Author: Zen, PANews

On October 1, at the TOKEN2049 event in Singapore, Tom Lee, co-founder and CIO of Fundstrat, chairman of BitMine, and Wall Street strategist, took the main stage at OKX to deliver a keynote speech titled "The Biggest Macro Shift on Wall Street Since the Gold Standard."

In recent months, he has made headlines with a series of bold predictions: Bitcoin is expected to surge to the $200,000 range driven by a loosening cycle and seasonal factors in the fourth quarter, while Ethereum's year-end target is set at $10,000 to $15,000, earning him the title of "Ethereum's first 'chorus singer.'"

In this speech, he attempted to explain why Wall Street, AI, and blockchain will converge into a "new inflection point" through a narrative extending from 1971 to 2025.

New Inflection Point in Wall Street Narrative: 2025 as the Next Structural Moment

Lee began with a "level set." He stated that he and his team have been systematically studying crypto assets for nine years, during which Bitcoin was around $963. Nine years later, Bitcoin has "evolved" as an asset class, with cumulative returns exceeding 100 times. In the same period, Nvidia has seen about 65 times returns, and gold has roughly tripled—while he believes Ethereum's long-term gains have "outperformed Bitcoin."

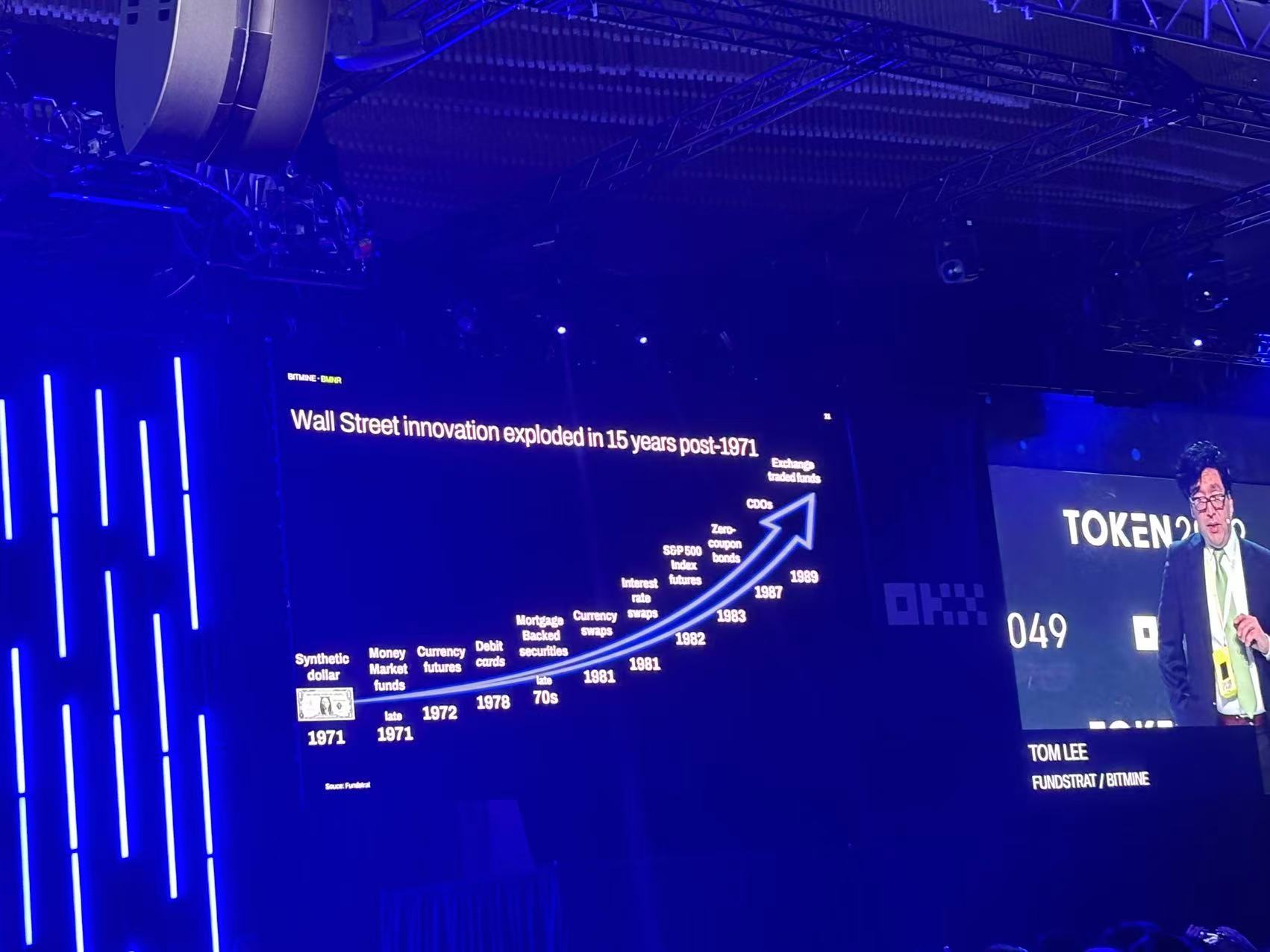

From this "relative return curve," he quickly shifted the focus back to 1971: when Nixon announced the end of the dollar's convertibility to gold, marking the farewell to the gold standard. After that, the real opportunity was not just to "go long on gold," but rather the wave of financial engineering that Wall Street initiated to maintain the dollar's dominance—creating a whole suite of tools such as money market funds, futures, debit cards, currency and interest rate swaps, index futures, and zero-coupon bonds. The financial industry thus grew stronger, and today a significant portion of the top 30 companies by market capitalization globally are financial institutions.

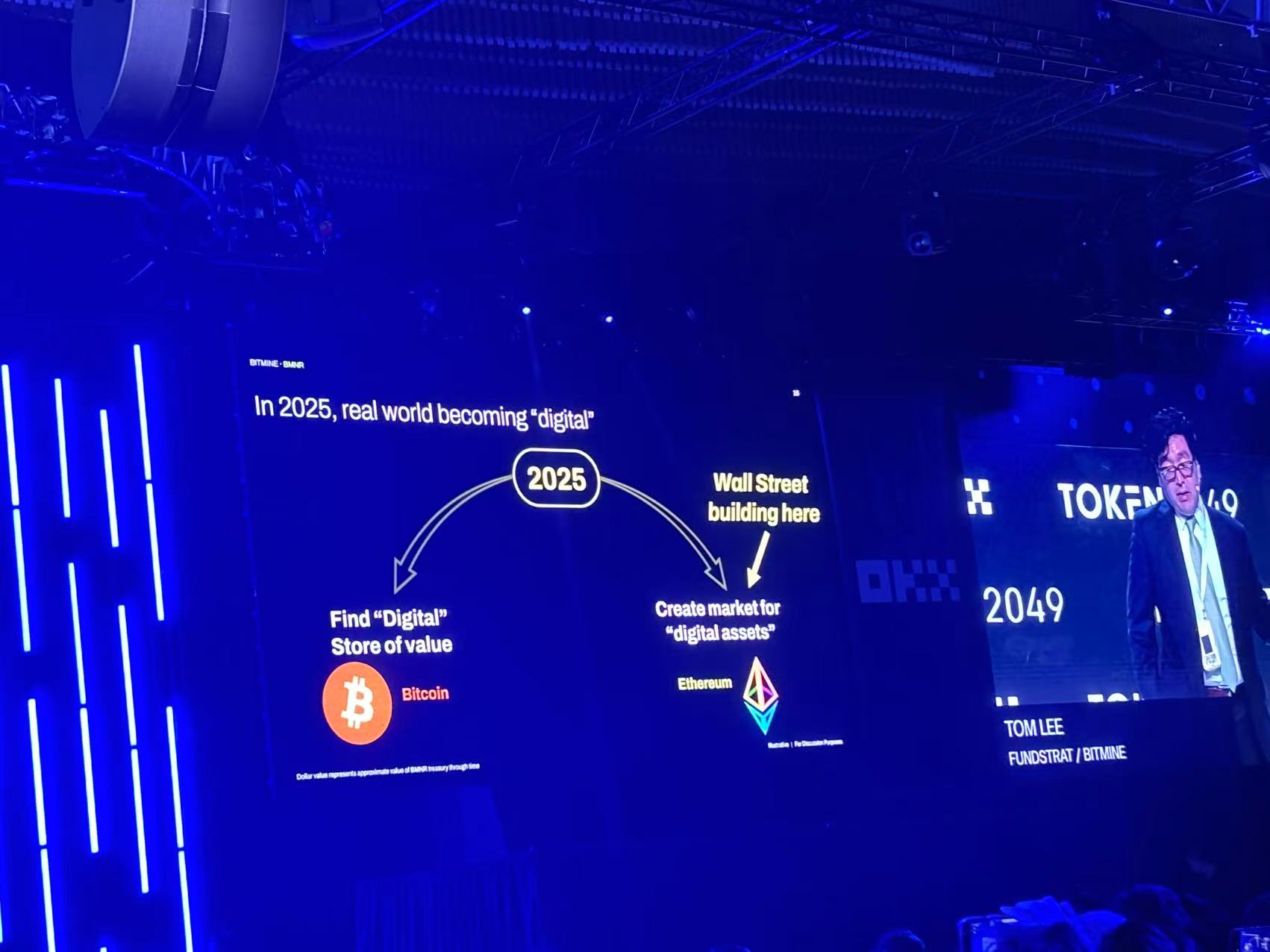

Lee proposed his core judgment: 2025 will see a structural moment similar to that of 1971.

On the "new 1971 path" he outlined, the key variables are "Wall Street × AI × Blockchain." He believes that the U.S. regulatory and legislative landscape has laid several "foundations"—including the GENIUS Act, which establishes a framework for stablecoins, the SEC's "Project Crypto," and the "Bitcoin Strategic Reserve Act," among other topics.

They all point to the same thing: using financial engineering to "synthesize" desired returns and turning real assets into tokens that can circulate on the blockchain. In this regard, Bitcoin remains the "OG" level digital store of value, but from the perspective of the "other side of the ledger," Wall Street will deeply engage and create a vast market for digital assets, with Ethereum being the biggest beneficiary.

Compared to Gold, Bitcoin's Market Value Still Has Room to Rise

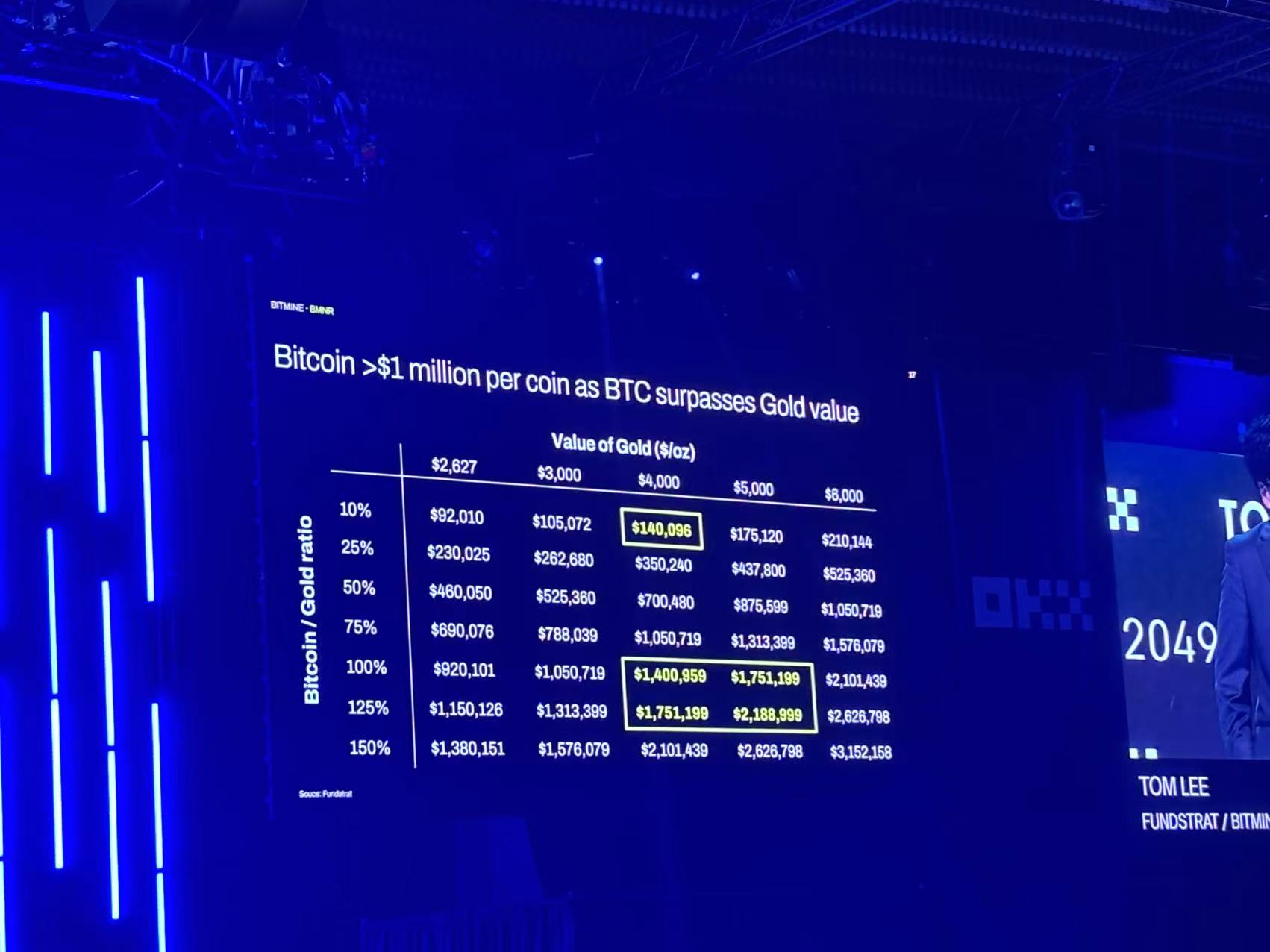

Regarding asset pricing, he first provided a reference framework for Bitcoin: if gold reaches $4,000 (or even $5,000) per ounce. If Bitcoin's network value is compared to gold at just 10%, the target price for Bitcoin would be around $140,000. However, he believes this ratio is too low; if it matches or even surpasses gold, the corresponding range would be $1.4 million to $2.2 million per coin. Based on this, he remains bullish on Bitcoin, currently around $110,000.

However, the main thread he emphasized is "how tokenization starts from stablecoins and covers all measurable elements in the economy." In his list, stablecoins are the starting point for "tokenizing the dollar," which will then extend to stocks, credit, real estate, reputation, and intellectual property; even more "invisible" metrics will be brought on-chain and monetized—data collection, royalty distribution, membership and loyalty, Agent AI, and "Proof of Human."

Why is the U.S. government concerned about stablecoins? Lee's answer echoes the "dollar maintenance war" after 1971: the dollar accounts for about 27% of global GDP but 57% of central bank foreign exchange reserves, and its share in financial market transactions is as high as 88%, while stablecoins are almost 100% dollar-denominated.

Today, the circulation of stablecoins is about $280 billion, and some in the Treasury Department believe it could grow to $4 trillion; once the stablecoin ecosystem collectively holds over $1 trillion in U.S. Treasury bonds, it could even become "the largest holder of U.S. debt globally." Meanwhile, companies that "restructure their business on-chain" will gain actual benefits from improved settlement and process efficiency, which is also the business motivation for tokenization.

He then reinforced the feasibility of "rebuilding Wall Street on-chain" with a comparison of "native chain company profitability": taking Tether, the issuer of stablecoins, as an example, he noted that its financing valuation reached $500 billion with about 150 employees, translating to a "per capita corresponding market value" far exceeding traditional large banks; while JPMorgan, with a market value of $869 billion and 317,000 employees, has a "market value per employee" significantly lower than Tether's.

From this, Lee concluded: native companies built on public chains demonstrate strong capital efficiency and profit elasticity.

The Biggest Beneficiary of Transformation: Institutional Preference for Ethereum

Returning to what he identifies as the "biggest winner": Ethereum. Lee's logic is that Wall Street wants to build businesses on a "neutral public chain," and in reality, more and more institutions are choosing Ethereum; he mentioned that Ethereum's current TVL (Total Value Locked) accounts for about 68%, and over several cycles, TVL has supported Ethereum's valuation like a "floor"; he also noted that SWIFT recently announced it would conduct migration trials on Ethereum's second layer.

In terms of price structure, he views Ethereum as having undergone an extended consolidation since 2018: reaching a peak in 2021, followed by four years of horizontal fluctuations, and is now attempting to break upward. In relative price terms, ETH/BTC is currently around 0.036, with a long-term average of about 0.047 and a 2021 peak of 0.087. "2025 is Ethereum's '1971 moment'," he stated, suggesting that a ratio returning to at least 0.087 is not far-fetched.

In scenario analysis, he applied the aforementioned ratio to the assumption of "Bitcoin reaching $250,000 by year-end": if it returns to the long-term average of 0.0479, Ethereum would be about $12,030; if it returns to the 2021 peak of 0.087, it would be about $22,000; if Ethereum becomes the primary payment/settlement rail and its network value equals that of Bitcoin, it would correspond to about $62,000.

"This is not the ceiling," he added, "overall, we are more optimistic about Ethereum."

To substantiate the investment thesis of "going long on Ethereum," Lee turned to the capital market strategy of "digital asset treasury companies": using MicroStrategy as a model, since it began "issuing shares to increase Bitcoin holdings" five years ago, Bitcoin's price has increased about tenfold (from around $11,000 to about $108,000), while MSTR's stock price has risen about 25 times, significantly outperforming the underlying asset.

Multi-Chain Landscape, Solana and Others Still Have a Big Stage

Following this line of thought, he elaborated on the practices of BitMine (also referred to as Bitline), where he serves as chairman: claiming to be the second-largest treasury company holding Ethereum globally, with a financing speed faster than MSTR and ample liquidity, having increased "Ethereum held per share" by about nine times over the past nine weeks. In his vision, such treasury companies are not just "holding assets," but also crypto infrastructure companies: providing network security services through staking, generating revenue, and promoting cross-border "Wall Street—crypto" through ecological investments.

During the Q&A session, the first questioner asked whether only one chain would ultimately survive and if Solana and others still have a chance. Lee responded that there is no need to fall into the "single-chain destiny"; the infrastructure and market organization of the real world are inherently diverse, and so is the blockchain.

With a global GDP of $80 trillion, about half of which is already financial transactions, and adding elements like royalties on-chain, on-chain economic activities could potentially expand to a scale of $100 trillion. If all of this were to be concentrated on Ethereum, "then Ethereum's price would reach an incredible height," and clearly, the market would leave enough space for other layer networks with expertise, and Solana and others still have a big stage. "Don't be too tribalistic," he emphasized, "the pie is big enough."

How Can DATs Survive the Bear Market?

The second question focused on "how bear markets allow digital asset treasury companies to survive." Lee provided two disciplines: first, maintain a clean balance sheet, avoid debt, and complex capital structures, using ample cash as a buffer to weather downturns; second, continuously increase "Ethereum held per share."

Even if a winter arrives 12 months later, as long as the company accumulates intrinsic value per share day by day during this period, then even if the stock price retreats 50% in a bear market, it may not be lower than today. This method of "continuously increasing core assets based on equity capital" is, in his view, the fundamental means to combat cycles.

At the end, Lee once again drew the timeline back to the metaphor at the beginning: in 2025, it resembles a new 1971. Bitcoin plays the role of a reserve and value anchor, while Ethereum will become the main stage for innovation and tokenization; Wall Street will "redo finance" on public chains.

This is both his macro judgment and the betting direction he provides as "Ethereum's first 'chorus singer'."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。