Bitcoin (BTC) spent the week grinding inside a tight $3,155 band, a calm surface that hides busy positioning underneath. The spot tape continues to orbit the mid-$115,000s, and the term structure reflects that equilibrium: no stampede, but plenty of sizing as traders prepare for the final week of September and quarter-end roll activity.

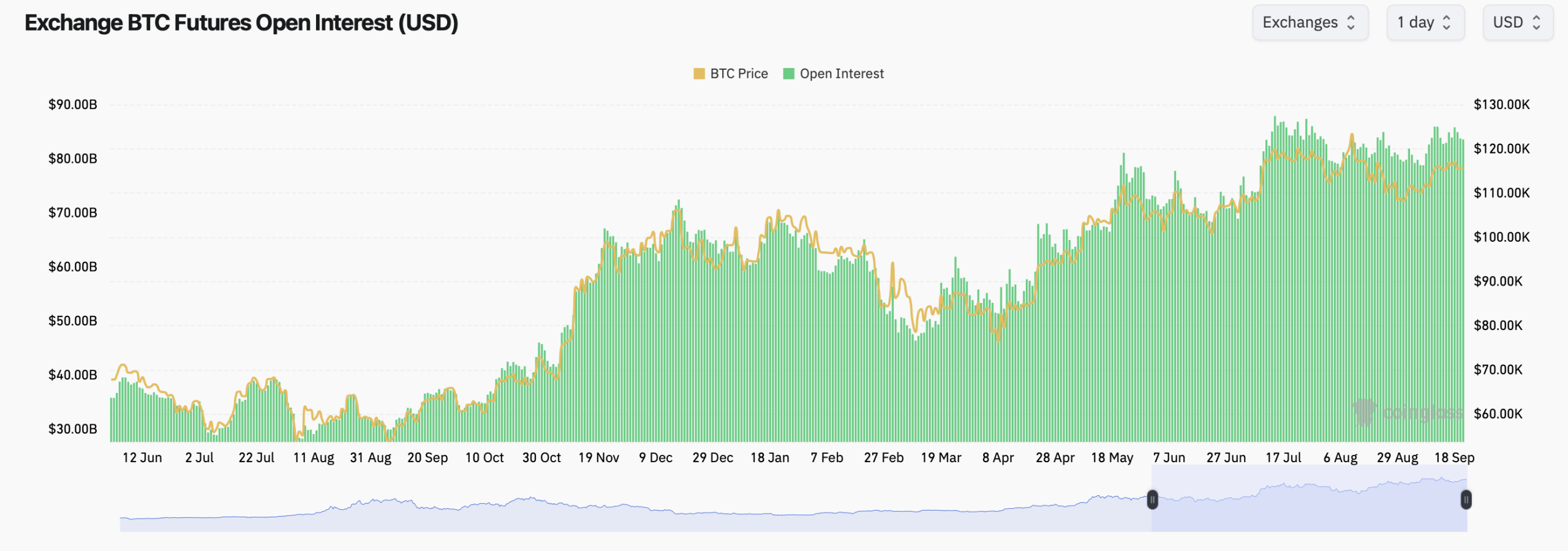

On futures, according to coinglass.com stats, total open interest (OI) sits around $83.56 billion, much higher than ethereum’s OI, which is $64.57 billion this weekend. That’s near the upper zone seen since spring, matching the elevated bars on the OI chart while the price line hugs the same altitude. The build is broad, not just a single venue effect, and it keeps the perpetual funding conversation lively without tipping into extremes.

BTC futures open interest according to coinglass.com stats.

Venue share tells the story. CME leads with about $17.19 billion in OI (20.57%), a reminder that traditional money hasn’t left the arena. Binance is next with roughly $14.59 billion (17.46%), followed by Bybit at $10.23 billion (12.24%) and OKX at $4.60 billion (5.5%). Gate shows $8.68 billion (10.38%), Bitget $6.15 billion (7.36%), MEXC $3.09 billion (3.69%), WhiteBIT $2.52 billion (3.01%), while Kucoin and BingX are smaller at $670.32 million (0.8%) and $504.39 million (0.6%), respectively.

Day-over-day moves are tame rather than theatrical. CME’s OI is off about 0.12% on the day; Binance slipped 0.90%; Bybit eased 1.51%. Offsetting that, KuCoin ticked up 0.80% and several mid-tier venues posted fractional gains. Net-net: positioning is stable, with rotation instead of wholesale de-risking.

Coinglass figures show options are where the tone tilts optimistic. Across venues, calls make up 59.92% of OI (263,276.82 BTC) versus 40.08% puts (176,130.99 BTC). The past 24 hours echo that split on volume—60.48% calls (4,777.91 BTC) to 39.52% puts (3,122.52 BTC)—suggesting traders are paying for upside exposure while keeping a foot on the brake.

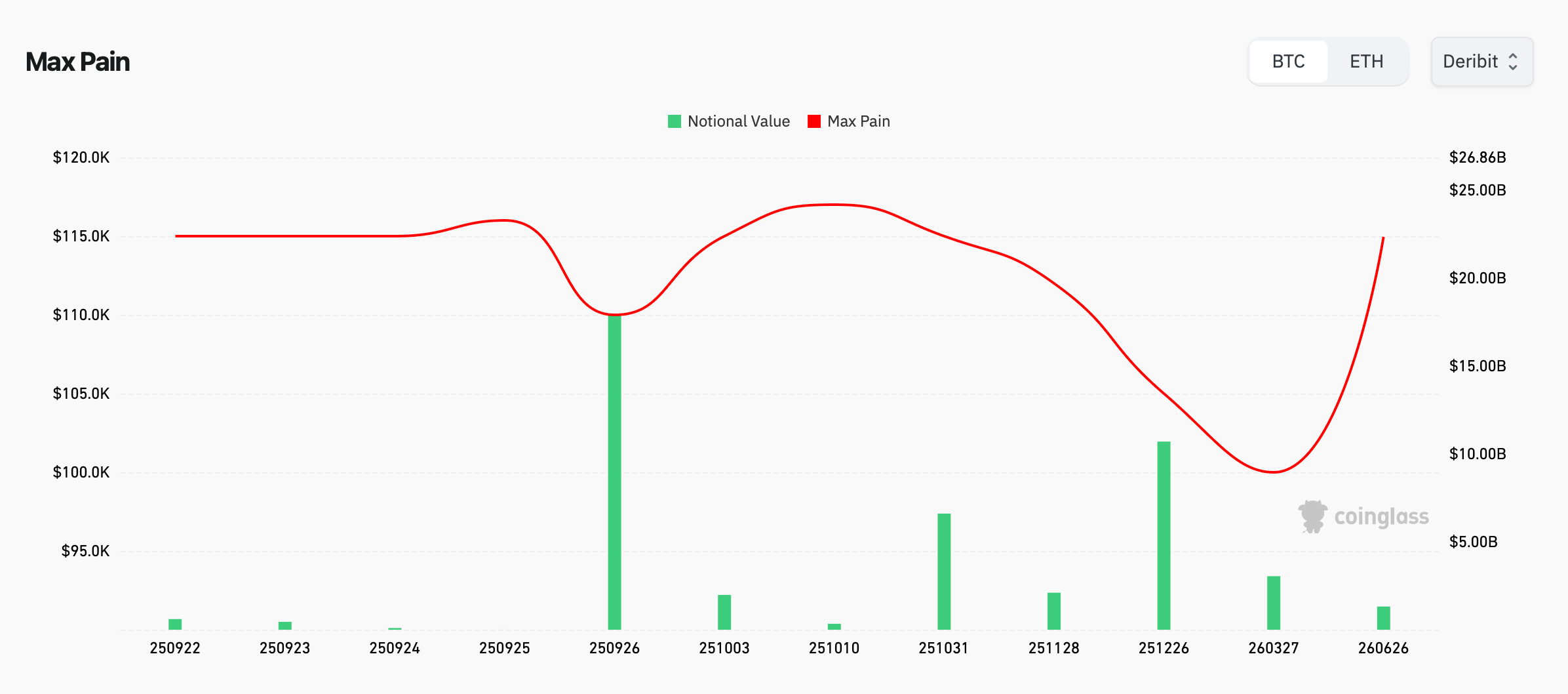

Max pain on Deribit, according to coinglass.com stats. Max pain is the price point where the greatest number of options contracts—both calls and puts—expire worthless, causing the most financial loss to option holders. It often acts as a magnet for price action near expiry, as market makers typically hedge around this level.

Max pain hovers near the price action. Deribit’s near-dated series cluster around $115,000, with a dip toward $110,000 for the Friday, Sept. 26 expiry before bending back into the mid-$115,000s into early October. That profile implies classic pin risk around $115,000 as expirations approach, especially if spot refuses to wander.

The strike distribution shows traders hedging both sides of the field. On Sept. 26, 2025, the largest open positions include a 95,000 put option with about 10,166 BTC and a 108,000 put option with roughly 7,770 BTC. On the upside, there’s a hefty 140,000 call option expiring the same day with about 9,974 BTC.

Looking further out, the December 2025 contracts include another 140,000 call with nearly 9,693 BTC and a 200,000 call with around 8,471 BTC. In short, traders are covering downside risks while also betting on the possibility of much higher prices by year-end.

Near-term flow shines a light on the week ahead. The busiest 24-hour volumes were clustered in the 110,000–121,000 call bands (611.1 BTC to 401.6 BTC on 23–24 Sept expiries) with a notable 108,000 put print (215.9 BTC). If spot remains range-bound, those strikes become magnets; if it wanders, they become tripwires.

Bottom line: with futures OI lofty and options leaning call-heavy, bitcoin looks content to orbit $115,000 until expiries force a decision. Quarter-end could add a nudge; otherwise, pins and gamma will do the steering—quietly ruthless, as always.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。