Investor Confidence Returns as Bitcoin ETFs Add $163 Million, Ether ETFs $213 Million

The tide turned on Thursday, Sept. 18, as both bitcoin and ether ETFs saw a return to strong inflows, signaling a fresh wave of investor confidence in crypto-linked funds. Together, the two asset classes drew in $376 million, with ether leading the charge.

Bitcoin ETFs ended the day with $163.03 million in net inflows spread across seven funds. Fidelity’s FBTC topped the leaderboard with $97.35 million, while Ark 21Shares’ ARKB added $25 million. Bitwise’s BITB and Grayscale’s Bitcoin Mini Trust contributed $12.78 million and $10.93 million, respectively.

Franklin’s EZBC ($6.80 million), Vaneck’s HODL ($6.65 million), and Invesco’s BTCO ($3.51 million) rounded out the green day. With no outflows recorded, total value traded came in strong at $3.45 billion, and net assets climbed to $155.05 billion.

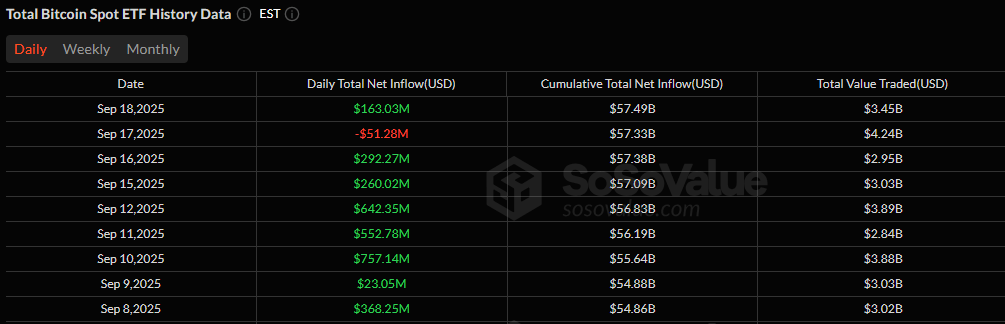

Only one day of outflows for Bitcoin ETFs over the past nine days. Source: Sosovalue

Ether ETFs saw even greater momentum, securing $213.07 million in inflows concentrated across five funds. Fidelity’s FETH dominated with $159.38 million, followed by Grayscale’s Ether Mini Trust at $22.90 million. Bitwise’s ETHW drew $17.47 million, Grayscale’s ETHE added $9.83 million, and Franklin’s EZET contributed $3.49 million. Like their bitcoin counterparts, no ether ETFs posted outflows. Trading volumes stood at $1.54 billion, with net assets increasing to $30.54 billion.

The synchronized rebound across both bitcoin and ether ETFs suggests renewed appetite among institutional investors, hinting that the recent pullbacks may have been more of a pause than a reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。