The perpetual contract exchange sector is undergoing a technological revolution. Following Hyperliquid igniting the entire DeFi derivatives market and unveiling a new chapter in the industry, Aster, which has recently been personally promoted by CZ, has emerged as a strong contender, even overshadowing Hyperliquid for a time, adding fuel to this trend. Beyond the spotlight of these two star projects, a new project named Lighter is quietly rising, attracting over 56,000 users and $700 million in locked funds within just a few months, thanks to its unique zero-fee model and ZK Rollup technology architecture, also garnering significant market attention. What makes this project, dubbed the "next Hyperliquid," stand out?

Core Features

ZK Architecture Optimized for Trading

Traditional CEXs offer fast execution speeds but are centralized and opaque, making it easy for "black box operations" to harm traders' interests. While DEXs have made all operations on-chain, ensuring transparency and verifiability, they suffer from slow trade matching speeds and poor user trading experiences. To address this issue, various technical schools have emerged in DEXs:

Taking dYdX as an example, it employs "off-chain matching, on-chain settlement." Although this improves order matching and execution speeds, the off-chain part remains opaque, reverting to a CEX state.

Hyperliquid is the first DEX to successfully and extensively operate entirely on-chain. Hyperliquid is not just a simple DEX; it is a Layer1 specifically tailored for trading. By comprehensively optimizing the execution layer and consensus layer, Hyperliquid achieves full on-chain functionality while maintaining high throughput, meeting the real-time requirements of professional trading teams such as high-frequency traders and market makers.

Lighter has taken a third path. Lighter is a zk-rollup under the Ethereum ecosystem, where its exchange functions (such as order matching and forced liquidation) are completed by a single Sequencer on Layer2, similar to a CEX, offering fast speeds but lacking transparency. To address this drawback, Lighter uses zero-knowledge proofs (ZK Proof) to ensure the fairness of trades. Each matching and forced liquidation calculation generates a ZK proof submitted to Layer1 for verification. This means that all matches strictly adhere to the price-time priority principle, preventing any black box operations or front-running (theoretically, this should be the case; the actual situation will be discussed later). Thus, Lighter follows the path of "centralized execution, decentralized verification," balancing execution efficiency with trust.

However, the above solutions also have drawbacks. Traditional ZK Rollups need to handle various complex smart contract operations, and the speed of generating proofs is often slow, failing to meet the real-time demands of professional trading teams. Lighter's biggest highlight is its self-developed ZK Rollup technology solution. Unlike generic ZK Rollups on the market, Lighter is specifically optimized for order book trading. Moreover, by focusing solely on matching logic, Lighter significantly simplifies the complexity of zero-knowledge proofs, achieving sub-second ZK Proof generation to meet the real-time requirements of professional trading teams.

Dual-Layer Architecture Security Assurance

Lighter's core architecture adopts the design concept of "asset custody on Layer1, trade execution on Layer2." Specifically:

Layer1 (Ethereum Mainnet): Responsible for fund custody, with all user assets stored in audited smart contracts.

Layer2 (Lighter Network): Responsible for high-speed matching and settlement, with the final account state published on L1 in a compressed diff format.

The greatest advantage of this design is security. Even if Lighter's Layer2 system completely fails, users' funds remain safely stored on the Ethereum mainnet and can be retrieved through an emergency exit mechanism.

LLP Dual-Use Innovation

Lighter has a public liquidity pool (LLP) similar to an insurance fund, used to absorb liquidation losses and provide market-making liquidity for the platform. Users can deposit funds into the LLP, contributing liquidity to Lighter while enjoying market-making profits. This design mimics Hyperliquid's HLP mechanism.

In future versions, funds deposited into the LLP will not only earn market-making profits as LPs but are also planned to allow LP shares to be used as margin for trading, achieving dual utilization of funds. This design prevents funds from being idle, improving capital efficiency (similar to Aster's USDF and other yield-bearing collateral models), although this feature has not yet been launched. The implementation process must fully consider risk control, which will be discussed in detail in the following sections.

Zero-Fee Strategy

Lighter adopts a bold business model in the DeFi space—completely waiving trading fees for ordinary users. Whether placing orders (Maker) or taking orders (Taker), users can enjoy zero-cost trading. In a DeFi world where fees can be a fraction of a percent, this is undoubtedly a significant attraction.

So how does the platform maintain operations and profitability? The answer is the "paid API model."

Ordinary Users: Both placing and taking orders are free, but matching has a delay of 200-300 milliseconds.

Premium Accounts: A fee of 0.002% for placing orders and 0.02% for taking orders. However, matching delays are significantly reduced: 0 milliseconds for order cancellation and 150 milliseconds for taking orders.

Professional traders and market makers are willing to pay these fees for lower latency and better service quality. Additionally, the platform generates revenue through liquidation fees (up to 1%) and other value-added services.

However, one must not forget that "free is the most expensive thing in the world." Lighter's free strategy inevitably evokes comparisons to Robinhood's "Payment for Order Flow" (PFOF) model, and the zero-fee structure also encourages some "wash trading." The risks associated with this will be discussed later.

Project Status and Data

Development Progress

Lighter began testing at the end of 2023, with an early version (then called "zkLighter") running in 2024 and private testing starting in early 2025. As of now (September 2025), the platform is still in an invitation-only testnet/closed testing phase and has not yet fully opened to the public. The specific timeline for the mainnet launch and token issuance has not been announced by the official team.

Since the mainnet has not yet launched, Lighter's core code has not been fully open-sourced, but the smart contracts have passed audits (ZK circuits audited by ZKSecurity). The code details may be publicly disclosed for community oversight upon the mainnet release.

Growth Data Performance

From the data performance perspective, Lighter's growth is indeed remarkable:

User Scale: As of September 2025, the number of registered users has exceeded 56,000.

Fund Scale: The total value locked (TVL) skyrocketed from $2.5 million in March this year to over $700 million, a 280-fold increase.

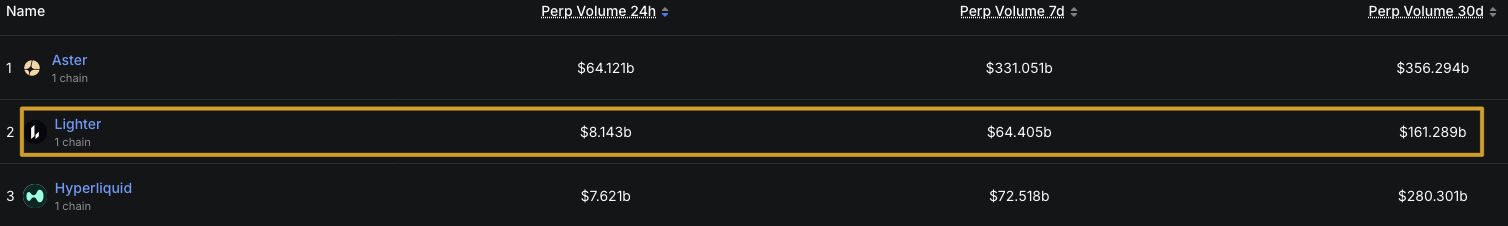

Trading Activity: Daily trading volume surged from several hundred million dollars in the summer to approximately $8 billion recently, reaching $18.9 billion on September 25, 2025, quickly approaching Hyperliquid's market share. Recently, its daily trading volume even surpassed Hyperliquid.

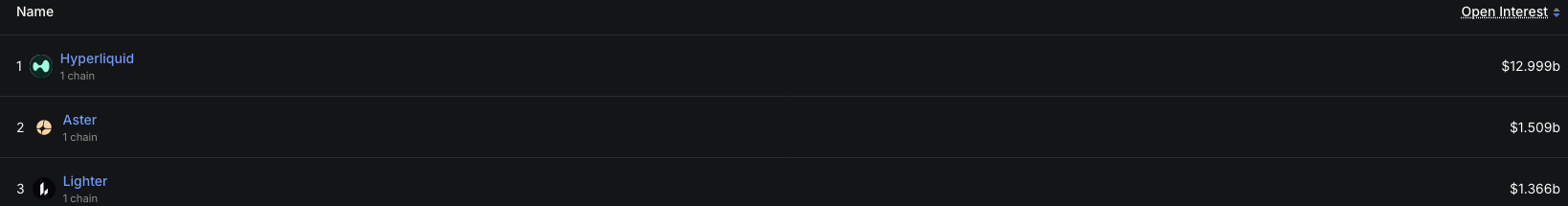

On the other hand, Lighter's total open interest (OI) is relatively low. Currently, Lighter's OI is around $1.3 billion, which is an order of magnitude lower than Hyperliquid's $13 billion and below Aster's recent $1.5 billion level. The high trading volume and low OI suggest that both Lighter and Aster, as emerging popular platforms, exhibit a significant amount of short-term frequent wash trading behavior, which will be analyzed in the risk section below.

Competitive Comparison Analysis

As a new generation ZK architecture perpetual DEX, Lighter is often compared with Hyperliquid (the star project that first ignited the perps craze) and Aster (the rising star backed by the Binance ecosystem). Below, we will horizontally compare Lighter with Hyperliquid and Aster in terms of decentralization, performance throughput, product functionality, and ecosystem integration, analyzing their respective strengths and weaknesses.

Underlying Architecture and Decentralization

Hyperliquid: The customized Layer1 has multiple validation nodes, which is theoretically decentralized. However, due to the limited number of nodes, all controlled by the team, the actual degree of decentralization is limited.

Aster: Core matching is implemented off-chain, making it more centralized.

Lighter: As a Rollup, it has a single Sequencer responsible for matching, making the execution layer centralized, but the verification of ZK Proof consumes very few resources, allowing lightweight nodes to verify, thus making the verification process highly decentralized, compensating for the shortcomings of "centralized execution." Additionally, all asset ledgers are on the Ethereum mainnet, allowing users to independently retrieve funds even if the Lighter team disappears, ensuring asset security.

Performance and Trading Experience

Hyperliquid: Processes hundreds of thousands of orders per second, maintaining stability even in extreme market conditions, without congestion or downtime.

Lighter: Achieves millisecond-level matching, with sub-second generation of zero-knowledge proofs, providing an experience close to centralized exchanges. Performance is adequate, with slight delays in extreme cases.

Aster: Limited by the 3-second block time of the BNB chain, its performance is relatively weaker. To compensate for the performance gap, ordinary users can execute trades with its automated market-making pool with one click, effectively taking liquidity directly from the AMM pool, eliminating the need to wait for order placement. In the future, Aster plans to launch its own ZK Rollup chain to improve performance and privacy, making its future architecture more similar to Lighter.

Product Features and Innovations

Hyperliquid: As a pioneer, it has a relatively balanced and mature feature set. It offers both spot trading and perpetual contract trading. HIP-3 allows users to create their own contract markets, which will promote trading of RWA products like US stocks on Hyperliquid. HIP-4 proposes to develop "prediction markets" on Hyperliquid.

Aster: Quickly acquires users by leveraging Binance's influence. It has three innovative features: multi-chain liquidity sharing, 1001x leverage, and planned dark pool trading, attracting high-risk speculators. Additionally, Aster has launched perpetual trading for US stocks, including contracts for Tesla, Apple, and others, allowing users to trade US stock prices 24/7.

Lighter: As an Ethereum Layer2, it is expected to achieve good compatibility with the Ethereum mainnet and other Rollup ecosystems, such as directly supporting users to use any mainstream Ethereum asset as collateral, and integrating with Ethereum wallets and strategy protocols to leverage the composability advantages of Ethereum DeFi. Furthermore, Lighter's planned LLP dual-use margin feature is a potential innovation: it allows liquidity providers to earn market-making profits while also gaining the opportunity to participate in trading, effectively giving LPs a yield-bearing collateral attribute.

Liquidity Depth and Trading Costs

Hyperliquid boasts substantial market-making funds (with the HLP pool once exceeding $1.5 billion) and a rich participation of institutional market makers, resulting in the depth of its mainstream trading pairs surpassing that of some second-tier CEXs, with minimal trading slippage and implied spreads. Although its fees are not zero, the rates of 0.01% for placing orders and 0.03-0.05% for taking orders are very low in the DEX space. Overall, Hyperliquid provides a low-cost environment close to that of CEXs for large capital traders.

Lighter adopts a zero-fee strategy in exchange for larger spreads: ordinary users do not need to pay fees, appearing to have lower costs on the surface, but market makers will widen the bid-ask spread to cover their costs. Therefore, the actual trading spreads for Lighter users may be slightly higher than those of Hyperliquid. Particularly for niche trading pairs, Lighter currently lacks widespread market maker participation, resulting in relatively insufficient liquidity depth, with some users reporting that Lighter's order book thickness for certain altcoins lags behind Hyperliquid.

Aster presents a more complex situation: its ordinary mode provides liquidity through the ALP automated market-making pool, with depth depending on the asset scale and algorithm within the pool; the Pro mode, due to multi-chain reasons, sees market maker funds dispersed, and many Binance-affiliated market makers are concentrated on the BNB chain, leading to generally lower depth for non-BNB chain assets.

Valuation Analysis

Valuation based on revenue forecasts:

Hyperliquid Reference:

Daily revenue conservatively exceeds $3 million, which calculates to an annual revenue of approximately $1.1 to $1.2 billion.

Based on the current HYPE's approximately 4.5 billion FDV, this results in a PE ratio of about 40 times.

Lighter Forecast:

Lighter's recent trading volume has exceeded $8 billion. However, considering that Lighter's current momentum may not be sustainable, and the market generally believes that this trading volume includes too much wash trading, I cautiously assume a future stable daily trading volume of $4 billion.

Lighter currently does not charge ordinary users trading fees, with revenue primarily coming from premium account fees. Assuming 20% of daily trades come from paying users, and an average fee rate of 0.01%, the annual revenue would be approximately $40 billion * 20% * 0.01% * 365 = about $30 million.

Using a similar 40 times PE as Hyperliquid, I estimate Lighter's FDV to be around $1.2 billion.

Currently, Polymarket's prediction market gives an 80% probability that Lighter's market cap will exceed $2 billion upon launch, reflecting the market's optimistic sentiment towards Lighter. This high premium indicates the market's enthusiasm for high-performance order book DEXs.

Risk Analysis

Questionable Business Model

Lighter currently waives trading fees for users, which has indeed attracted a large number of users in the early stages, but in the long run, where will the platform's profits come from? Who will they be making money from?

The "zero-fee" strategy inevitably brings to mind traditional zero-commission platforms like Robinhood. Robinhood has shifted its revenue source to "order flow auctions," charging market makers/high-frequency trading firms fees to execute trades at favorable prices. This effectively shifts costs to the spread: retail investors do not pay fees on the surface, but may execute trades at worse bid-ask spreads, with market makers "taking the spread." Lighter's founder has openly expressed agreement with the Robinhood model, believing that DeFi can learn from this "wool comes from the pig, let the cow pay" approach. However, the trading structure in the crypto market differs from that in US stocks—crypto users are relatively niche and specialized, and are more sensitive to spreads; otherwise, there wouldn't be a technological migration from vAMM to CLOB models. If Lighter's zero-fee structure leads to spreads significantly larger than competitors, seasoned traders will notice and leave.

Moreover, since high-speed API fees are Lighter's main source of income, Lighter should optimize the experience for these users. However, some in the community have reported that Lighter is slow to open external interfaces, with insufficient API documentation and poor integration experiences, raising doubts about whether the team intends to keep retail order flow for its internal team and not allow external high-frequency trading and market-making teams to share in the profits.

Authenticity of Trading Data

The impressive data from Lighter may contain significant discrepancies. The most obvious abnormal indicator is the ratio of trading volume to open interest (OI). This indicator should normally be within a range of 5 times; Hyperliquid's ratio is about 0.76 times, while Lighter's ratio is approximately 27 times, far exceeding normal levels.

This unusually high turnover rate strongly suggests that there is a significant amount of short-term frequent wash trading on the platform. Since Lighter has not yet issued tokens, the primary motivation for users to inflate trading volume is to compete for future airdrop points. The zero-fee structure greatly reduces the cost of wash trading, allowing some users to frequently trade between self-controlled accounts, creating massive transaction volumes with almost no losses.

On-chain data analysis shows that many top addresses on Lighter open and close positions thousands of times within a day, but hold very few positions overnight, which is characteristic of exploiting airdrops.

Furthermore, the low OI further confirms that there has not been a large-scale influx of genuine liquidity, with a significant amount of trading likely being left-hand trades to right-hand trades. Once the airdrop distribution ends, this portion of "false prosperity" in trading volume is likely to disappear quickly, leading to a cliff-like drop in platform activity.

LLP Reuse Risks

LLP plans to allow users to use their LP shares as collateral for trading in the future, and this "multiple uses of one money" innovation may introduce complex systemic risks. Consider the following extreme scenarios:

The Lighter team uses funds from the LLP for market making. Although the Lighter team has professional traders, participating in trading carries the risk of "loss." In the event of significant market volatility, the LLP, as the counterparty, may incur substantial losses, leading to a decline in the net value of each LLP share.

If users who use LLP shares as collateral experience trading losses, the number of LLP shares in their margin accounts will also be deducted.

The combination of market-making losses and trading losses will cause the net value of the LLP and the number of LLP shares in margin accounts to decline simultaneously, amplifying users' margin account losses, potentially triggering a chain of liquidations and further exacerbating system instability.

Because of these risks, insurance funds on mature platforms like Hyperliquid operate independently and do not allow users to pledge and reuse funds. For Lighter to successfully implement this feature, it needs to design a comprehensive risk control mechanism, such as: limiting the maximum LLP collateral ratio, introducing dynamic risk parameter adjustments, and establishing multi-tiered risk buffer mechanisms.

Uncertainty in Team Governance

The success or failure of a startup project is closely tied to the quality of its team. Lighter's founders and team have strong technical backgrounds (founder Vladimir has worked in AI and FinTech, and core members include former institutional quantitative engineers), but there are also some unfavorable rumors in the industry that raise concerns.

Lighter is not a project that became famous overnight; its predecessor "zkLighter" was established as early as 2022, but initially did not gain much traction. It wasn't until the end of 2023, when Hyperliquid became popular, that the team accelerated its progress, giving the impression of "rushing to capitalize on the trend and hastily launching a token for monetization."

There are rumors online questioning the founder's unstable character. According to an analysis blogger JulianKin, Lighter's founder Vladimir Novakovski allegedly violated rebate promises to several partners and reneged on profit distribution; there are also rumors that he is infatuated with the luxurious lifestyle of Miami yacht parties and lacks discipline in his personal life.

Although many sources state that Lighter has received investments from a16z and Lightspeed, there are also claims that a16z and Lightspeed invested in Novakovski's previous project Lunchclub, an AI social platform. Therefore, Novakovski is actually using the funds from Lunchclub's main business to run a side project, Lighter, which unexpectedly became popular. If these claims are true, Lighter has not received any endorsement from well-known institutions and may instead be used by investors from the previous project as a channel for cashing out.

Summary

As an emerging force in the perpetual contract DEX space, Lighter indeed showcases several highlights: an innovative ZK Rollup architecture, a zero-fee model, and rapidly growing user and capital scales. In the context of a new wave of competition in the DeFi derivatives market, Lighter is undoubtedly a project worth paying attention to.

However, we must also rationally consider the risks and challenges involved. The current high trading volume likely contains a significant amount of false volume generated for airdrops, and the sustainability of the zero-fee model still needs to be verified. More importantly, in the face of strong competitors like Hyperliquid and Aster, whether Lighter can establish a true moat remains uncertain.

For investors, Lighter could either become the next legendary project like Hyperliquid or fade into obscurity after the hype subsides; its ultimate trajectory is worth our close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。