Rising Bitcoin ETF Inflows Signal New $BTC ATH, But Is Fed The Key?

The world’s biggest cryptocurrency is now flirting with a new all-time high $BTC ATH of $125,708 as big investors continue pouring billions into digital assets.

This price jump isn’t random—it’s being powered by record Bitcoin ETF inflows, strong global signals, and growing hopes that the U.S. Federal Reserve will cut interest rates soon.

Now, the big question in every trader's mind is: Will these inflows push to a new record high, or will the Fed’s decision slow it down?

Bitcoin ETF Inflows Historic Weekly Surge Fueled Rally

Over the past week, BTC ETF news has been trending because it has seen massive buying activity, adding billions in new money to the market.

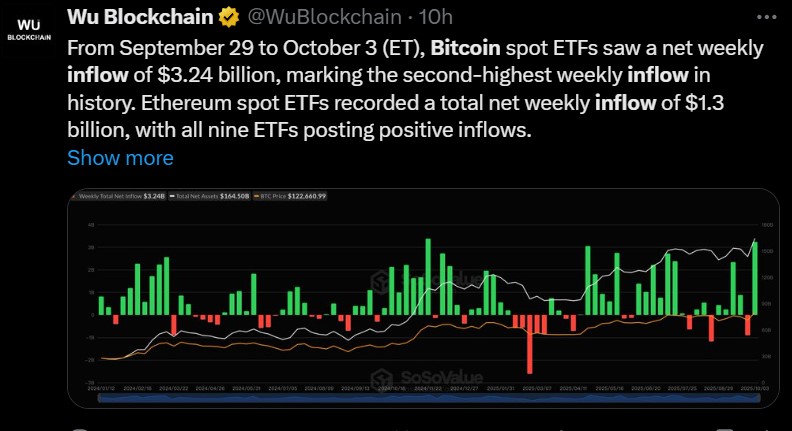

Here’s what the Wu Blockchain ’s data says:

-

$3.24 billion weekly inflows, second highest in history

-

$1.3 billion into Ethereum ETFs

-

$5.95 billion total into digital asset funds

These data show that institutions are confident about the asset's future. History shows that whenever bitcoin ETF inflows surge , the prices usually move up, so this steady rise is increasing market liquidity and momentum—the two key reasons behind why Bitcoin price is going up today as $BTC hit ATH of $125,708.

Growing AUM Shows Long-Term Institutional Trust

Right now, the exchange traded funds together hold more than $165 billion in total Assets Under Management (AUM). That means large investors are not just trading—they’re holding it for the long term.

Being a crypto analyst I can assure that this strong AUM is often seen as a bullish signal for the asset’s price.

Key Highlights

-

Daily $BTC ETF inflows near $985 million are adding major liquidity.

-

Volatility during an influx usually accelerates the price rally.

It clearly shows that institutional confidence in this asset remains high for Q4 2025.

Fed Rate Cut Oct Probability: The Big Wild Card

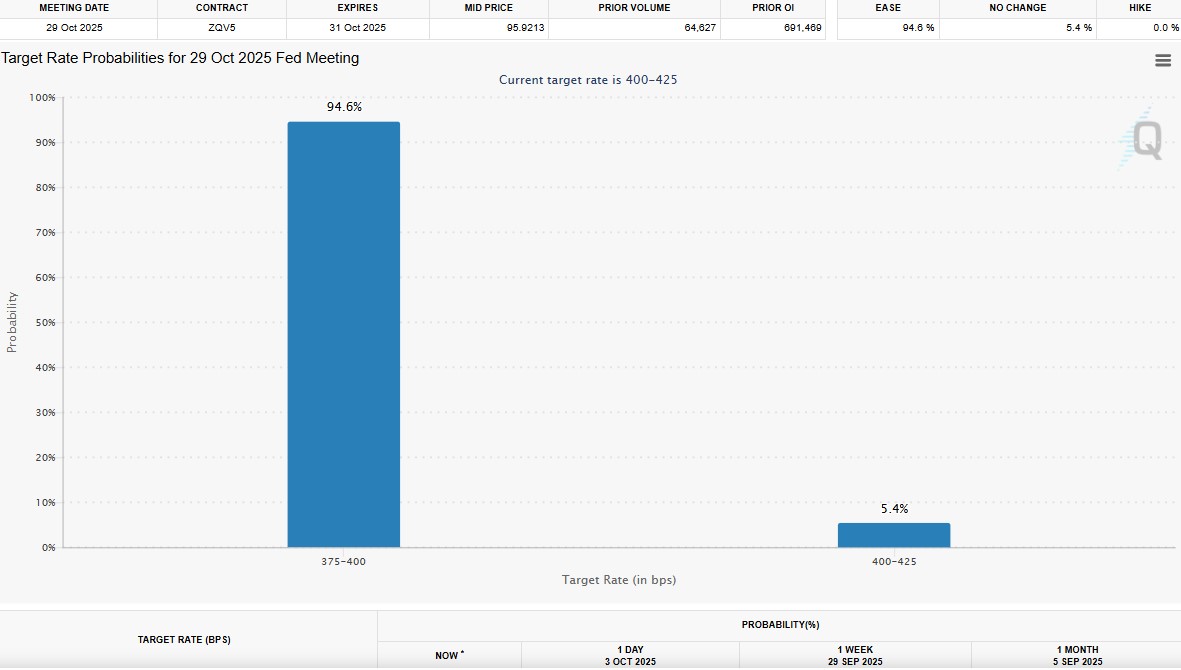

While the current news is fueling the rally, the Federal Reserve’s next decision could shape how far it goes. Before the upcoming FOMC meeting on October 29, 2025, as per FedWatch Tool , the market expects:

-

94.6% chance of a rate cut to 375–400 bps

-

5.4% chance of no change

If this Fed rate cut October prediction comes true then it could shake the entire market, as people will panic and send more money into Bitcoin and Ethereum ETFs . That could easily trigger new $BTC ATH near $130,000. But if they hold rates steady, assets might see a short pause or sideways movement.

So, while the current momentum is clearly supporting the token, macroeconomic policies will still play the deciding role in how far it goes next.

Token's recent rally isn’t just about crypto—it’s about how global financial forces are working together, so people asking; why Bitcoin ETF inflow is rising have clear answers: US weak job data, rising inflation, and rate cut hope all together fueling the surge.

Conclusion

As Bitcoin ETF inflows keep rising, the bitcoin price prediction new target looks ready to break all records soon. But the Federal Reserve’s decision later this month could decide whether we see a breakout or a brief pause.

For now, one thing is clear:

Institutional investors aren’t backing off. Confidence in the asset remains rock solid—and the next $BTC ATH might be closer than anyone expects.

Disclaimer: Cryptocurrency investments are highly volatile. Always do your own research and manage risk before trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。