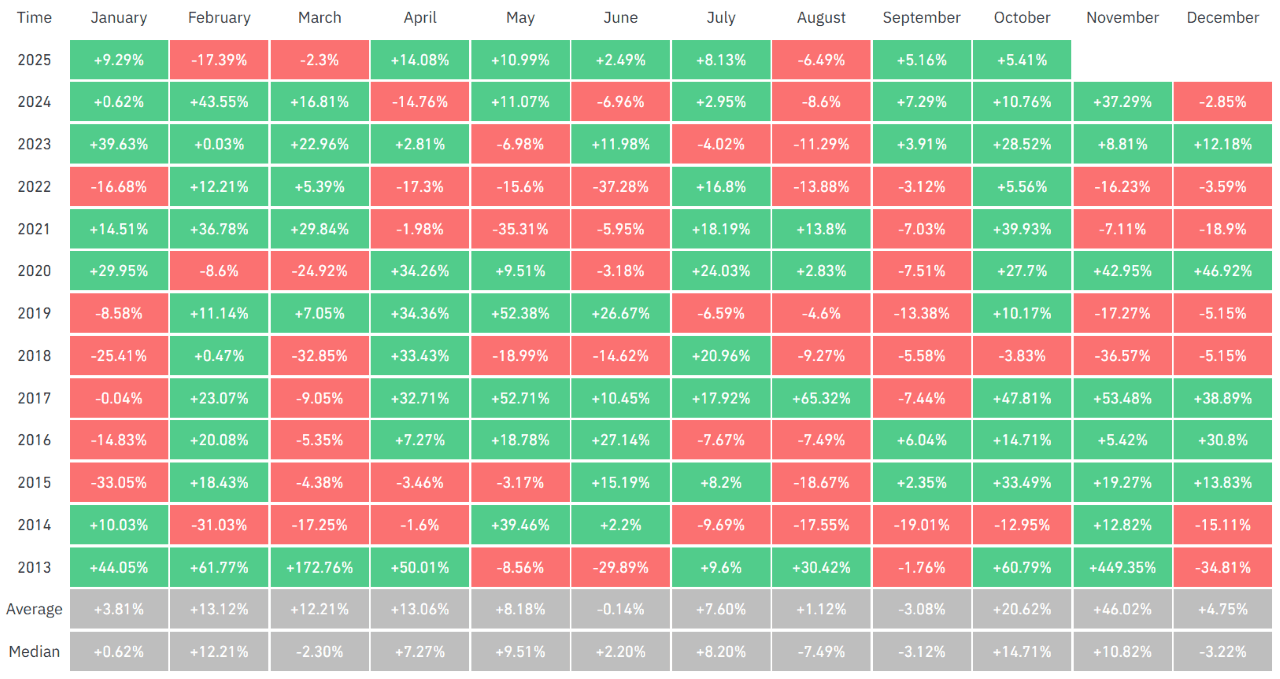

October is the month when bitcoin bulls run, at least that’s what performance data from Coinglass shows. For the past twelve years, bitcoin has printed a positive return every October except in 2014 and 2018. And even though it’s only the second day of the month, the cryptocurrency has already recorded a 5.41% monthly return after rallying for the past couple of days.

(The month of October boasts bitcoin’s highest median return and has almost always performed better than any other month for the past 12 years, according to Coinglass data. / Coinglass)

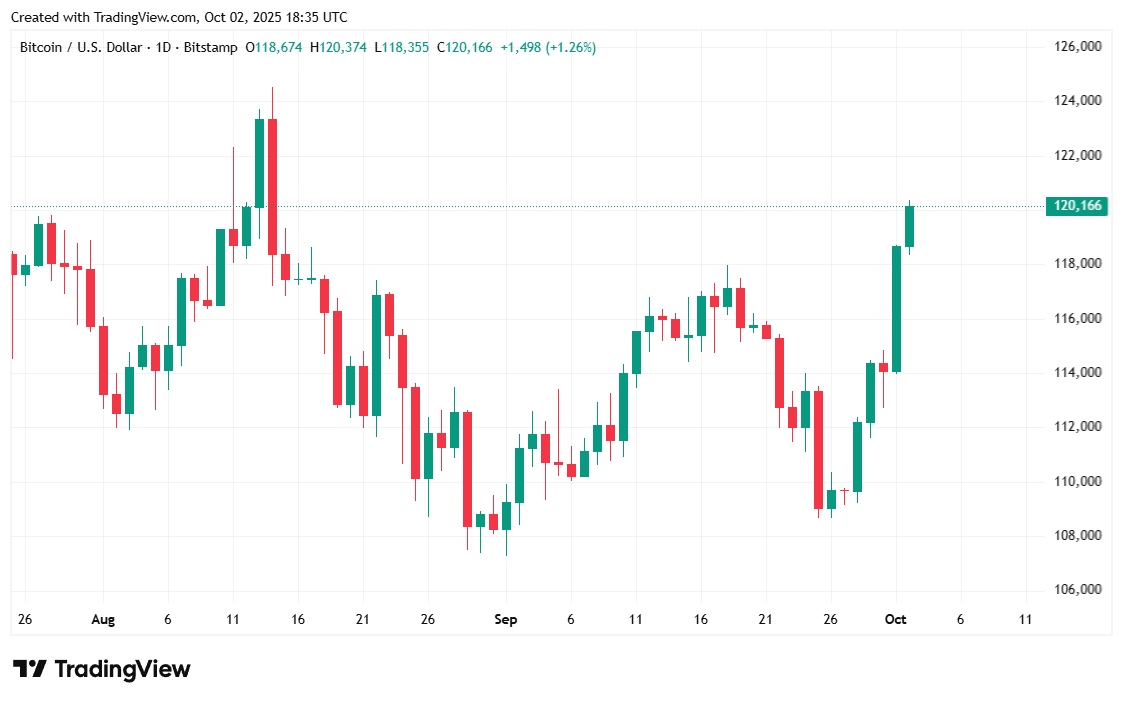

A government shutdown that started at midnight on Wednesday didn’t deter traders; in fact, it appeared to only embolden them. Both bitcoin and stocks shot up after Senate Republicans and Democrats reached an impasse over temporary funding for the federal government. Even a surprise drop in private sector employment was viewed less as a bearish signal and more as a reason for the Fed to continue cutting interest rates for the remainder of the year. Subsequently, both stocks and bitcoin jumped.

And now, the monthly trend continues to hold true. The S&P 500, Nasdaq, and Dow are all up 0.16%, 0.42%, and 0.29% respectively, and bitcoin has gained 2.55% over 24 hours. The so-called “Uptober” phenomenon seems to be living up to the hype.

Bitcoin was priced at $120,128.94 at the time of writing, up 2.55% since yesterday and also up 9.7% for the week, according to data from Coinmarketcap. The cryptocurrency has traded between $117,235.26 and $120,324.11 since yesterday.

( BTC price / Trading View)

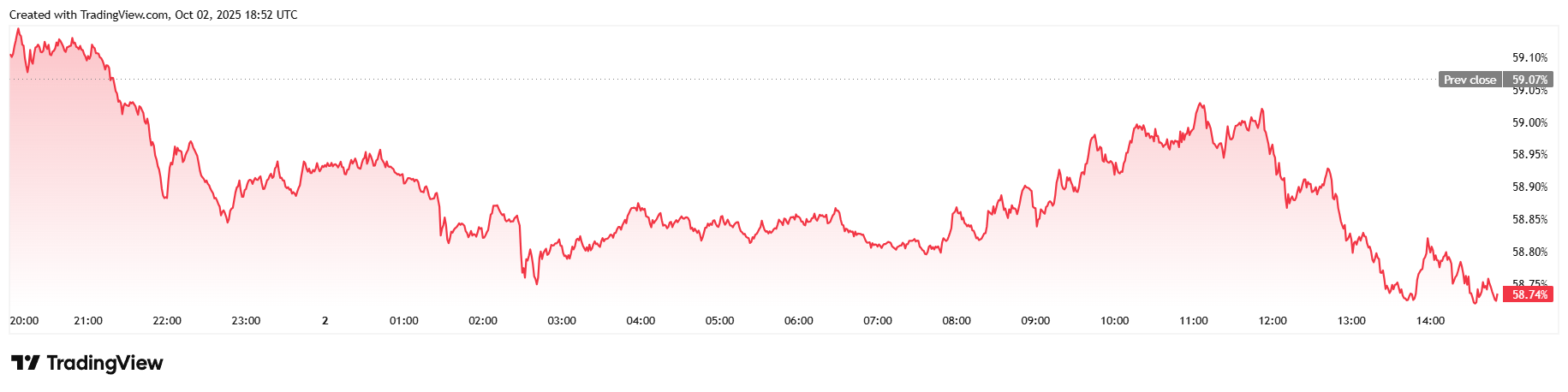

Twenty-four-hour trading volume dipped 4.88% to $67.82 billion at the time of reporting. Market capitalization climbed 2.54% to $2.39 trillion, matching the 24-hour price increase. Bitcoin dominance dipped 0.52% to 58.74%, hinting at concurrent rallies in the altcoin market.

( BTC dominance / Trading View)

Total bitcoin futures open interest rose 3.59% over 24 hours to $88.40 billion, according to data from Coinglass. Bitcoin liquidations stood at $134.70 million since yesterday, dominated by short sellers who bet in the wrong direction and lost $117.17 million. Overzealous bulls who went long racked up a smaller $17.53 million portion of the overall liquidations figure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。