Original Title: The Aster Counterstrike

Original Source: Token Dispatch

Original Compilation: LenaXin, ChainCatcher

Background

On September 18, 2025, Zhao Changpeng released a price chart that was neither Bitcoin nor BNB.

The chart displayed the price of the native token of the decentralized perpetual trading platform ASTER, which had just launched the day before.

"Well done! A smooth start. Keep it up!" he said.

Within hours, the ASTER token surged 400% from its issuance price. The market clearly received this signal: the former CEO of Binance was not just expressing congratulations but declaring war on Hyperliquid.

As HYPE token holders watched their Hyperliquid assets soar to nearly $60, a historic high, Zhao Changpeng's meticulously calculated tweet struck like a precision strike. Although Zhao Changpeng was banned from operating Binance, he was clearly not prohibited from shaking the market, and he was fully supporting Hyperliquid's strongest competitor.

However, the war machine had already started. YZi Labs (formerly Binance Labs) had been quietly funding the development of ASTER. The BNB Chain cooperative network was being activated. The world's largest crypto empire was launching a full-scale siege against this decentralized newcomer daring to seize market share in derivatives.

This was the first shot in the war of decentralized perpetual contract trading platforms, and Binance had no intention of conceding defeat.

(1) What is ASTER?

ASTER was born from the merger of two major DeFi protocols, Astherus and APX Finance, in December 2024. This integration built a unified trading infrastructure aimed at directly countering Hyperliquid's expanding market share.

(Note: Astherus focuses on multi-asset liquidity for yield products, while APX Finance is a decentralized perpetual trading platform.)

The platform is a multi-chain decentralized trading platform that supports BNB Chain, Ethereum, Solana, and Arbitrum networks, enabling seamless trading without manual cross-chain transfers by aggregating multi-chain liquidity. Since its launch in March 2025, ASTER has processed over $514 billion in trading volume for 2 million users. After the token issuance, the total locked value on the platform briefly peaked at $2 billion, but as of September 2025, it had fallen back to $655 million.

Unlike decentralized trading platforms that focus solely on spot trading, ASTER positions itself as a comprehensive trading platform offering both spot and perpetual futures markets. While perpetual derivatives are its core business, the platform also provides spot trading functionality, with its native token ASTER/USDT being the first trading pair to go live.

(2) How does ASTER address front-running and liquidation manipulation?

The core architecture of ASTER is dedicated to solving the liquidity fragmentation problem that plagues multi-chain DeFi. The platform constructs "unified liquidity" by aggregating cross-chain order book depth rather than forcing users to transfer assets across chains.

Its "hidden order" system is particularly notable, as it always conceals the order size and direction before execution. This dark pool-style design effectively addresses key pain points of on-chain trading: front-running and liquidation manipulation.

Zhao Changpeng previously commented on this feature, noting that it resolves the "liquidation manipulation issues present in other on-chain DEXs."

The platform's margin system supports both isolated and cross-margin trading, allowing users to use liquid staking tokens like asBNB or ecosystem stablecoins as collateral. This capital efficiency innovation enables traders to earn passive income on their collateral assets while maintaining active positions.

The core of the ASTER ecosystem is USDF. USDF is an ecosystem stablecoin backed by delta-neutral positions. Users can mint USDF by depositing supported assets and use this stablecoin as collateral for trading while also earning yields. This creates a self-circulating liquidity system where users holding stablecoins naturally become liquidity providers.

The ASTER roadmap includes the integration of zero-knowledge proof for enhanced privacy and the development of a custom Layer1 blockchain, Aster Chain, optimized for trading. In June 2025, this feature was opened for beta testing to select traders, allowing the platform to ultimately compete with Hyperliquid's customized L1 architecture.

(3) The Epic Showdown between ASTER and Hyperliquid

ASTER and Hyperliquid represent two different paths in decentralized perpetual contract trading. Hyperliquid builds a dedicated Layer1 blockchain from scratch, employing fully on-chain order book trading to achieve performance comparable to centralized trading platforms. This vertical integration sets the benchmark for trading execution efficiency and user experience, but confines it to a single ecosystem.

In contrast, ASTER adopts the opposite strategy, maximizing coverage and liquidity access through multi-chain deployment. Although this increases technical complexity, it allows ASTER to leverage existing DeFi ecosystem resources to serve user groups that prefer specific chains.

Hyperliquid dominates with approximately 70% of the DeFi perpetual contract market share, with open contracts reaching $15 billion and maintaining an average daily trading volume of over $800 million.

However, ASTER's multi-chain strategy possesses advantages that Hyperliquid finds difficult to replicate. The capital efficiency opportunities created by ASTER's integration with yield protocols like Pendle and Venus are beyond the reach of Hyperliquid's isolated L1 architecture.

ASTER users can simultaneously earn BNB staking rewards, USDT deposit interest, and trading fees.

There are also significant differences in leverage configurations. Hyperliquid sets a leverage cap of 40 times, while most trading pairs on ASTER support up to 100 times leverage, with specific assets reaching as high as 1001 times. ASTER's US stock perpetual contracts provide 24/7 traditional market risk exposure, extending its service range beyond crypto-native traders.

(4) Token Flow Reveals Competitive Landscape

The token economic model of ASTER emphasizes community incentives and long-term sustainability. The total supply of 8 billion tokens is allocated in specific proportions: 53.5% for airdrops and community rewards, 30% for ecosystem development, 7% for the treasury, 5% for the team, and 4.5% for liquidity and trading platform launch.

The community allocation ratio ranks among the top in the DeFi space, exceeding 50% of the total supply. The unlocking mechanism releases 25% of the tokens immediately upon generation events, with the remaining portion set to a three-month lock-up period followed by a linear release over nine months.

The token has multiple functions within the ecosystem, including governance rights, fee discounts, staking rewards, and access to premium features. Revenue sharing is achieved through fee buybacks, with a portion of trading fees used to purchase and potentially burn ASTER tokens, creating deflationary pressure as trading volume increases.

Users can stake their ASTER tokens while also using derivatives of these tokens as collateral for trading. This allows a single position to generate multiple streams of value.

(5) Token Showdown: Comprehensive Analysis of ASTER and HYPE

The token economic models of ASTER and HYPE showcase different philosophies regarding value capture and distribution mechanisms.

Hyperliquid's HYPE token adopts a more traditional crypto economic model, employing aggressive buybacks through protocol revenue. The platform generates over $1 billion in annual revenue, with most of the profits allocated for HYPE buybacks, creating strong deflationary pressure.

HYPE's core advantage lies in its proven "revenue-buyback" flywheel effect. Currently, 43.4% of the total supply is staked, combined with substantial protocol revenue, which maintains strict circulation limits for the token. This powerful price support mechanism is something ASTER has yet to achieve.

In November 2025, Hyperliquid will initiate a large-scale token unlock for core contributors. These unlocks will bring significant selling pressure, potentially overwhelming aggressive buyback plans. Hyperliquid is preparing to launch the USDH stablecoin to generate additional buyback pressure, but the timing brings uncertainty.

ASTER's strategy places community ownership above immediate value capture. While this means weaker buyback efforts in the short term, it can create stronger network effects and governance decentralization. The 53.5% community allocation ensures that value flows to actual users rather than early investors or team members.

(6) Binance's Strategy

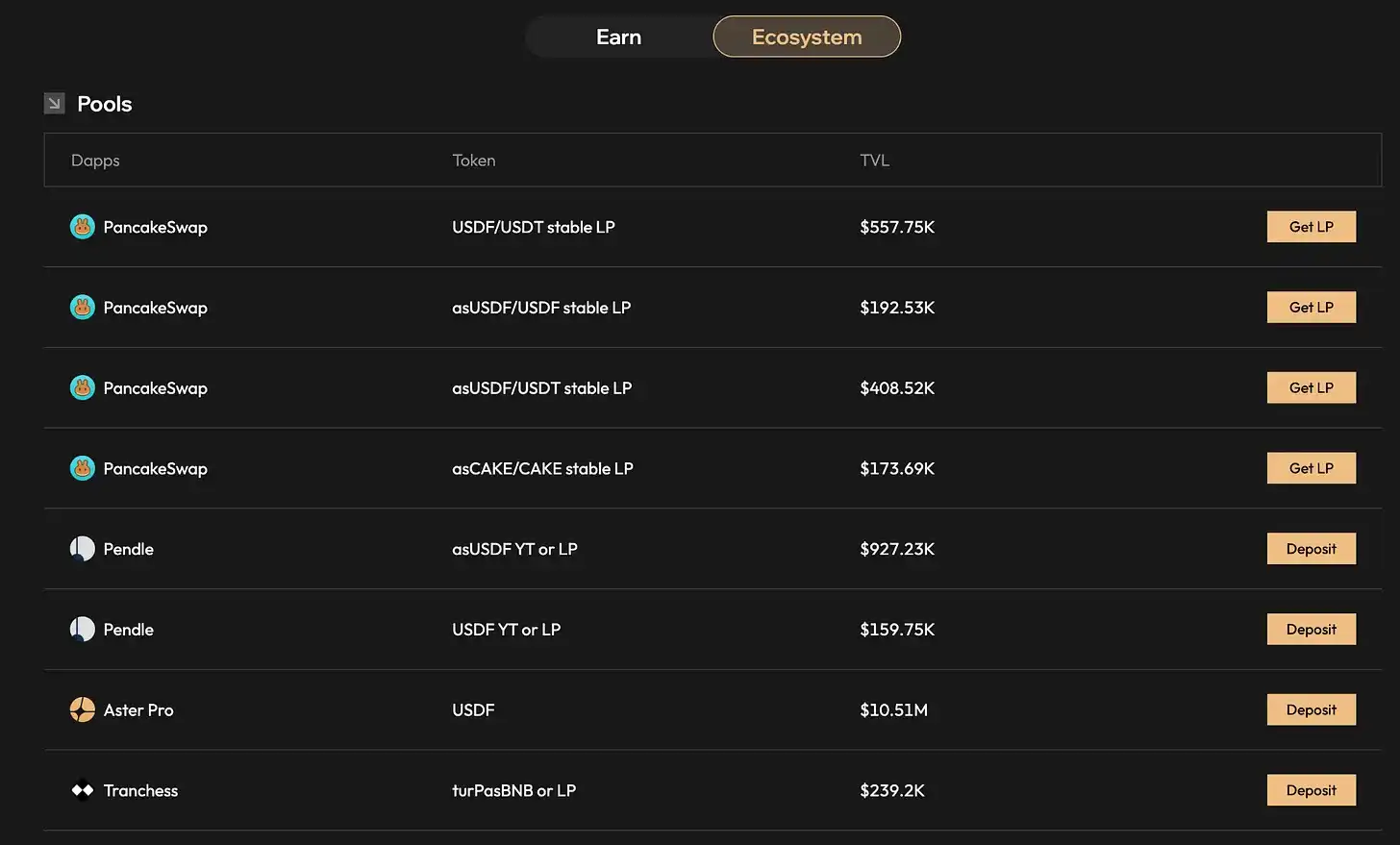

Analyzing ASTER's liquidity supply system reveals the strategic depth behind its launch. Professional market makers provide core order book depth, while the platform's cross-chain architecture aggregates multi-blockchain liquidity. Strategic partnerships with protocols like Pendle, ListaDAO, Kernel, Venus, YieldNest, and PancakeSwap create additional sources of liquidity and user incentives.

Pendle enables yield tokenization, ListaDAO provides liquid staking for BNB (generating asBNB), Venus offers lending services, and PancakeSwap directs arbitrage trades from the largest DEX on the BNB Chain. These collaborations position ASTER as a central hub where users can engage in multiple DeFi strategies while trading derivatives.

The ecosystem's collateral system addresses the opportunity cost issue by allowing users to earn yields from trading margins. Users do not need to hold idle USDT; they can mint USDF to earn delta-neutral yields while using it as collateral.

(Note: USDF is ASTER's ecosystem stablecoin.)

Similarly, asBNB can still earn staking rewards (approximately 5-7% annualized) while serving as margin for leveraged positions. This allows a single deposit to generate multiple streams of income, including staking rewards, trading profits, and token incentives, encouraging users to keep more funds on the platform long-term, naturally deepening the liquidity pool.

The investment timeline of YZi Labs provides a key annotation for Binance's strategic layout. This investment institution completed its funding of Astherus (the predecessor of ASTER) in November 2024, coinciding with Hyperliquid posing a substantial competitive threat to Binance's dominance in derivatives.

According to representatives from the BNB Chain, ASTER, as a key project in YZi Labs' incubation program, has received mentorship, ecosystem exposure, and technical marketing resource support, thereby establishing its position as the largest perpetual contract DEX on the BNB Chain.

Hyperliquid's trading volume has steadily increased between 2024 and 2025. While Binance still maintains a significant advantage in absolute trading volume, Hyperliquid's growth trajectory from nearly zero to a notable market share demonstrates its success in carving out an independent market rather than directly poaching Binance traders.

Combined with its investments in other projects like MYXFinance, YZi Labs' investment strategy is becoming increasingly clear. These investments show a collaborative layout aimed at building DeFi infrastructure on the BNB Chain and creating alternatives for successful protocols on other chains.

(Note: MYX Finance is a perpetual contract on the BNB Chain, and its DEX has also experienced explosive growth.)

Binance's overall strategy focuses more on ecological defense rather than direct competition. It has not simply replicated Hyperliquid's customized L1 solution but has fully leveraged its existing ecological advantages: regulatory relationships, fiat on-ramps, institutional partnerships, and deep liquidity pools. While ASTER enjoys the benefits of these network effects, it is also providing a decentralized trading experience that is increasingly favored by mature traders.

Binance does not view decentralized protocols as threats to be ignored or marginalized; instead, it actively invests in and promotes DeFi alternatives that still fall within its ecological influence.

(7) What is the Conclusion?

The rise of ASTER either marks a turning point in decentralized derivatives trading or becomes Zhao Changpeng's most expensive "I can do it too" to his competitors.

On the surface, the platform possesses all the elements for success: multi-chain liquidity, ecological collateral, US stock perpetual contracts, and strong support. The idea of earning yields while trading derivatives sounds wonderful, but it is important to recognize that innovations in the cryptocurrency space that seem "too good to be true" often are.

The reality of total locked value plummeting from a peak of $2 billion to $655 million may warrant caution: there is a fundamental difference between initial hype and sustainable adoption. When daily TVL drops by 67%, we may need to question whether these numbers truly represent real users or merely reflect the interests of yield farmers chasing quick profits.

Its token economic model emphasizes long-term community building rather than short-term value capture, a strategy that can be seen as visionary or naively idealistic, depending on one's perspective. Unlike Hyperliquid's proven "revenue-buyback" machine, ASTER's value proposition requires users to believe in the sustainability of a business model that generates 3% margin yields while operating 100x leveraged positions.

The real test lies in whether the platform can persuade traders to abandon Hyperliquid's proven infrastructure in favor of a multi-chain experiment supported by the ecosystem that once birthed the 2022 FTX collapse.

When the world's largest trading platform feels the need to support DeFi competitors, it suggests that the centralized model is not as unshakeable as once thought. Whether this move will make ASTER a winner or merely an expensive risk hedge remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。