USDe isn’t a cash-in-the-bank stablecoin; it’s a crypto-native dollar built on Ethereum and a handful of other chains, flexing a delta-neutral hedge to keep its peg locked. The protocol holds crypto collateral and shorts perps in equal size, so gains and losses cancel out, leaving a U.S. dollar-like asset with yield options for depositors.

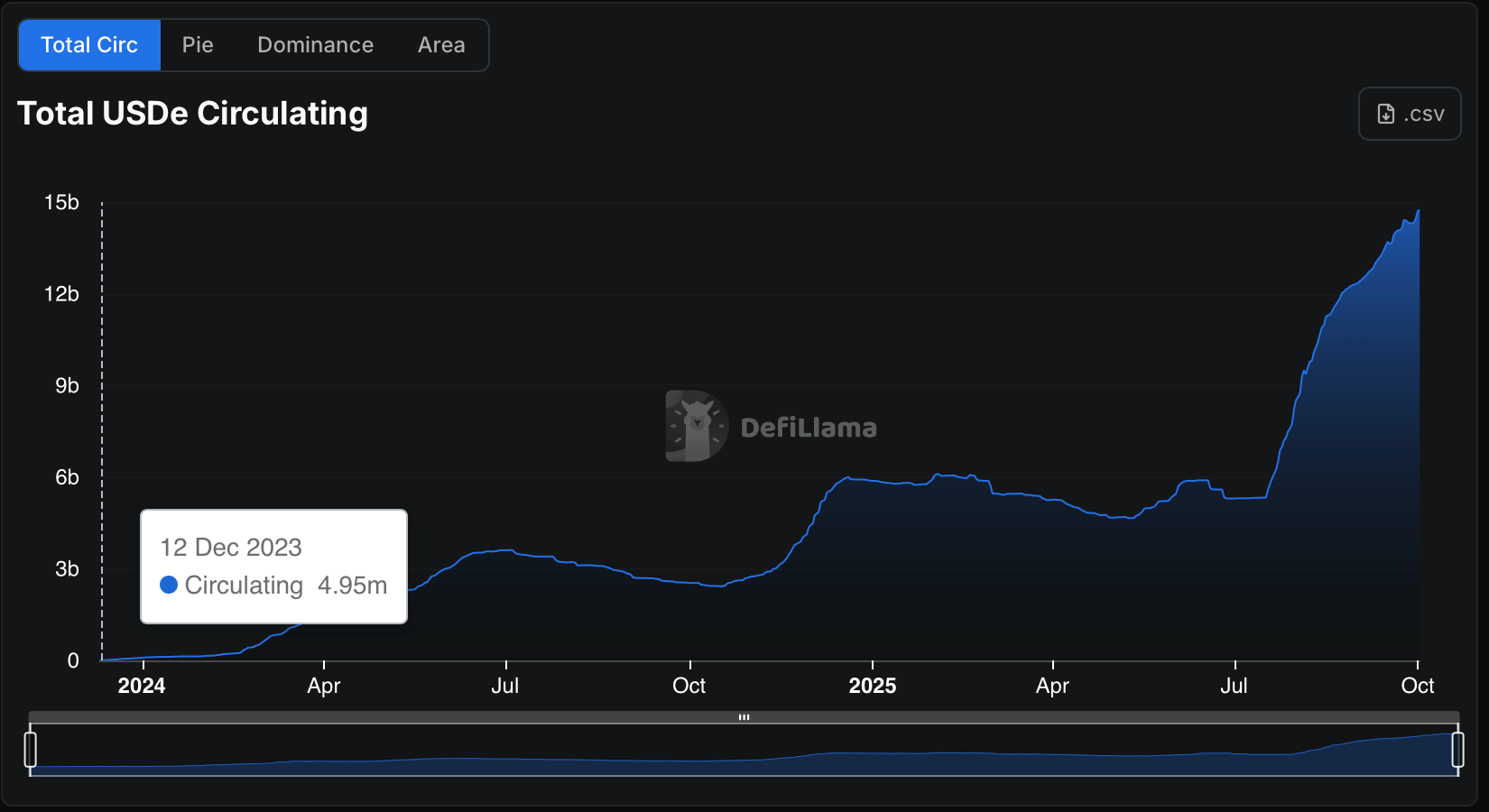

The growth curve is obvious from defillama.com visuals: total USDe outstanding is hovering around $14.755 billion, creeping toward that $15 billion line. Price sits at $1, as advertised, while issuance has scaled sharply since late 2023. On Dec. 12, 2023, USDe’s supply was under the $5 million mark. As of Oct. 2, 2025, USDe is the third-largest fiat-pegged token amid a $299.447 billion stablecoin sector.

During the course of 659 days, USDe’s circulating count grew by 297,878%.

Trading activity looks anything but sleepy, according to figures recorded on Dune. Cumulative buying volume tallies about $31.55 billion across venues, with Entropy Advisors’ dashboard tallying 24 supported decentralized exchange (DEX) platforms. Monthly action tells the story of adoption.

After a quiet start, liquidity and buyers broadened through winter and spring before a late-summer jump. The bars stack higher; the users follow.

Pairs matter, and USDe has them. The recorded decentralized finance (DeFi) metrics show deep activity in USDC-USDe, FRAX-USDe, and crvUSD-USDe, plus pockets in DAI-USDe and cmETH-USDe. Breadth like that gives traders places to park size and move risk.

The network split is still dominated by USDe issued on Ethereum, with smaller slices on Arbitrum, Base, Mantle, Optimism, and Solana. Call it pragmatic multichain rather than chain-hopping for headlines.

Liquidity is building where it counts. USDe DEX liquidity clocks in around $194.4 million across pools, and 16 pools clear the $100,000 threshold. That’s enough depth for market makers to quote without sweating every clip.

Why does the design matter? Because Ethena‘s USDe hedge converts crypto volatility into a stable dollar profile while harvesting staking rewards and funding-rate carry for stakers. It’s a decidedly crypto approach to stability, not a promise of treasuries in a vault.

None of this erases risk. The model leans on derivatives markets and exchange rails, and regulators are still mapping rules for synthetic dollars. But with transparent mechanics and onchain usage, the market is voting with capital.

If the current pace holds, USDe’s march past $15 billion becomes a formality, and the real question turns to whether crypto’s next big dollar will keep compounding across DEX rails as the rest of decentralized finance (DeFi) wakes up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。