IBIT Bitcoin ETF Breaks Records as BTC Eyes $140K

IBIT races to $100B AUM, showing massive institutional demand for Bitcoin and driving ETF flows that lift prices and market confidence.

IBIT Nears $100 Billion: BlackRock’s Fastest Riser

BlackRock’s iShares Bitcoin Trust — the IBIT Bitcoin ETF — is about to pass $100 billion in assets under management, setting a new speed record and making it the firm’s most profitable exchange-traded product.

Source : X

How Fast did this Happen?

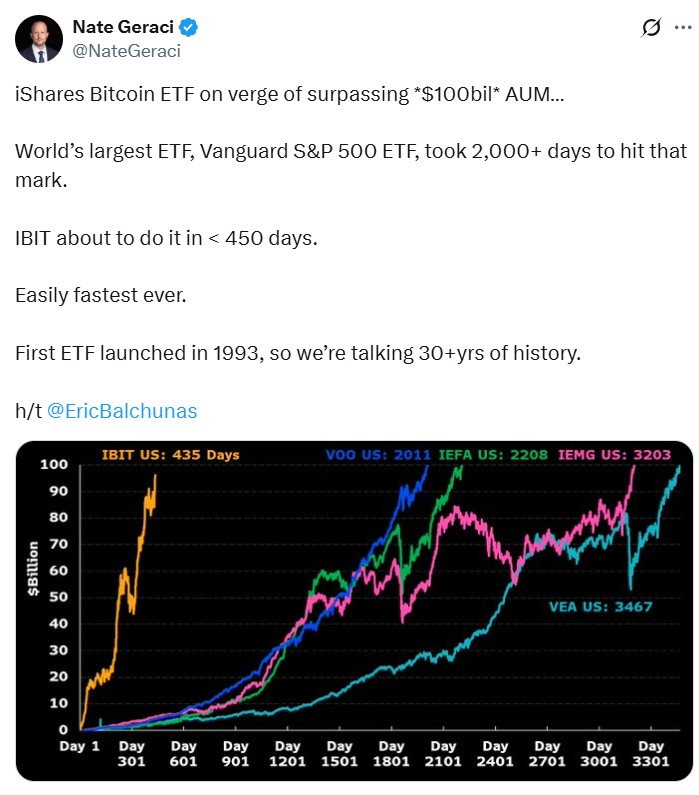

The Bloomberg analyst Eric Balchunas said " fastest ever to $100B, now most profitable for BlackRock" and Nate Geraci said "Absolutely wild momentum" in ETFs inflows. This fund began trading after the SEC approvals in early 2024 and reached nearly $100 billion in just 435 days.

For context, Vanguard’s S&P 500 Exchange Traded Funds took more than 2,000 days to hit the same milestone. That gap shows how quickly institutions moved into a regulated BTC vehicle.

The asset manager firm holds roughly 783,768 BTC, which equals almost $98 billion at recent prices. Those coin holdings are the backbone of the ETF’s value and explain why its assets climbed so fast.

Revenue and profits — why BlackRock is Smiling

Analysts report the firm has generated about $245 million in annual revenue in only 435 days, making it BlackRock’s highest-earning Exchange-traded product in that period. That rapid profit shows how fee income from a single crypto product can be very large when flows are massive.

Flows and Market Impact

Spot BTC ETFs kept drawing money this quarter. Industry trackers show quarterly inflows measured in the billions, which lifted both the digital assets market price. These flows helped push Bitcoin near fresh record highs this week.

Price Surged — Bitcoin at record highs

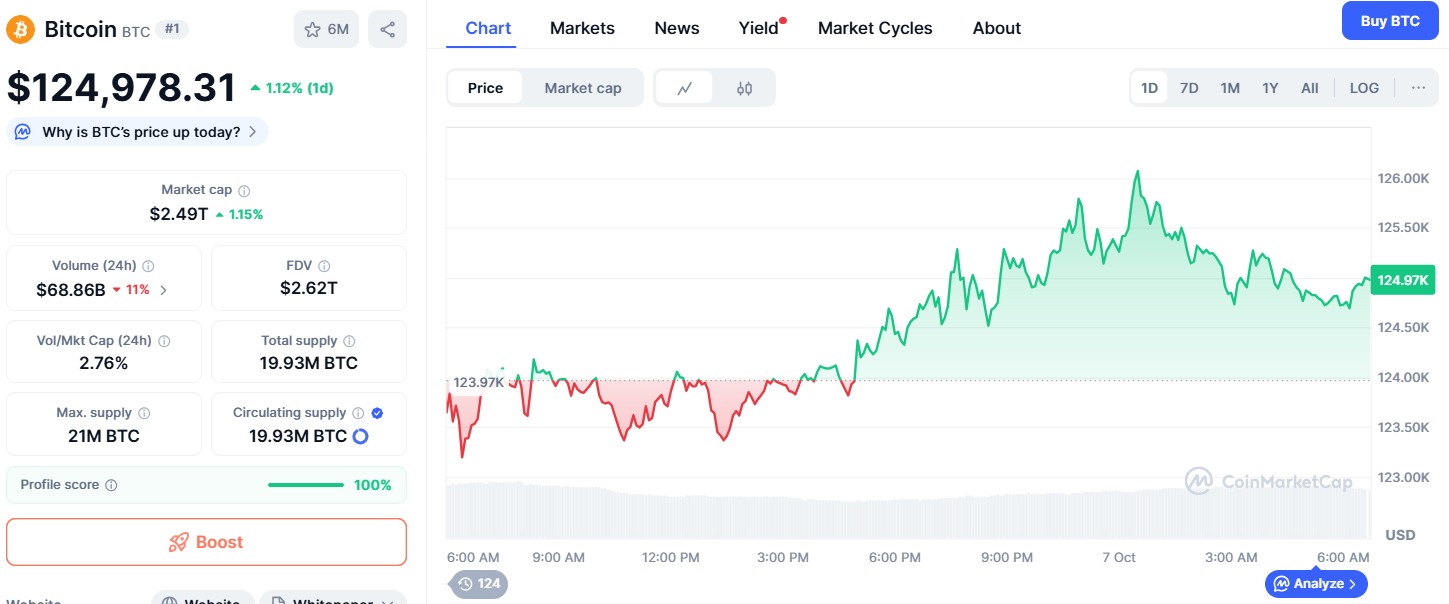

Bitcoin climbed above $125,000 in recent days, helped by heavy ETF demand and other macro drivers. The strong price pushed IBIT’s AUM and made the fund even more profitable.

With IBIT flows boosting demand, coin now trading at $124,978 could climb toward $140,000 or higher within the next few weeks amid ETF momentum.

Source : Coinmarketcap

What this Means for Investors and the Market

The company’s fast rise shows that large investors prefer regulated, easy-to-access vehicles to hold crypto exposure. For many institutions, buying shares of an ETF is simpler than custodying coins, and that ease is pouring capital into the firm. This trend could keep supporting price momentum and widen mainstream adoption.

Global Reach Grows — UK Launch Imminent

BlackRock is also set to expand in Europe . The firm plans to list a UK bitcoin ETP on October 8, 2025, after the FCA eased earlier restrictions. That move can open retail demand in UK and add fresh inflows to the ecosystem.

Risks and Balance

Fast growth brings questions. Regulators, custody risk, fee pressure, and market volatility all matter. While IBIT’s numbers are impressive, investors should remember ETFs can still fall fast if price and flows reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。