Ripple US Bank License Document Review News Again in Crypto Markets

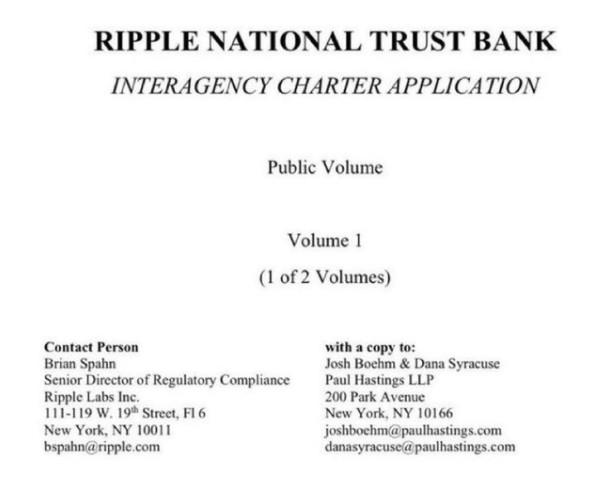

Ripple Labs’ application for a US national trust bank charter is making waves in the crypto world again. Officially filed on July 2, 2025, the application for the Ripple US Bank License ( National Trust Bank) was released publicly in early August. While some social media posts are hyping this news as fresh, the filing itself has been under review for several months.

What is the Ripple National Trust Bank Application?

According to recent market hype, many Ripplers are re-posting the Ripple US Bank License document already gone for review in August 2025. However, this hype has created an aura of Ripple Labs around the crypto sphere, where the community hyped the market again with the previous announcements. This could bring some notable impact on the XRP price and upcoming developments.

Source: X

The Office of the Comptroller of the Currency (OCC) permits financial institutions to become federally chartered banks. The Ripple application is dedicated to the custody of digital assets and fiduciary services, such as the management of its RLUSD stablecoin reserves.

With approval, Ripple Labs would be a US-chartered bank, which would bridge the divide between conventional banking and crypto services. This may provide a substantial regulatory edge to the company and make XRP a more valid asset to institutions and payment systems.

Public Review and Comment Period.

The OCC had a 30-day public comment period after the release of the application. Feedback on the proposal could be submitted by stakeholders, industry groups, and the public. Although the comment period has been closed, the OCC review schedule is not final, and there is no date by which it will be approved.

Source: Official X Account

This has attracted the interest of not just the community, but also regulatory and consumer advocacy groups, such as the National Community Reinvestment Coalition (NCRC), which has in the past expressed concerns regarding regulation in digital asset banking.

The Impact of a Banking License on XRP.

There might be several significant implications for a US-chartered bank license:

-

Institutional Adoption: Banks and corporate treasuries may be more willing to hold XRP as a reserve asset.

-

Cross-Border Payments: The technology can be directly integrated into existing banking networks, allowing XRP to be a remittance and settlement medium in between.

-

Market Legitimacy: Approval could boost XRP’s credibility, increasing investor confidence and market demand.

However, Ripple has not confirmed specific intentions to directly incorporate XRP into the operations of banks, and it is not clear how this would directly affect prices in the short term.

Timing Could Be Pivotal

October 2025 may prove crucial for Ripplers, as several events could influence the trajectory:

-

ETF Launch: Cryptocurrency ETFs are likely to be approved in the near future, but it is possible that delays may happen because of a US government shutdown.

-

Ripple Bank License Decision: According to the OCC’s usual 120-day review period, a decision could come by the end of October 2025.

-

Legislative Developments: Bills like the Market Structure Bill and developments that are still going on with SWIFT would also have an effect on the opportunities.

XRP Price Outlook and Market Scenarios

As of October 6, 2025, XRP traded at $2.97, down by 1.47%, close to the $3 psychological resistance level. The market cap stands $178 billion, and the Trading volume $5.53 billion.

Source: Coin Market Cap

XRP Price Bullish Scenario, if:

-

XRP-spot ETFs approved

-

Bank license granted

-

Blue-chip companies adopt XRP

-

Ripple gains market share from SWIFT

XRP Price Bearish Scenario, if:

-

ETF delays or outflows

-

Ripple license rejected or delayed

-

SWIFT maintains dominance

Technical levels to watch include support at $2.8 and $2.5 and resistance at $3, $3.1, $3.3, and $3.66.

Conclusion

The National Trust Bank application represents a critical milestone. Coupled with potential ETF launches, October could be a decisive month for the token and the broader crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。