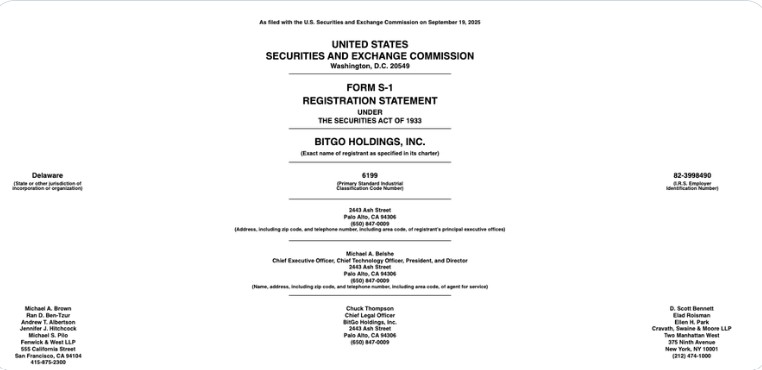

Cryptocurrency Custody Firm BitGo Files for U.S. IPO

BitGo, a major U.S. crypto custody company, filed S-1 paperwork with the U.S. SEC showing a sharp revenue jump in the first half of 2025. The firm reported $4.19 billion in revenue for the six months ended June 30, 2025, and a net profit of $12.6 million. This move signals BitGo IPO plan to list on the New York Stock Exchange under the ticker BTGO.

Source : Bloomberg

Profit Margins and Assets Under Custody in Spotlight

In its SEC filing, BitGo said revenue nearly quadrupled year-over-year from the same period last year. The company’s income details and the strong top-line growth surprised many in the market, given how choppy crypto markets have been in recent years.

The company’s public filing also names Goldman Sachs and Citigroup as lead underwriters for the offering, a sign that big banks see value in the company’s institutional custody business. BitGo confidentially filed for a U.S. IPO and later filed an S-1 registration, but the company has not announced stock price, share count, or a listing date

Source : SEC

Investor Excitement Builds With Institutional Adoption Trend

BitGo’s public filing shows a dramatic revenue jump, $4.19 billion in the first half of 2025 and net income of $12.6 million. That spike caught Wall Street’s eye because few pure-play cryptocurrency infrastructure firms report such big top-line growth.

If the firm lists as BTGO on the New York Stock Exchange, retail and institutional investors will finally get a simple way to buy major cryptocurrencies.

This matters for portfolio diversification and instead of buying directly, some investors may prefer an exchange-traded route via public shares.

The BitGo files IPO so that more traditional investors join crypto infrastructure stocks and help normalize valuations in the sector.

Market Reaction: What the IPO Could Mean for Bitcoin & Ethereum

When big crypto companies go public, markets often get jumpy. Traders may sell cryptocurrency to book profits, or they may buy expecting institutional demand to both happen. Look at past examples, Coinbase and Circle’s IPO debut showed a big initial interest with heavy price swings in Bitcoin and other tokens.

More recently, Gemini's public debut had strong stock demand while Bitcoin and many other altcoins triggered.

Bitcoin & Ethereum will likely move the most, because they are the largest and most sensitive to macro and sentiment shifts.

So expect immediate volatility around the filing and pricing window. Traders could sell into strength (profit taking) or buy the rumor and sell the news. The first 24–72 hours after pricing often see the biggest swings.

Final Thoughts

The BitGo IPO is a big step for crypto infrastructure. If it lists successfully under the ticker BTGO, it could become a benchmark for other crypto service firms looking to go public. For anyone watching institutional adoption, custody firms like this matter a great deal because they help big money enter crypto with more trust and fewer custody fears.

Also read: Syntax Verse Daily Quiz Answer 20 September 2025: Answer Inside!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。