The week kicked off with a roar across crypto exchange-traded fund (ETF) markets. Bitcoin ETFs saw another day of relentless inflows, adding $1.21 billion, while ether ETFs continued their steady climb with $181.73 million in new capital. It marked the sixth straight day of inflows for both bitcoin and ether, keeping both funds in positive territory.

The strength in bitcoin ETF inflows was once again anchored by Blackrock’s IBIT, which pulled in a massive $969.95 million, over 80% of the day’s total. Fidelity’s FBTC followed with $112.32 million, and Bitwise’s BITB added $60.12 million.

Additional support came from Grayscale’s Bitcoin Mini Trust with $30.55 million and Vaneck’s HODL with $15.10 million. Invesco’s BTCO added $7.51 million, Wisdomtree’s BTCW added $5.99 million, and Franklin’s EZBC brought in $3.64 million for a strong close.

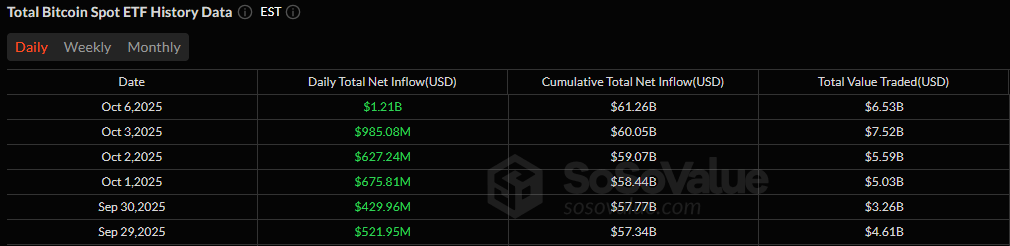

Six days of straight inflows for bitcoin ETFs. Source: Sosovalue

For a fifth consecutive session, no ETF posted an outflow, reflecting an increasingly one-sided demand landscape. Trading activity was robust at $6.53 billion, with net assets climbing to $169.48 billion, a fresh record.

Ether ETFs also kept the positive tone. Blackrock’s ETHA led the charge with $92.59 million, followed by Bitwise’s ETHW with $26.99 million, and Fidelity’s FETH with $23.52 million. Grayscale’s Ether Mini Trust and ETHE added to the inflows with $18.69 million and $14.77 million, respectively. Vaneck’s ETHV rounded up the inflows with a $5.17 million entry.

Total value traded came in at $2.65 billion, and ether ETF net assets rose to $32.01 billion. This reinforces a strong start to October for both leading digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。