Master Discusses Hot Topics:

It is said that every year in October and November, historically, the market tends to rise, but don't think for a second that this means a bull market is restarting. In reality, from October to December, it is highly likely to be a transition from bullish to bearish.

In simple terms, there are two possibilities: if interest rates are raised on October 30, then the market will basically declare an end. After November 5, it will be a bear market welcoming guests, and by the end of October, one should prepare to short in advance, as it is expected to drop at least until mid to late December, waiting for that wave of funds to come in before Christmas.

If the interest rates are delayed until December 19, then November will become a transitional month, unable to rise, and hitting a high point would be fatal, leading to direct shorts. History shows that every year around mid-November, once the peak is touched, it immediately turns down. The safest bet is to exit the market two weeks ahead of time.

So don’t be greedy, and if you don’t clear your spot positions in advance, the time cost alone could drag you down. Once the expectation of an interest rate hike rises next month, it’s time to exit in batches.

Returning to the market, Bitcoin has broken through 114k on a smaller scale, which means the correction from 118k is officially over. The market is likely to enter a phase of consolidation. However, to restore bullish momentum, it must first reach 118k, which has only a 40% chance.

If it stays between 118k and 108.6k, then it will still be in a consolidation phase, with a 60% chance over the next week, and it will be hopeless two weeks later. I have never fantasized about a major bull returning; if it doesn’t surpass 118k, actively going long is not worth it. Short-term trading is fine, but I won’t touch it for the long term.

Last night’s rebound brought Bitcoin back above the mid-line, but unfortunately, the channel is still descending. In the short term, the probability of it consolidating around 114k is greater. The upper resistance at 117k is a major supply zone; as long as 114k holds for two days, it’s not impossible to test 117k.

But remember, if the price rises too quickly, it’s a standard trap for bulls, and bears will come in with a hammer. A slow grind upwards is what truly benefits the bulls.

As for contract liquidity, the short-term rebound target is at 115k, and we are still a breath away from fully liquidating the shorts. There is a gap between 115k and 117k; if 114k can hold for 24 hours, that gap may be slowly filled, and the price could attempt to reach 117.5k.

However, if the price cannot hold today and instead makes a hard push only to pull back, then the latter half of the week will definitely see a drop. Don’t be foolishly optimistic expecting a spike to bring in a bull market; many are likely looking to short on this rebound. So I suggest if it hasn’t dropped by tonight, it’s best to exit.

On the Ethereum side, it’s even weaker; last night’s rebound wasn’t as strong as Bitcoin. Although it barely reversed the decline during the day, it is still below the MA120 and MA200 on the 4-hour chart, with no breakthrough. If the key resistance at 4350 cannot be overcome, then don’t expect a turnaround.

Support is at 4100 and 4000, with the real strong support at 3880. The market is currently divided into two camps: one side says this is a rebound and shorts directly, while the other side claims the bull is back and altcoins are about to take off. I’ll share my view: Ethereum is still in a correction phase, and that hasn’t changed.

However, going all in on the left side during a rebound is purely self-destructive. In trading, don’t go head-to-head with the market; while the momentum of a rise or fall hasn’t diminished, left-side positions are a heart attack waiting to happen, even if the direction is right, you can’t hold the position. Right-side entries may have slightly worse points, but the defense is clear, and the trend is more evident.

Master Looks at Trends:

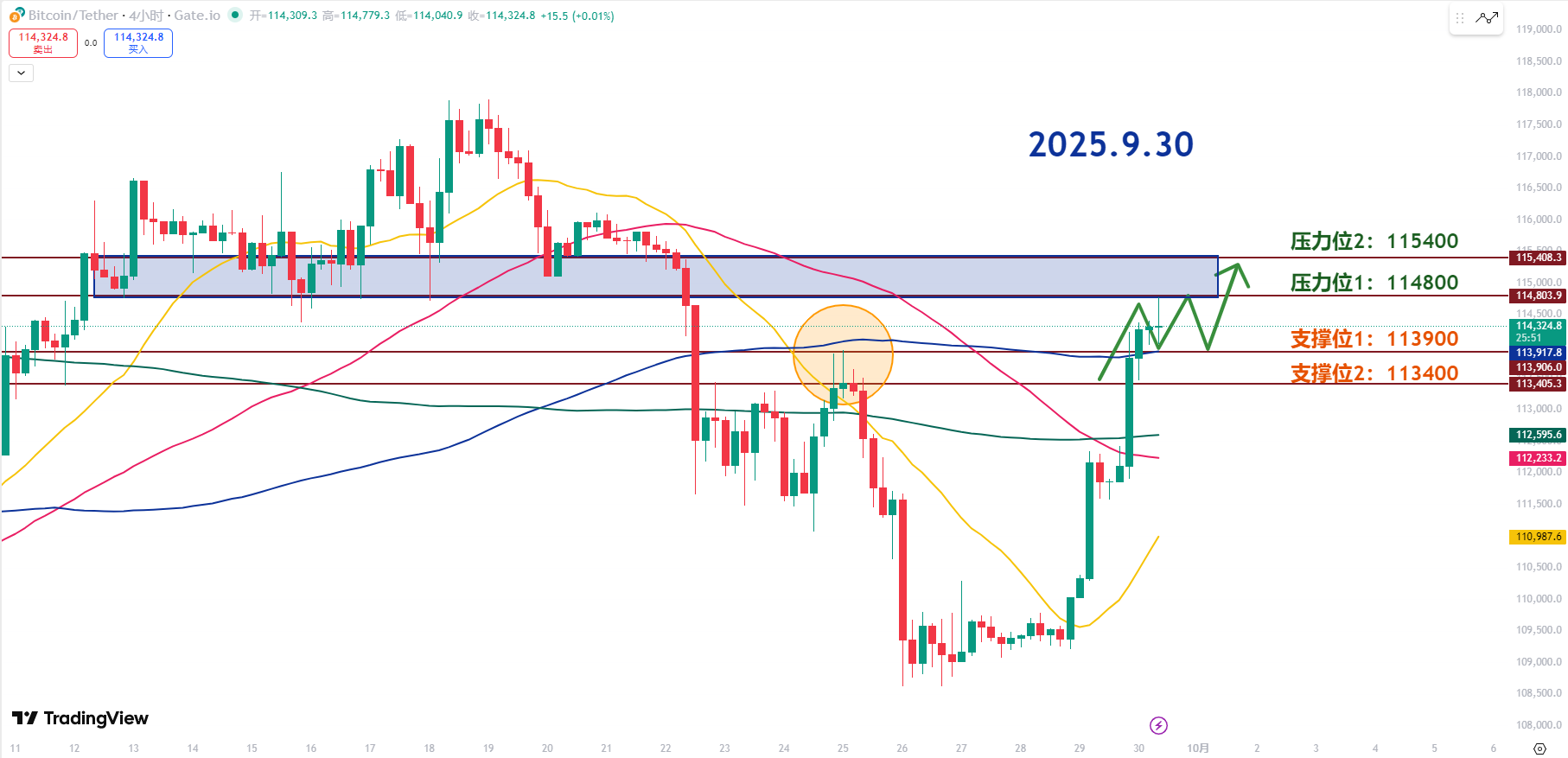

Resistance Level Reference:

Second Resistance Level: 115400

First Resistance Level: 114800

Support Level Reference:

First Support Level: 113900

Second Support Level: 113400

Yesterday, Bitcoin had a strong rebound, pushing up to 114K. The short-term trend has stabilized again, and now the market needs to hold the key support line and push up again.

As long as the range of 113.9K to 114K is maintained, the short-term bullish logic remains intact. 113.4K was previously a high, and now it has turned into strong support, plus it coincides with the support logic of the 120-day moving average, so holding here has a high probability of continuing the rebound.

The first resistance at 114.8K is where the upper shadow line from yesterday’s high is. If it can hold around the 120MA in the short term, this point could be hit again.

115.4K is a more critical resistance area; whether it can break through depends on whether there is volume to support it. If the volume breaks through together, it will be a healthy upward trend. If it cannot break through, it will grind above, moving sideways and slowly lowering the points, which would be considered true strength.

113.9K is currently the most important first support, coinciding with the 120-day moving average; holding it can still be seen as a low-buy opportunity. 113.4K is the breakout point of the previous high, and yesterday’s rebound relied on this support.

If it drops below, there will definitely be disappointed positions exiting in the short term, which could lead to a wave of selling. So if 113.4K is lost, wait for a pullback to find an entry opportunity.

The RSI indicator has entered the overbought zone, and there may be a slight pullback in the short term; this kind of pullback after a rise is actually a good opportunity. In simple terms, wait for it to pull back before entering, don’t blindly chase after it.

9.30 Master’s Wave Strategy:

Long Entry Reference: Not currently applicable

Short Entry Reference: 103400-103900 range, enter in batches, target: 114800-115400

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize shorts, making it seem like they "always catch the top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。