Author: Frank, PANews

Hyperliquid has recently faced intense competitive pressure, not only losing its position as the leading decentralized derivatives exchange but also seeing its daily trading volume surpassed by competitor Aster by about ten times. Meanwhile, security incidents within the ecosystem have been frequent, and the stablecoin project is still in its infancy. Under both external and internal pressures, is Hyperliquid fighting a desperate battle or is it gathering strength for a major comeback?

Winter Has Arrived: The Lost Throne and the "Data Black Hole"

Hyperliquid's recent situation can be described as being surrounded on all sides. After witnessing the strong performance of the decentralized derivatives market and the HYPE token, a large number of competitors quickly flooded into this space.

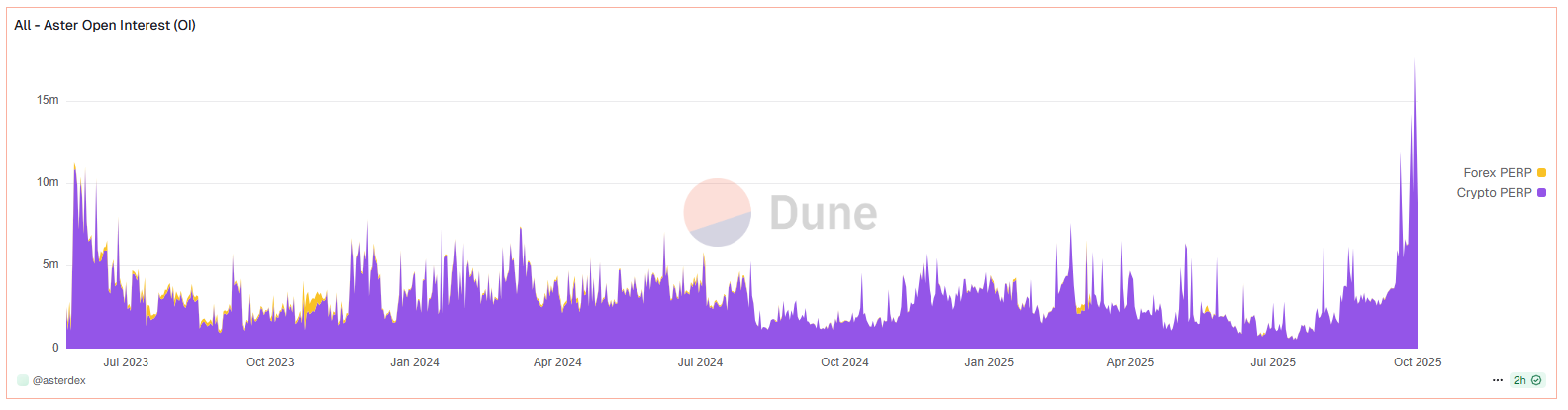

Among them, the strongest competitor is Aster on the BNB Chain, which not only quickly took over the long-held market share of Hyperliquid in the decentralized derivatives market but also led in daily trading volume by about ten times.

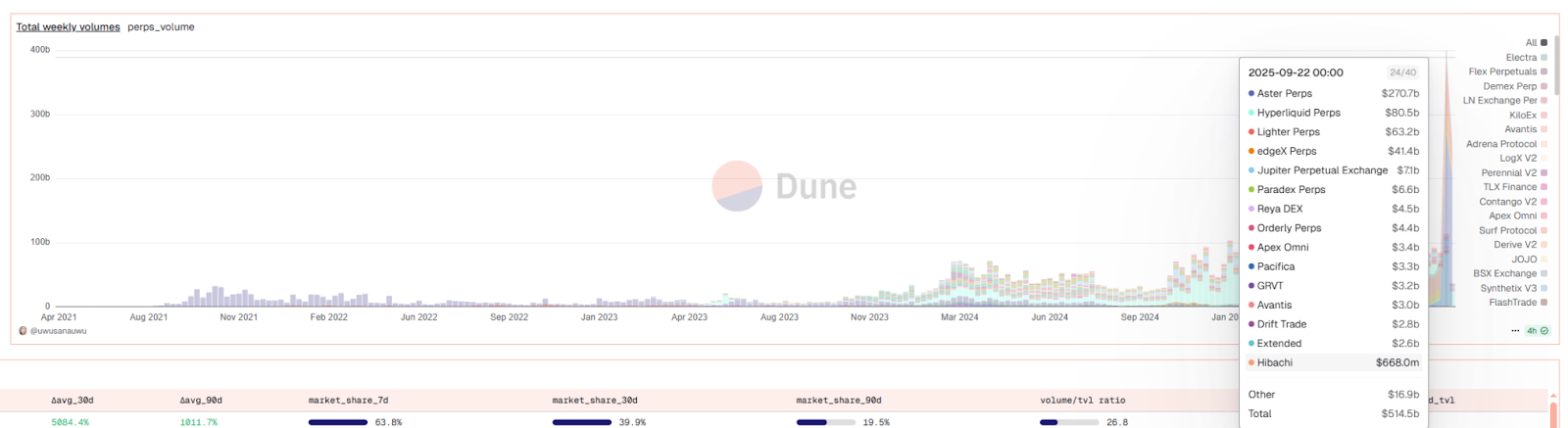

In July of this year, Hyperliquid held about 65% of the market share in decentralized derivatives exchanges, a figure that had remained stable since the mainnet launch at the end of 2024. However, data from September 22 shows that Aster's market share has reached 70%, while Hyperliquid's share has been squeezed down to just 8.3%.

However, this change in market share did not occur in a stagnant market. Hyperliquid's trading volume has not changed much, and there has even been some growth. With Aster entering the competition, trading incentive activities have brought significant incremental volume to the entire market. For example, during the week from September 22 to September 29, Hyperliquid's trading volume was $80 billion, still at a high level since its launch. However, compared to Aster's exaggerated $270 billion trading volume during the same period, it appears quite lacking.

Additionally, in terms of user data, as of now, Aster's total user count has exceeded 3 million, while Hyperliquid has only reached 719,000 users after a year of development. In comparison, Aster's traffic performance is indeed far superior to Hyperliquid's.

Data from October 1 shows that Aster's perpetual contract trading volume in the past 24 hours was about $72.8 billion, with approximately 60,000 addresses participating in the trading, averaging $1.21 million in trading volume per address. During the same period, Hyperliquid's average trading volume per user was about $165,200.

Moreover, besides Aster, several other competitors such as Lighter and edgeX have also shown strong performance recently. Hyperliquid is truly surrounded on all sides.

Counterattack: The Three-Pronged Approach of Culture, Infrastructure, and Ecosystem

In the face of fierce challenges, Hyperliquid has not fallen into mere data anxiety but has also launched a set of "counterattacks" to consolidate long-term value.

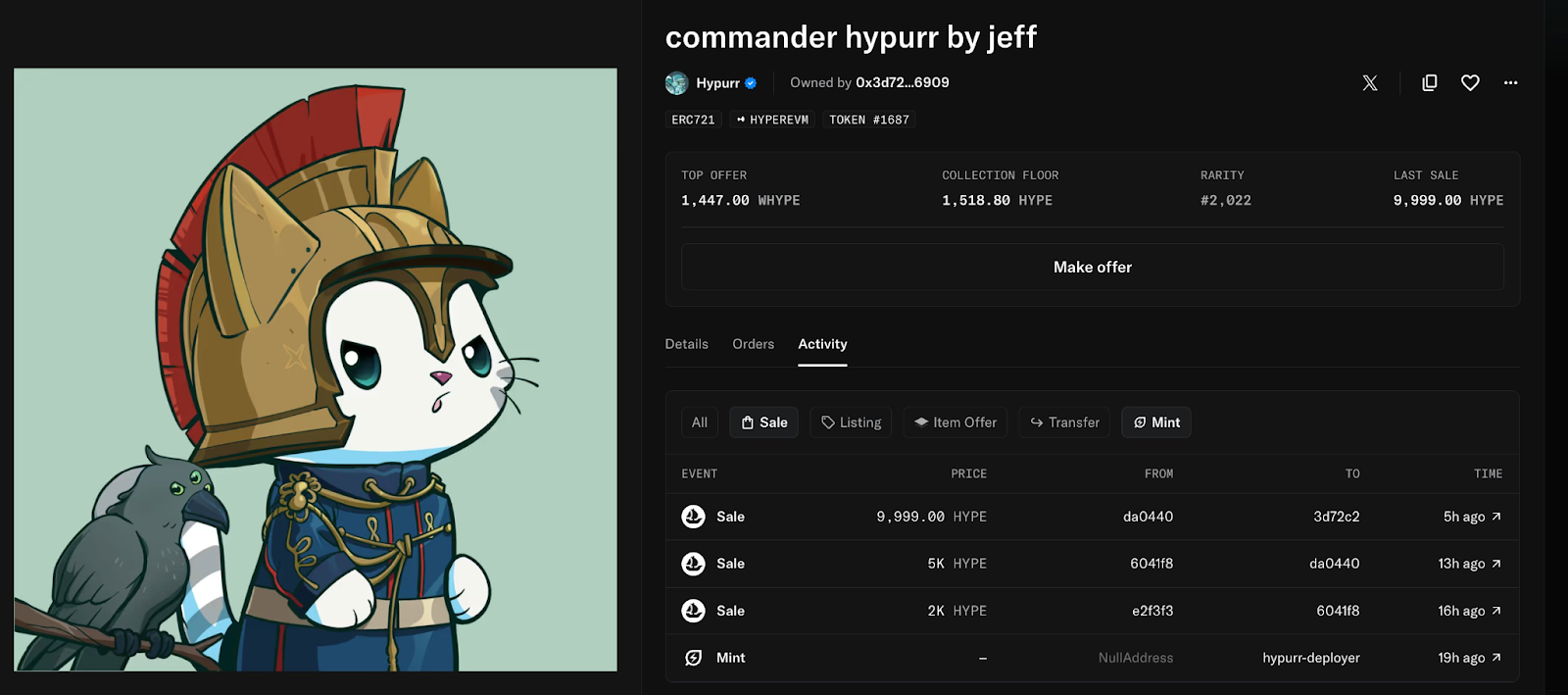

On September 28, Hyperliquid airdropped 4,600 NFTs named "Hypurr" to early users and contributors. This move quickly ignited the community. In just 24 hours, the trading volume of this NFT series exceeded $44.6 million, with the floor price reaching as high as $68,700, and the rarest one even sold for a staggering $75,000.

The issuance of Hypurr NFTs also quickly sparked market discussions, and the market began to explore Hyperliquid's potential for profit-taking once again.

On the same day that NFTs ignited the community, Hyperliquid officially launched the "Permissionless Spot Quoting Asset" feature on its mainnet. This is a seemingly technical move that actually has far-reaching strategic significance.

This feature allows any stable asset that meets strict on-chain standards to become a quoting currency on the platform in a permissionless manner. The requirement is that the deployer must stake 200,000 HYPE tokens (locked for 3 years) and provide extremely high liquidity for trading pairs with USDC and HYPE.

This move offers a new perspective on the recent heated competition for stablecoins at Hyperliquid. From this standpoint, USDH issued by Native Markets does not seem to be Hyperliquid's last-ditch effort. Moreover, several giants that previously participated in the stablecoin competition can also join Hyperliquid's stablecoin competition under this mechanism. The most critical core is that it further weakens the monopolistic effect of USDC within its ecosystem. On October 1, Guy Young, founder of Ethena Labs, revealed that Ethena will collaborate with Liminal to launch a new stablecoin on Hyperliquid.

In addition, with several major global crypto events taking place recently, Hyperliquid has also gained significant exposure during these events. At the offline hackathon held in Seoul, the three winning projects were: Hyperliquid Copilot, Edgescan, and HODL Bot. In terms of categories, these winning projects are primarily focused on trading tools. On one hand, this may reflect Hyperliquid's focus on ecosystem development, but on the other hand, the diversity of the ecosystem still seems somewhat limited.

The Moat Debate: What Remains for Hyperliquid After the Clamor?

The traffic and data driven by Aster's airdrop expectations are undoubtedly impressive, but this raises a more fundamental question: When this costly incentive frenzy gradually recedes and trading volume returns to real demand, will the market return to Hyperliquid? Or will it completely rewrite the landscape of the decentralized derivatives trading market?

To answer this question, we must delve into the fundamental differences between the two and clarify where Hyperliquid's true moat lies.

First, in terms of operational philosophy, the two represent entirely different development philosophies.

Hyperliquid is a "technological idealist," with its ecosystem construction centered around an extreme trading experience. In fact, Hyperliquid, as a public chain, essentially serves as a supporting infrastructure for Hyperliquid itself.

In contrast, Aster's operational foundation has a different logic. As a significant player in the decentralized derivatives space for Binance and the BSC chain, Aster's main role is to counter the impact of decentralized derivatives exchanges like Hyperliquid on the entire Binance ecosystem. Therefore, Aster has borne greater pressure and possesses more resources since its inception, even being referred to as Binance's "proxy war."

In terms of product competition, whether it is multi-chain compatibility, economic model narratives, or ecosystem resources, Aster is in a leading position, which is why it has been able to quickly gain an advantage. Hyperliquid's main advantage may lie in its sub-second latency and 100,000 TPS performance. However, as the performance of the BSC chain improves, this advantage is gradually diminishing. On September 23, BNB Chain disclosed that it would accelerate the block interval from 750 milliseconds to 450 milliseconds to maintain competitiveness with the fastest blockchains in the cryptocurrency space.

So, what is Hyperliquid's core moat? Setting aside these superficial technical and product characteristics, there may still be significant advantages in the following aspects.

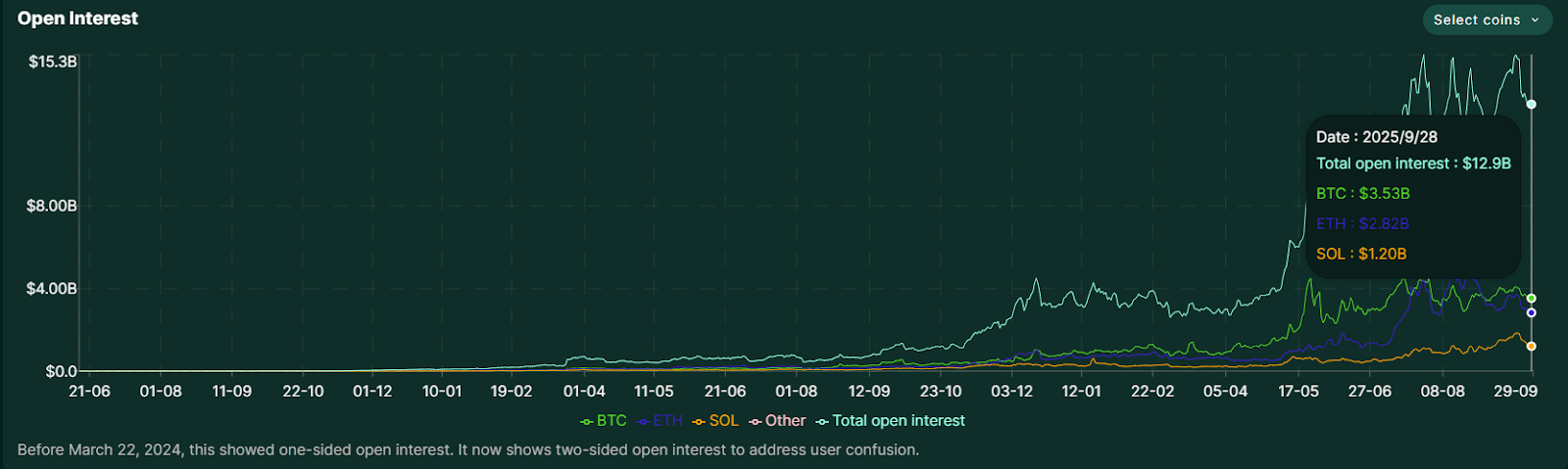

- High-quality user retention: Although Aster's trading volume data is significantly ahead, there is a huge contrast in the open interest (OI) data between the two. On September 29, Hyperliquid's open interest was $12.9 billion, while Aster's was only $200 million during the same period, a difference of over 60 times. Higher OI means that Hyperliquid has accumulated more real, long-term, large-cap trading positions, and its user quality and stickiness are far beyond those of short-term users focused on volume arbitrage.

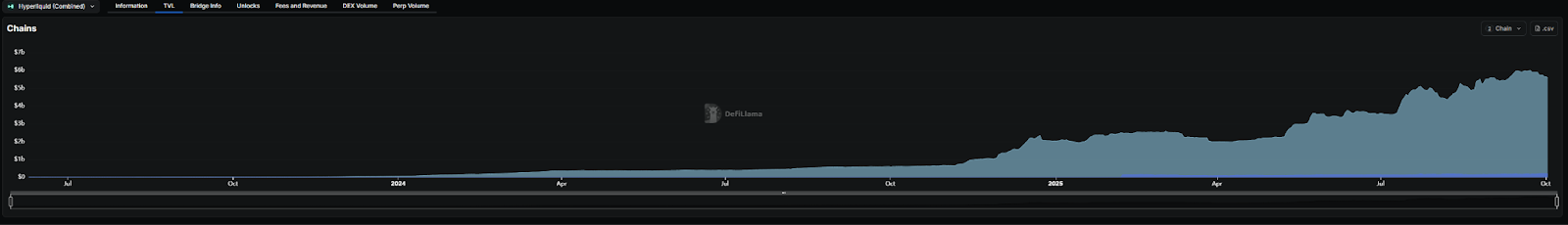

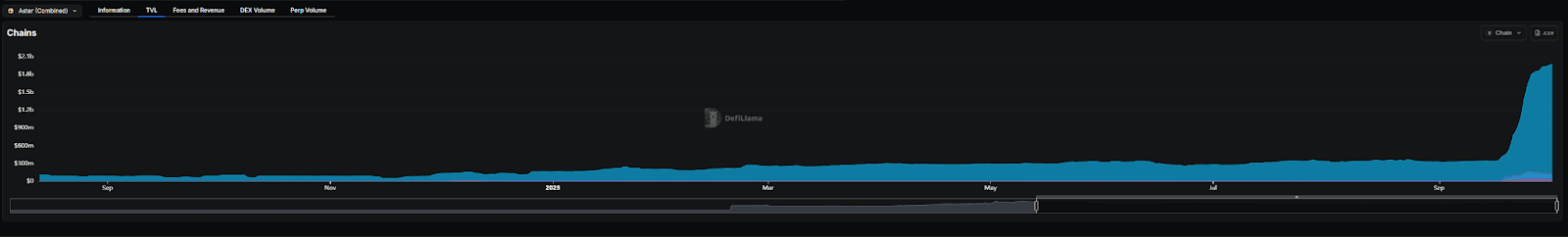

- Higher locked value: Hyperliquid's TVL is about $5.77 billion, while Aster's is about $2.2 billion. Although the difference seems to be just over 1 times, the premise is that Aster's TVL is stimulated by airdrops, while Hyperliquid's data reflects a relatively stable performance. Fundamentally, Aster currently represents more speculative forces, while Hyperliquid has clearly accumulated more long-term value investment strength.

- An independent ecosystem: Compared to the powerful resources of the Binance ecosystem, Hyperliquid's independence may seem lonely, but on the other hand, it represents greater decision-making independence. Especially in the face of crises, the Hyperliquid system may make decisions entirely from the perspective of maintaining trading system stability, as seen in previous instances of trading manipulation. Even when faced with external doubts, Hyperliquid will resolutely maintain the stability of the trading system. In contrast, Aster has not yet encountered such incidents, but if similar events were to occur, would the BSC chain be able to take emergency measures like Hyperliquid to protect Aster's users or treasury interests? The likelihood is low.

Overall, even though Hyperliquid still possesses multiple moats, the situation remains grim. It faces not just Aster but a multitude of challengers, akin to six major sects attacking the Bright Summit, all waiting for their turn to challenge. At this time, Hyperliquid must not only innovate to address the crisis of declining traffic but also be cautious in its decision-making; any major misstep could lead to dire consequences.

The ultimate outcome of this confrontation will depend on whether the market ultimately values "short-term revelry" or "long-term internal strength" more. For Hyperliquid, the real test has only just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。