Author: Cointelegraph

Translation: White55, Mars Finance

Bitcoin Mining Difficulty Hits New High Amid Centralization Concerns

The increase in network difficulty and the demand for energy payments are squeezing small businesses and even publicly traded companies.

Bitcoin mining difficulty is an indicator of the relative difficulty of adding new blocks to the ledger, and on Friday, this difficulty climbed to a historic high of 142.3 trillion.

Driven by newly deployed computing power over the past few weeks, mining difficulty has set consecutive historical highs in August and September.

According to CryptoQuant, Bitcoin's hash rate (the average total computing power that secures the decentralized currency protocol) also reached a historic high of over 1.1 trillion hashes per second on Friday.

The continuous rise in mining difficulty and the ongoing demand for high energy consumption and high-performance computing capabilities have made competition more challenging for individual miners and businesses, raising concerns about the increasing centralization of Bitcoin mining.

_ Bitcoin network difficulty reached a historic high in September. Source: _CryptoQuant

Bitcoin network difficulty reached a historic high in September. Source: _CryptoQuant

Public Companies Face Pressure from Governments and Energy Infrastructure Providers

Small miners and even publicly traded companies are facing increasing competition from governments that can access free energy resources, while energy infrastructure providers can vertically integrate Bitcoin mining into their business operations.

Some governments, including Bhutan, Pakistan, and El Salvador, have already begun mining Bitcoin or exploring the use of surplus or runoff energy for mining.

In May of this year, the Pakistani government announced plans to allocate 2,000 megawatts (MW) of surplus energy for Bitcoin mining, as part of its regulatory measures for cryptocurrencies and digital assets.

Energy providers in Texas, USA, are also collaborating with the Texas Energy Reliability Council (ERCOT) to integrate Bitcoin mining into their infrastructure to balance electricity loads.

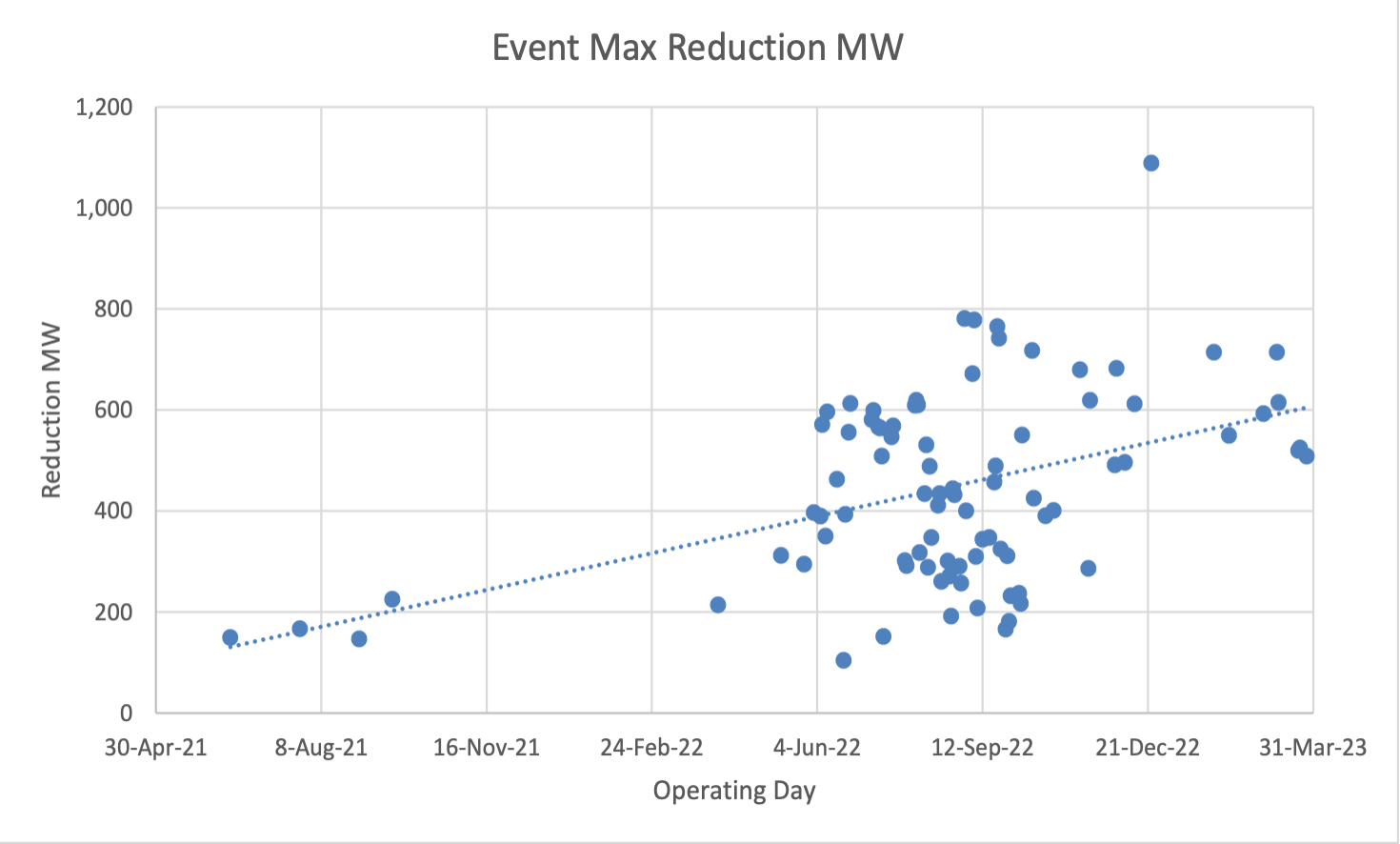

The chart shows the reduction in energy consumption of cryptocurrency miners in Texas during peak electricity demand from 2021 to 2023. Source: ERCOT

The chart shows the reduction in energy consumption of cryptocurrency miners in Texas during peak electricity demand from 2021 to 2023. Source: ERCOT

During peak demand periods, the grid may lack the energy to meet consumer needs, while during low consumption periods, there may be excess surplus energy, which, if not properly redistributed, can damage the grid and pose dangers.

Energy companies in Texas are using Bitcoin mining as a controllable load resource to balance these electricity discrepancies, consuming excess energy during low demand and shutting down mining equipment during peak consumption demands.

This creates profits for these power suppliers, who do not have to worry about fluctuations in energy costs, giving them a significant competitive advantage over publicly traded mining companies that must pay for energy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。