By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin (BTC) may be entering a decisive phase as macro and crypto-specific forces converge.

With the U.S. government shutdown and traditional market indicators like employment reports delayed, traders are leaning into alternative assets, especially bitcoin and gold. BTC climbed to $120,000 after rallying 9% this week, while gold rose 2.9% to touch $3,900.

The shutdown has furloughed over 90% of SEC staff and left the CFTC with a skeleton crew. Reacting to the shutdown markets rallied, as investors see the Federal Reserve lowering interest rates by 25 bps later this month as a near certainty over an unexpected drop in U.S. private payrolls and a delay in other key economic data.

“Traders have lacked immediate catalysts, evidenced by subdued commitment following the FOMC meeting, even as gold and equities have posted strong gains. However, the broader trend remains higher as we move into a rate-cutting cycle,” Jake Ostrovskis, Head of OTC Trading at Wintermute, told CoinDesk.

Lower interest rates make risk assets like cryptocurrencies more attractive, and that’s coming in a month where sentiment is high given historical performance.

"October has historically been a bullish month for Bitcoin, and early signs suggest this year may be no exception." said Gadi Chait of Xapo Bank, in an emailed statement. "Far from being a speculative outlier, bitcoin continues to show its ability to defy the odds and assert itself as a digital asset with staying power.”

On-chain data backs that up. Apparent bitcoin demand has grown by roughly 62,000 BTC per month since July, according to CryptoQuant, driven largely by ETFs and whales. For context, ETF holdings surged by 71% in fourth-quarter 2024.

On top of that, the crypto-native market has kept on growing.

“Over the past month, DeFi’s share of trading activity has been climbing significantly, expanding both the market and our opportunity,” dYdX Labs President Eddie Zhang told CoinDesk.

“A big driver of this shift is the renewed energy and participation we’re seeing out of Asia. We believe DeFi is beginning to fulfill its long-standing promise, and the pace of market adoption is accelerating in response."

Looking ahead, crypto markets are anticipating other potential catalysts: ETF decisions for several altcoins including solana and XRP that could be delayed over the shutdown, and Ethereum’s Fusaka upgrade, which is slowly moving closer. Stay alert!

What to Watch

For a more comprehensive list of events this week, see CoinDesk's Crypto Week Ahead.

- Crypto

- Oct. 3: SOL treasury firm Brera Holdings begins trading under new ticker SLMT on Nasdaq, reflecting its impending name change to Solmate.

- Macro

- Oct. 3, 9 a.m.: S&P Global Brazil Sept. PMI. Composite (Prev. 48.3), Services (Prev. 49.3).

- Oct. 3, 9:30 a.m.: S&P Global Canada Sept. PMI. Composite (Prev. 48.4), Services (Prev. 48.6).

- Oct. 3, 9:45 a.m.: S&P Global U.S. Sept. PMI (final). Composite Est. 53.6, Services Est. 53.9.

- Oct. 3, 10 a.m.: U.S. ISM Sept. Services PMI Est. 51.7.

- Oct. 3, 1:40 p.m.: Fed Vice Chair Philip N. Jefferson delivers a speech on "U.S. Economic Outlook and the Fed’s Monetary Policy Framework" in Philadelphia.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's Crypto Week Ahead.

- Governance votes & calls

- Compound DAO is currently holding a non-binding "temperature check" vote on a proposal to deprecate Compound V2. Voting ends Oct. 6.

- Unlocks

- Oct. 3: Immutable (IMX) to unlock 1.26% of its circulating supply worth $17.56 million.

- Token Launches

- Oct. 3: EVAA Protocol (EVAA) to be listed on Binance Alpha, MEXC and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's Crypto Week Ahead.

- Day 2 of 3: Lightning Plus Plus Berlin

- Oct. 3: DePIN Day Singapore 2025

Token Talk

By Oliver Knight

- The crypto market rose on Friday with tokens including ETH, SOL and XRP all rising more than 2%, while smaller altcoins like ETHFI and CAKE climbed as much as 25%.

- The relative strength comes as bitcoin, the world's largest cryptocurrency, hit $120,000 on Thursday as it takes aim at August's record high above $124,000.

- Still, unlike previous forays above $120,000, this move has been rather muted; with the price remaining in a tight range as opposed to a spike in volatility.

- This bodes well for altcoins, which typically perform well when bitcoin consolidates as it allows capital to rotate from bitcoin to more speculative bets.

- However, the upside shift has not been kind to a select few tokens, notably MYX Finance (MYX), which was dealt a grueling 43% decline due to a rapid unwind of leverage.

- Plasma's XPL token, as reported in Thursday's Daybook, continues to stutter amid speculation around whether market makers are shorting on behalf of the founding team, a claim that XPL founders have denied.

Derivatives Positioning

- The BTC futures market remains strongly bullish, with open interest holding at all-time highs above $32 billion. The three-month annualized basis is also elevated, approaching 8%.

- A notable divergence exists, however, in funding rates. Deribit's rate is exceptionally high at 25%, while other exchanges like Bybit show more neutral funding, suggesting a potential concentration of aggressive long positions in specific areas.

- The BTC options market is showing a state of neutrality. The 24-hour put-call volume is still slightly call-dominated at 52.25%, but this is a decrease from previous days, indicating a potential moderation of bullish conviction.

- Concurrently, the 1-week 25 delta skew is now essentially flat at 0.33%, signaling a balanced implied volatility for both puts and calls.

- This combination of metrics suggests a market that is settling into a more balanced and hesitant phase after a period of stronger bullish sentiment.

- Coinglass data shows $380 million in 24 hour liquidations, with a 35-65 split between longs and shorts. Binance liquidation heatmap indicates $121,300 as a core liquidation level to monitor, in case of a price rise.

Market Movements

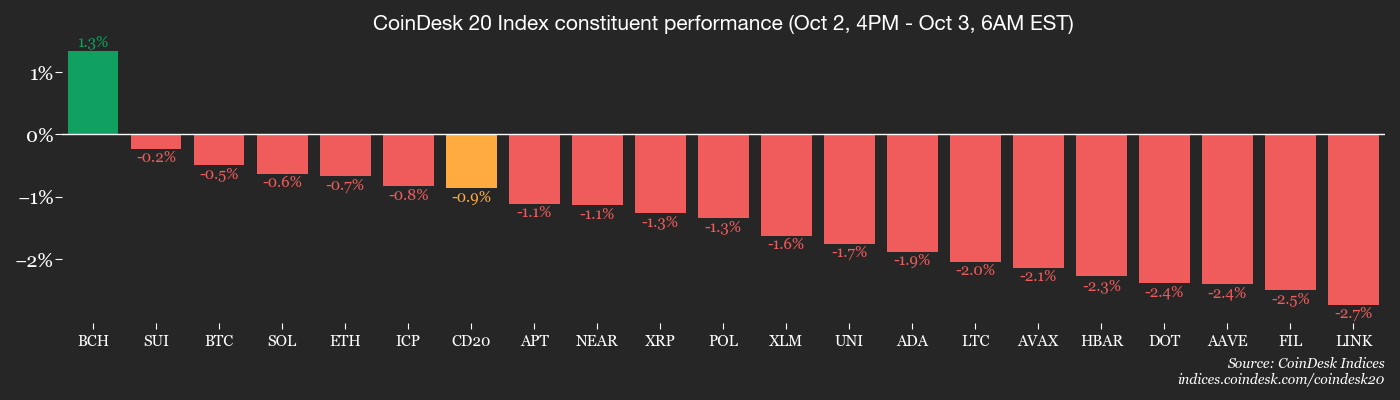

- BTC is down 0.3% from 4 p.m. ET Thursday at $120,378.11 (24hrs: +1.44%)

- ETH is down 0.4% at $4,476.43 (24hrs: +2.05%)

- CoinDesk 20 is down 0.55% at 4,297.29 (24hrs: +1.59%)

- Ether CESR Composite Staking Rate is unchanged at 2.87%

- BTC funding rate is at 0.0023% (2.5185% annualized) on KuCon

- DXY is unchanged at 97.76

- Gold futures are up 0.39% at $3,883.00

- Silver futures are up 1.87% at $47.24

- Nikkei 225 closed up 1.85% at 45,769.50

- Hang Seng closed down 0.54% at 27,140.92

- FTSE is up 0.63% at 9,486.91

- Euro Stoxx 50 is up 0.16% at 5,654.70

- DJIA closed on Thursday up 0.17% at 46,519.72

- S&P 500 closed up 0.06% at 6,715.35

- Nasdaq Composite closed up 0.39% at 22,844.05

- S&P/TSX Composite closed up 0.18% at 30,160.59

- S&P 40 Latin America closed down 0.42% at 2,893.79

- U.S. 10-Year Treasury rate is down 0.2 bps at 4.088%

- E-mini S&P 500 futures are up 0.27% at 6,785.25

- E-mini Nasdaq-100 futures are up 0.28% at 25,180.75

- E-mini Dow Jones Industrial Average Index are up 0.28% at 46,937.00

Bitcoin Stats

- BTC Dominance: 58.79% (unchanged)

- Ether to bitcoin ratio: 0.03722 (unchanged)

- Hashrate (seven-day moving average): 1,059 EH/s

- Hashprice (spot): $50.69

- Total Fees: 4.14 BTC / $495,121

- CME Futures Open Interest: 141,485 BTC

- BTC priced in gold: 31.2 oz

- BTC vs gold market cap: 8.81%

Technical Analysis

- Ether has deviated back into the weekly range after tapping the 100-day exponential moving average (EMA) on the daily chart and is now trading at the $4,500 level.

- While the price is trading above all key EMAs on the daily, it is currently within a bearish daily order block, an area of interest for a potential pullback.

- Bulls will want to see a break above this level followed by a successful retest to target the range highs and, eventually, the all-time highs.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $372.07 (+7.48%), +0.36% at $373.42

- Circle Internet (CRCL): closed at $149.72 (+16.04%), -0.68% at $148.70

- Galaxy Digital (GLXY): closed at $36.52 (+1.93%), +0.77% at $36.80

- Bullish (BLSH): closed at $67.91 (+11.68%), -0.6% at $67.50

- MARA Holdings (MARA): closed at $18.79 (+0.97%), +0.85% at $18.95

- Riot Platforms (RIOT): closed at $19.25 (+1.69%), +0.73% at $19.39

- Core Scientific (CORZ): closed at $18.1 (+0.72%)

- CleanSpark (CLSK): closed at $15.14 (+3.77%), +1.52% at $15.37

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $46.49 (+3.15%), +0.56% at $46.75

- Exodus Movement (EXOD): closed at $30.86 (+9.01%), +0.42% at $30.99

Crypto Treasury Companies

- Strategy (MSTR): closed at $352.33 (+4.11%), unchanged in pre-market

- Semler Scientific (SMLR): closed at $31.36 (+1.06%), -0.19% at $31.30

- SharpLink Gaming (SBET): closed at $18.09 (+4.15%), +1.05% at $18.28

- Upexi (UPXI): closed at $7.29 (+11.64%), +0.96% at $7.36

- Lite Strategy (LITS): closed at $2.68 (+4.69%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $627.2 million

- Cumulative net flows: $59.03 billion

- Total BTC holdings ~ 1.32 million

- Daily net flow: $307.1 million

- Cumulative net flows: $14.20 billion

- Total ETH holdings ~ 6.64 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin to $200K by End of 2025? This Cycle Indicator Points to Explosive Months Ahead (CoinDesk): Whale and spot ETF demand mirror past fourth-quarter rallies, and CryptoQuant’s cycle indicator suggests bitcoin staying above $116,000 for several weeks could clear the path toward $200,000.

- Multinationals Race Ahead as Dollar Slump Divides U.S. Stock Market (Financial Times): Donald Trump’s trade policies, Fed rate cuts and hedging flows have pushed the dollar down nearly 10% this year, boosting global earners like Meta while squeezing domestic importers such as Target.

- Accumulation Trends Strengthen as Bitcoin Breaks Through $120K (CoinDesk): Wallets holding 10–1,000 BTC have flipped from selling to buying for the first time since August, signaling stronger demand as retail also begins edging back into accumulation.

- Nomura Unit Laser Targets Japan’s Booming Crypto Trading Market (Bloomberg): Switzerland-based Laser Digital Holdings, a Nomura subsidiary, is in talks with Japan’s regulator to obtain a license to offer crypto trading services for institutional clients.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。