On September 24, just a week after the Federal Reserve's first interest rate cut in 2025, Chairman Powell spoke publicly again, conveying a complex and nuanced signal. He warned that the U.S. labor market is showing signs of weakness, the economic outlook is under pressure, while inflation remains above 2%. This "dual risk" puts policymakers in a difficult position, and he stated, "There is no risk-free path to take."

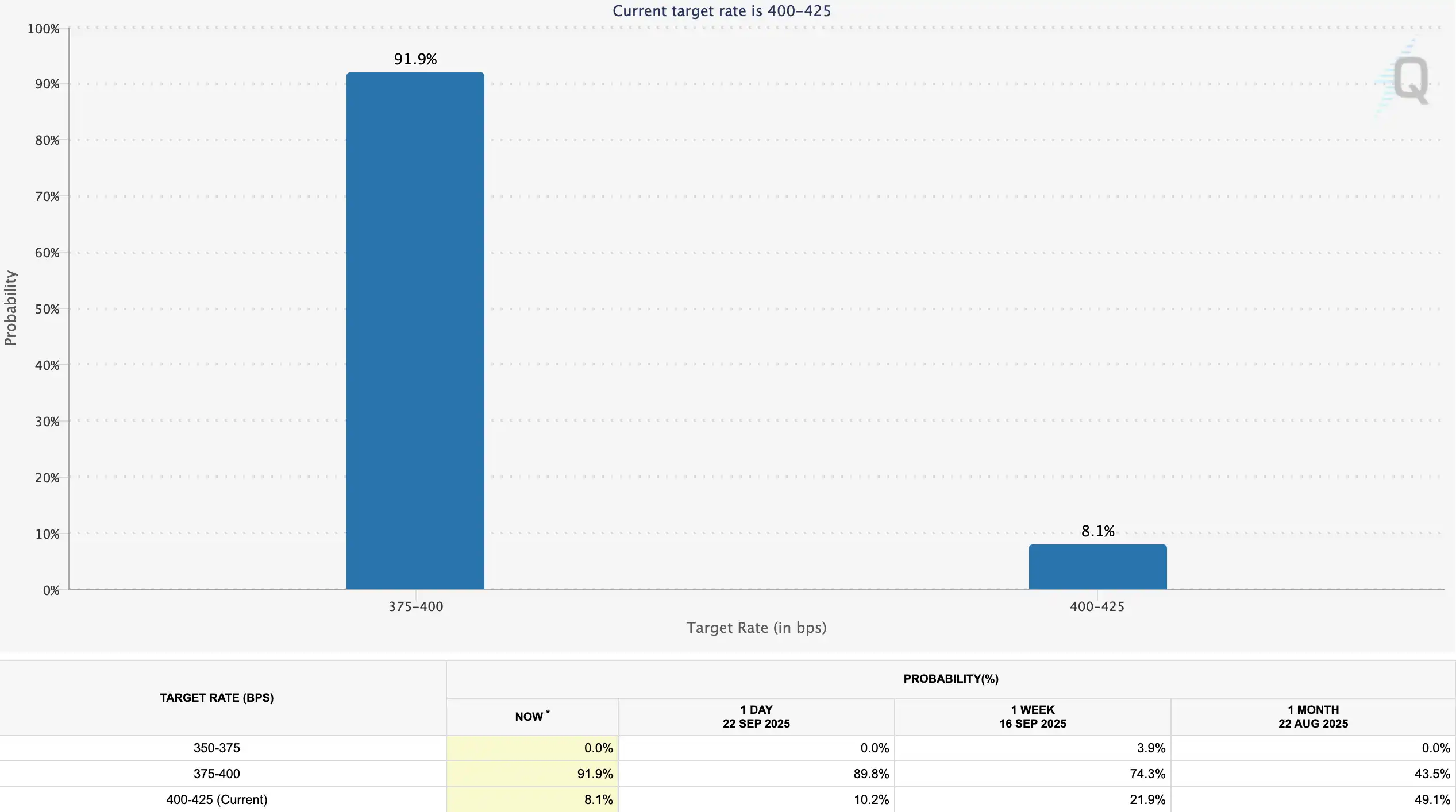

Powell also commented that stock market valuations are quite high, but emphasized that this is "not a time of rising financial risks." Regarding the interest rate meeting in October, Powell indicated that there is no preset policy path. The market interpreted this speech as having a "dovish tendency": after the speech, the probability of a rate cut in October rose from 89.8% to 91.9%, with the market essentially betting on three rate cuts occurring this year.

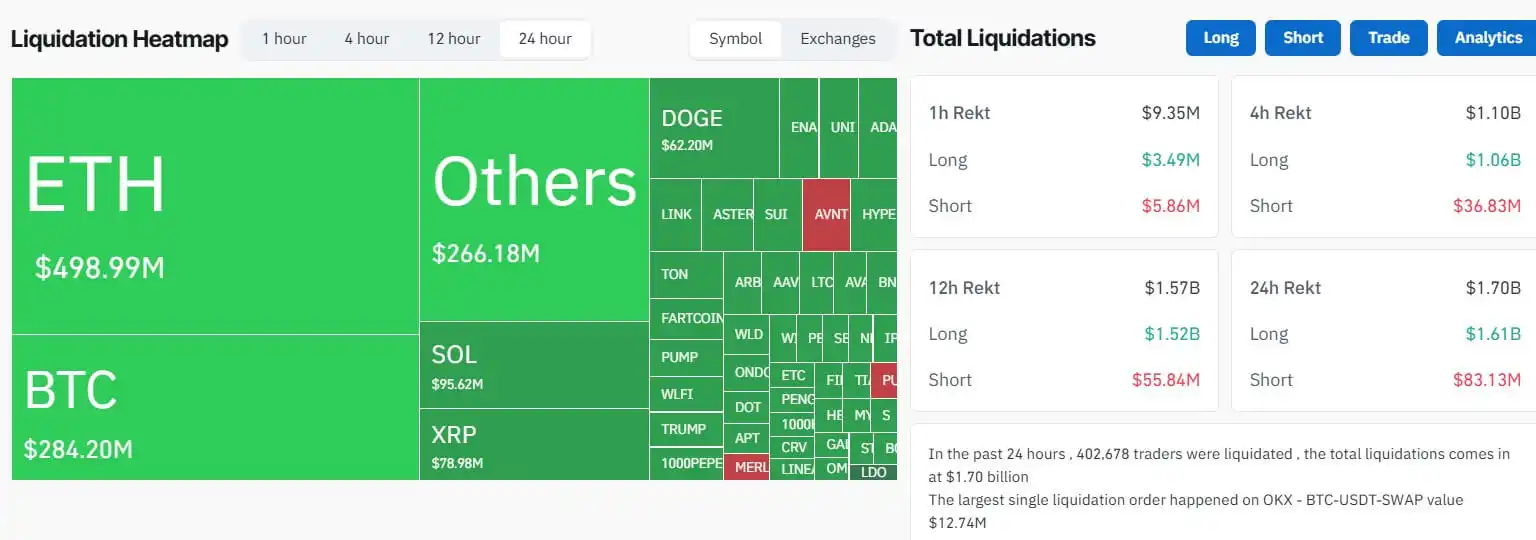

Driven by expectations of easing, U.S. stocks have repeatedly hit new highs, while the cryptocurrency market has shown a starkly different picture. On September 22, the cryptocurrency market saw a liquidation amount of up to $1.7 billion in a single day, marking the largest liquidation scale since December 2024. Subsequently, Rhythm BlockBeats compiled traders' views on the upcoming market situation to provide some directional reference for trading this week.

@0xENAS

Trader Doves believe that various signs indicate the cryptocurrency market is gradually weakening.

When I re-entered the market after a two-week break, I coincided with the largest liquidation pullback of the year. As a result, those "liquidation buy orders" that historically have an 80% chance of leading to a rebound continued to decline this time—this misalignment is a very clear danger signal. The 20% failure scenario often means that there are no sufficient marginal buyers left in the market, and no one is willing to take the baton for a rebound.

I suspect that we will increasingly detach from the correlation logic with U.S. stocks and other "risk assets," beginning to lose several key support levels. My observation points are: BTC breaking the $100,000 structure, ETH falling below $3,400, and SOL dropping below $160.

@MetricsVentures

We believe that the global asset bubble cycle has likely entered a warming phase, and starting it seems to be just a matter of time. This bubble cycle occurs against the backdrop of unemployment and social division under the impact of AI, supported by the global fiscal-led economic cycle and political economic ecology, accelerating as the polarization of the world becomes clearer, with the two major countries jointly expecting to export inflation to resolve internal contradictions. It is expected to enter the public discussion arena in the coming months.

Looking ahead, apart from the digital currency market, which has not seen significant fluctuations for nearly a year and is a potential huge winner, the global cyclical mineral and AI derivative investment chains will continue to create excess returns. In terms of coin stocks, the successful combination of ETH's coin stock will lead to a series of imitations, and it is expected that the combination of strong large-cap coins and strong stocks will become the most eye-catching segment in the coming months.

As competitive advantage countries begin to consider setting up investment accounts for newborns, further relaxing investment restrictions on pensions, and elevating capital markets, which have historically served as financing channels, to new heights, the bubble of financial assets has become a highly probable event.

We are also pleased to see the dollar market beginning to welcome the native volatility of digital currencies and providing ample liquidity pricing for it, which was unimaginable two years ago, just as the success of MSTR was a financial magic we could not predict two years ago.

In short, we are clearly optimistic about the digital currency market in the next six months, the global mineral and pro-cyclical markets in the next 1-2 years, and the AI derivative industry chain. At this moment, economic data is no longer that important, as many in the crypto circle jokingly say, "Economic data is always good news." In the face of the roaring historical train, embracing the bubble in line with the trend may have become the most important topic for our generation.

@Murphychen888

According to the "three-line convergence" trend, after October 30 this year, mvrv will enter a long-term oscillating downward trend, completely aligning with BTC's past four-year cycle timing.

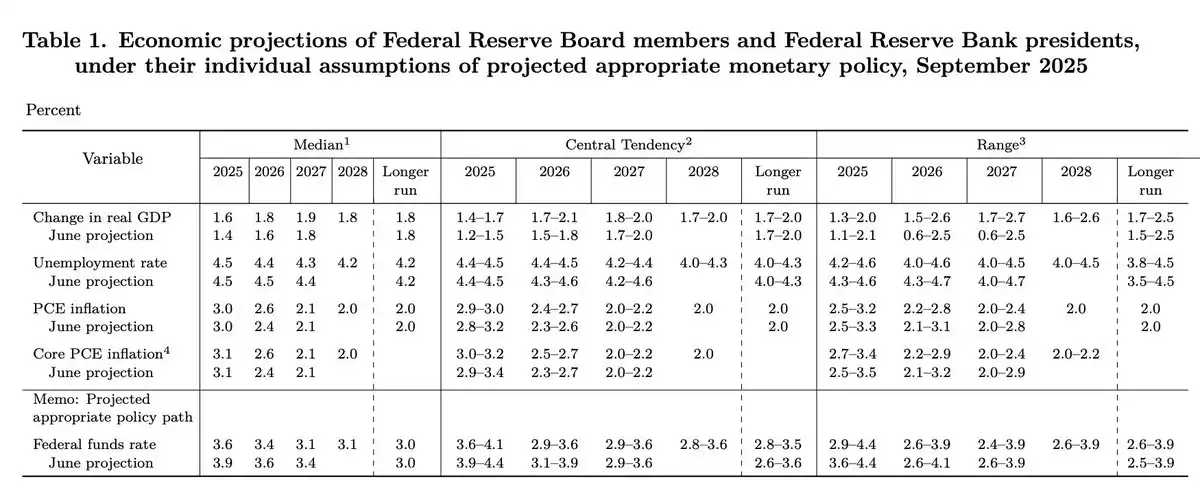

However, according to this macro expectation data, the overall signal conveyed is "soft landing + inflation retreat + gradual easing of monetary policy."

Although the future is unknown, if this is indeed the case, then the four-year cycle theory may really be broken, and Bitcoin may enter an "eternal bull market."

@qinbafrank

The logic behind the U.S. stock market outperforming coins in a large-scale wide fluctuation is that the market as a whole is still subtly worried about the future trend of inflation. The strength of the U.S. stock market lies in its strong fundamentals and the acceleration of AI, allowing it to withstand concerns about inflation and continue to surge. The issue with coins is that they rely on funds and expectations for momentum, and macro concerns will affect the flow of external funds.

Currently, the deep-seated issue in the coin market is that traditional funds entering as buyers are based on ETF and listed company purchases, while ancient whales and trend investors are taking profits as sellers. The market's price fluctuations, ups and downs, are largely driven by the competition between these two forces. In the short term, the strength or weakness of the economy, inflation trends, and interest rate expectations will all affect the speed of fund inflows from buyers, with good expectations accelerating inflows and poor expectations halting inflows or even leading to outflows.

As the Fed returns to cutting rates, but inflation is still slowly rising, the market naturally worries that future rate cuts may be interrupted by inflation again. In this case, the inflow of buyer funds will be affected, as can be seen from the changes in ETF net inflow scale. Meanwhile, the core mainline of the U.S. stock market, AI penetration rate, is about to reach 10%. Once it surpasses this threshold, it will enter a golden period of rapid penetration increase, as it has been said that AI is accelerating to be accelerated. From this perspective, the strength and weakness are naturally reflected.

The subsequent market trend needs to reference macroeconomic data:

1) Best case: The pace and magnitude of rising inflation are below expectations, which is favorable for both coins and U.S. stocks.

2) Moderate case: The pace of inflation aligns with expectations, which is more favorable for U.S. stocks due to their stronger fundamentals, while coins are relatively good but likely to experience large-scale wide fluctuations.

3) Worst case: A significant inflation surprise occurs in the future, leading to a correction in both the U.S. stock and coin markets, with U.S. stocks possibly experiencing a small correction and the coin market a medium correction.

@WeissCrypto

The impact of the Fed's rate cuts on liquidity will not inject into the cryptocurrency market until mid-December. Its model indicates that sideways fluctuations may continue for 30 to 60 days, with a significant bottom possibly appearing around October 17. Notably, Weiss Crypto recently predicted a peak around September 20.

@joao_wedson

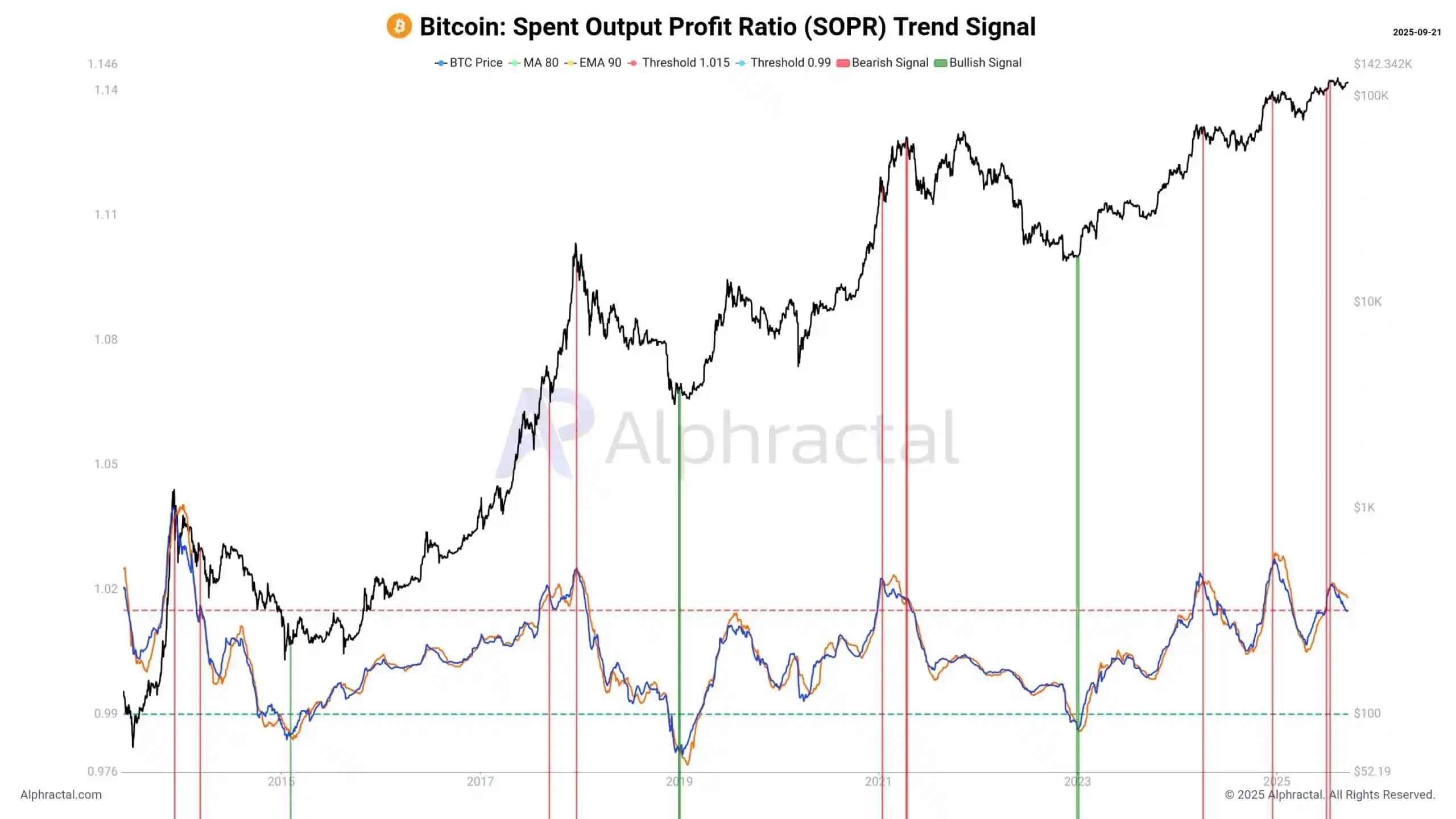

Joao Wedson, founder of the blockchain analysis platform Alphractal, stated that Bitcoin is showing clear signs of cyclical exhaustion. He pointed out that the SOPR trend signal, which tracks on-chain realized profitability, indicates that investors are buying at historically high levels, while profit margins are shrinking. The actual price for short-term holders of Bitcoin is currently $111,400, which institutional investors should have reached earlier. He also noted that the Sharpe ratio for Bitcoin, used to measure risk and return, has weakened compared to 2024.

He suggested, "Those who bought BTC at the end of 2022 are satisfied with a +600% return, but those accumulating in 2025 should reconsider their strategies," while market makers tend to sell BTC and buy altcoins, which are expected to perform better in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。