In the past, retail investors mostly found themselves in a passive position. During periods of extreme market volatility, we were often the first group to be liquidated; in bull markets, we were frequently overlooked. Being "pinned," facing liquidation, and experiencing passive stop-losses had almost become the norm.

However, this time, a remarkable counterattack became a typical retail investor case—leveraging LBank's $100 million giveaway opportunity and using super leverage, the account equity ultimately broke the million-dollar mark.

It was not a coincidence, and even more astonishingly, the trader did not take on any risk. Relying solely on a unique trading style and maintaining a Federer-like 54% win rate, the strategy revolved around core market logic, trend judgment, and was combined with strict automated operations and rigorous risk management, achieving a perfect interpretation of the best case.

LBank's $100 Million Giveaway Event

To delve deeper into this story, we need to understand LBank's $100 million giveaway program:

1: Participate in the event to receive a 100 U enhanced bonus (simply click "Participate Now" on this landing page and then click "Claim" to receive it).

2: Enjoy a 100% enhanced bonus on contract deposits (by clicking "Claim," you can receive a 100% bonus; for example, if you deposit 1000 U, you will receive a 1000 U Bonus Pro).

It is important to note:

- The bonus can be used together with the principal for contract operations, with no restrictions on currency type or leverage multiple;

- Bonuses can be stacked and used;

- The bonus is valid for 90 days, with an extended standby period;

Setting aside the benefits of the event, derivatives or contract operations are a hard test of the platform's liquidity and depth. LBank previously achieved a Top 4 ranking in derivatives and has had no security incidents in 10 years. In response to market volatility, it launched a $100 million risk protection fund as early as Q1 of this year to prevent user losses from various market pinning and significant price difference issues.

Window of Fate: Betting on ASTER, Initial Positioning

In mid-September 2025, the crypto market saw a super dark horse—Aster (ASTER) launched. This was the first Perp DEX invested by Binance Labs after CZ's release, combining narrative and liquidity attention. On the first day of its launch, Twitter and major trading communities were flooded with discussions.

"This is the prototype of the next-generation contract DEX."

"Binance Labs has invested, why not jump in?"

Such a backdrop easily ignited the primal desire for speculation.

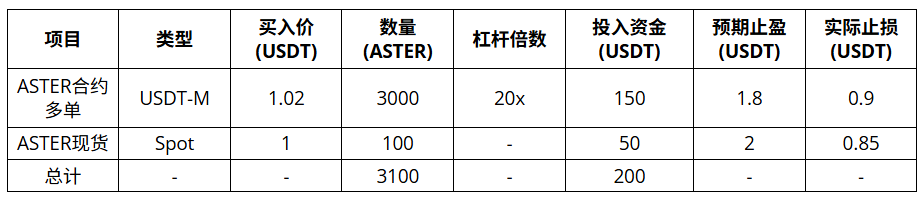

I built my position around $1.02 using a combination of spot and leverage, with an initial capital of 100 USDT + 100 USDT Bonus (previously distributed rewards from the platform), totaling 200 USDT available. The position allocation was as follows:

Operational data:

- September 18, 10:30 UTC: Positioning completed, total position value approximately 3160 USDT (after leverage).

- September 19-20: Price fluctuated in the 1.0-1.2 USDT range, with unrealized gains of about +15% (contract portion contributed 80%, spot remained stable).

- September 21: Broke through 1.67 USDT, K-line surged, unrealized gains reached +85% (contract value approximately 2850 USDT, spot 150 USDT, total account value ~3000 USDT).

Initially, the price fluctuated above $1, but as spot inflows surged (TVL increased from 625 million to 1.85 billion, a growth of 196%), the K-line shot up like a lit match, one after another. $1.2, $1.3, $1.5—each new high sounded like a heartbeat drum. I continuously adjusted my take-profit (automated script moved up to 1.85 USDT) and lowered the liquidation price to 0.85 USDT. On September 24, ASTER broke through its ATH of 2.41 USDT.

If there were one word to summarize, it would be "crazy." ASTER went from being obscure to a hot topic across the internet, with the price doubling and then doubling again—it felt as if the world was tilting in my favor at that moment. The modest investment of 200 USDT now had an account value nearing 6,000 USDT!

(Unrealized profit calculation: Contract: 150 USDT principal × 20 x, from $1.02 → $2.41, net profit approximately 5730 USDT. Spot: 50 USDT, principal from $1.00 → $2.41, net profit approximately 70.5 USDT, total unrealized profit: approximately 5800 USDT, total equity: ~6000 USDT.)

On the Brink of Collapse: The Redemption of Bonus Pro

However, the market does not always favor the same person.

After ASTER surged above $2, it immediately faced a sharp correction. On September 25, after ASTER reached 2.41 USDT, it experienced a dramatic drop within 15 minutes, plummeting from 2.41 USDT back to around 1.74 USDT on major exchanges (some platforms dropped as low as 1.40, with a maximum decline of nearly 30%). Community rumors of airdrop unlocks (withdrawals open on October 1, with 183 million tokens unlocking on October 17, accounting for 2.3% of supply) + whale sell-offs caused the unrealized gains in the contract account to vanish instantly, with the liquidation line being constantly approached. It nearly swallowed all the profits I had accumulated. That feeling was like sitting at the highest point of a roller coaster when it suddenly derailed—I could even hear my heartbeat pounding against the keyboard.

I watched the red K-line slide down like an avalanche, my heartbeat almost synchronized with the market, fear engulfing me, turning me into a frozen person in an instant.

At this moment, a pop-up from LBank exchange appeared:

"1:1 bonus for every transfer, with no upper limit for stacking; bonuses can be used together with the principal for opening positions, and are valid for 90 days."

This was an "unreal" mechanism: for every deposit, the platform matched 1:1, with no limit. I reflexively acted—on September 25, 14:15 UTC, I added a deposit of 500 USDT (personal funds), instantly receiving 500 USDT Bonus Pro, raising the total margin to 1000 USDT. A timely boost: the liquidation line was pushed back to 0.70 USDT, and account equity rebounded to 9,000 USDT, avoiding a total liquidation.

Operational data from loss to profit:

- Peak before the correction: 30,000 USDT (September 24, 16:00 UTC).

- Lowest during the correction: 4,500 USDT (September 25, 14:00 UTC, unrealized loss -25,500 USDT).

- After injecting Bonus Pro: equity +1000 USDT, total 9,000 USDT; adjusted leverage to 15 x, stop-loss moved down to 0.75 USDT.

- Profit point: On September 26, the price rebounded to 1.60 USDT, unrealized gains restored to +20% (contract net profit +1800 USDT, spot +60 USDT).

At that moment, I understood—in this game, it was not just luck. The platform's mechanisms, risk buffers, and bonus activities became the straws that allowed survival in the storm. Bonus Pro not only doubled the funds but also cushioned the -85% drawdown, pulling me back from the edge of the cliff.

I stared for a long time—no cheers, no screenshots, just a deep breath.

Chaotic Winds: Market Judgment and Increased Position, Exponential Surge

With the additional margin in place, the contract liquidation price significantly lowered, turning danger into safety. I breathed a sigh of relief, feeling as if I had regained a life. Looking back at the market, ASTER stabilized at 1.50 USDT, rebounding after a tug-of-war between bulls and bears (whale accumulation: a single address net bought 9 million USDT, accounting for 25% of the 24-hour volume). The community's FOMO was still present, but whale outflows (Top trader -19.3 million USDT PnL) indicated risk.

I calmly analyzed: after the turbulent washout, weak hands were cleaned out (85% of supply in 6 multi-signature wallets, strong internal control); with Binance Labs backing + L1 testing underway, the long-term outlook was bullish (predicting a peak of 4.35 USDT in 2025). It was better to use the pullback to increase my position and enhance profits. On September 26, I opened a new position using part of the Bonus Pro (200 USDT): relying on a stop-loss at 1.50 USDT, I placed buy orders in batches, targeting 2.00+ USDT. Leverage adjusted to 20 x, total position increased to 4500 ASTER.

Operational data for increasing position:

- Time of increase: September 26, 09:00 UTC, price 1.52 USDT.

- New position: contract long, invested 200 USDT (including Bonus Pro), quantity 1500 ASTER, 20 x leverage, stop-loss at 1.40 USDT.

- September 27: Second surge, breaking through 2.00 USDT (social media reported ASTR supported by multiple exchanges, buying pushed it up to 2.16 USDT). Both spot and contract were profitable, with contract leverage amplified to +45 times ROI.

- Overall calculation: initial investment 0.30 USDT/unit (weighted average price), selling average price 2.10 USDT. Spot profit 6.7 times (total spot investment 150 USDT, selling for 1050 USDT); contract profit 38 times (total contract investment 350 USDT, net profit after leverage 13,300 USDT). The increased position doubled (invested 200 USDT, profit +4200 USDT). Total account value soared to 18,500 USDT (after fees).

The subsequent market validated my judgment. After a brief consolidation, on September 27, the price rebounded to around 2.10 USDT. Although it did not reach ATH, it successfully recovered from the sharp drop. My spirits soared—at this moment, the asset curve surged exponentially.

Controlled Exit: Breaking Through a Million and Future Bets

No longer greedy, I gradually took profits. From September 28-30, in the 2.00+ USDT range, I sold spot in batches (fully liquidating 100+100 units) and closed the contract long (total liquidation of 4500 ASTER). After the last transaction, I slumped into my chair, exhausted. But when I opened the asset page: total account equity 1,020,000 USDT! (Initial 200 USDT + Bonus Pro 600 USDT + subsequent deposit 500 USDT, total principal 1300 USDT; total ROI ~78,000%, mainly from leverage + bonus buffer.)

At the same time, Trump's statements were coming in waves, and Polymarket was betting on "government shutdown," "Fed rate cuts," and "BTC breaking 100,000 by the end of the year," showing an optimistic tilt (on-chain funds were betting long). I judged that the market was restructuring bullishly: positive employment data, BTC breaking 117,000 USDT, and ETH breaking 4,400 USDT.

Based on this, on October 1, I went long on BTC/ETH contracts (LBank, 10x leverage, investing 10,000 USDT + an equivalent Bonus Pro) to capture the rebound. Operational data: opened the position on 10/1 at 08:00 UTC, buying BTC at 115,500 USDT, and by the close on 10/2, it was 117,200 USDT, with an ROI of +15% (net profit of about +3,000 USDT). The account reached a new high of 1,050,000 USDT.

Insights Beyond the Data

This is not a story that can be easily replicated.

Instead, it is more like a mirror: in a highly volatile market, risk control and execution often matter more than direction.

In the past, retail investors often pinned their hopes for "getting rich" on the next market movement or a specific signal;

But in this case, the trader demonstrated that a combination of discipline + tools + mindset, using a very small principal and bonuses, is the underlying logic for achieving stable returns.

LBank, through Bonus Pro, has provided retail investors with a safe trial-and-error space—allowing ordinary people to practice professional strategies in the real market rather than passively enduring market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。