Author: Pavel

Compiled by: Deep Tide TechFlow

Abstract

We are exploring whether it is better to destroy assets or redistribute assets to maintain system health and the rationality of incentive mechanisms.

- When a reduction is the initial stage of punishing malicious behavior, redistributing assets is often more efficient than simple destruction.

- When destruction is a core feature of the design and does not involve reductions (such as in a deflationary economic model), there is no reason to implement redistribution.

- When redistribution is a core feature of the design but behaves like a loophole, destruction should not be used as a substitute; instead, the design needs to be fundamentally improved.

Definitions

Many people seem confused, thinking that when a token is significantly reduced, the staked amount that is reduced will automatically be destroyed, leading to a decrease in supply. But this is not the case.

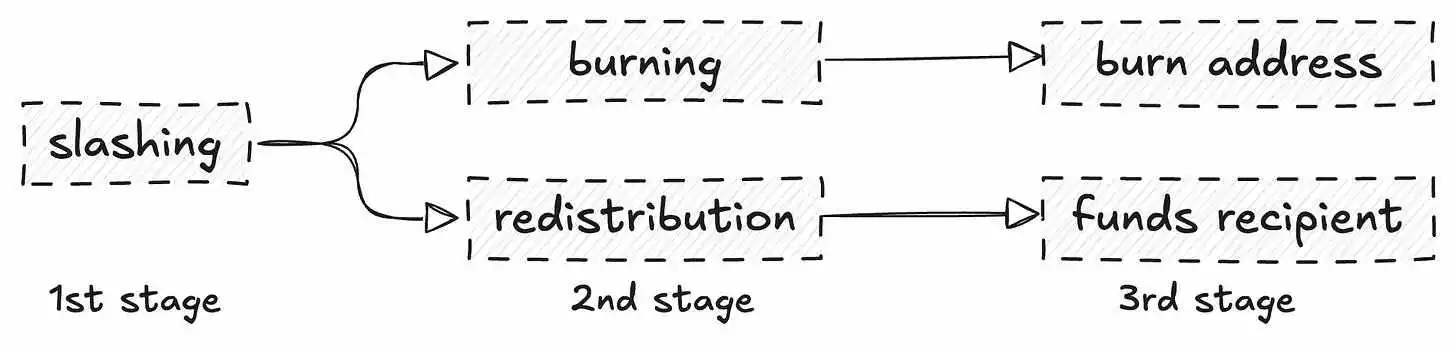

- Reduction: Refers to "recapturing" assets from malicious actors.

- Destruction and redistribution: Describe the subsequent handling of these recaptured assets.

As we mentioned earlier, the reduced assets can be destroyed or redistributed:

- Destruction reduces the total supply;

- Redistribution transfers value to another party (not necessarily the victim). Additionally, destruction may also occur independently through built-in mechanisms in the protocol without the need for a reduction.

How Redistribution Enhances Economic Security

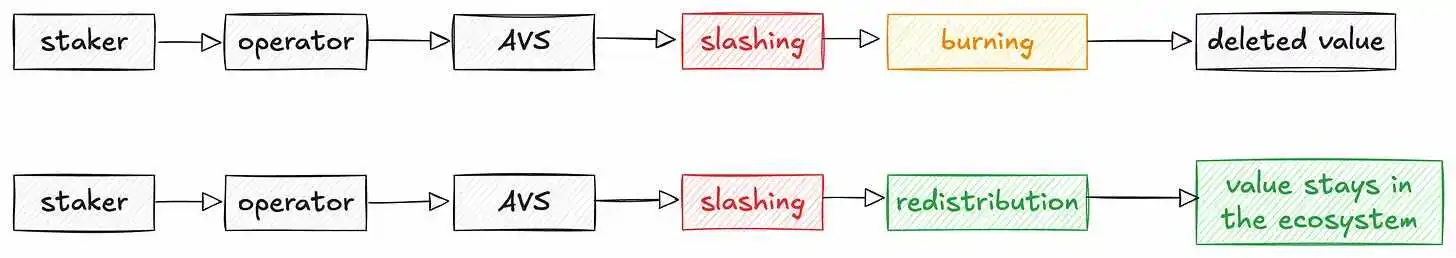

Let’s take one of the most well-known protocols in today’s cryptocurrency space—EigenCloud—as an example. Its operators were reduced for failing to fulfill their obligations, which is a good thing: malicious actors are punished. However, before the introduction of the redistribution of reduced funds, these funds are often destroyed (and can still be destroyed).

We believe that destroying reduced funds in such a system is akin to self-sabotage. Because when an operator's stake is reduced: the operator is punished (for good reason), but:

- The victim receives no compensation (imagine a victim hit by a car, the driver is sentenced, but the victim receives no help).

- The security of the system decreases (because the assets used to secure the system are reduced).

Since this value can be preserved and transferred to the victim, why destroy it? Through redistribution, reliable participants can receive more rewards, affected users can be compensated, and value remains in the ecosystem, merely being redistributed. This can also unlock more application scenarios for applications, such as:

- New types of on-chain insurance protocols operating in a permissionless manner;

- Faster and guaranteed decentralized exchange (DEX) transactions, such as compensating traders when requests fail, expire, or are not completed in time;

- Providing more incentives for operators to encourage them to operate honestly and transparently;

- Protecting borrowers by providing guaranteed annual percentage rates (APR), higher transparency, and potential native fixed rates.

Economic security can not only directly protect users before an incident occurs (such as through destruction mechanisms) but can also directly protect users after an incident occurs. Protocols like Cap have already implemented redistribution functions, where the funds of reduced operators are redistributed to affected cUSD holders.

Challenges of Redistribution

Destroying assets is easier than redistributing them; there is no need to worry about the subsequent handling of these assets, just destroy them, with neither profit nor risk. The benefits of destroying assets are fewer, and the risks are significantly lower. Redistribution, however, changes the rules of the game significantly; transferring value from malicious actors to victims is not as simple as it seems.

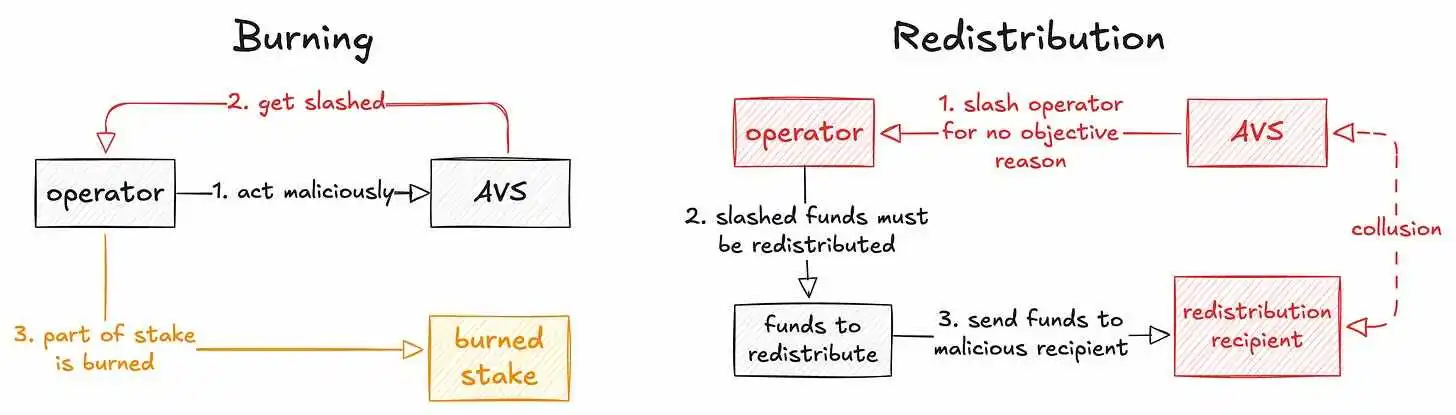

Malicious operators may now collude with malicious validation node services (AVS). Currently, AVS can implement any custom reduction logic, even if that logic is unfair or subjective. In a reduction mechanism, AVS has little reason to act maliciously because operators would not submit stakes knowing they might be reduced for non-objective reasons.

But in a redistribution mechanism, AVS can transfer one operator's stake to another malicious operator (with whom they collude), effectively extracting value from the system. If AVS keys are compromised, a similar situation can occur, which may also affect the overall "attractiveness" of the operator or AVS.

Here, additional evaluation of the mechanism design is needed:

- Operators should not have the option to "switch types" after creation;

- There should be a method to identify compromised (malicious) operators and redistribute value (if the value ultimately flows to the malicious party), along with ongoing monitoring, etc.

Although destroying funds is simpler, redistribution is fairer, but it requires additional complexity.

Fixing Errors through Redistribution

The maximum extractable value (MEV) scenario can be observed from the following perspective: innocent users and liquidity providers (LPs) may be unjustly reduced. For example, when users wish to swap assets, they may encounter front-running or sandwich attacks, resulting in worse output (price).

It can be confidently stated that they were reduced because they submitted stakes (assets for swapping) to the system (DEX) and held these assets for a certain period (swap time), only to receive far less than expected.

There are two core issues here:

- LPs are reduced without cause (they have no malicious behavior).

- Users are reduced without cause; they have no malicious behavior and are not trying to profit from the system or contribute to it; they just want their operations to be executed.

Here, value is extracted and redistributed, the exploiters are rewarded, while the party that did nothing wrong is reduced.

- By establishing certain sorting rules (like Arbitrum Boost), users can more easily resolve this issue.

- For LPs, this issue is more complex, as they are often victims of LVR (loss and rebalancing).

Can Destruction Solve These Issues?

Destruction can provide decentralized benefits to all token holders but cannot specifically compensate those LPs who directly lost due to arbitrage activities. Theoretically, the problem could be solved through destruction, as once profits are destroyed, there is no incentive for arbitrage.

However, once arbitrage profits are extracted, identifying such arbitrage becomes more difficult: while on-chain transactions are visible, CEX data does not show the exact addresses of traders.

In this case, poor redistribution design can be addressed through application-specific sorting rules, such as Angstrom's solution, allowing LPs to capture value that would have been taken by exploiters. This approach works quite well.

In this specific MEV case, neither redistribution nor destruction is a truly viable option; they can only address the symptoms, not the root cause. The problem needs a fundamental change at the design level.

Scenarios Where Destruction is Preferable to Redistribution

It should be clear that redistribution is not a panacea. In the following cases, destruction is more appropriate: when reductions are not involved, destruction is often a core feature of mechanism design.

Take BNB as an example; the quarterly destruction of BNB is a core feature of its deflationary token economic model, which cannot be replaced by redistribution because this process involves neither exploiters nor victim users.

A similar process occurs in the design of ETH (EIP-1559), where the base fee is destroyed, creating a deflationary effect. Considering Ethereum's mechanism design, during network congestion, fees can become very high, and some may argue that rather than destroying the base fee, it would be better to transfer the base fee to a treasury fund to compensate for some fees during network congestion. However, the drawbacks of doing so far outweigh the potential benefits:

- Redistributing fees may dilute the deflationary effect, leading to higher inflation and potentially depressing token value over time;

- Misallocation of funds, leading to reduced income (e.g., which transactions should the fund prioritize? Is it reasonable for users to pay priority fees if those fees can be compensated by funds? etc.);

- If it is known that fees will be compensated, it may lead to more spam transactions, exacerbating congestion;

- Assuming the base fee of Ethereum is redistributed to stakers, this may incentivize validators to prioritize high-fee transactions, ignoring those that are not sponsored or not paid in advance.

There are many other similar cases, but the key point is that redistribution is not a cure-all. If destruction occurs independently (not involving reductions), there is almost no reason to replace destruction with redistribution.

Conclusion

Ultimately, we want to point out that in scenarios not involving reductions, redistribution often performs worse than destruction, while in scenarios involving reductions, redistribution usually performs better than destruction.

The issue of incentive mechanism coordination is a long-standing problem in the cryptocurrency space and often varies by protocol. If economic value directly impacts the security of the system or other critical factors, it is better not to destroy that value but to find a way to redistribute it correctly to those who act honestly, thereby incentivizing fair and honest behavior.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。