Author: Darshan Gandhi, Polaris Fund

Translation: White55, Mars Finance

In-depth exploration of centralized exchanges (CEX) and their token burn: mechanisms, frequency, and other aspects.

The buyback and burn operations of exchanges are not new.

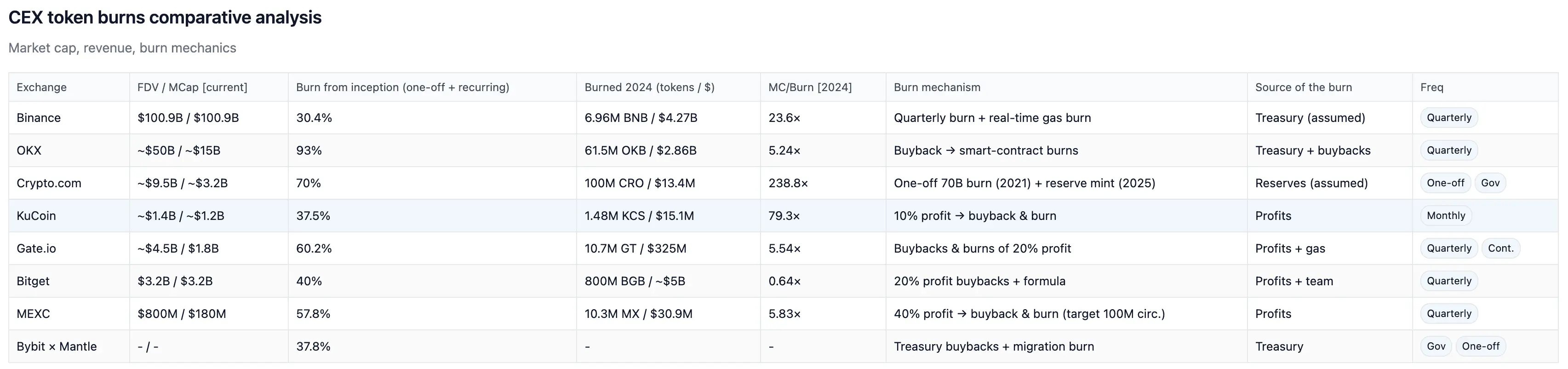

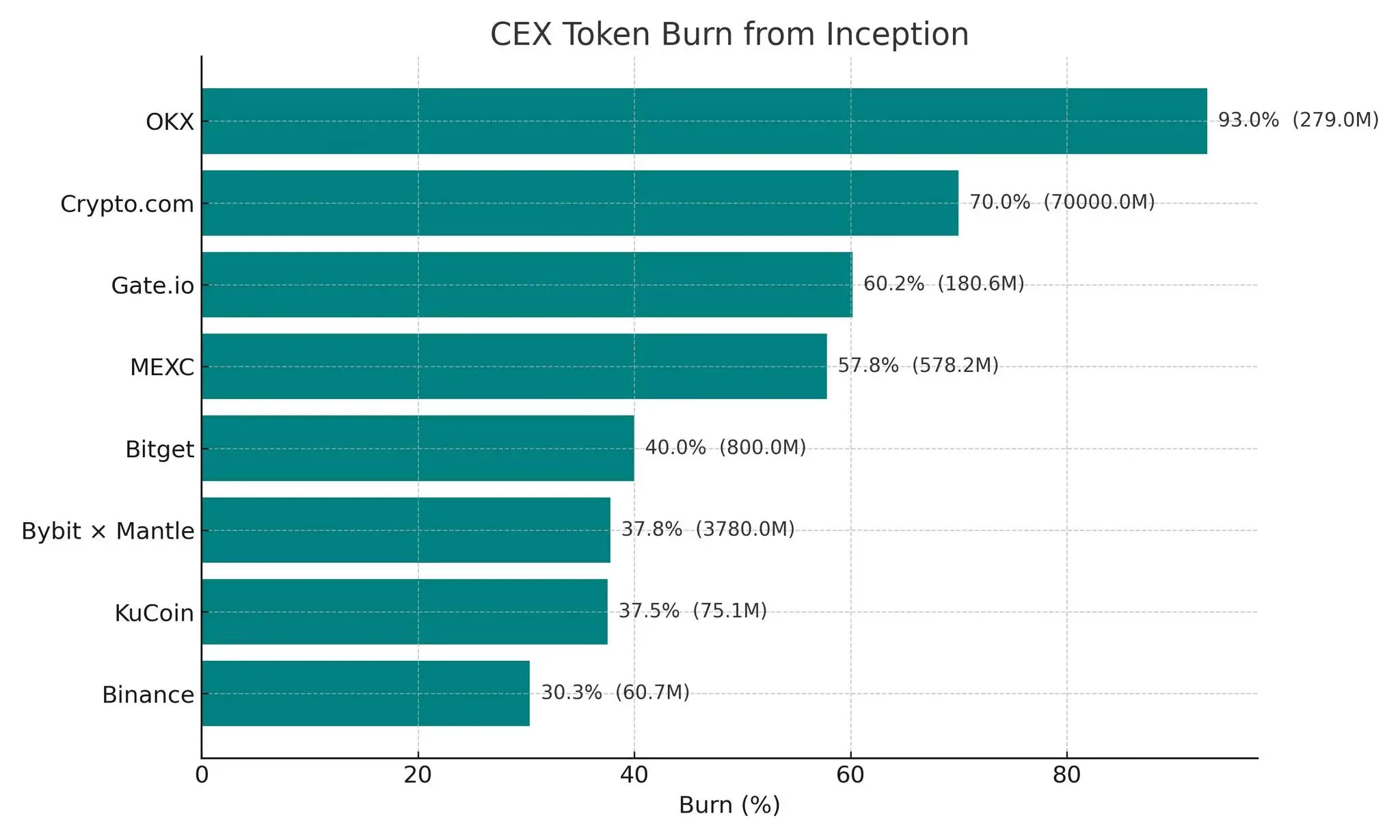

These actions have been quietly taking place for years, subtly shaping the supply-demand landscape long before attracting mainstream attention. Almost every major centralized exchange (CEX), including Binance ($BNB), OKX ($OKB), Gate ($GT), KuCoin ($KCS), and MEXC ($MX), has implemented some form of burn program for over five years.

Today, the presentation of these token burns has changed.

Hyperliquid ($HYPE) places token buybacks at the core of its token strategy, rather than hiding them in the fine print. It transforms the burn mechanism from a background function into a prominent feature. More importantly, Hyperliquid treats the burn as part of financial management, operating continuously and transparently, setting a new benchmark for transparency.

This positioning makes the burn mechanism appear fresh, even though established exchanges like Binance, OKX, Gate, KuCoin, and MEXC have been doing similar things for years. The difference is that established exchanges have never marketed it as aggressively or integrated the burn mechanism so closely into their financial operations (the reasons will be analyzed in detail later).

The burn mechanism is essentially a means of value transfer, demonstrating the following points:

- How exchanges link token supply to their business models

- What levers drive scarcity (profits, formulas, or governance)

- How credibility is built or lost over time

Additionally, the burn mechanism acts as an inflation control tool, stabilizing supply by offsetting token unlocks or issuances.

The question today is no longer whether burns will occur, but whether the execution of burns is sufficiently consistent and whether the model can provide transparency to token holders.

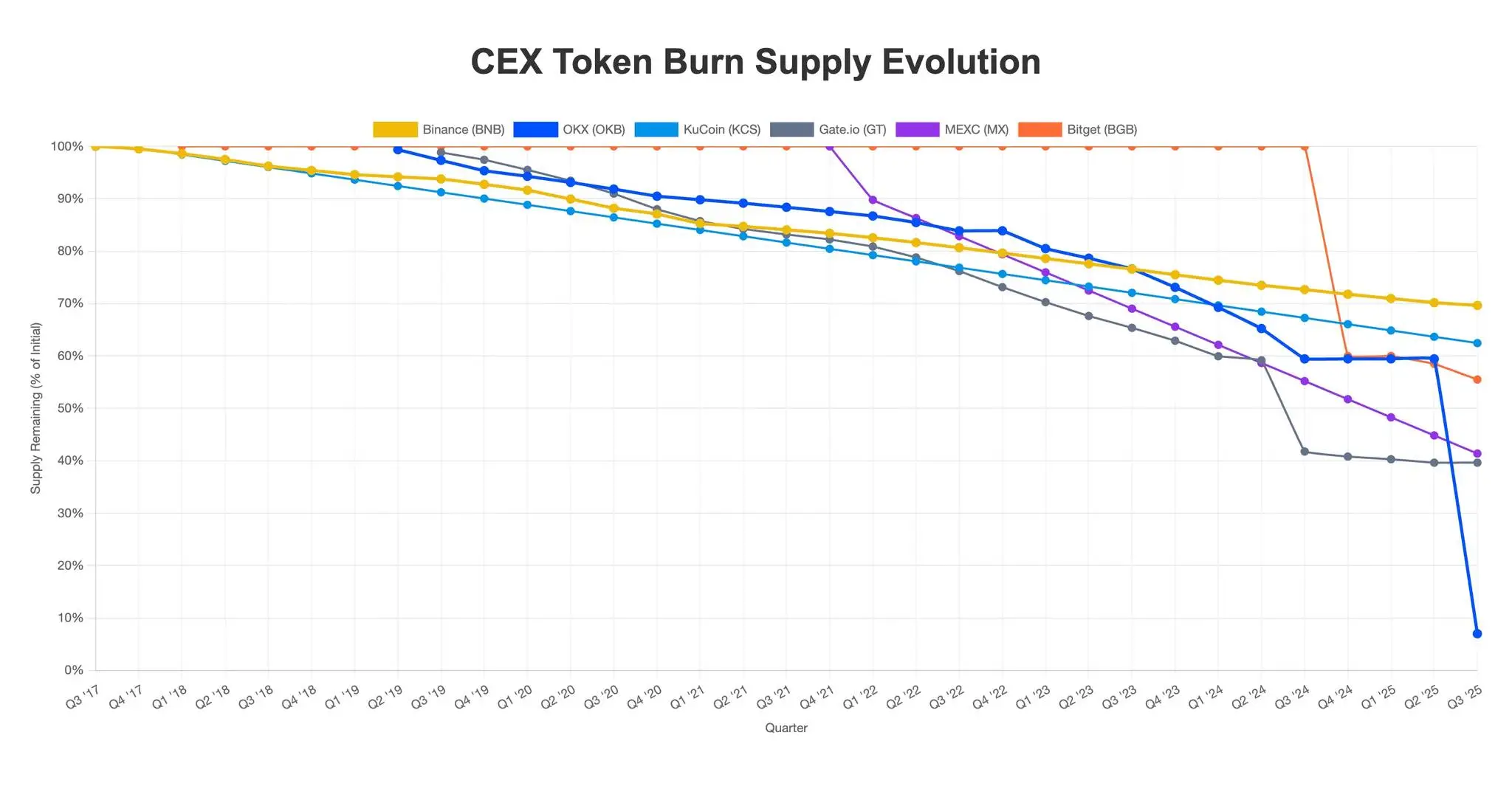

To clearly see this shift, here is a breakdown of how the dynamics of exchange token supply have changed.

Key Point: When analyzing exchange tokens, the burn model is crucial. Designs based on profits, formula-driven, or governance control will have distinctly different impacts on scarcity, predictability, and trust.

Burn Models: Operational Patterns of Exchanges

Exchange burn programs can be primarily categorized into three types:

- Profit or revenue-linked (Gate, KuCoin, MEXC): A fixed percentage of profits is used to buy and burn tokens. Cadence is predictable and auditable.

- Formula or fund-driven (Binance, OKX, Bitget): Supply reductions are determined by formulas or fund allocations. Larger in scale but less correlated with business health.

- Governance-driven (Bybit, HTX): The pace of burns is determined by token holder votes. This model decentralizes control but introduces political and execution risks.

Burn programs are also continuously evolving. For example, Binance transitioned from a profit-linked burn mechanism to a price and block count-based burn mechanism, later adding the BEP-95 gas fee burn mechanism. Binance once abruptly changed its burn rate as proof of BNB's non-securitization. From a regulatory perspective, this de-profiting burn reduces the risk of securities classification, but the constantly changing mechanism leaves the market feeling uncertain.

Additionally, other CEXs have updated their dynamics, such as:

KuCoin adjusting its burn pace to monthly for transparency.

Gate maintaining a stable 20% profit distribution since 2019.

Due to the fixed maximum supply of tokens, burns are not common. When they do occur, they are valuable as they can reduce circulating supply and accelerate the process of complete supply compression.

Key Point: The burn model determines persistence. Profit-linked = stable and auditable. Formula-driven = scalable but opaque. Governance-driven = decentralized but harder to trust. Sudden model shifts (e.g., Binance) can create structural risks, while increased transparency (e.g., KuCoin) can build trust.

Regulatory Perspective

The burn model is not only about economics but also involves regulatory positioning.

In traditional stock markets, corporate buybacks have been controversial, with the U.S. Securities and Exchange Commission (SEC) raising concerns about:

- Market manipulation

- Conflicts of interest

- Weak information disclosure standards

Token burns are equivalent to buybacks in cryptocurrency, but they lack legal protection. This gap changes the way models are designed.

- Profit-linked burns resemble buybacks the most. Since they directly tie token value to profits, they attract closer regulatory scrutiny.

- Formula-driven burn mechanisms (e.g., Binance's automatic burn, OKX's supply cap) are easier to defend. They can be described as mechanical, unrelated to income, and less likely to trigger securities classification.

- Governance-driven burns introduce political factors. Regulators may view community voting as insufficient to prevent manipulation.

Key Point: Burn design is part of token economics and also part of legal defense. Decoupling burns from profits reduces regulatory risk but also decreases transparency for token holders.

Trends in Exchange Models

The following three model trends are particularly notable:

1. Scale and Opacity

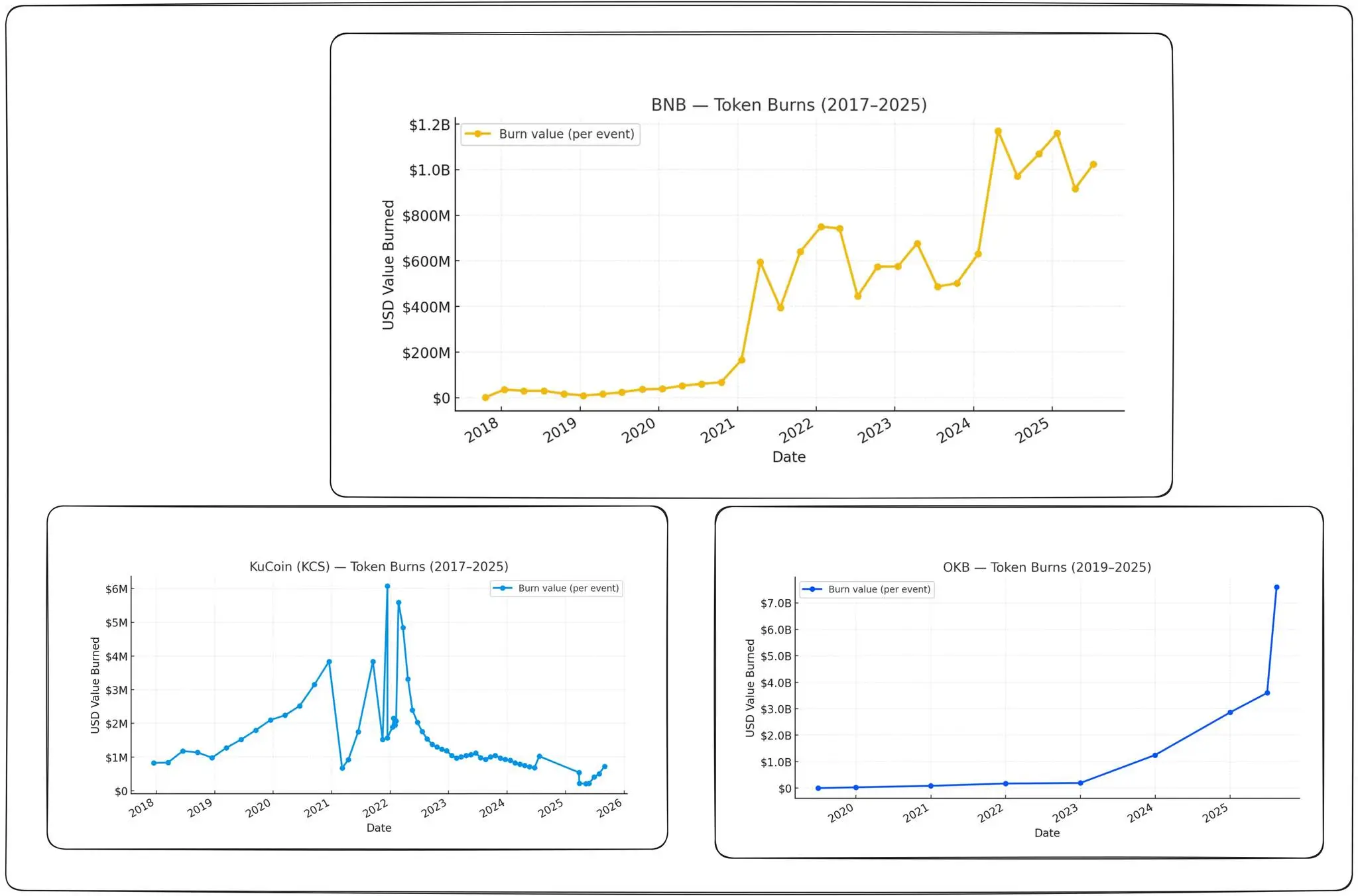

- Binance has the largest burn scale (approximately $1 billion per quarter), but the rules are constantly changing.

- OKX eventually set a supply cap of 21 million after years of pacing.

Key Point: Scale attracts attention, but changing rules and delayed cap settings weaken transparency.

2. Stable Profit-linked Cadence

- Gate: Fixed 20% profit distribution since 2019, having burned about 60% of the supply.

- MEXC: 40% profit distribution, having burned about 57%.

- KuCoin: Changed to monthly burns in 2022, but the scale of burns will shrink with increased profitability (10% of profits).

Key Point: Profit-linked models are the easiest to predict. The less capital consumed, the worse the business health.

3. New Entrants and Governance Risks

- Bitget: Plans to burn $5 billion by December 2024, currently burning about 30 million tokens per quarter, aiming to burn 95%.

- Mantle: Burned 98.6% of BIT during migration; now relies on DAO.

Key Point: Marketing does help, but only verified cadence can enhance persistence.

Burn Cadence, Scale, and Quality

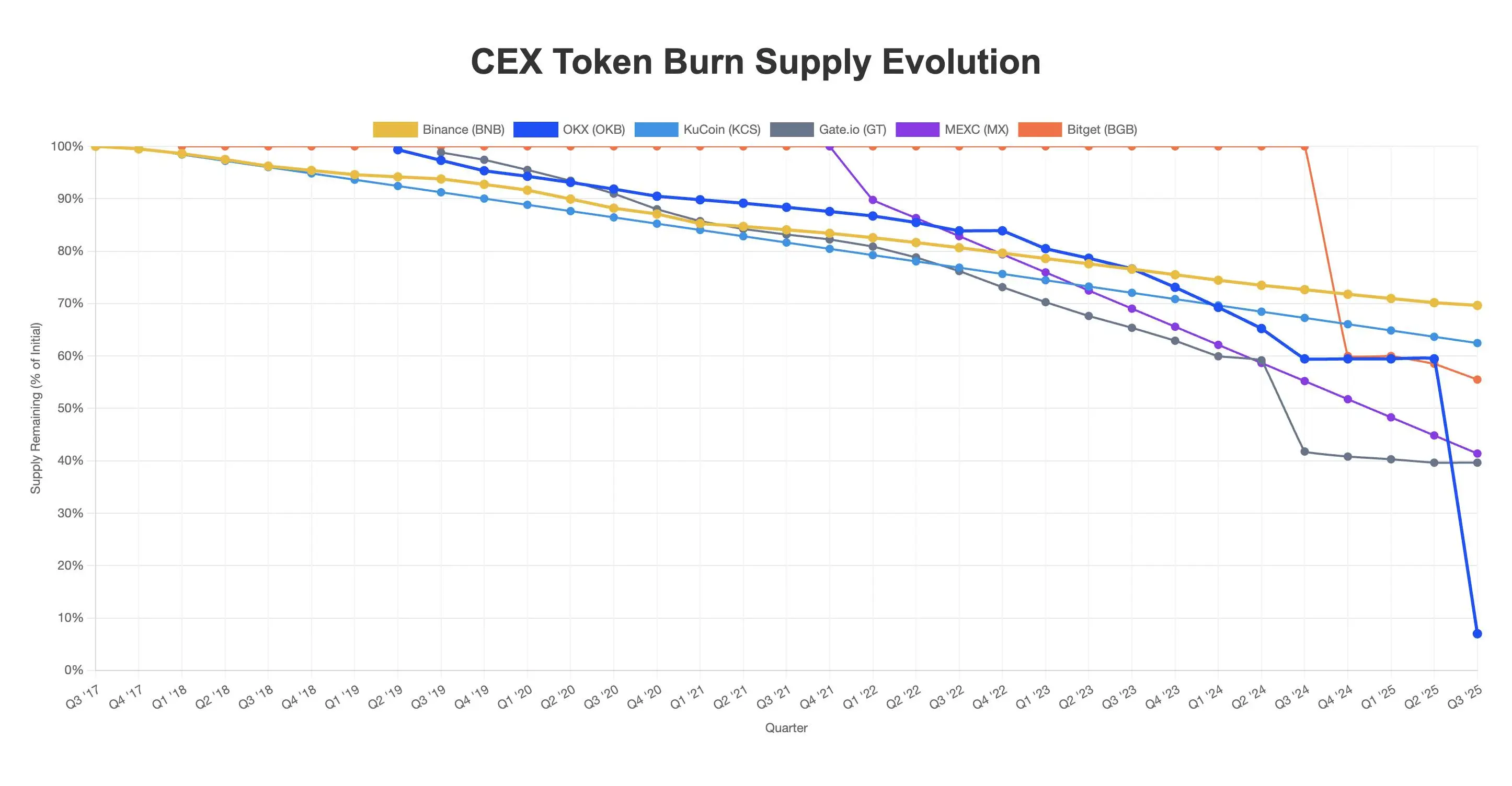

The extent of supply reductions varies from about 30% for Binance to about 93% for OKX. However, the market prices not just the percentage but also the sustainability of the burn scale and the predictability of the cadence.

- Gate, KuCoin, and MEXC: Stable profit-linked burns → build trust

- Binance: Largest scale → obscured by constant formula adjustments

- OKX: Enhanced confidence through a massive $7.6 billion burn → supported by years of consistency

- Bitget: $5 billion burn → first event not yet verified, needs to be observed for future developments

- Crypto.com: Revoked 2021 burn in 2025 → led to reduced trust

Note: The large-scale burn in August 2025 coincided with a significant rise in OKB, indicating that one-time supply events can sometimes drive recent price movements.

Key Point: Don’t just track the number of burns; ask: Is the scale repeatable? Is the cadence linked to profits? Is governance stable? Focus on the dollar scale of quarterly/annual burns. Massive burns = credibility indicator, not a guarantee.

Our Overall View

- Consistency is more important than scale: The market tends to reward repeatability rather than just making headlines.

- Profit-linked models are best: They tie token value to the health of the exchange and are easy to assess (transparent).

- Massive burns are just markers: Without follow-up actions, they will gradually become superficial.

Currently, buybacks remain an important marketing cost.

Interestingly, centralized exchanges actually choose to reinvest profits into their own tokens rather than retaining earnings in cash or USDC. This practice concentrates treasury value in the tokens themselves while amplifying both gains and risks.

Ultimately, as we have attempted to articulate throughout this report, true innovation lies not in the burn itself but in the sustainability and transparency of the burn. Hyperliquid undoubtedly redefines the burn as a visible, cyclical financial management function. This effectively reshapes the expectations of the entire industry: today, merely having scarcity is not enough. Regular, clear, and economically consistent scarcity is the truly valuable direction for all exchanges. This shift may pose significant challenges for those CEXs that are slow to act.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。