Massive Ethereum Whales Activity May Push ETH Price Up or Down

Have you wondered why big investors keep buying even when the market is falling? That is the question traders are asking after one of the most profitable Ethereum whales added fresh positions this week .

According to blockchain monitoring group EmberCN, the wallet has already earned $76.05 million from ETH swing trades and is showing no signs of slowing down.

Source: X (formerly Twitter)

In recent days:

-

The whale bought 18,000 ETH at $4,487.

-

Sold 10,000 at $4,600.

-

Then early this morning the whale picked up another 16,569 at $4,484, worth about $74.29 million.

-

This series of trades added another $1.13 million to its profits.

Sending a clear message: large Ethereum whales still see opportunity around current levels.

Ethereum Price Faces Market Pressure

While whales are buying, the broader market is under pressure.

It fell 2.76% in the last 24 hours, underperforming Bitcoin and the rest of the crypto market.

The decline came as over $210 million in long positions were liquidated, part of a wider $2.2 billion crypto wipeout.

These moves erased weeks of inflows and reflected profit-taking by institutions.

On top of that, uncertainty around the recent U.S. The Fed rate cut pushed traders to de-risk, further adding to the downward momentum.

Key Levels to Watch

The liquidations drove ETH below $4,400.

-

Traders are now watching the next major support at $4,365.

-

Which lines up with the 78.6% Fibonacci level.

-

If that floor holds, it could rebound toward $4,500–$4,600, a range where recent Ethereum whales activity also clusters.

-

Yet a breakdown lower could have crypto testing $4,200 before it stabilizes.

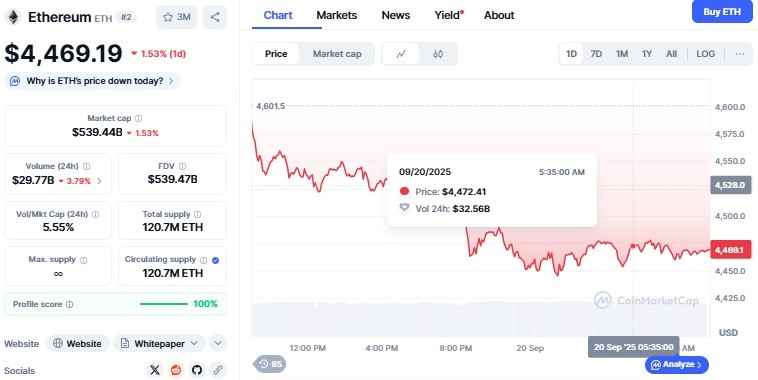

Source: CoinMarketCap

The coin is now trading at $4469, with a decrease of 1.53% in the last 24 hours as per the CoinMarketcap.

Even more interestingly, the whales are accumulating aggressively around these levels.

This indicates they consider this sell-off to be interim in nature and not the beginning of a more severe correction.

Their conviction may stabilize sentiment in the near term.

Long-Term Ethereum Prediction

Aside from short-term volatility, the cryptocurrency retains a few long-term catalysts.

The forthcoming Fusaka upgrade on December 3, 2025.

It will be expected to increase network capacity up to 12,000 transactions per second, a significant step towards scalability.

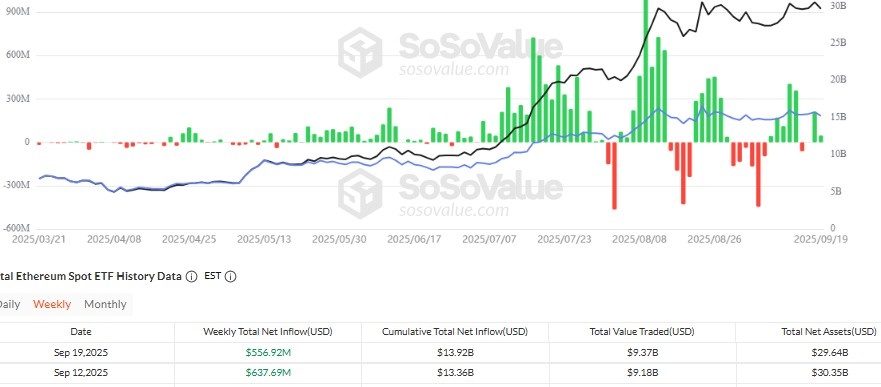

According to Sosovalue, ETH ETFs recorded weekly inflow of $556.92M , indicating that institutional demand is still strong despite recent outflows.

Source: Sosovalue

There are challenges, though. Fears of centralization in staking and future validators' selling pressure can cap upside momentum.

The interplay among whale accumulation, institutional inflows, and network upgrades will probably determine the pace of it's future performance.

Conclusion

The recent buying frenzy serves to remind that investors are hoping for strength despite retail and institutional investors selling into strength.

With ETH at the edge of critical support, the next couple of days will be determining whether the price stabilizes or goes lower.

For the time being, the market is still stuck between overwhelming selling pressure and the confidence of whales, with traders wondering which one will dominate.

Disclaimer: This article is for information purpose only, kindly do your own research before investing in crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。