The company announced the new deals, which are for deployments of advanced Nvidia Blackwell GPUs, on Oct. 7. To date, the company has secured customer contracts for 11,000 of its 23,000 total GPUs, representing approximately $225 million in annualized run-rate revenue.

These contracted GPUs are expected to be operational by the end of 2025. The new Blackwell GPUs are being contracted ahead of delivery on an average two-year term.

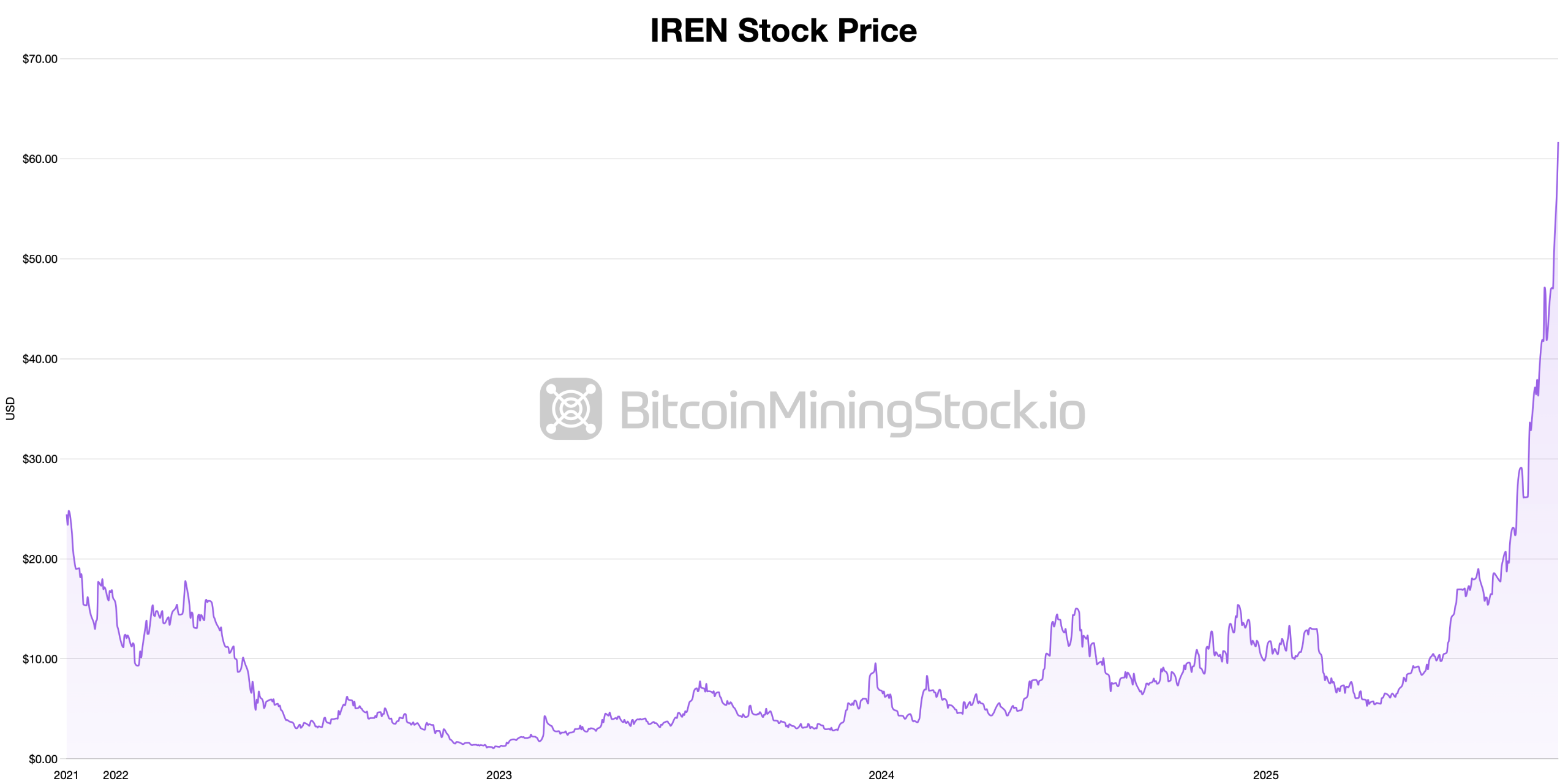

Year-to-date, IREN has gained more than 500% against the greenback.

Beyond the initial 23,000 GPU deployment, IREN is engaged in advanced discussions with existing and prospective customers. The company’s sites in British Columbia and its Horizon 1 & 2 data centers under construction in Childress, Texas, provide capacity for more than 100,000 future GPUs.

“Our ability to rapidly transition from ASICs to GPUs across our British Columbia campuses, and the speed at which we’re building Horizon 1 & 2, demonstrates how IREN is uniquely positioned to meet accelerating demand for AI compute,” said Daniel Roberts, IREN’s co-founder and co-CEO.

He highlighted the company’s nearly 3 gigawatts of secured power as a key advantage for scaling. IREN (Nasdaq: IREN) is a developer and operator of next-generation data centers, powering its operations with 100% renewable energy. Its business is built on three verticals: Bitcoin mining, AI cloud services, and the design and operation of tailored AI data center infrastructure.

With its business evolving, the company also stated it will transition to a standardized reporting process used by industry peers and will discontinue its monthly operational updates. The revenue targets are based on internal assumptions and are not fully guaranteed, as noted in the company’s release on Tuesday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。