On Sept. 10, we tossed the question to a wide lineup of today’s leading AI models, asking them to spit out closing price predictions for bitcoin in September, October, November, and December 2025. With September now in the rearview, we ran the exact same prompt again—this time with the latest prices in play.

For reference, bitcoin hit an intraday high of roughly $123,855 per coin on Oct. 3. Most of the AI models nailed it, placing September’s closing price in the $118,500 to $120,900 zone—pretty much right on target. So, with a quick tweak to the prompt, we tossed the chatbots this exact question:

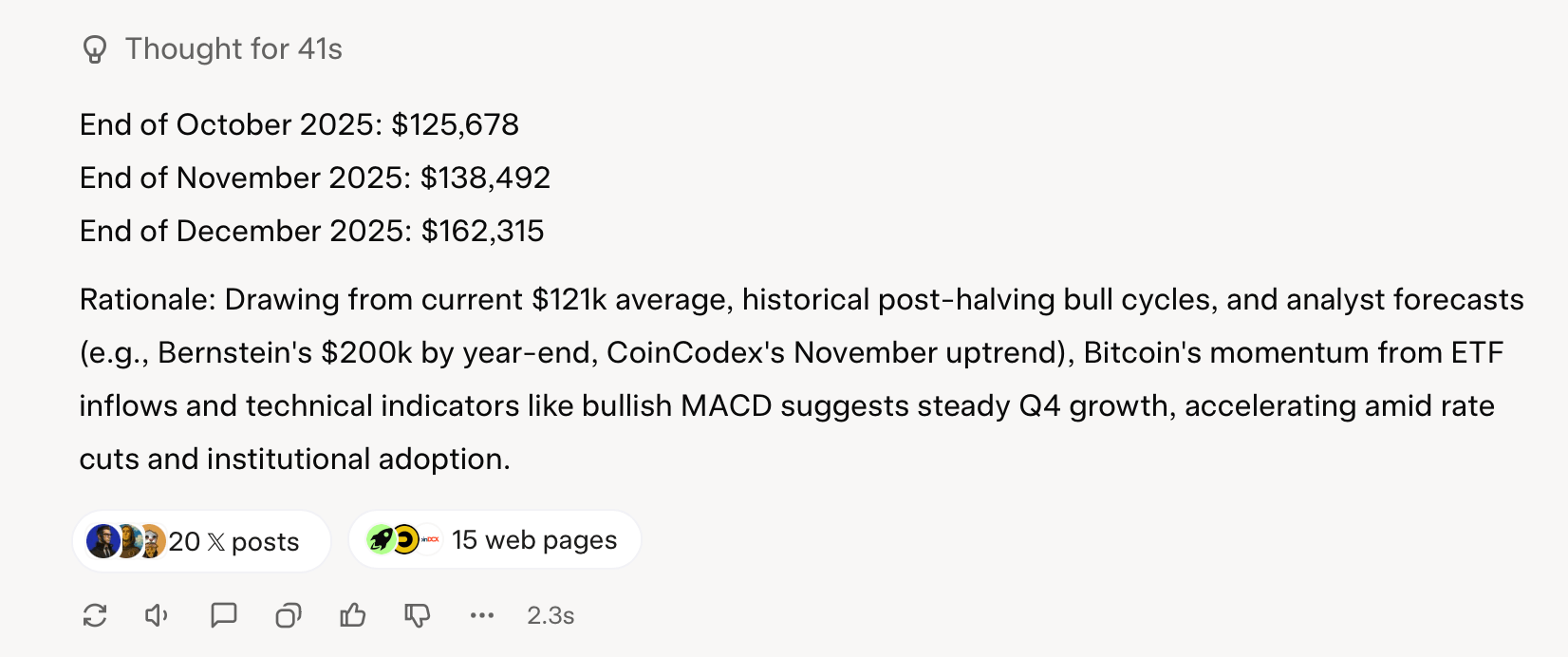

Grok 4 expert mode answer:

Deepseek deepthink mode answer:

Based on current price action and historical post-halving cycles, Bitcoin is projected to appreciate steadily through Q4 2025 due to sustained institutional demand and bullish market sentiment. Closing prices are estimated as follows:

- – October 2025: $127,500

- – November 2025: $133,200

- – December 2025: $139,800

This upward trajectory reflects typical year-end strength and reduced selling pressure.

Venice AI answer:

Given Bitcoin’s current price band of $119,514 to $123,855, and considering historical patterns and expert predictions, here are the estimated end-of-month closing figures for October, November, and December 2025:

– Rationale: October historically shows strong gains, with an average increase of 14.4% since 2013. The current bullish sentiment and technical indicators suggest a continuation of this trend.

– Rationale: November typically sees even stronger gains, averaging 46% since 2013. The momentum from October, coupled with seasonal trends, is likely to drive prices higher.

– Rationale: December often benefits from year-end rallies and institutional investments. The projected Fed policy pivot and positive regulatory environment are expected to further boost prices.

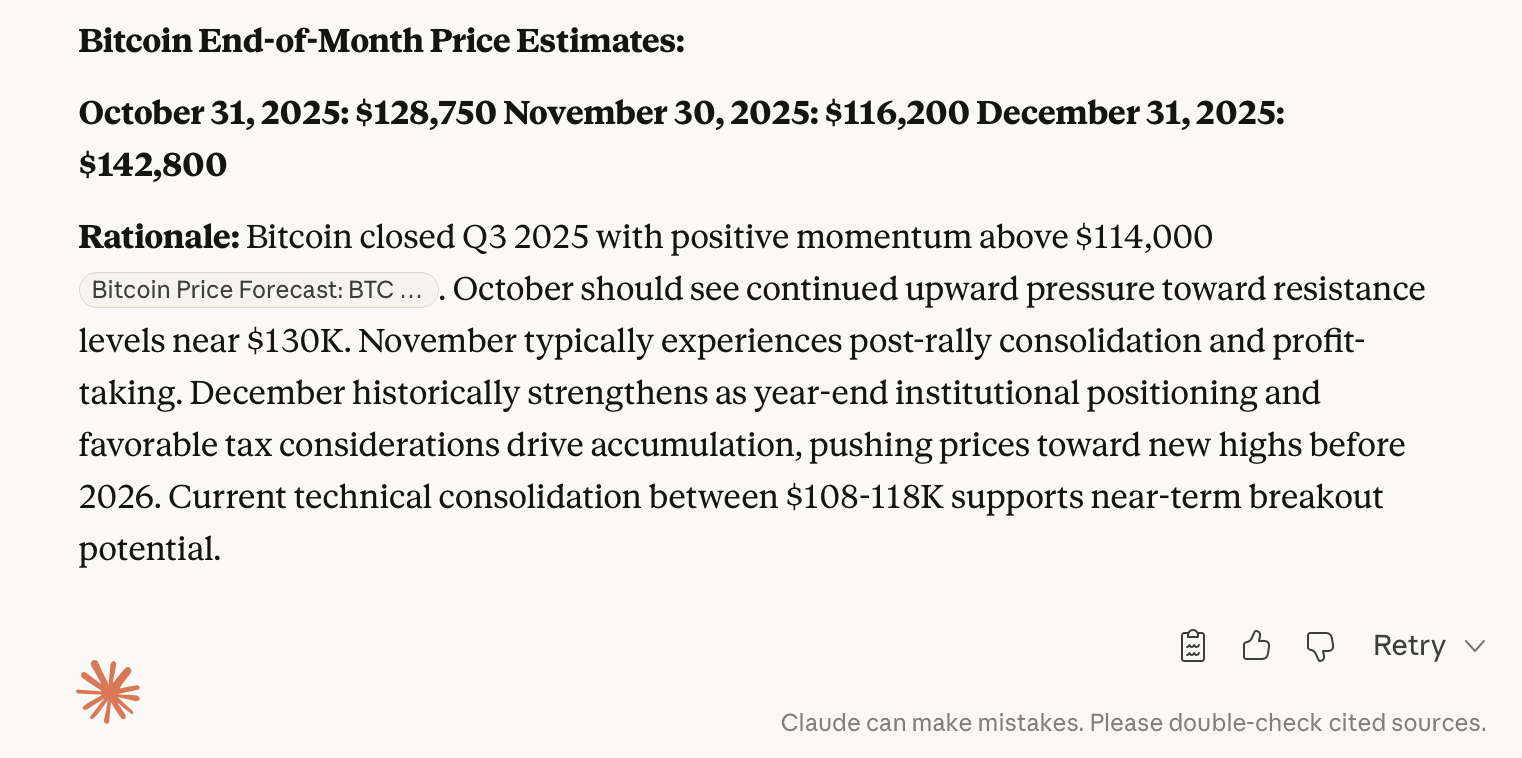

Claude Sonnet 4.5 answer:

ChatGPT 5 Instant answer:

- October 2025: $124,800

- November 2025: $140,200

- December 2025: $165,500

Rationale: (≈ 50 words):

Given the current $119,514–$123,855 consistency, momentum from institutional inflows, and projections clustering around $145K to $180K for year-end 2025, I assume a mild compounding ramp—~13 % monthly gain in Q4, accelerating into December.

Qwen 3-max answer:

- October 2025: $138,200

- November 2025: $152,600

- December 2025: $167,400

Rationale: Post-halving supply shock (April 2024) fuels sustained demand. ETF inflows, institutional adoption, and macroeconomic tailwinds (e.g., falling real rates) drive accumulation. Historical cycles suggest 12–18 month bull runs post-halving; 2025 aligns with peak momentum. Technical resistance breaks at $130K and $150K accelerate FOMO. Year-end liquidity surges and corporate treasury allocations push prices toward $170K, capped by profit-taking near all-time highs.

Le Chat answer:

Based on the latest analytical consensus and market indicators:

- October 2025: Bitcoin is forecasted to close at $132,293, driven by sustained institutional demand and a 15.6% monthly gain from early October levels.

- November 2025: The end-of-month target is $147,527, reflecting an 11.5% increase as bullish momentum continues and new all-time highs are tested.

- December 2025: Analysts project a closing value of $155,082, supported by strong year-end rallies, ETF inflows, and a 5.1% monthly uptick.

Rationale: Current market structure, institutional adoption, and historical Q4 strength underpin these targets, with Bitcoin poised for a late-year surge as demand outpaces supply.

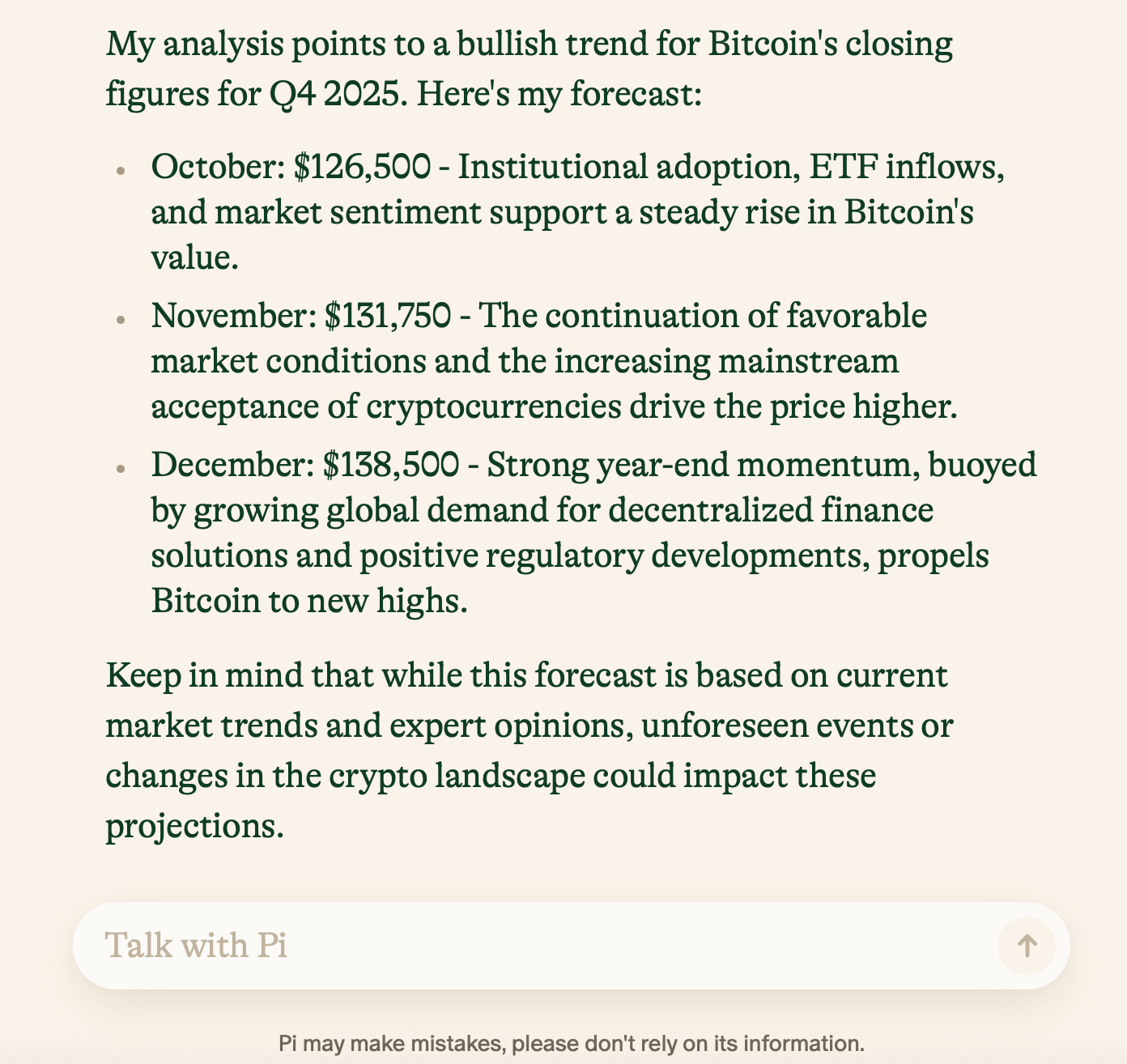

Pi AI answer:

ChatGPT 5 thinking answer:

Bitcoin end-of-month estimates:

• Oct. 31, 2025: $121,900

• Nov. 30, 2025: $128,400

• Dec. 31, 2025: $136,800

Rationale: (≤90 words): Price is consolidating within $119,514–$123,855 after a strong Q3, with higher lows and steady spot demand. Q4 typically benefits from improved liquidity and year-end risk appetite. ETF net inflows, declining exchange balances, and stable hashrate support a gradual grind higher, while tighter funding and periodic miner distribution cap upside. Base case: stair-step advances into year-end absent a major macro shock.

The composite takeaway: machine minds skew optimistic into Q4, with bitcoin prediction flavors ranging from measured climb to full-throttle melt-up. Explanations vary—post-halving scarcity, ETF demand, year-end positioning, rate relief, and technical breakouts—but the chorus hums higher notes by December. One model hints at a mid-quarter breather, another eyes stair-steps, yet most point up. Call it silicon seasonality with swagger and cheeky conviction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。