B (N=4): PUMPUSDT Example (Increased Frequency)

Collection Frequency: 8/4=2 (2 collections every 8 hours)

Single Settlement Funding Rate: 0.02%/2=0.01%

Number of Settlements in 24 Hours: 24/4=6

Single Settlement Payment Amount: $100,000×0.0001=$10

24-Hour Effective Cumulative Cost: $10×6=$60

3.3 Scenario C (N=2): High-Frequency Settlement

Collection Frequency: 8/2=4 (4 collections every 8 hours)

Single Settlement Funding Rate: 0.02%/4=0.005%

Number of Settlements in 24 Hours: 24/2=12

Single Settlement Payment Amount: $100,000×0.00005=$5

24-Hour Effective Cumulative Cost: $5×12=$60

3.4 Scenario D (N=1): Hourly Settlement

Collection Frequency: 8/1=8 (8 collections every 8 hours)

Single Settlement Funding Rate: 0.02%/8=0.0025%

Number of Settlements in 24 Hours: 24/1=24

Single Settlement Payment Amount: $100,000×0.000025=$2.50

24-Hour Effective Cumulative Cost: $2.50×24=$60

From the above calculations, it can be seen that regardless of the frequency, the final (24h) funding rate remains the same.

Section 4: Market Impact and Binance's Response

From a strategic perspective, this update can be seen as a response to the systemic risks exposed by past market crises—the "weaponization" of funding rates—while also being a strategic move aimed at dominating the listing and trading of emerging high-risk assets. The crypto market is already known for its extreme volatility, especially in a "high market cap, low liquidity" environment, where this mechanism and tool, seemingly returning to normal value, gradually become a weapon.

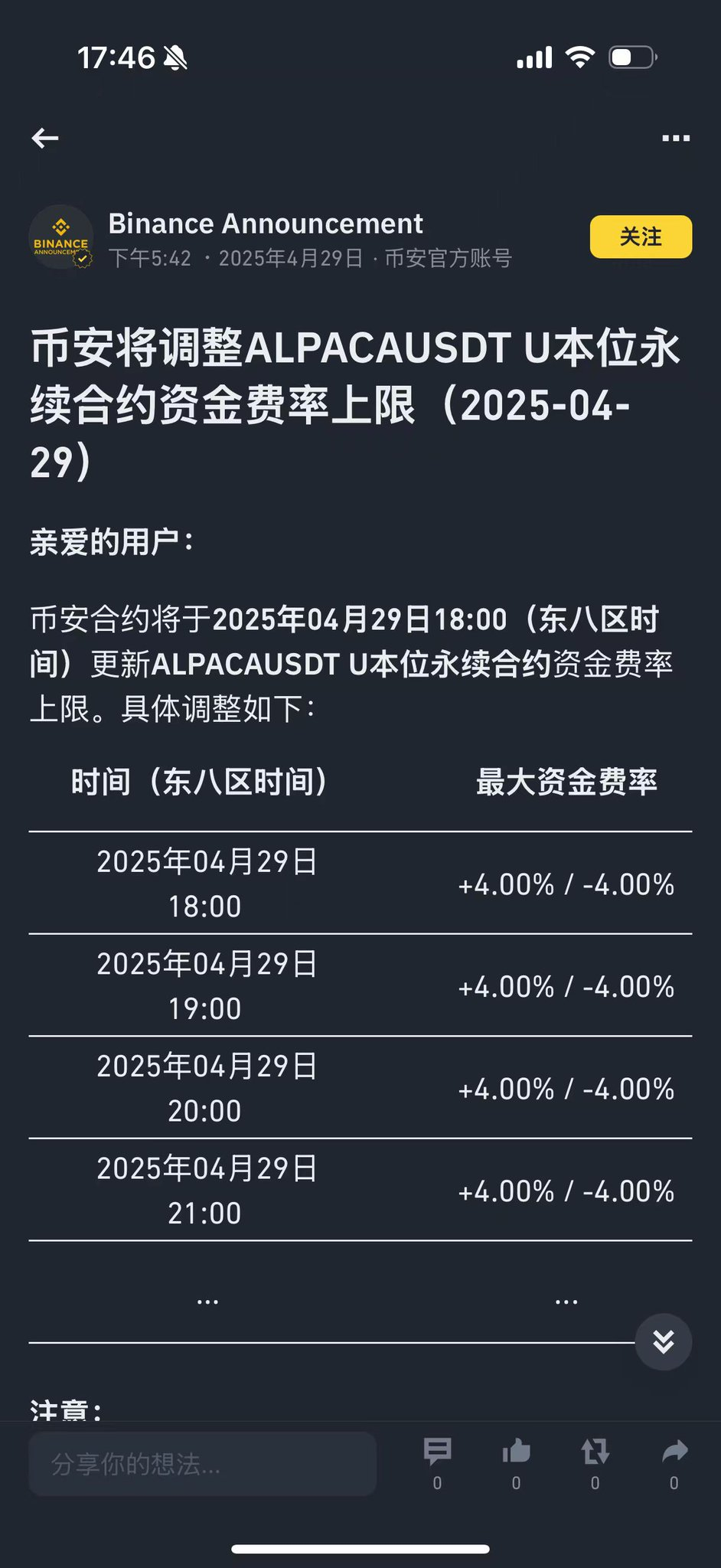

In classic "battles" involving Alpaca, MYX, and TRB, it has gradually been used as a weapon to restrain or even suppress opposing positions. In extreme cases, a maximum funding rate of 2% per hour translates to 48% over 24 hours (with Alpaca even reaching 4%), which is a painful realization! This means that while using the funding rate of the opposing position to provide blood transfusions to oneself, it can also reduce the margin of the opposing position, thus requiring fewer capital chips to "liquidate" the opposing position, achieving a spiral acceleration upwards/downwards.

8/N is Binance's response to the narrative of delisting coins, high control manipulation, and bleeding positions over the past few months. This model essentially limits the daily funding rate to 6% (assuming 2% every 8 hours), effectively blocking the route of funding rate blood transfusions and theft.

Some may wonder why not simply set it to settle every 8 hours; this is mainly because an 8-hour funding settlement interval is too slow to respond to viral tokens that can double or halve in price within a few hours. During this period, the premium may become extremely large, and the final calculated funding rate may be punitive, exacerbating market instability. By implementing a variable N, Binance can configure the settlement frequency to 1/2/4/8 hours for its volatility on the first day of launching a high-risk new asset.

As mentioned earlier, the role of the funding rate is to adjust the price difference between futures and spot, but unfortunately, it has been exploited by those with ulterior motives, becoming a roller that crushes retail investors who have little understanding of the contract mechanism.

The market is ever-changing; when God closes a door, he opens a window—this applies to everyone. Let us look forward to the next grand game of strategy.

May we always hold a heart of reverence for the market.

This article references: @owenjin12's tweet analysis

https://x.com/OwenJin12/status/1968294143169618117

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。