Aster Airdrop Stage 2 Ends, Stage 3 Dawn Launches: Price Prediction

Will Aster’s massive airdrop claim trigger the next price rally or a brutal correction? With Aster Airdrop Stage 2 officially closed on Oct 5 (23:59 UTC) and Phase 3 “Dawn” launching immediately, traders are eyeing the critical October 14 claim date. This period could define the next leg for its price action.

Aster Airdrop Stage 2 Ends : Claim Opens October 14

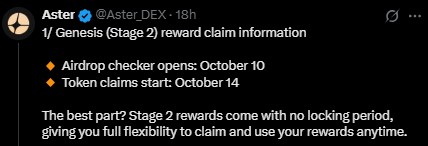

The Genesis (Stage 2) airdrop checker goes live on October 10 , and token claims begin on October 14 . The key highlight: there’s no locking period , meaning users can claim and use their rewards immediately — potentially flooding the market with liquidity.

Source: X

Source: X

This flexibility is attractive for participants but could inject sell pressure worth up to $600M , sparking intense debate across crypto communities about whether Aster can absorb such volume.

Phase 3 Dawn Launch: New Rules, Fairer Scoring

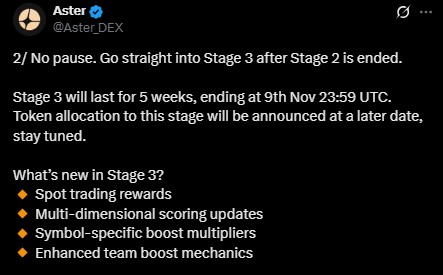

Immediately after Genesis phase completion, Stage 3 Dawn started , which lasted for five weeks until November 9 (23:59 UTC). For the first time ever, S3 features a multi-dimensional scoring system to encourage real trading activity.

Source: X

Source: X

Major upgrades are:

-

Reward for spot trading into Rh points

-

Symbol-specific multiplier increases

-

Multi-dimension scoring for volume, P&L, asset holding (asBNB, USDF), and referrals

-

Increased team boosts now stacking for the whole phase rather than resetting each week

Referral caps are set at 10 %, with premium prices offered via performance unlocks. Long-term interaction rather than short-term farming is the team's priority.

Aster Price Prediction: S3 as a Turning Point?

It is now at $1.837, from intraday high of $2.40 on Oct 4, with market cap of $3.06 B and 24 h volume of $1.25 B. RSI (14) is at 45.27, which indicates bearish medium momentum.

Source: TradingView

Source: TradingView

Bullish Case: A break above $2.00 has the potential to reach $2.20 (short term) and $2.50–$2.70 (medium term) — driven by S3 action and fresh demand.

Bearish Argument: Not defending $1.80 could send the token as low as $1.55 or even $1.30, particularly once claims unlock on Oct 14.

Furthermore, DeFiLlama also delisted Aster's perpetual trading volume because of suspicious similarity with Binance volumes — an action which triggered fresh controversy regarding liquidity authenticity.

Should Stage 3 mechanisms be capable of ushering in real trading, Aster Dawn might have a solid base of users and stabilization of prices. A breakout above $2.50 sustained might build the target range of $5–$7 by 2025, subject to adoption and exchange growth. Should sell-off after air-dropping be the order of the day, it may be pulled out into consolidation.

Conclusion

Aster Airdrop Stage 2 is set for a make-or-break moment. With S3 Dawn live and claims opening Oct 14, its ability to handle massive unlocks while sustaining growth will decide whether it breaks new highs or corrects deeper. Traders should watch $1.80 support and $2.00 breakout levels closely in the coming weeks.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。