Aster, the decentralized exchange (DEX) known for its high-frequency perpetuals trading, has found itself at the center of a growing controversy following the explosive performance of its newly launched token, ASTER. Since its token generation event (TGE) on Sept. 17, where it debuted at just $0.02, ASTER skyrocketed by more than 7,000%, reaching a high of $2 by Sept. 21. This meteoric rise briefly pushed its market capitalization to an eye-popping $3.3 billion, drawing intense scrutiny from market participants and analysts alike.

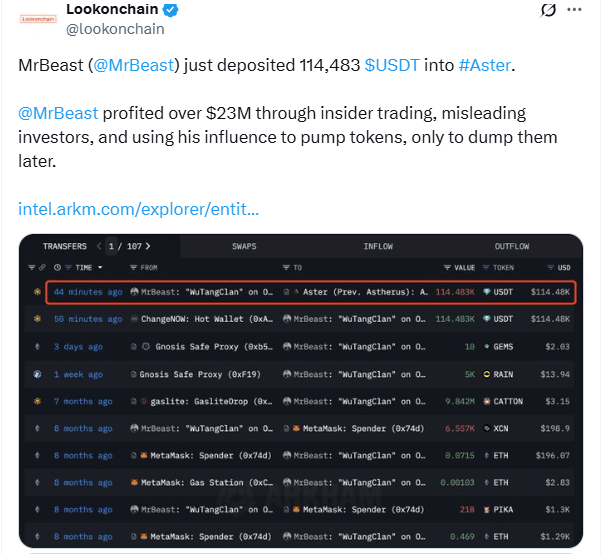

Source: X post by Look Onchain.

However, at the time of writing, ASTER has since pulled back to $1.60, shaving nearly $660 million off its peak valuation and settling its market cap at approximately $2.64 billion. The dramatic price action has fueled speculation about potential market manipulation and raised questions about the token’s distribution and liquidity structure, especially amid reports of concentrated holdings.

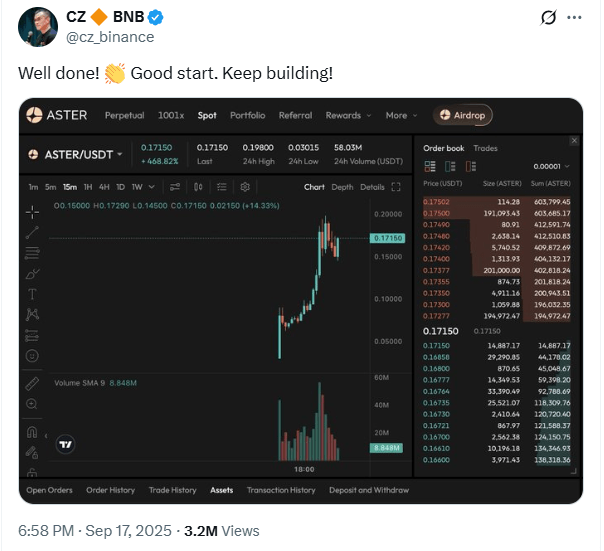

Since its endorsement by Binance founder Changpeng Zhao (CZ) soon after its launch, both centralized and decentralized exchanges have scrambled to list ASTER. So far, it has been listed on Bitget and Bybit as a new spot trading pair. The token is also available on DEX platforms across various networks, including BNB Chain, Ethereum, Solana, and Arbitrum.

Source: X post by CZ.

However, the token’s rapid rise—and claims that just six wallets hold or control more than 96% of the ASTER supply—has sparked allegations of market manipulation. On the social media platform X, some users argued that such concentrated ownership makes ASTER vulnerable to the influence of those controlling the wallets. Others alleged that Binance holds 95% of the 1.65 billion ASTER tokens currently in circulation.

Cyclop, a crypto trader and angel investor, argued that Aster does not have a working product to justify the market’s valuation of the token, but this hardly matters anymore.

“Everyone knows it’s complete garbage, but the worst part: you can’t short it. And that’s exactly what makes ASTER bullish – they decide where the price goes because they control the entire supply. You can argue all day that supply control is bad, but this project is proof that it works. Heavily controlled supply = bearish. Heavily controlled supply by trusted people = bullish,” Cyclop said in a post on X.

The angel investor told followers that in today’s crypto world, often it is not real utility that drives a token’s price. Instead, it is the profile of the people backing the project and the funding behind it that matters. This perspective gained traction following Binance founder CZ’s apparent endorsement of Aster via his X account. CZ’s post, interpreted by many as tacit support, raised eyebrows given his historically cautious approach to public endorsements.

Meanwhile, some social media users speculated on why ASTER was listed on perpetual futures contracts or perps markets first, prior to listing on spot markets, with one user positing that this was done to encourage investors to short it.

“Simple human psychology: the whole market is dumping, one token is going up, let’s short it. They will liquidate all these sellers to pump $Aster even more volatile. You saw the dip at $1. You saw the dip before $2,” the user argued.

According to the user, this process is likely to continue until Aster gains enough power to dominate Hyperiquid.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。