Will Michael Saylor Bitcoin bet Truly Surpass the S&P 500 Index?

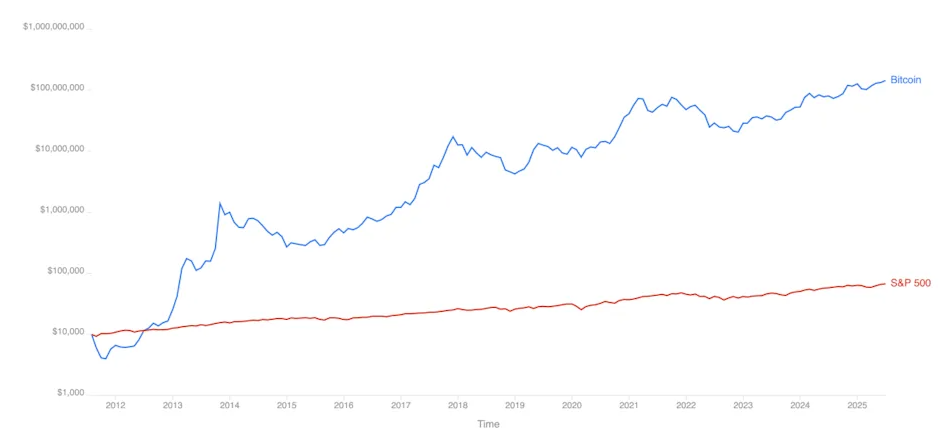

Can Bitcoin truly outshine traditional markets for decades to come? Michael Saylor Bitcoin prediction says that BTC will outperform the S&P 500 index “forever,” setting off debates across the financial world.

The Strategy co-founder and executive chairman believes asset's appreciation will consistently surpass equities, making it the ultimate form of "digital capital".

Strategy CEO on Bitcoin’s Rise Over the S&P 500

Michael Saylor interview with Coin Stories hosted by Natalie Brunell , he argued that it rises faster than traditional equities, including the index. He estimated that the index could lose nearly 29% each year against the asset for the next 21 years.

He described BTC’s fixed supply and decentralized nature as clear advantages over currencies such as the US dollar which devalued under inflation and central bank policies.

Source: X

On September 5, according to a Bloomberg report, Strategy had cleared the S&P 500 profitability bar with a $14B unrealized gain last quarter. If the firm were added to the index, analysts say that tract the S&p 500 would have to buy 10m of shares which is about $16B at today’s prices.

Michael Saylor BTC Prediction: Digital Capital and Credit

Mentioning Bitcoin as “digital capital", Saylor suggested it could underpin a new era of credit instruments. His forecast that Bitcoin-backed loans will pay higher yields, last longer and eventually rival sovereign debt and corporate bonds.

He discussed in the interviews that :

-

BTC has already outperformed the S&P 500 over the past decade.

-

Digital gold’s scarcity makes it more reliable than the traditional currencies.

-

Institutional adoption will accelerate as volatility decreases.

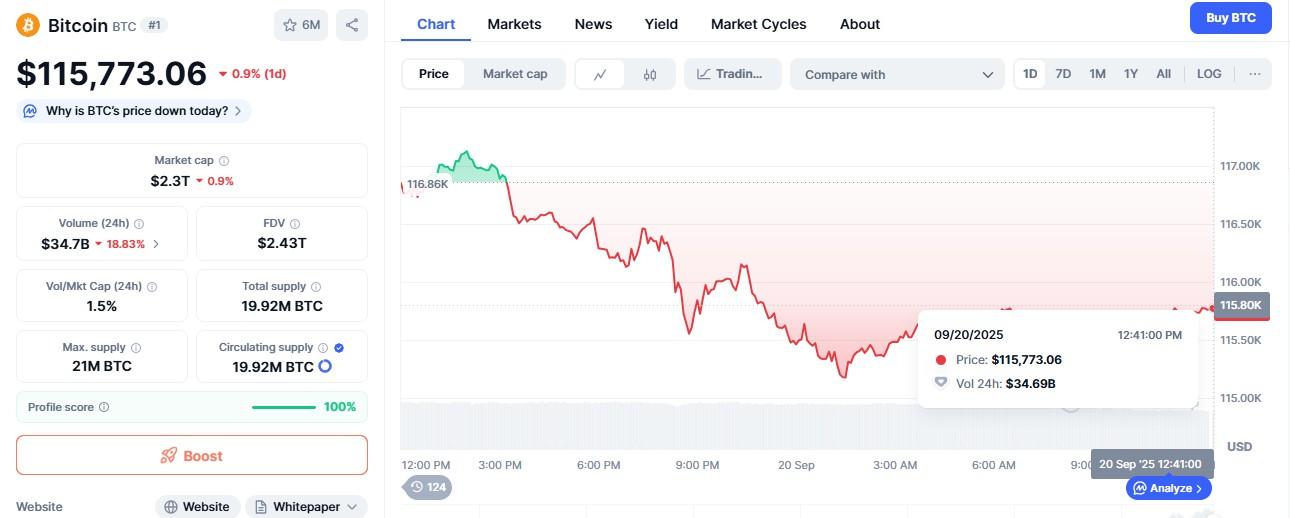

Why Bitcoin price is down today?

As per the data of CoinMarketCap, BTC-trading at $115,637.10, showing a decline of 1.15% recorded in 24 hours. Although, the coin price is down today, it fell after the Fed’s 25bps cut. And over $2.2B in leveraged positions were liquidated which is pushing the prices below $116k.

Source: CoinMarketCap

Insights Shared on Saylor Twitter

On Michael Saylor Twitter , he emphasizes that short-term BTC dips are less concerning than they appear. He says Bitcoin’s price dip as a buying opportunity, on September 15, his firm purchased 525 coins worth $60.15 million. This coin shopping was done when it was trading around $114, showing the CEO's confidence over the asset.

Despite volatility he pointed out Bitcoin-remains up 90% year on year, underlining its strength compared to equities.

Final Thoughts: BTC vs. the S&P 500

Michael predicts that the digital coin will eventually replace the index as the world’s long-term wealth benchmark. Traditional institutions may resist but his views highlights the growing acceptance of virtual asset as more than a speculative asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。