The U.S. Treasury can be said to be the most active and largest sector in the field of RWA (Real World Asset) tokenization. With the participation of global traditional financial institutions, the on-chain demand for treasury-like assets is both real and rapidly growing.

For example, BlackRock's BUIDL fund has reached a scale of several billion dollars and can be used as collateral for derivatives. Currently, these tokens are still primarily aimed at qualified investors, subject to minimum investment amounts and whitelist controls.

This report analyzes the actual situation of 12 tokenized U.S. Treasuries, elaborating on the innovative opportunities generated by the tokenization of U.S. Treasury funds and the RWA market, as well as some limitations in compliance, regulation, and technology. Understanding this information can help investors and developers formulate more reasonable strategies.

At the same time, we also see that, similar to the views mentioned in the previous article "M&A Reaches New Heights, Web3 Industry Officially Enters Upstream and Downstream Integration Period," the B2B model may be the mainstream path for future RWA on-chain applications. Institutions will have significant opportunities in the packaging and distribution of "yields": the combination of large financial institutions and DeFi protocols allows bond fund tokens to indirectly benefit retail users through stablecoins or investment portfolios.

We have compiled "What I Learned from Analyzing 12 Tokenized U.S. Treasuries" to gain a clearer understanding of this important RWA sector and to discuss it together.

Written by: 100y / Four Pillars

Compiled by: ODIG Invest

Original report: https://4pillars.io/en/issues/what-i-learned-from-analyzing-12-tokenized-us-treasuries

Key Points:

- One of the most active tokenized assets in the RWA market is U.S. Treasuries. This is mainly due to their strong liquidity, stability, relatively high yields, increasing institutional participation, and suitability for tokenization.

- The tokenization of U.S. Treasuries does not involve any special legal mechanisms. The implementation method is that the transfer agent responsible for managing the official shareholder register no longer uses a traditional internal database but instead operates on a blockchain.

- This article proposes three frameworks for analyzing major U.S. Treasury tokens. The first is the token overview, including protocol introduction, issuance scale, number of holders, and management fees; the second is the regulatory framework and issuance structure; the third is on-chain application scenarios.

- Since U.S. Treasury tokens are classified as digital securities, they must comply with securities laws and related regulations. This has significant implications for issuance scale, number of holders, on-chain application scenarios, and more. The article explores how these seemingly unrelated factors interact with each other.

- Finally, contrary to common perception, U.S. Treasury tokens actually face many limitations. The last part of the article provides an in-depth analysis of these constraints.

1. Everything Can Be "Tokenized"

"Every stock, every bond, every fund, every asset can be tokenized." — BlackRock CEO Larry Fink.

Since the passage of the U.S. GENIUS Act, global interest in stablecoins has rapidly increased. But the question is: Is stablecoin really the end point?

Stablecoins, as the name suggests, are tokens anchored to fiat currencies and operate on public blockchains. Ultimately, they are "money," and money must be used in some context. The application scenarios for stablecoins include remittances, payments, settlements, and various other fields.

However, the area that is now considered capable of truly unleashing the potential of stablecoins is RWA.

RWA stands for Real-World Assets, referring to various tangible assets represented in digital token form on the blockchain. However, in the context of the blockchain industry, RWA more commonly refers to traditional financial assets such as commodities, stocks, bonds, and real estate.

So, why has RWA become the next hot topic after stablecoins?

The reason is that blockchain has the potential not only to change the currency itself but also to fundamentally revolutionize the "back end" of traditional financial markets.

Today's traditional financial markets still rely on extremely outdated infrastructure. While fintech companies have indeed improved the front-end experience for retail customers, making financial products and securities more accessible, the back-end processes of trading remain lagging and severely outdated.

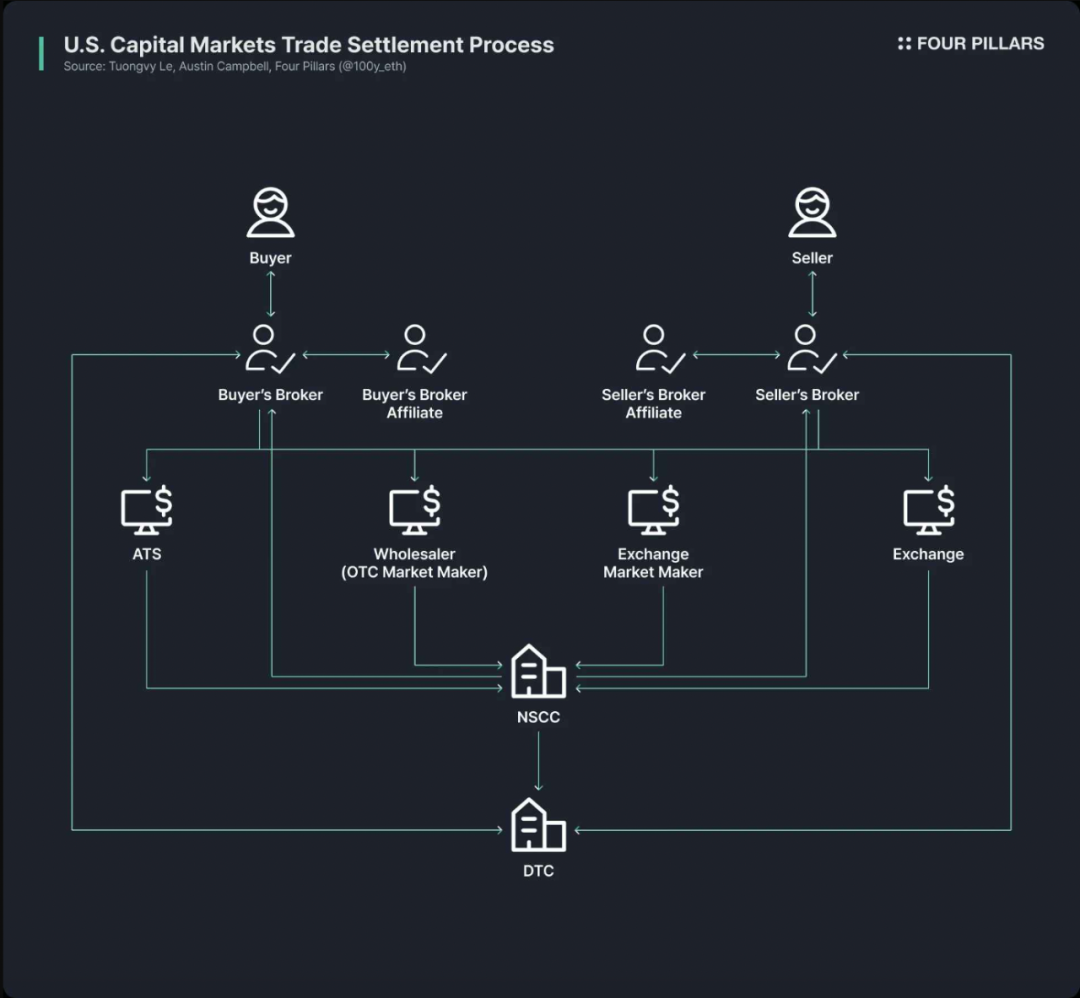

Taking the U.S. stock and bond trading market as an example, its existing structure was established in the 1970s, stemming from the "Paperwork Crisis" of the late 1960s. Subsequently, the U.S. enacted the Securities Investor Protection Act and a series of amendments to securities laws, establishing institutions such as the DTC (Depository Trust Company) and NSCC (National Securities Clearing Corporation).

In other words, this complex system has existed for over 50 years, accompanied by long-standing issues such as excessive intermediaries, settlement delays, lack of transparency, and high compliance costs.

Blockchain has the potential to fundamentally improve this outdated market structure, making it more efficient and transparent. If the back end of financial markets could be upgraded based on blockchain, it could achieve:

- Instant settlement

- Smart contract-driven programmable finance

- Direct ownership without intermediaries

- Greater transparency

- Lower costs

- Fractional investing

- And more innovative models.

Because of this potential, many public institutions, financial institutions, and enterprises are actively promoting the on-chain tokenization of financial assets, such as:

- Robinhood has announced plans to support stock trading through its own blockchain network and has submitted a proposal to the SEC regarding a federal regulatory framework for RWA tokenization.

- BlackRock has partnered with Securitize to issue BUIDL—a tokenized money market fund with a scale of $2.4 billion.

- SEC Chairman Paul Atkins has also publicly expressed support for stock tokens, and the SEC's internal crypto working group is promoting the institutionalization of regular meetings and roundtable discussions on RWA.

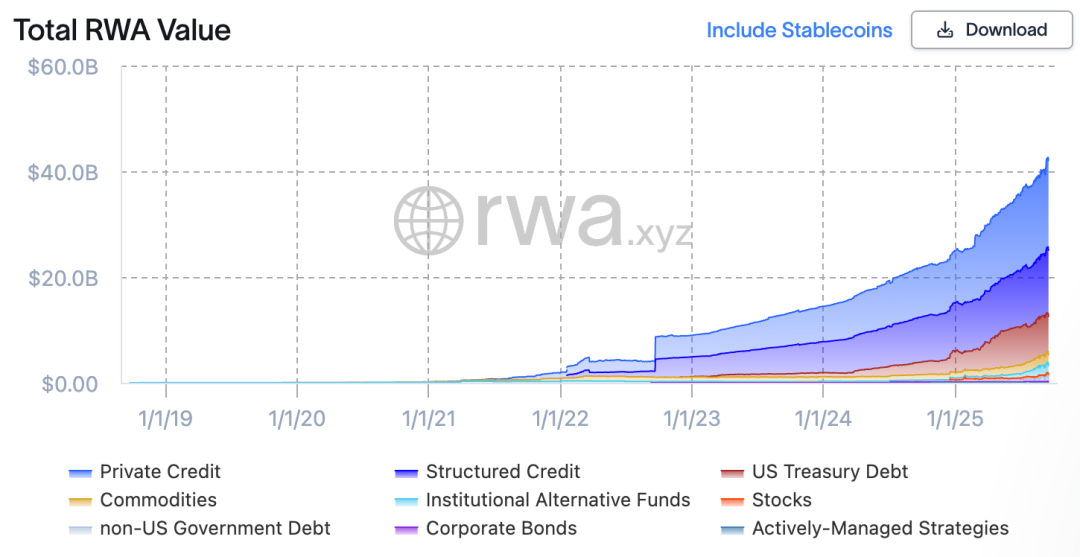

Setting aside the hype, the RWA market is actually growing rapidly. As of August 23, 2025, the total scale of issued RWA has reached $26.5 billion, representing increases of 112%, 253%, and 783% compared to one year ago, two years ago, and three years ago, respectively.

The types of financial assets being tokenized are diverse, but the fastest-growing areas are U.S. Treasuries and private credit, followed by commodities, institutional funds, and stocks.

2. U.S. Treasuries

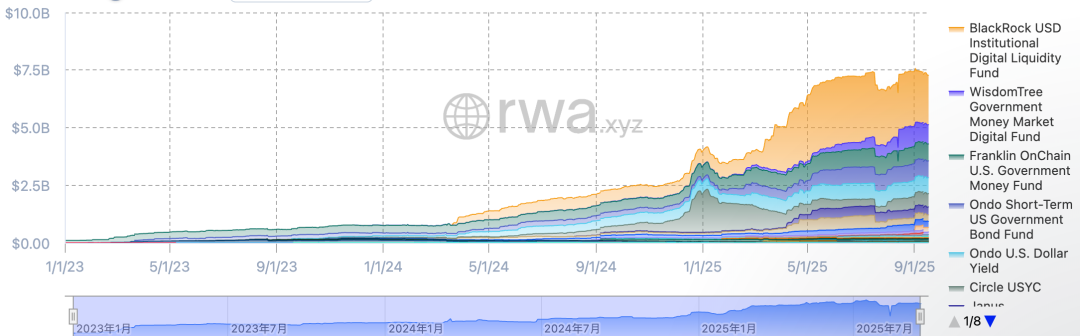

In the RWA market, the most active tokenized area is undoubtedly U.S. Treasuries. As of August 23, 2025, the market size of U.S. Treasury RWA is approximately $7.4 billion, with a staggering growth of 370% over the past year.

It is noteworthy that global traditional financial institutions and DeFi platforms are actively entering this field. For example:

- BlackRock's BUIDL fund leads with a scale of approximately $2.4 billion;

- DeFi protocols like Ondo have launched funds such as OUSG based on RWA tokens supported by BUIDL and WTGXX, maintaining a scale of around $700 million.

Why are U.S. Treasuries the most active and largest sector in the RWA market for tokenization? The main reasons are as follows:

- Overwhelming liquidity and stability: U.S. Treasuries have the deepest liquidity globally and are regarded as safe assets with almost no default risk, making them highly credible.

- Global accessibility: Tokenization enhances the investment accessibility of U.S. Treasuries, allowing overseas investors with demand to participate more conveniently.

- Increased institutional participation: Large institutions such as BlackRock, Franklin Templeton, and WisdomTree lead the market through tokenized money market funds and U.S. Treasury products, providing strong trust endorsements for investors.

- Yields: U.S. Treasury yields are stable and relatively high, averaging around 4%.

- Convenience of tokenization: Although there is currently no specific regulatory framework for U.S. Treasury RWA, basic tokenization is still feasible under existing regulations.

3. The Tokenization Process of U.S. Treasuries

So, how are U.S. Treasuries tokenized on-chain?

At first glance, it seems that complex legal and regulatory mechanisms should be involved, but in reality, the tokenization of U.S. Treasuries is completed in a very straightforward manner while adhering to existing securities regulations. (Of course, due to differences in the issuance structure of different tokens, only representative methods are introduced here.)

Before explaining the tokenization process, it is important to clarify one point: the RWA tokens based on U.S. Treasuries currently issued in the market are not directly tokenizing the Treasuries themselves but rather tokenizing funds or money market funds that have U.S. Treasuries as underlying assets.

Traditionally, public asset management funds like U.S. Treasury funds must designate a transfer agent registered with the SEC. A transfer agent is a financial institution or service company that manages the record of investor fund holdings on behalf of the securities issuer. Legally, the transfer agent is the core institution managing the registration and ownership of securities, responsible for formally maintaining the share registration of fund investors.

The tokenization method for U.S. Treasury funds is very direct: fund shares are mapped to tokens on the blockchain, and the transfer agent maintains the official shareholder register through a blockchain-based system. In other words, the proprietary database originally used to record shareholder information has been migrated to the blockchain.

Of course, since the U.S. has not yet established a clear regulatory framework specifically for RWA, holding tokens cannot legally be equated 100% with owning fund shares. However, in practice, the transfer agent manages fund shares based on the on-chain token holding situation, so as long as there are no hacking incidents or operational accidents, token ownership in most cases indirectly equates to ownership of fund shares.

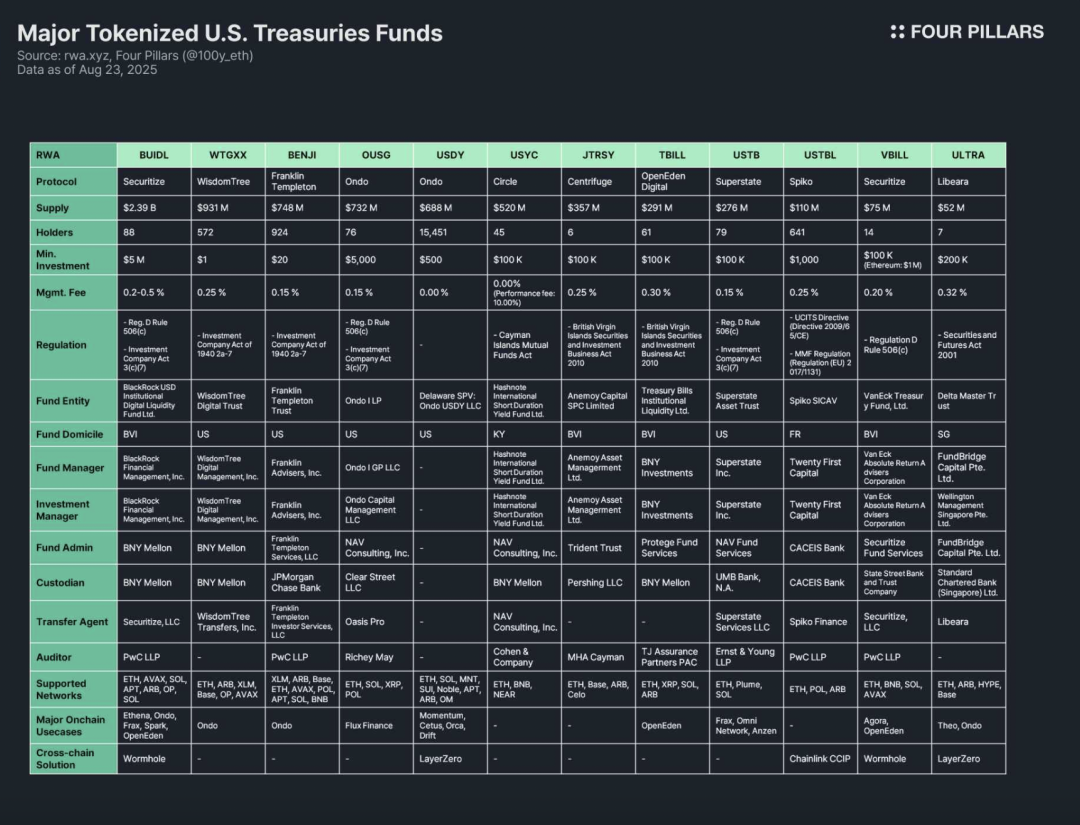

4. Major Protocols and RWA Analysis Standards

Since funds based on U.S. Treasuries are the most active sector in the RWA industry for tokenization, many tokenization protocols have issued related RWA tokens. The table above summarizes the main protocols and tokens, and the report divides its analysis into three parts.

Part One: Token Overview

This section includes an overview of the token issuance protocols, issuance scale and number of holders, minimum investment amounts, and management fees. Since each protocol varies in fund structure, tokenization methods, and on-chain application levels, starting with the token issuance protocols allows for a quick understanding of their overall characteristics.

- Issuance Scale: An important indicator for understanding the size and popularity of the fund.

- Number of Holders: Can reveal the legal structure of the fund and its on-chain application scenarios.

If the number of holders is very small, it is likely that, according to securities law requirements, investors must be high-net-worth accredited investors (accredited investor or qualified purchaser).

This also means that, aside from whitelisted wallets, the holding, transfer, or trading of tokens may be relatively restricted, and due to the limited investor base, such tokens may not be widely used in DeFi protocols.

Part Two: Regulatory Framework and Issuance Structure

This section analyzes which country's regulatory framework the underlying fund adheres to, as well as the various entities involved in fund management. Among the 12 U.S. Treasury fund-type RWA tokens analyzed, the regulatory frameworks can be broadly categorized as follows:

- Regulation D Rule 506(c) & Investment Company Act 3(c)(7)

The most commonly used regulatory framework. Rule 506(c) allows for public fundraising from unspecified investors, but all investors must be accredited investors, and the issuer must strictly verify investor identities through tax records, asset proofs, and other materials. The 3(c)(7) exemption allows private funds to avoid SEC registration, requiring all investors to be qualified purchasers while maintaining the private nature of the fund.

The combination of both can expand the investor base while effectively avoiding regulatory burdens such as registration and information disclosure. This is applicable not only to U.S. funds but also to qualifying offshore funds.

Main Funds: BUIDL, OUSG, USTB, VBILL.

- 1940 Investment Company Act 2a-7

Applicable to money market funds registered with the SEC. It requires maintaining a stable value, investing only in ultra-short-term high-credit instruments, and ensuring high liquidity. Unlike the above framework, this model allows for public issuance to ordinary investors. Therefore, the minimum investment amount for tokens is lower, making it easier for investors to participate.

Main Funds: WTGXX, BENJI.

- Cayman Islands Mutual Funds Law

Applicable to open-ended funds established in the Cayman Islands, allowing flexible issuance and redemption. Cayman funds based on U.S. Treasuries must comply with this law. The initial minimum investment amount is usually set at over $100,000.

Main Fund: USYC.

- British Virgin Islands (BVI) Securities and Investment Business Act 2010 (Professional Funds)

This is the core legal framework for all investment funds and investment companies in the BVI. Professional funds target professional investors, not the general public, with a minimum initial investment of $100,000. Notably, if a BVI fund wishes to raise funds from U.S. investors, it must also comply with U.S. Regulation D Rule 506(c); merely adhering to BVI regulations is insufficient for targeting U.S. investors.

Main Funds: JTRSY, TBILL.

- Others

Funds established in different countries follow their respective regulatory frameworks. For example, the Spiko USTBL issued in France adheres to the UCITS directive (2009/65/CE) and MMF regulations (EU 2017/1131); the Libeara ULTRA issued in Singapore follows the Securities and Futures Act 2001.

To provide a more intuitive comparison of the above content, the translator has organized the information into a table:

The fund issuance structure includes the following seven key participants:

- Fund Entity: The legal entity that pools investor funds, usually a U.S. trust or an offshore fund established in the BVI or Cayman Islands.

- Fund Manager: The entity that establishes the fund and is responsible for its overall operation.

- Investment Manager: Responsible for investment decisions and portfolio management, sometimes the same entity as the fund manager.

- Fund Admin: Responsible for accounting, net asset value calculation, investor report preparation, and other back-office tasks.

- Custodian: Safeguards the fund's assets (bonds, cash, etc.).

- Transfer Agent: Manages the shareholder register, legally records and maintains ownership of the fund or shares.

- Auditor: An independent accounting firm that conducts external audits of the fund's accounts and financial statements, a key link in protecting investor rights.

Part Three: On-Chain Application Scenarios

One of the biggest advantages of tokenizing bond funds is their potential uses within the on-chain ecosystem. Although regulatory compliance and whitelist restrictions make it difficult for bond fund tokens to be used directly in DeFi, DeFi protocols like Ethena and Ondo have already used tokens like BUIDL as collateral to issue stablecoins or included them in investment portfolios, thereby providing indirect exposure for retail users. In fact, BUIDL's ability to rapidly expand its issuance scale is largely due to its integration with mainstream DeFi protocols, making it the leading product among bond-type tokens.

Cross-chain solutions are also crucial for on-chain applications. Most bond fund tokens are issued not only on a single network but are also distributed across multiple networks, providing investors with more choices.

Although the liquidity demand for bond fund tokens is not as high as that for stablecoins (and they typically do not possess such high liquidity), cross-chain solutions remain important as they can significantly improve user experience, allowing investors to seamlessly transfer bond fund tokens across multiple networks.

5. Insights

In the upcoming RWA report, a detailed analysis of 12 major U.S. Treasury fund-type RWA tokens will be provided. Before that, some insights and limitations discovered during the research will be shared.

Challenges in On-Chain Applications: RWA tokens cannot be freely used simply because they are tokenized; they remain digital securities and must adhere to real-world regulatory frameworks. Fundamentally, all bond fund tokens can only be held, transferred, or traded between whitelisted wallets that have completed KYC. This layer of access restriction makes it nearly impossible for bond fund tokens to directly enter permissionless DeFi usage.

Limited Number of Holders: Due to regulatory thresholds, the number of holders for bond fund tokens is generally very low. Money market funds like WTGXX and BENJI, which are available for retail participation, have relatively more holders. However, most funds require investors to be accredited investors, professional investors, or high-net-worth investors, significantly limiting the potential investor base and making it difficult for the number of holders to exceed double digits.

On-Chain B2B Application Scenarios: Therefore, there are currently no bond fund tokens directly applied to retail-facing DeFi scenarios. Instead, large DeFi protocols often adopt these tokens. For example, Omni Network uses Superstate's USTB for treasury management; Ethena issues stablecoin USDtb using BUIDL as collateral, allowing retail users to benefit indirectly.

Fragmented Regulation and Lack of Standards: Bond fund tokens are issued by funds established in different countries, following vastly different regulatory frameworks. For instance, BUIDL, BENJI, TBILL, and USTBL may all appear to be bond fund tokens, but their regulatory frameworks are entirely different, leading to significant differences in investor qualifications, minimum investment amounts, and usage scenarios. This regulatory fragmentation increases investment complexity, and in the absence of unified standards, DeFi protocols find it difficult to widely adopt bond fund tokens, limiting their on-chain applications.

Lack of a Dedicated RWA Regulatory Framework: Currently, there is still no clear regulatory framework specifically for RWA. Although the transfer agents in bond fund tokens record the shareholder register on the blockchain, on-chain token ownership has not yet been legally recognized as equivalent to ownership of real-world securities. To achieve a connection between on-chain and real-world laws, dedicated regulations are needed.

Insufficient Adoption of Cross-Chain Solutions: Although almost all bond fund tokens support multi-network issuance, very few have successfully implemented cross-chain solutions. In the future, broader applications of cross-chain solutions are needed to avoid liquidity fragmentation and improve user experience.

This article is for learning and reference purposes only. It is hoped to be helpful to you and does not constitute any investment advice. DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。